January 17, 2025

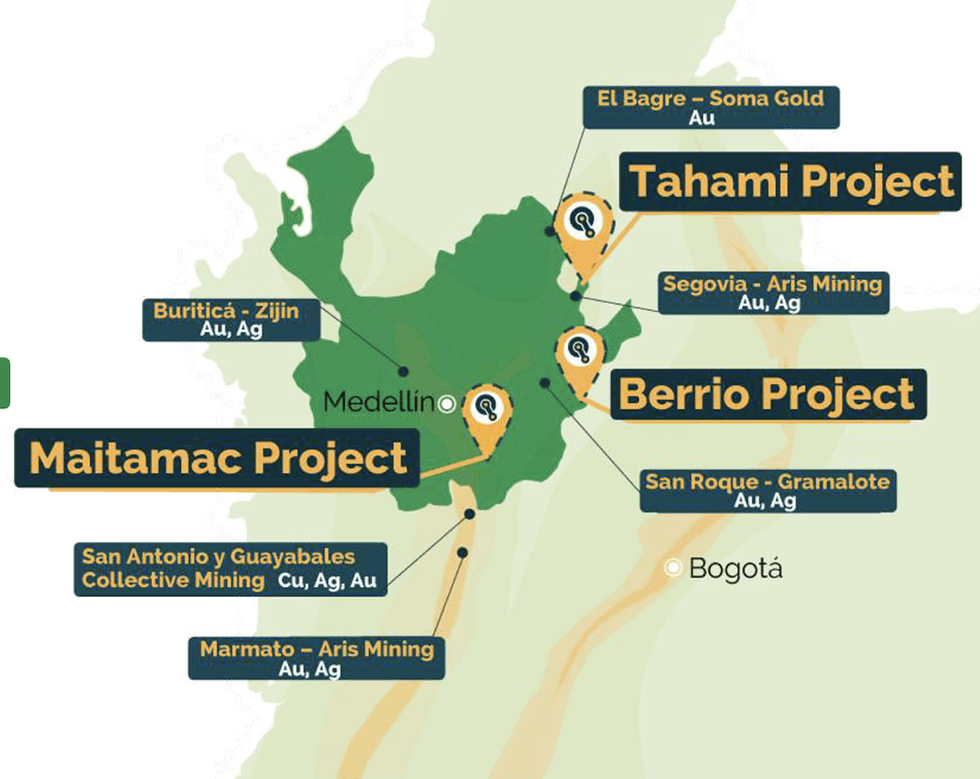

Quimbaya Gold (CSE:QIM)) is a junior gold exploration company exploring high-grade gold projects in Colombia. Quimbaya Gold's portfolio spans 59,057 hectares in highly prospective regions in the Antioquia mining district, the region responsible for about 50 percent of Colombia’s total gold production or around one million ounces (Moz) annually.

Located next to Aris Mining’s (TSX:ARIS) Segovia mine, Quimbaya leverages its proximity to established infrastructure and gold-rich geological formations. With Colombia being one of the most underexplored yet top mining jurisdictions in South America, Quimbaya’s projects are uniquely poised for significant discoveries.

Quimbaya's flagship Tahami project spans 17,087 hectares featuring mesothermal veins with multiple mineralization events underlain by Precambrian metamorphic rocks consolidated within the San Lucas Gneiss unit.

Company Highlights

- Quimbaya Gold controls 59,057 hectares across three distinct projects in Antioquia, Colombia — renowned as the country's top mining department, accounting for over half of Colombia’s gold production.

- The flagship Tahami project is adjacent and on trend to Aris Mining’s Segovia mine, one of the highest-grade gold mines globally. Tahami benefits from its strategic proximity to Segovia and its potential for discovery of high-grade vein gold systems.

- Tight share structure (60 percent insider/family offices/institutions ownership) with a market cap of approximately C$11.45 million, ensuring alignment with shareholder interests.

- Quimbaya has entered into a partnership with Independence Drilling, Colombia’s largest drilling company, which secures an extremely cost-effective 100,000 meters of drilling over five years.

- Quimbaya utilizes software that allows for rapid and cost-effective acquisition of mining claims, giving the company a competitive edge in securing high-value assets.

- The technical team’s proven track record of major discoveries in Colombia positions Quimbaya as a standout explorer in the region.

This Quimbaya Gold profile is part of a paid investor education campaign.*

Click here to connect with Quimbaya Gold (CSE:QIM) to receive an Investor Presentation

QIM:CC

Sign up to get your FREE

Quimbaya Gold Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

29 July

Quimbaya Gold

Unlocking high-grade gold potential in Antioquia, Colombia’s premier mining district

Unlocking high-grade gold potential in Antioquia, Colombia’s premier mining district Keep Reading...

04 November

Quimbaya Gold Closes C$14.4 Million Bought Deal Financing

Quimbaya Gold Inc. (CSE: QIM,OTC:QIMGF) (OTCQB: QIMGF) (FSE: K05) ("Quimbaya" or the "Company") is pleased to announce the closing of its previously announced "bought deal" private placement, with Stifel Canada (the "Underwriter") as sole underwriter and bookrunner, pursuant to which the... Keep Reading...

24 October

Quimbaya Gold Announces Upsize of Bought Deal Financing to $12.5 Million

/NOT FOR DISTRIBUTION TO U.S. NEWSWIRE SERVICES OR FOR RELEASE, PUBLICATION, DISTRIBUTION OR DISSEMINATION DIRECTLY, OR INDIRECTLY, IN WHOLE OR IN PART, IN OR INTO THE UNITED STATES./ Quimbaya Gold Inc. ("Quimbaya" or the "Company") (CSE:QIM,OTC:QIMGF) (OTCQB: QIMGF) (FSE: K05) is pleased to... Keep Reading...

24 October

Canadian Investment Regulatory Organization Trade Resumption - QIM

Trading resumes in: Company: Quimbaya Gold Inc. CSE Symbol: QIM All Issues: Yes Resumption (ET): 8:15 AM CIRO can make a decision to impose a temporary suspension (halt) of trading in a security of a publicly-listed company. Trading halts are implemented to ensure a fair and orderly market. CIRO... Keep Reading...

23 October

Quimbaya Gold Announces C$10 Million Bought Deal Financing

/NOT FOR DISTRIBUTION TO U.S. NEWSWIRE SERVICES OR FOR RELEASE, PUBLICATION, DISTRIBUTION OR DISSEMINATION DIRECTLY, OR INDIRECTLY, IN WHOLE OR IN PART, IN OR INTO THE UNITED STATES./ Quimbaya Gold Inc. ("Quimbaya" or the "Company") (CSE: QIM,OTC:QIMGF) (OTCQB: QIMGF) (FSE: K05) is pleased to... Keep Reading...

23 October

Quimbaya Gold Expands Strategic Land Position at Tahami Project

Company claims 7,637 hectares of new concessions adjacent to its flagship Tahami Project and Aris Mining operation in Segovia, increasing the project footprint from 17,087 to 24,724 hectares and building on recent fieldwork successQuimbaya Gold Inc. (CSE: QIM,OTC:QIMGF) (OTCQB: QIMGF) (FSE: K05)... Keep Reading...

9h

Peter Schiff: Gold, Silver Correction Over? Next Price Triggers, Where to Focus

Peter Schiff, chief economist and global strategist at Euro Pacific Asset Management and founder of Schiff Gold, shares his outlook on gold and silver prices. He also discusses Bitcoin and emerging markets. Don't forget to follow us @INN_Resource for real-time updates!Securities Disclosure: I,... Keep Reading...

9h

Top 10 Gold-mining Companies

Regardless of how the gold price is doing, the top gold-mining companies are always making moves.Right now, gold is in the limelight — stimulated by increasing global inflation, geopolitical turmoil and economic uncertainty, the gold price is repeatedly setting new highs in 2025, and broke... Keep Reading...

11h

Aureka Pays AU$1.3 Million to Exit Tandarra Joint Venture

Aureka (ASX:AKA) has sold its 49 percent interest in the Tandarra joint venture in Victoria to its co-owner Catalyst Metals (ASX:CYL) for a cash sale AU$1.3 million.In the Monday (November 10) announcement, Aureka said the move is aligned with its strategy to focus on its flagship Stawell... Keep Reading...

11 November

Trump’s Fed Feud: Fears Over Fed Independence Benefit Gold

Uncertainty over the autonomy of the Federal Reserve under US President Trump echoes historical executive overreach, and is boosting gold’s safe-haven appeal. In its annual Precious Metals Investment Focus report, published on October 25, Metals Focus highlighted a number of factors amplifying... Keep Reading...

Latest News

Sign up to get your FREE

Quimbaya Gold Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00