August 08, 2024

Jindalee Lithium Limited (ABN 52 064 121 133) (Jindalee, the Company) is pleased to announce the results of its non-renounceable pro-rata entitlement offer of fully paid ordinary shares (New Shares) on the basis of one (1) New Share for every six (6) shares held at 5pm AWST on 15 July 2024 (Record Date), together with two (2) attaching options for every two (2) New Shares subscribed for (Attaching Options) to raise up to approximately $3.1 million (Entitlement Issue).

The Entitlement Issue was offered to persons registered as a holder of Company Shares as at the Record Date with a registered address in Australia or New Zealand as identified in the Prospectus dated 10 July 2024 (Eligible Shareholders). Eligible Shareholders were also able to apply for additional New Shares and Attaching Options not subscribed for pursuant to the Entitlement Offer (Top-Up Offer).

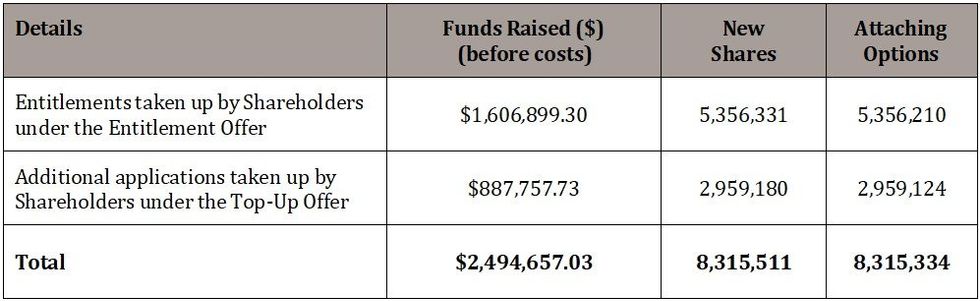

A summary of the results of the Entitlement Offer are as follows:

An Appendix 2A will be lodged following release of this announcement in relation to the application for quotation of 8,315,511 New Shares and 8,315,334 Attaching Options.

Jindalee’s CEO Ian Rodger commented:

“I would like to thank all shareholders who participated in Jindalee’s Entitlement Issue. Your support is crucial, and we're grateful for your confidence in our vision. The funds raised will be key in advancing the optimised Pre- Feasibility Study at our McDermitt Lithium Project. With McDermitt being the largest lithium resource in the USA, we see it as a pivotal asset in the development of America's domestic battery material supply chains.

We appreciate your continued trust in Jindalee and look forward to achieving great milestones together.”

Authorised for release by the Jindalee Board of Directors.

Click here for the full ASX Release

This article includes content from Jindalee Lithium Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

JLL:AU

Sign up to get your FREE

Jindalee Lithium Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

16 April 2025

Jindalee Lithium

Game-changing, economically significant lithium resource for North American battery supply chain

Game-changing, economically significant lithium resource for North American battery supply chain Keep Reading...

23 January

Quarterly Cashflow Report - December 2025

Jindalee Lithium (JLL:AU) has announced Quarterly Cashflow Report - December 2025Download the PDF here. Keep Reading...

23 January

Quarterly Activities Report - December 2025

Jindalee Lithium (JLL:AU) has announced Quarterly Activities Report - December 2025Download the PDF here. Keep Reading...

11 December 2025

US Government Approves Major Drilling Program at McDermitt

Jindalee Lithium (JLL:AU) has announced US Government Approves Major Drilling Program at McDermittDownload the PDF here. Keep Reading...

08 December 2025

Trading Halt

Jindalee Lithium (JLL:AU) has announced Trading HaltDownload the PDF here. Keep Reading...

04 November 2025

Drilling Underway at McDermitt Lithium Project

Jindalee Lithium (JLL:AU) has announced Drilling Underway at McDermitt Lithium ProjectDownload the PDF here. Keep Reading...

27 February

UK Enters Commercial Lithium Production with Geothermal Plant Launch

The UK has entered commercial lithium production for the first time as Geothermal Engineering Ltd (GEL) began operations in its plant at Cornwall, anchoring the government's hopes of a domestic battery metals supply chain.The Redruth-based facility marks the country’s first commercial-scale... Keep Reading...

26 February

Zimbabwe Imposes Immediate Ban on Raw Mineral and Lithium Exports

Zimbabwe has imposed an immediate ban on exports of all raw minerals and lithium concentrates, halting shipments already in transit as the government tightens control over the country’s mining sector.Mines and Mining Development Minister Polite Kambamura announced Wednesday that the suspension... Keep Reading...

19 February

Top Australian Mining Stocks This Week: Lithium Valley Results Boost Gold Mountain

Welcome to the Investing News Network's weekly round-up of the top-performing mining stocks listed on the ASX, starting with news in Australia's resource sector.Mining giant BHP (ASX:BHP,NYSE:BHP,LSE:BHP) reported strong half-year copper results, saying that its copper operations accounted for... Keep Reading...

17 February

Howard Klein Doubles Down on Strategic Lithium Reserve as Project Vault Takes Shape

Before the Trump administration revealed plans for Project Vault, Howard Klein, co-founder and partner at RK Equity, proposed the idea of a strategic lithium reserve. “The goal of a strategic lithium reserve is to stabilize prices and allow the industry to develop,” he told the Investing News... Keep Reading...

17 February

Sigma Lithium Makes New Lithium Fines Sale, Unlocks US$96 Million Credit Facility

Sigma Lithium (TSXV:SGML,NASDAQ:SGML) has secured another large-scale sale of high-purity lithium fines and activated a production-backed revolving credit facility as it ramps up operations in Brazil.The lithium producer announced it has agreed to sell 150,000 metric tons (MT) of high-purity... Keep Reading...

12 February

Albemarle Lifts Lithium Demand Forecast as Energy Storage Surges

Albemarle (NYSE:ALB) is raising its long-term lithium demand outlook after a breakout year for stationary energy storage, underscoring a shift in the battery materials market that is no longer driven solely by electric vehicles.The US-based lithium major reported fourth quarter 2025 net sales of... Keep Reading...

Latest News

Sign up to get your FREE

Jindalee Lithium Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00