October 29, 2024

Pursuit Minerals Ltd (ASX: PUR) (“PUR”, “Pursuit” or the “Company”) is pleased to present its activities report for the quarterly period ended 30 September 2024.

HIGHLIGHTS

1. High Grade Lithium Results The latest drill results at the Rio Grande Sur Project demonstrated lithium concentrations exceeding 500mg/L, enhancing project value and supporting an anticipated resource upgrade. These results reenforce the project’s significant potential

2. Pilot Plant Milestone On Track

The 250 tpa Lithium Carbonate Pilot Plant is set for initial production by late 2024, a key milestone that moves the project closer to generating revenue and showcases Pursuit’s commitment to advancing value-creating phases.

3. Focused Resource and Feasibility Expansion With recent drill data, Pursuit is targeting a resource upgrade and continues its feasibility study scheduled for delivery in H1, 2025. These developments pave the way for potential commercial scaling, aligning with value driven growth.

4. Offtake Discussions Ongoing

Advanced negotiations for offtake agreements for lithium carbonate from the Pilot Plant focus on securing product demand and building revenue streams, all whilst minimising cash burn and supporting continuous production targets.

5. Strategic Review of Commando Gold Project The Commando Gold Project, with high grade intersections and renewed market interest, is being evaluated for review for potential exploration or partnerships, aligning with Pursuit’s low-cost strategy to create shareholder value from underutilised assets.

PROJECT DEVELOPMENT

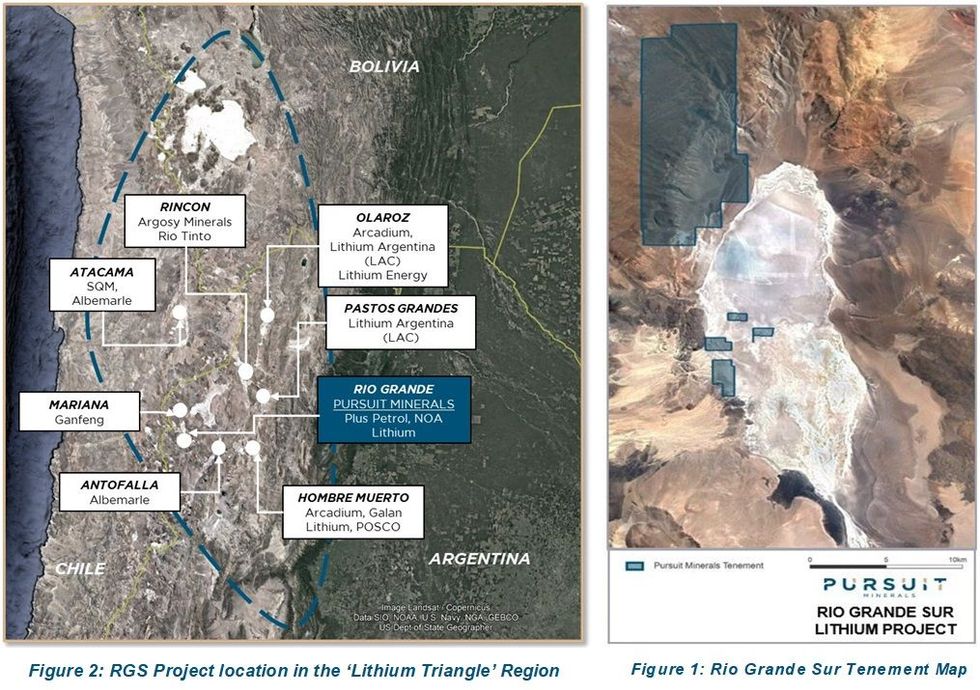

During the September 2024 quarter, Pursuit Minerals Ltd (“Pursuit” or “Company”) has continued to advance through numerous engineering and geological workstreams, permitting approval processes and stakeholder engagement activities at our flagship Rio Grande Sur Lithium Project in the Salta province of Argentina.

Rio Grande Sur (RGS) Lithium Project Argentina

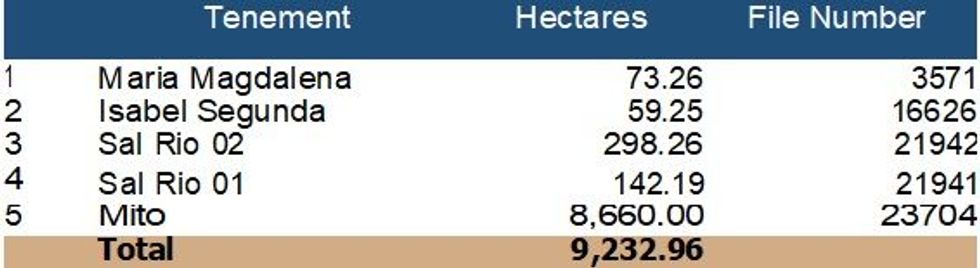

The Rio Grande Sur Project comprises of 5 tenements prospective for lithium on the Rio Grande Salar in the Salta province of Argentina, in addition to a Lithium Carbonate Pilot Plant located in the city of Salta. The five tenements cover approximately 9,233 hectares (Table 1).

Rio Grande Sur Stage 1 Drilling Campaign.

During the quarter, Pursuit announced the preliminary results of Drill Hole 2 / DDH-2 at the Sal Rio 02 tenement (announcement dated 29 August 2024) with full results announced following the end of the period (See announcement dated 30 October 2024.)

DDH-2 achieved a depth of 500m, with Pursuit’s on-site geologists and drilling team having been extremely encouraged by the geological units encountered across the depths of the hole.

Click here for the full ASX Release

This article includes content from Pursuit Minerals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

PUR:AU

The Conversation (0)

02 May 2024

Pursuit Minerals

Tier 1 lithium play in the prolific Lithium Triangle in Argentina

Tier 1 lithium play in the prolific Lithium Triangle in Argentina Keep Reading...

07 April 2025

First Production of Lithium Carbonate

Pursuit Minerals (PUR:AU) has announced First Production of Lithium CarbonateDownload the PDF here. Keep Reading...

30 March 2025

Completion of Capital Raise

Pursuit Minerals (PUR:AU) has announced Completion of Capital RaiseDownload the PDF here. Keep Reading...

24 March 2025

$1.1 Million Placement

Pursuit Minerals (PUR:AU) has announced $1.1 Million PlacementDownload the PDF here. Keep Reading...

19 March 2025

Trading Halt

Pursuit Minerals (PUR:AU) has announced Trading HaltDownload the PDF here. Keep Reading...

06 March 2025

Lithium Carbonate Pilot Production Commences

Pursuit Minerals (PUR:AU) has announced Lithium Carbonate Pilot Production CommencesDownload the PDF here. Keep Reading...

1h

Zimbabwe Imposes Immediate Ban on Raw Mineral and Lithium Exports

Zimbabwe has imposed an immediate ban on exports of all raw minerals and lithium concentrates, halting shipments already in transit as the government tightens control over the country’s mining sector.Mines and Mining Development Minister Polite Kambamura announced Wednesday that the suspension... Keep Reading...

19 February

Top Australian Mining Stocks This Week: Lithium Valley Results Boost Gold Mountain

Welcome to the Investing News Network's weekly round-up of the top-performing mining stocks listed on the ASX, starting with news in Australia's resource sector.Mining giant BHP (ASX:BHP,NYSE:BHP,LSE:BHP) reported strong half-year copper results, saying that its copper operations accounted for... Keep Reading...

17 February

Howard Klein Doubles Down on Strategic Lithium Reserve as Project Vault Takes Shape

Before the Trump administration revealed plans for Project Vault, Howard Klein, co-founder and partner at RK Equity, proposed the idea of a strategic lithium reserve. “The goal of a strategic lithium reserve is to stabilize prices and allow the industry to develop,” he told the Investing News... Keep Reading...

17 February

Sigma Lithium Makes New Lithium Fines Sale, Unlocks US$96 Million Credit Facility

Sigma Lithium (TSXV:SGML,NASDAQ:SGML) has secured another large-scale sale of high-purity lithium fines and activated a production-backed revolving credit facility as it ramps up operations in Brazil.The lithium producer announced it has agreed to sell 150,000 metric tons (MT) of high-purity... Keep Reading...

12 February

Albemarle Lifts Lithium Demand Forecast as Energy Storage Surges

Albemarle (NYSE:ALB) is raising its long-term lithium demand outlook after a breakout year for stationary energy storage, underscoring a shift in the battery materials market that is no longer driven solely by electric vehicles.The US-based lithium major reported fourth quarter 2025 net sales of... Keep Reading...

21 January

Official signing of the Portuguese State Grant

Savannah joins other grant recipient companies at official signing ceremony

Savannah Resources Plc, the developer of the Barroso Lithium Project in Portugal, a 'Strategic Project' under the European Critical Raw Materials Act and Europe's largest spodumene lithium deposit (the 'Project'), was delighted to join with other recipients of State grants yesterday at the... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00