December 11, 2023

Charger Metals NL (ASX: CHR, “Charger” or the “Company”) is pleased to announce it has met the funding conditions precedents under the binding farm-in agreement with Rio Tinto Exploration Pty Ltd (“RTX”), a wholly-owned subsidiary of Rio Tinto Limited (ASX:RIO) for its Lake Johnston Lithium Project in the Yilgarn of Western Australia (RTX Agreement)1. The RTX investment of $1.2 million is expected to be received this week with a further $500,000 RTX re-imbursement of exploration expenditure expected in January following “completion” under the LIT Agreement.

- On 20 November 2023, Charger announced that it had signed a binding farm-in agreement for the Lake Johnston Lithium Project with Rio Tinto Exploration Pty Ltd (“RTX”), a wholly-owned subsidiary of Rio Tinto Limited (ASX: RIO) (RTX Agreement)1:

- RTX convertible loan funding of $1.2 million is expected to be received this week;

- RTX also expected to pay Charger $500,000 in January 2024;

- RTX to fund minimum $3 million exploration expenditure on the Lake Johnston Lithium Project over the first 12 months;

- RTX can earn 51% by sole funding $10 million in exploration expenditure and paying Charger minimum further cash payments of $1.5 million;

- RTX can earn 75% by sole funding cumulative $40 million in exploration expenditure or completing a Definitive Feasibility Study.

- Simultaneously, Charger entered into a binding agreement with Lithium Australia Limited (ASX: LIT) to purchase their minority interest in the Lake Johnston Lithium Project for $2 million to increase Charger’s interest to 100% (LIT Agreement)1:

- General meeting for shareholders to approve this transaction will take place at 10am Thursday 11th January 2024;

- Independent expert’s report concludes transaction is “fair and reasonable”; and

- Strong shareholder support for the LIT Agreement with all directors and major shareholders totalling over 19% interest indicating their written support.

- Preparations are well advanced to recommence drilling at the Lake Johnston Lithium Project.

Charger is also pleased to announce it has simultaneously entered into a binding agreement with Lithium Australia Limited (ASX:LIT) to purchase their minority interest in the Lake Johnston Lithium Project moving the Company to a 100% beneficial ownership (LIT Agreement)1, subject to shareholder approval and one remaining third party approval.

Charger’s Managing Director, Aidan Platel, commented:

“The Rio Tinto Exploration farm-in agreement is an excellent result for Charger and its shareholders and is validation that the Lake Johnston Project has potential to host a large-scale lithium deposit. The planned significant investment by RTX will allow thorough systematic exploration over the entire project tenure, with initial exploration focused on fast-tracking the Medcalf Spodumene Prospect as well as progressing the Mt Day and Mt Gordon lithium prospects.

The RTX farm-in agreement and recent placement ensures Charger will be well funded going forward with only ~73 million shares on issue.”

Charger’s Chairman, Adrian Griffin, commented:

“The Rio Tinto Exploration farm-in agreement will see them potentially spending up to $42.5 million to earn up to a 75% interest in the Lake Johnston Project. The largely unexplored Lake Johnston Greenstone belt now hosts multiple spodumene discoveries and with the recent focus and increasing exploration activity could evolve into a prominent lithium province.”

The $1.2M RTX convertible loan is expected to convert to 4,705,882 fully paid ordinary shares ($0.255 per Share) in Charger (CHR Shares) within three business days of the LIT Agreement obtaining shareholder approval under ASX Listing Rule 10.1 at its meeting on 12 January 2023. This would give RTX a 6.08% significant shareholder interest in the Company.

The independent expert’s report concluded the LIT Agreement is “fair and reasonable” (refer to Notice of Meeting announcement 11 December 2023). Charger has received strong shareholder support for the LIT Agreement with written confirmation from directors and major shareholders totalling over 19% interest indicating their support for the deal.

If Charger does not obtain shareholder approval under ASX Listing Rule 10.1 to proceed with the LIT Agreement, or the RTX farm-in conditions are not satisfied, RTX can elect whether to require that Charger repay the convertible loan or convert to CHR shares (at the 10-day VWAP of CHR shares prior to conversion but subject to a minimum conversion price of $0.255 per CHR share).

Preparations are well advanced to recommence drilling at the Lake Johnston Lithium Project in early January 2024.

About the Lake Johnston Lithium Project

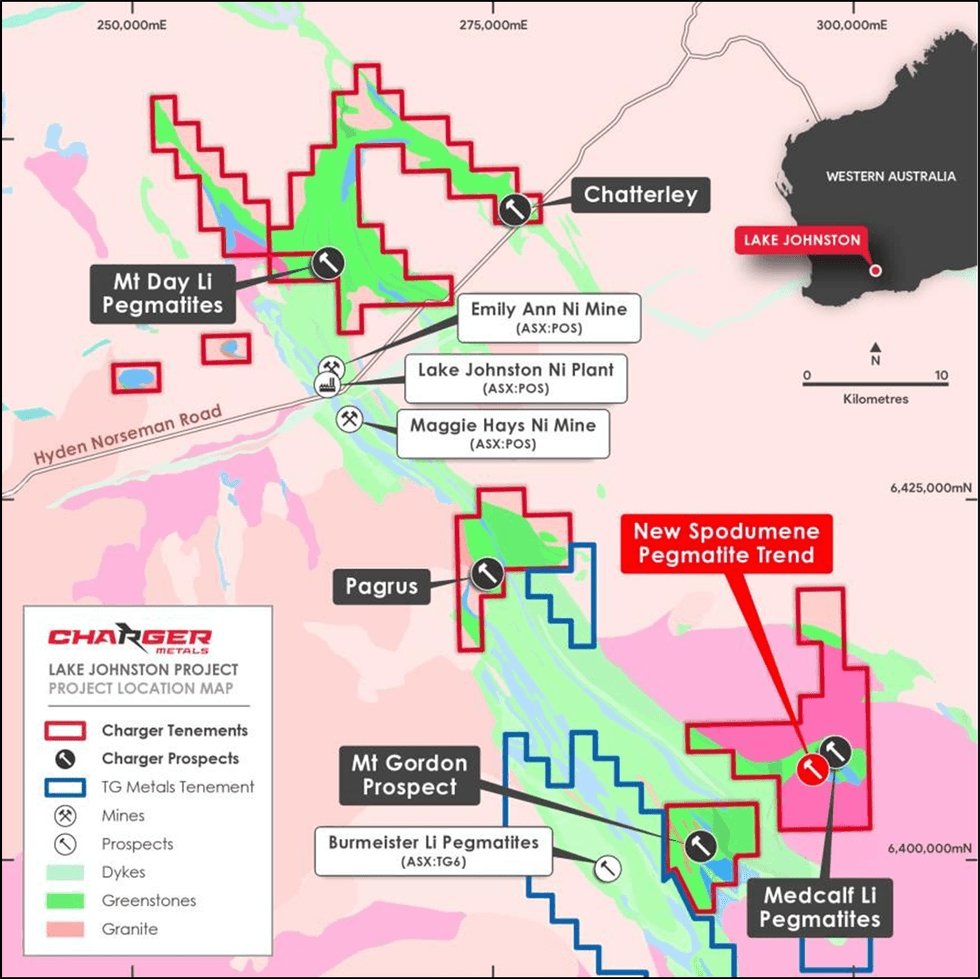

The Lake Johnston Lithium Project is located 450km east of Perth, Western Australia. Lithium prospects occur within a 50km long corridor along the southern and western margin of the Lake Johnston granite batholith. Key target areas include the Medcalf Spodumene Prospect, the Mt Gordon Lithium Prospect and much of the Mount Day LCT pegmatite field, prospective for lithium and tantalum minerals.

The Lake Johnston Lithium Project is located approximately 70km east of the large Earl Grey (Mt Holland) Lithium Project which is under development by Covalent Lithium Pty Ltd (manager of a joint venture between subsidiaries of Sociedad Química y Minera de Chile S.A. and Wesfarmers Limited). Mt Holland is understood to be one of the largest hard-rock lithium projects in Australia with Ore Reserves for the Earl Grey Deposit estimated at 189 Mt at 1.5% Li2O.2

Click here for the full ASX Release

This article includes content from Charger Metals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

CHR:AU

The Conversation (0)

21 January

Official signing of the Portuguese State Grant

Savannah joins other grant recipient companies at official signing ceremony

Savannah Resources Plc, the developer of the Barroso Lithium Project in Portugal, a 'Strategic Project' under the European Critical Raw Materials Act and Europe's largest spodumene lithium deposit (the 'Project'), was delighted to join with other recipients of State grants yesterday at the... Keep Reading...

21 January

Excellent Results from 2025 Core Drilling Program at McDermitt

Jindalee Lithium Limited (Jindalee, or the Company; ASX: JLL, OTCQX: JNDAF) is pleased to report assay results from the drilling program at the McDermitt Lithium Project completed late 2025. All holes returned strong lithium and magnesium intercepts from shallow depths, including:R92: 36.5m @... Keep Reading...

08 January

Top 5 US Lithium Stocks (Updated January 2026)

The global lithium market enters 2026 after a punishing 2025 marked by oversupply, weaker-than-expected EV demand and sustained price pressure, although things began turning around for lithium stocks in Q4. Lithium carbonate prices in North Asia fell to four-year lows early in the year,... Keep Reading...

07 January

5 Best-performing ASX Lithium Stocks (Updated January 2026)

Global demand for lithium presents a significant opportunity for Australia and Australian lithium companies.Australia remains the world’s largest lithium miner, supplying nearly 30 percent of global output in 2024, though its dominance is easing as other lithium-producing countries such as... Keep Reading...

05 January

CEOL Application for Laguna Verde Submitted

CleanTech Lithium PLC ("CleanTech Lithium" or "CleanTech" or the "Company") (AIM: CTL, Frankfurt:T2N), an exploration and development company advancing sustainable lithium projects in Chile, is pleased to announce it has submitted its application (the "Application") for a Special Lithium... Keep Reading...

29 December 2025

SQM, Codelco Seal Landmark Lithium Joint Venture in Salar de Atacama

Sociedad Quimica y Minera (SQM) (NYSE:SQM) and Codelco have finalized their long-awaited partnership, forming a new joint venture that will oversee lithium production in Chile’s Salar de Atacama through 2060.SQM announced on Saturday (December 27) that it has completed its strategic partnership... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00