June 24, 2024

Metals Australia Ltd (“Metals Australia”, or “the Company”) continues to advance its flagship high- grade flake-graphite development project in the Tier 1 mining district of Quebec, Canada.

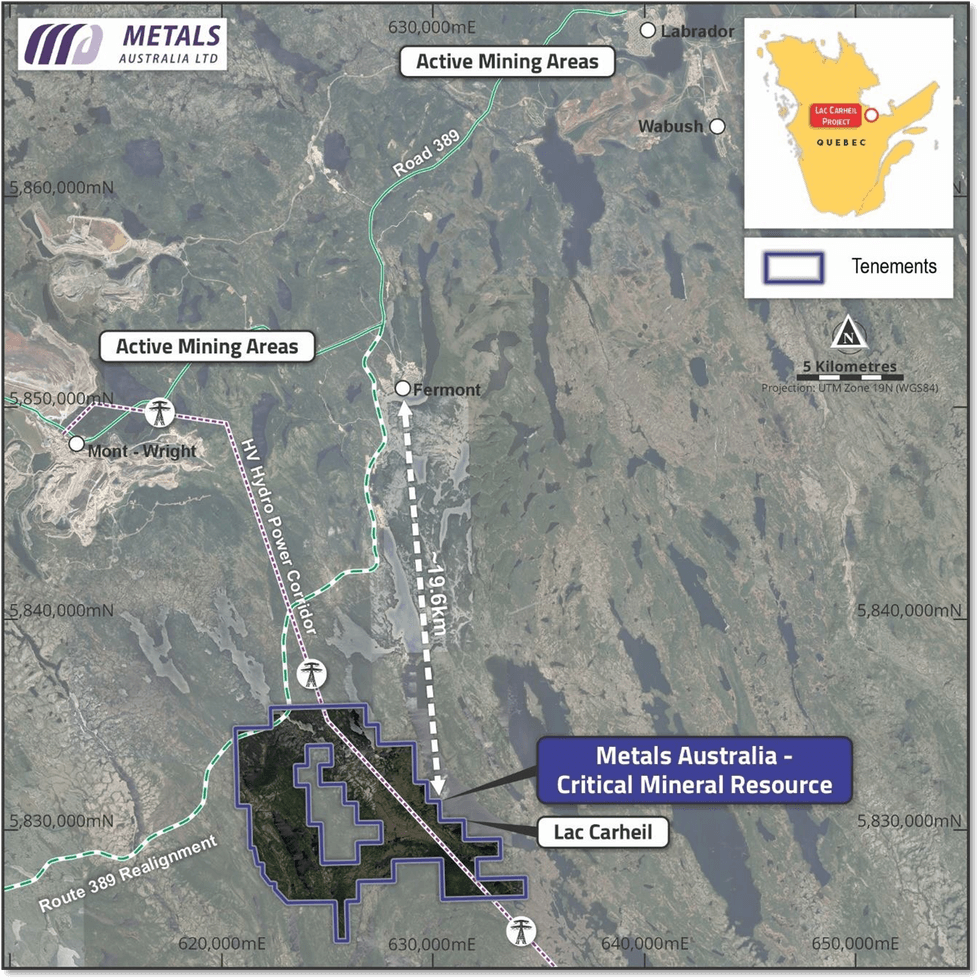

- Project Name change to Lac Carheil Graphite project: Metals Australia is changing the name of its graphite project to Lac Carheil Graphite Project to better align the projects proximity with its closest and most significant geographical feature (Figure 1). The existing project Mineral Resource1 is located on the Carheil Trend, east of Hydro Quebec’s high voltage powerline corridor (315 kV) which bisects the claims owned by the Company. The current resource is a considerable distance from Lac Rainy and much closer to Lac Carheil. The primary objective of the name change is to avoid confusion among all stakeholders (see Figure 2).

- Metals Australia has submitted a new Impact Exploration Assessment (IEA) to the Quebec Ministry of Natural Resources and Forestry (MRNF), following consultation with all stakeholders. The application recognises changes that came into effect from May 6th this year. An application must satisfy the conditions set out in the new regulations and contain questions, requests and comments from local authorities and indigenous communities concerned as well as exploration attributes and delineation of the areas proposed. Metals Australia believes that all Impact concerns raised for a short duration drilling program have been addressed.

- Further contract awards signed. Metals Australia has signed a contract with Lonestar Technical Minerals (LSTM) for the completion of its marketing and pricing strategy as part the overall pre-feasibility (PFS) assessment. This study will investigate the optimum flake-graphite product mix and market opportunities, based on its unique chemical characteristics and flake-size distribution. Graphite is designated as a Critical Mineral in countries such as the USA, Canada, and Australia – given its wide- ranging applications, including as the key anode material in battery energy storage.

- Advancing further detailed proposal reviews for key elements of the project. Significant additional work program scopes are under evaluation, with detailed proposals received and more anticipated. These include Mineral Resource Estimation and Mining Design scopes, which will follow the resource expansion and definition drilling program. Environmental and Social Impact Assessment (ESIA) studies will also be carried out – including baseline environmental studies and ongoing monitoring of the project area. Professional service agreements to support strategic advisory and community engagement programs will also be implemented.

- Progressing previously announced study contracts – Laboratory test work with SGS laboratories is underway, investigating key elements of the design for the Flake Graphite Concentrate Plant, including planned design elements focused on lowering environmental risks associated with long term deposition of tailings. PFS design work with Lycopodium Minerals, Canada is also advancing. Commitments with ANZAPLAN in Germany for downstream design work and location studies are scheduled and will commence when the required sample material has been generated by the SGS test program.

Project Name change to Lac Carheil Graphite project.

Metals Australia has changed the name of the Graphite project to Lac Carheil Graphite Project, as the project’s existing Mineral Resource (13.3 Mt @ 11.5% Graphitic Carbon (Cg) including Indicated of 9.6Mt @ 13.1% Cg & Inferred 3.7Mt @ 7.3% Cg)1 is relatively close to Lac Carheil and a considerable distance from Lac Rainy. Communications have frequently referenced the Carheil trend as the graphite trend on which the current resource exists. The use of Lac Rainy as a project reference has created confusion with stakeholders, given its position to temporarily suspended exploration areas (Figure 2). Figure 2 shows the position of the project resource and lake locations. Also shown are exclusion areas that form part of an Aquatic reserve associated with the Moisie River and its key tributaries, which is approximately 35km south of our current resource. Areas shown in orange have been designated as mining incompatible, while purple areas are under temporary suspension.

Click here for the full ASX Release

This article includes content from Metals Australia Ltd, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

MLS:AU

Sign up to get your FREE

Metals Australia Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

02 July 2025

Metals Australia

High-quality graphite development project with an accelerated pathway to production, complemented by a diversified portfolio of critical, precious and base metals assets in tier-1 jurisdictions across Canada and Australia.

High-quality graphite development project with an accelerated pathway to production, complemented by a diversified portfolio of critical, precious and base metals assets in tier-1 jurisdictions across Canada and Australia. Keep Reading...

17 February

High Grade Assays Verify the Emerging Manindi VTM Project

Metals Australia (MLS:AU) has announced High Grade Assays Verify the Emerging Manindi VTM ProjectDownload the PDF here. Keep Reading...

29 January

Quarterly Activities/Appendix 5B Cash Flow Report

Metals Australia (MLS:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

27 January

Graphite Project Links to Quebec's Critical Minerals Plan

Metals Australia (MLS:AU) has announced Graphite Project Links to Quebec's Critical Minerals PlanDownload the PDF here. Keep Reading...

18 December 2025

High Copper Anomalies Show Deeper Potential at Warrego East

Metals Australia (MLS:AU) has announced High Copper Anomalies Show Deeper Potential at Warrego EastDownload the PDF here. Keep Reading...

16 December 2025

Titanium-Vanadium-Magnetite Discovery Extended over 1km

Metals Australia (MLS:AU) has announced Titanium-Vanadium-Magnetite Discovery Extended over 1kmDownload the PDF here. Keep Reading...

24 February

Iyan Deposit Delivers Further Significant Graphite Intercepts from Surface in the Final Release of Assays

Final Assay Batch Again Reinforces Bulk Blending Strategy, Resource Growth and Imminent JORC

Blencowe Resources Plc (LSE: BRES) is pleased to report the final set of assay results completed from the 87 shallow holes drilled at the Iyan deposit, part of the Company's Orom-Cross Graphite Project in Uganda. These results represent the third batch from the Stage 7 drilling programme, with... Keep Reading...

18 February

US Slaps Higher Tariffs on Chinese Graphite Imports After Final Commerce Determination

The US Department of Commerce has sharply increased trade penalties on Chinese graphite anode materials, concluding that producers in China engaged in unfair pricing and subsidy practices that harmed the US market.In a final determination issued February 11, 2026, Commerce raised countervailing... Keep Reading...

27 January

Top 5 Canadian Graphite Stocks (Updated January 2026)

Graphite stocks and prices have experienced volatility in recent years recently due to bottlenecks in demand for electric vehicles, as graphite is used to create lithium-ion battery anode materials. One major factor experts are watching is the trade war between China and the US.China introduced... Keep Reading...

09 December 2025

Greenland Government Grants Exploitation Licence for Amitsoq

GreenRoc Strategic Materials Plc (AIM: GROC), a company focused on the development of critical mineral projects in Greenland, is delighted to announce that the Government of Greenland has granted an Exploitation Licence for the Amitsoq Graphite Project to Greenland Graphite a/s ("Greenland... Keep Reading...

30 November 2025

Altech - Board Renewal and Strategic Focus

Altech Batteries (ATC:AU) has announced Altech - Board Renewal and Strategic FocusDownload the PDF here. Keep Reading...

Latest News

Sign up to get your FREE

Metals Australia Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00