November 26, 2025

East Star Resources Plc (LSE: EST), the Kazakhstan-focused gold and base metals explorer, is pleased to announce an Independent JORC-Compliant Exploration Target (the "Exploration Target") for the Soviet-era Rulikha Deposit. The Rulikha Deposit is located primarily on East Star's 100%-owned tenements in the East Region of Kazakhstan. The estimate contains an upper limit of 23Mt @ 2.4% copper equivalent (CuEq), constrained by an open pit using the processing recoveries and metal prices contained in Table 2 below. Using the upper limit assessment, the deposit has the potential to contain over 550,000 tonnes of copper; nearly double the CuEq metal of the Company's Verkhuba Copper Deposit.

The town of Rulikha and the district of Shemonaikha have already provided East Star with the required land access approvals to drill, however, further environmental approvals are still required.

Highlights:

- Near-surface, high-grade copper

- Vein 1 contains very high Cu grades and significant thickness

- Mineralisation begins from approximately 30 m depth resulting in a low strip ratio

- Multiple payable metals

- Contributions from Zn, Ag, Pb and Au improve optionality and potential economics

- Excellent infrastructure

- Rail (<2km), roads, power lines, existing concentrators within trucking/rail distance

- Large mineralised system

- Numerous mineralised lenses over a 1.9 km strike

- Additional untested anomalies (such as the Rulikha North IP target) provide significant upside beyond current modelling

- Water, the local settlement, and moving infrastructure are three hurdles which need to be overcome for permitting drilling and any future mining of this deposit

- The full report can be found here: https://www.eaststarplc.com/presentationsandreports

Table 1: Exploration Target, Upper and Lower Limit

Veins 1-3 | Tonnage | Cu (%) | Contained Cu (t) | Au (g/t) | Au (oz) | Zn (%) | Zn (t) | Ag (g/t) | Ag (oz) |

Lower Limit | 15,000,000 | 1% | 150,000 | 0.1 | 48,000 | 0.80% | 120,000 | 5 | 2,400,000 |

Upper Limit | 23,000,000 | 2% | 460,000 | 0.3 | 222,000 | 1.50% | 345,000 | 15 | 11,000,000 |

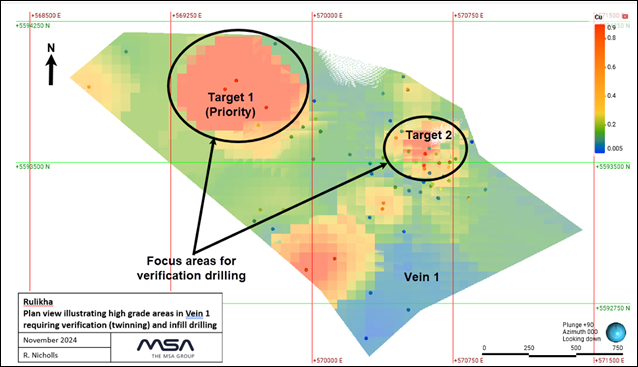

Independent Consultant Recommendations to Convert to a Mineral Resource

1. Verification/twin drilling of Vein 1 and upper lens system

2. Infill drilling to confirm continuity and reduce spacing

3. Density measurements

4. Metallurgical sampling

5. Regulatory approvals for water-protection areas

Alex Walker, CEO of East Star Resources, commented:

"We're delighted to add a second and significant multi-element advanced exploration target to our portfolio. If converted to a JORC resource, Rulikha could increase our copper inventory by three times, while the economic modelling, based on the limited historic drill data available, provides an early indication of an extremely robust operation. East Star will need to undertake the significant consulting work to advance this project, and we look forward to working with the government and local communities to realise the shared benefits such a development could bring."

Figure 1: Two Priority Target Areas Requiring Verification Drilling

Figure 2: Samples from Site Containing Copper Oxides and Sulphides Directly Above Target 1

|

|

In-situ copper oxide (malachite) at Target 1 | In-situ sulphides at Target 1 |

Table 2: Pit Optimisation Parameters

Value | Unit | |

Ore Mining Cost | 2.00 | USD$/t |

Waste Mining Cost | 2.00 | USD$/t |

Mining Loss | 0.0 | % |

Mining Dilution | 0.0 | % |

Processing cost (Flotation) | 20 | USD$/t |

Processing recoveries: | ||

Copper | 90 | wt % |

Zinc | 70 | wt % |

Lead | 50 | wt % |

Gold | 50 | wt % |

T&R Cost | 4.0 | USD$/t |

G&A Cost | 2.0 | USD$/t |

Element price: | ||

Copper | 9,300 | USD$/t |

Zinc | 2,500 | USD$/t |

Lead | 1,750 | USD$/t |

Gold | 3,000 | USD$/oz |

Payability | ||

Copper | 90 | wt % |

Zinc | 60 | wt % |

Lead | 60 | wt % |

Gold | 50 | wt % |

Royalties: | ||

Copper | 8.6 | wt % |

Zinc | 10.5 | wt % |

Lead | 10.4 | wt % |

Gold | 10.5 | wt % |

Copper Equivalent (Cu_Eq) Factor: | ||

Copper | 1.000 | |

Zinc | 0.209 | |

Lead | 0.105 | |

Gold | 0.580 | |

Ore Density | 2.9 | t/m3 |

Waste Density | 2.9 | t/m3 |

Final Pit Slopes | 40 | degrees |

Cutoff Grade | 0.50 | Cu_Eq % |

Reference

Nichols, R (2025) Estimation and Reporting of an Exploration Target for the Rulikha Deposit, East Kazakhstan. [Accessed 20 November 2025]. Available at: https://www.eaststarplc.com/presentationsandreports

Contacts:

East Star Resources Plc

Alex Walker, Chief Executive Officer

Tel: +44 (0)20 7390 0234 (via Vigo Consulting)

SI Capital (Corporate Broker)

Nick Emerson

Tel: +44 (0)1483 413 500

Vigo Consulting (Investor Relations)

Ben Simons / Peter Jacob / Anna Stacey

Tel: +44 (0)20 7390 0234

About East Star Resources Plc

East Star Resources is focused on the discovery and development of copper and gold in Kazakhstan. The Company is pursuing multiple exploration strategies including:

- Volcanogenic massive sulphide (VMS) exploration, which to date includes a deposit with a maiden JORC MRE of 20.3Mt @ 1.16% copper, 1.54% zinc and 0.27% lead, in an infrastructure-rich region, amenable to a low capex development

- Copper porphyry and epithermal gold exploration, with multiple opportunities for Tier 1 deposits and a $25 million+ strategic JV agreement with Endeavour Mining for gold exploration

Visit our website:

Follow us on social media:

LinkedIn: https://www.linkedin.com/company/east-star-resources/

Subscribe to our email alert service to be notified whenever East Star releases news:

www.eaststarplc.com/newsalerts

The person who arranged for the release of this announcement was Alex Walker, CEO of the Company.

This announcement contains inside information for the purposes of Article 7 of Regulation 2014/596/EU which is part of domestic UK law pursuant to the Market Abuse (Amendment) (EU Exit) Regulations (SI 2019/310) ("UK MAR"). Upon the publication of this announcement, this inside information (as defined in UK MAR) is now considered to be in the public domain.

The Conversation (0)

26 February

T2 Metals Acquires High-Grade Aurora Gold-Silver Project in the Yukon from Shawn Ryan

Past Drilling Results Include 3.4m @ 24.45 g/t Au at AJ Prospect

T2 Metals Corp. (TSXV: TWO) (OTCQB: TWOSF) (WKN: A3DVMD) ("T2 Metals" or the "Company") is pleased to announce signing of an Option Agreement (the "Option") with renowned explorer Shawn Ryan ("Ryan") and Wildwood Exploration Inc. (together with Ryan, the "Optionor") to earn a 100% interest in... Keep Reading...

25 February

Copper Prices Rally on Tariff Fears, Weak US Dollar

Copper prices continue to rise, driven by supply and demand fundamentals and boosted by tariff fears.Prices for the red metal reached a record high on January 29, and while they have since moderated somewhat, several factors have injected fresh concerns and volatility into the market.Among them... Keep Reading...

25 February

Top 10 Copper-producing Companies

Copper miners with productive assets have much to gain as supply and demand tighten. The price of copper reached new all-time highs in 2026 on both the COMEX in the United States and the London Metals Exchange (LME) in the United Kingdom. In 2025, the copper price on the COMEX surged during the... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00