(TheNewswire)

Montréal, QC - TheNewswire - Jan uary 17, 2023 - Sama Resources Inc. ("Sama" or the "Company") (TSXV:SME ) ( OTC:SAMMF) is pleased to announce assay results from four additional drill holes from the 2021-22 drilling campaign at the Grata nickel-copper prospect. Sama drilled a total of 85 drill holes totalling 26,787 metres (" m ") at the Ivory Coast project in 2021-22, including 45 drill holes totalling 14,893 m at the Grata prospect and 21 holes for 5,643 m at the Samapleu deposit. The assay results for holes GR-29, GR-31, GR-32 and GR-35 at Grata are summarized in this release ( Table 1 ). Assays results for ten holes drilled at the Grata deposit are pending.

Highlights:

-

Hole GR-29 intersected a total of 140 metres of mineralisation including 50.55 metres grading 0.45% nickel, 0.37% copper and 0.42gpt palladium; including 2.55 metres grading 2.60% nickel, 1.53% copper and 2.22gpt palladium

-

Hole GR-31 intersected 172 metres of mineralisation including 72.60 metres grading 0.36% nickel and 0.34% copper.

" We are very pleased with today's results, which will contribute meaningfully to our next resource estimate for the combined Samapleu-Grata prospects. Our drill program continues to have great success, extending the mineralisation continuity and thickness toward the north-east of the Grata prospect. " stated Dr. Marc-Antoine Audet, President & CEO of Sama Resources Inc.

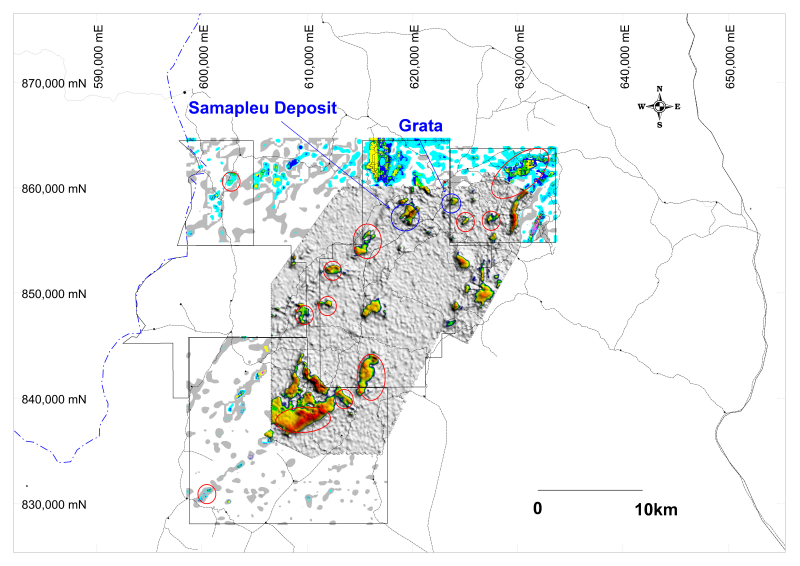

Sama's Ivorian project is comprised of five exploration permits for 850 square kilometers. More than twenty targets were outlined from geophysical surveys, out of which only three zones have been explored ( Figure 1 ).

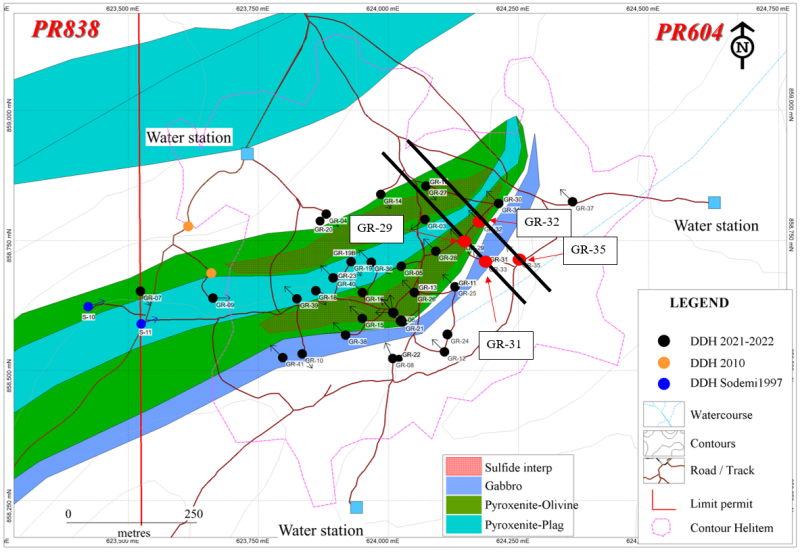

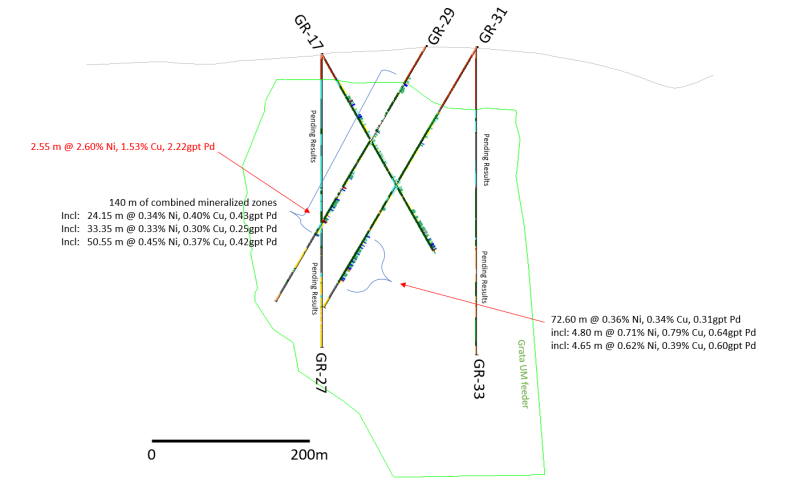

Assays results for four holes (GR-29, GR-31, GR-32 and GR-35) are presented in Table 1 . All measurements are core lengths and may not represent true geological widths. Figure 2 provides the location of the four holes.

Grata: Latest discovery in the Yacouba Ultramafic-Mafic ("UM") Intrusive Complex

In September 2021, Sama announced the Grata discovery located 5 kilometres east of the Samapleu deposit ( Figure 1 ).

The discovery hole, GR-03, drilled in June 2021, returned a 310 m sequence of pyroxenite and gabbro containing a 147 m interval of disseminated sulphides and several intersections of semi-massive sulphide mineralisation. The second hole, GR-04, confirmed the width of the mineralised zone with a 141 m mineralised intersection, including 6.4 m grading 1.05% nickel ("Ni") , 1.28% copper ("Cu") and 0.48 grams per tonne (" gpt") palladium ("Pd") and 6.6 m grading 0.73% Ni, 0.38% Cu and 0.30gpt Pd. Previous intersections included hole GR-21 with a combined 191.70 m of mineralised material, including 11.85 m grading 0.82% Ni, 0.68% Cu and 0.99 gpt of Pd and 108.20 m at 0.32% Ni, 0.38% Cu and 0.50gpt Pd.

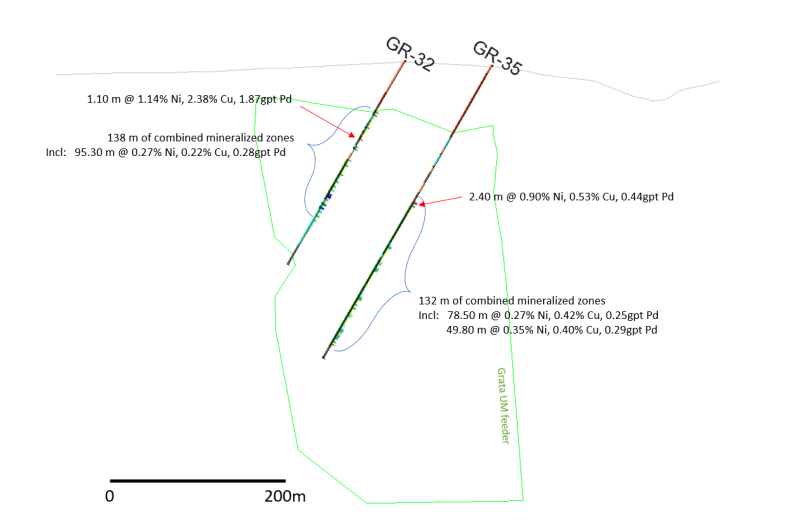

This release discloses results for holes GR-32 and GR-35 ( Figure 3 ) which intersected 138 m and 132 m of combined mineralised zones respectively. Hole GR-35 included 12.40 m grading 0.39% Ni, 0.53% Cu and 0.44gpt Pd and 78.50 m grading 0.27% Ni, 0.42% Cu and 0.25gpt Pd. These two holes confirm the extension of mineralisation toward the north-east.

Figure 4 shows a cross-section with holes GR-29 and GR-31, in which hole GR-29 intersecting a total of 140 m of mineralisation including 50.55 m grading 0.45% Ni, 0.37% Cu and 0.42gpt Pd including an interval of 2.55 m grading 2.60% Ni, 1.53% Cu and 2.22gpt Pd. Hole GR-31 drilled 50 m south-east of GR-29 returned 172 m of combined mineralised zones including 72.60 m grading 0.36% Ni and 0.34% Cu. Assay results for GR-27 and GR-33 are pending.

The mineralisation at Grata is similar in composition to the Samapleu deposit (" Samapleu ") but shows a higher proportion of chalcopyrite. Metallurgical studies are ongoing using Grata and Samapleu material.

Sama's goal is to increase mineral resources at Samapleu and Grata as well as to search for massive sulphide veins and lenses that could have accumulated at depth in traps and embayments along the feeder system of the Yacouba UM Intrusive Complex.

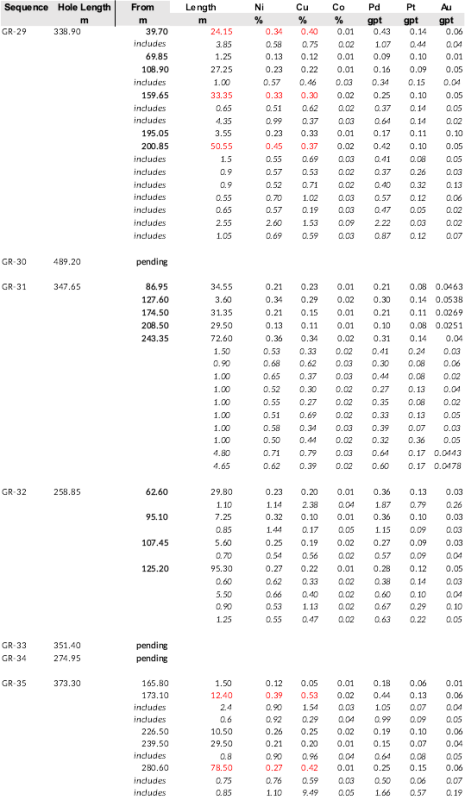

Table 1: Results for GR-29, GR-31, GR-32 and GR-35, using a cut-of-grade of 0.1% nickel.

Figure 1: Samapleu project showing the Samapleu deposits and the Grata occurrence (blue circles) together with target areas for detailed exploration (red circles). Conductivity from airborne surveys (2013 & 2018) is shown in the background.

Figure 2: The Grata prospect is located five kilometres east of the Samapleu deposits. Current and historic drilling are presented together with the four holes reported in the press release.

Figure 3: Grata Prospect, vertical section NW-SE showing holes GR-32 and GR-35.

Figure 4: Grata Prospect, vertical section NW-SE showing holes GR-29 and GR-31.

QA/QC

Co re logging and sampling was performed at Sama's Samapleu and Yepleu field facilities. Sample preparation was conducted at the Bureau Veritas Mineral Laboratory in Abidjan, Ivory Coast . Sample pulps were delivered to Activation Laboratories Ltd, Ancaster and Thunder Bay, Ontario, Canada, for assaying. All samples were assayed for Ni, Cu, Co, Fe, S, Pt, Pd and Au using sodium peroxide fusion ICP for the first five elements and by Fire Assay ICPOES for the last three.

The technical information in this release has been reviewed and approved by Dr. Marc-Antoine Audet, Ph.D. Geology, P.Geo and President and CEO of Sama, and a ‘qualified person', as defined by National Instrument 43-101 Standards of Disclosure for Mineral Projects.

Stock Options

The Company is pleased to announce, subject to regulatory acceptance, that the Company has granted an aggregate total of 2,055,000 incentive stock options to certain officers, employees and consultants, subject to certain vesting provisions . These options will be exercisable at a price of $0.135 per common share and will expire on January 17, 2033.

ABOUT SAMA RESOURCES INC.

Sama is a Canadian-based , growth-oriented resource company focused on exploring the Samapleu nickel-copper-palladium project in Ivory Coast, West Africa. The Company is managed by experienced industry professionals with a strong track record of discovery. Sama, is committed to develop and exploit the Samapleu Ni-Cu and Platinum Group of Elements Resources.

Sama's projects are located approximately 600 km northwest of Abidjan in Côte d'Ivoire. Sama's projects are located adjacent to the world-class nickel-cobalt laterite deposits of Sipilou and Foungouesso forming a 125 km long new Base Metal Camp in West Africa.

Sama owns a 70% interest in the Ivory Coast project with its joint venture partner Ivanhoe Electric owning 30%. Ivanhoe Electric has the option to earn up to a 60% interest in the project. For more information about Sama, please visit Sama's website at www.samaresources.com .

ABOUT IVANHOE ELECTRIC INC.

Ivanhoe Electric (NYSE American: IE, TSX: IE ), is an American technology and mineral exploration company that is re-inventing mining for the electrification of everything by combining advanced mineral exploration technologies, renewable energy storage solutions and electric metals projects predominantly located in the United States . For more information, visit www.ivanhoeelectric.com

FOR FURTHER INFORMATION, PLEASE CONTACT:

SAMA RESOURCES INC./RESSOURCES SAMA INC.

Dr. Marc-Antoine Audet, President and CEO

Tel: (514) 726-4158

OR

Mr. Matt Johnston, Corporate Development Advisor

Tel: (604) 443-3835

Toll Free: 1 (877) 792-6688, Ext. 5

Forward-Looking Statements

Certain of the statements made and information contained herein are "forward-looking statements" or "forward-looking information" within the meaning of Canadian securities legislation. Forward-looking statements and forward-looking information such as "will", could", "expect", "estimate", "evidence", "potential", "appears", "seems", "suggest", are subject to a variety of risks and uncertainties which could cause actual events or results to differ from those reflected in the forward-looking statements or forward-looking information, including, without limitation, the ability of the company to convert resources in reserves, its ability to see through the next phase of development on the project, its ability to produce a pre-feasibility study or a feasibility study regarding the project, its ability to execute on its development plans in terms of metallurgy or exploration, the availability of financing for activities, risks and uncertainties relating to the interpretation of drill results and the estimation of mineral resources and reserves, the geology, grade and continuity of mineral deposits, the possibility that future exploration, development or mining results will not be consistent with the Company's expectations, metal price fluctuations, environmental and regulatory requirements, availability of permits, escalating costs of remediation and mitigation, risk of title loss, the effects of accidents, equipment breakdowns, labour disputes or other unanticipated difficulties with or interruptions in exploration or development, the potential for delays in exploration or development activities, the inherent uncertainty of cost estimates and the potential for unexpected costs and expenses, commodity price fluctuations, currency fluctuations, expectations and beliefs of management and other risks and uncertainties.

In addition, forward-looking statements and forward-looking information are based on various assumptions. Should one or more of these risks and uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described in forward-looking information or forward-looking statements. Accordingly, readers are advised not to place undue reliance on forward-looking statements or forward-looking information. Except as required under applicable securities legislation, the Company undertakes no obligation to publicly update or revise forward-looking statements or forward-looking information, whether as a result of new information, future events or otherwise.

Neither the TSXV nor its Regulation Services Provider (as that term is defined in the policies of the TSXV) accepts responsibility for the adequacy or accuracy of this release.

Copyright (c) 2023 TheNewswire - All rights reserved.