January 07, 2024

USD$3.5M Cash Sale Formalises Growth of WA Assets

Labyrinth Resources Limited (ASX: LRL) (‘Labyrinth’ or ‘the Company’) advises that it has agreed to sell the Labyrinth and Denain gold projects in the Abitibi region of Quebec, Canada (‘Projects’) along with related assets and mining information (together, ‘the Canadian Assets’) for US$3.5 million cash.

The sale of the Canadian Assets follows Labyrinth’s strategic decision to switch its focus to generating shareholder value through exploration and resource extension at its Comet Vale tenement package in Western Australia.

The Company acquired the Canadian Assets in September 2021 after entering into a Project Acquisition Agreement (‘PAA’) with G.E.T.T. Gold Inc. (‘GETT’). The original terms and conditions of the PAA and subsequent variations were set out in the Company’s ASX announcements dated 2 September 2021, 9 November 2022, 3 April 2023, 1 May 2023 and 4 January 2024.

As part of the process to sell the Canadian Assets, Labyrinth has entered into a Sale and Purchase Agreement (‘SPA’) with Gold Projects WA Pty Ltd (‘GPWA’). GPWA is a special purpose vehicle set up to facilitate the transaction. The shareholders of GPWA are Carey Group Holdings Pty Ltd (a First Nation mining, civil and construction company) holding 51% and Erasano DMCC (‘Erasano’), a precious metals trading company based in Dubai, holding 49%.

GPWA’s obligations under the SPA are guaranteed by Erasano.

Neither GPWA, Erasano, their directors or proposed directors, are related parties or substantial shareholders of the Company, nor entities referred to in Listing Rule 10.1 or associates of any of them.

The key terms of the SPA are:

- consideration of a USD$3,500,000 cash payment to the Company;

- payment by GPWA of a cash deposit of USD$175,000;

- settlement of the sale and purchase of the Canadian Assets is subject to the satisfaction or waiver of the following key conditions precedent on or before 31 January 2024 (or such other date as agreed):

- Labyrinth obtaining all necessary regulatory and shareholder approvals pursuant to Chapter 11 of the ASX Listing Rules and the Corporations Act 2001 (Cth);

- Labyrinth receiving the necessary consent from GETT to novate or assign the PAA to GPWA, including GPWA assuming all royalties and physical gold payment obligations under the PAA;

- GPWA being registered as the holder of the Mining Rights (excluding the 15% registered interest in the Denain Mining Rights held by Bell Copper Corporation);

- there being no material adverse change in respect of the Projects; and

- Labyrinth receiving any necessary consents from each counterparty to the royalty contracts relating to royalties payable under the PAA to novate or assign each of the royalty contracts to GPWA, and the relevant parties entering into deeds of assignment or novation for the assignment or novation of each royalty contract (on terms satisfactory to the GPWA acting reasonably), which are conditional only upon settlement occurring under the SPA; and

- the Rocmec Hypothec being discharged and removed by GETT and the Company providing GPWA with evidence of the discharge and removal.

The SPA otherwise contains customary terms for a transaction of this kind.

The ASX has confirmed that based solely on the information provided, Listing Rules 11.1, 11.2 and 11.4 do not apply to the sale.

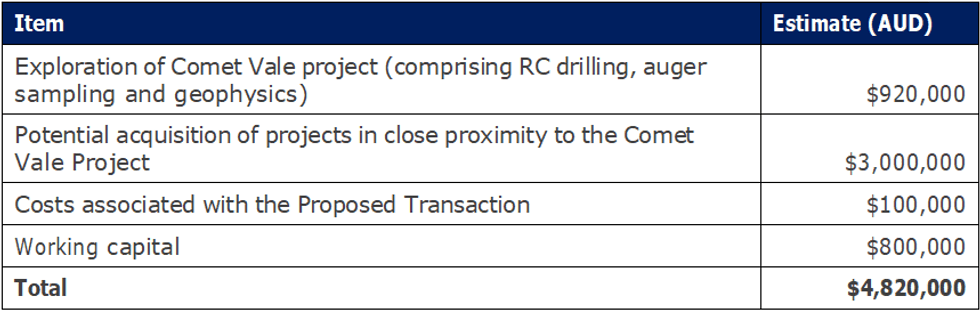

The intended use of funds received for the sale is as follows:

Labyrinth Chief Executive Officer, Jennifer Neild said, “The Sale of the Canadian Assets ensures Labyrinth is well placed to enter a new stage of exploration and growth in Western Australia. The cash injection into LRL provides significant optionality in the prolific WA Goldfields region that hosts the Company's 51% owned Comet Vale project. We look forward to communicating Labyrinth's strategic intent in the coming months.”

The Company is in compliance with its continuous disclosure obligations.

Click here for the full ASX Release

This article includes content from Labyrinth Resources, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

LRL:AU

The Conversation (0)

31 August 2023

Labyrinth Resources

Developing underexplored gold assets in the prolific Canadian Abitibi Gold Belt and the Yilgarn Craton of Western Australia.

Developing underexplored gold assets in the prolific Canadian Abitibi Gold Belt and the Yilgarn Craton of Western Australia. Keep Reading...

11h

High-Grade Extensions at BD Deposits for Resource Growth

Aurum Resources (AUE:AU) has announced High-Grade Extensions at BD Deposits for Resource GrowthDownload the PDF here. Keep Reading...

12h

Precious Metals Price Update: Gold, Silver, PGMs Stage Recovery After Crash

It's been a wild week of ups and downs for precious metals prices.Gold, silver and platinum have already recorded new all-time highs in 2026. But this week, the rally reversed course — only briefly, but in a big way, as is the case with such highly volatile markets.Let’s take a look at what got... Keep Reading...

14h

Centurion Minerals Ltd. Announces Revocation of MCTO

CENTURION MINERALS LTD. (TSXV: CTN) ("Centurion" or the "Company") announces that the British Columbia Securities Commission ("BCSC") has revoked the management cease trade order ("MCTO") previously issued on December 1, 2025 under National Policy 12-203 - Management Cease Trade Orders.The... Keep Reading...

03 February

Fabi Lara: What to Do When Commodities Prices Go Parabolic

Speaking against a backdrop of record-high gold and silver prices, Fabi Lara, creator of the Next Big Rush, delivered a timely reality check at this year’s Vancouver Resource Investment Conference. Addressing a packed room that included a noticeable influx of first-time attendees, she urged... Keep Reading...

03 February

Joe Cavatoni: Gold Price Drop — Why it Happened, What's Next

Joe Cavatoni, senior market strategist, Americas, at the World Gold Council, breaks down gold's record-setting run past US$5,500 per ounce as well as its correction. "At the end of this, you're looking at a lot of people who were pushing the price higher — speculative in nature — pulling back... Keep Reading...

03 February

Gold-Copper Consolidation Continues as Eldorado Moves to Acquire Foran

Eldorado Gold (TSX:ELD,NYSE:EGO) and Foran Mining (TSX:FOM,OTCQX:FMCXF) have agreed to combine in a share-based transaction that will create a larger, diversified gold and copper producer with two major development projects that are set to enter production in 2026.Following completion under a... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00