April 03, 2025

Description

A recent analyst report from Longspur Clean Energy highlights Provaris Energy’s (ASX:PV1) progress in establishing a hydrogen and CO2 transport solution, alongside a strategic shift to a capital-light business model.

With key agreements in place, new revenue streams emerging, and an expanded valuation outlook, Provaris is well-positioned for growth in the global clean energy market.

Key Highlights from the Report:

Building Blocks for Hydrogen and CO₂ Transport in Place

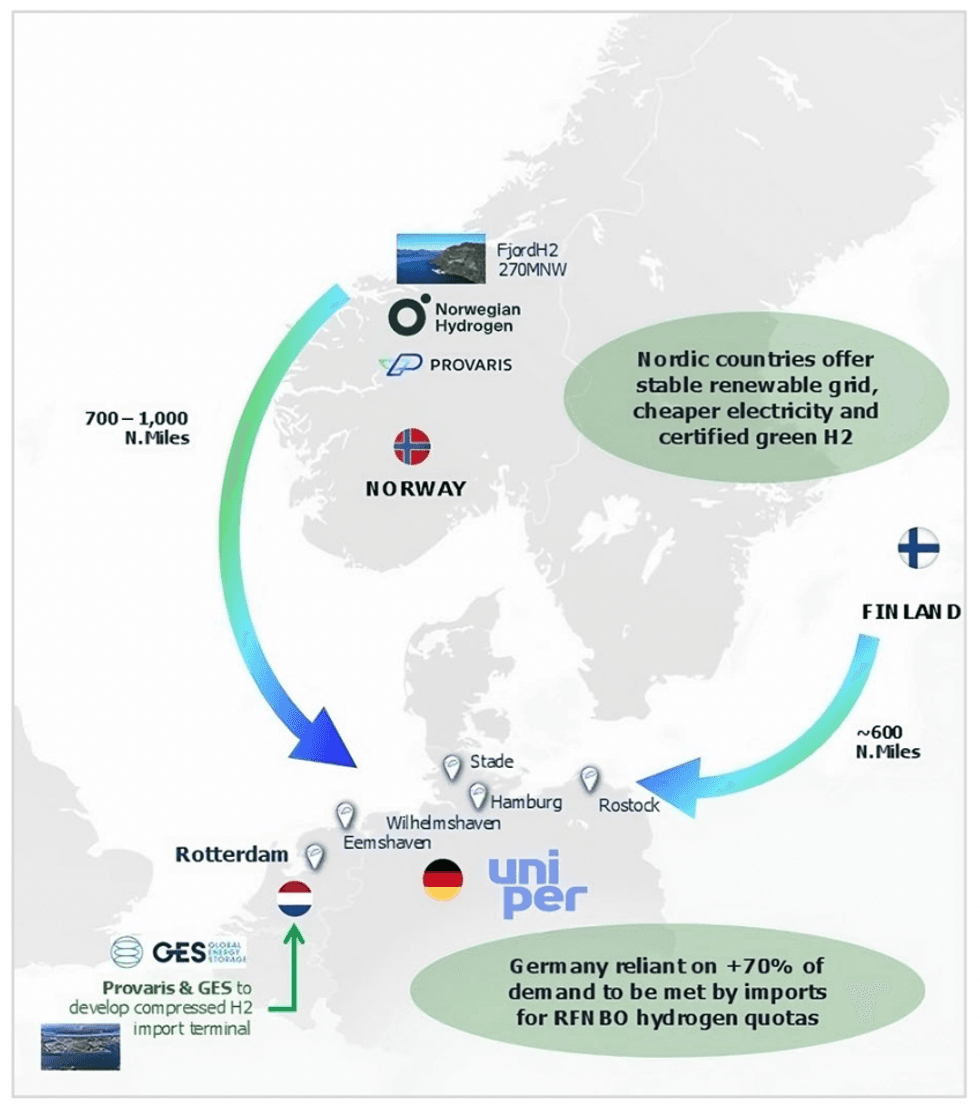

Provaris has secured foundational agreements to advance its hydrogen and CO2 transport solutions. This includes a 42,000 tpa hydrogen supply chain agreement with Uniper and Norwegian Hydrogen, a 30,000 tpa supply deal from Norway to a German utility, and a joint development agreement with Yinson Production Offshore for a 5 mtpa CO2 transport project targeted for the end of the decade.

Capital-light Model to Reduce Funding Needs

Adopting a capital-light model, Provaris will generate licence and origination fees while avoiding the need to fund vessel construction directly. This approach lowers financial risk while maintaining long-term participation in the sector.

Licence Fees Unlock Near-term Revenue

Provaris will now earn a 5 percent technology licence fee on the capital expenditure of its H2Neo hydrogen carrier and H2Leo hydrogen barge, providing upfront revenue during the 30-month construction period. Once operational, the company targets a 5 percent free-carried equity ownership, allowing further financial participation.

Revised Forecasts and Increased Valuation

The updated financial model anticipates technology licence revenue as early as FY 2027, earlier than previous forecasts. Longspur Clean Energy has raised its base-case valuation slightly from AU$0.07 to AU$0.08, with a single CO2 project pushing this to AU$0.13. A larger-scale Norwegian hydrogen project could drive a high-case valuation of AU$0.15. The lower capital requirements under the new model increase the feasibility of new projects, improving confidence in higher valuation scenarios.

For the full analyst report, click here.

This content is intended only for persons who reside or access the website in jurisdictions with securities and other applicable laws which permit the distribution and consumption of this content and whose local law recognizes the scope and effect of this Disclaimer, its limitation of liability, and the legal effect of its exclusive jurisdiction and governing law provisions [link to Governing Law section of the Disclaimer page].

Any investment information contained on this website, including third party research reports, are provided strictly for informational purposes, are general in nature and not tailored for the specific needs of any person, and are not a solicitation or recommendation to purchase or sell a security or intended to provide investment advice. Readers are cautioned to seek the advice of a registered investment advisor regarding the appropriateness of investing in any securities or investment strategies mentioned on this website.

PV1:AU

Sign up to get your FREE

Provaris Energy Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

25 May 2025

Provaris Energy

Enabling the scale-up of clean energy supply chains through innovative hydrogen and CO2 storage and transport solutions.

Enabling the scale-up of clean energy supply chains through innovative hydrogen and CO2 storage and transport solutions. Keep Reading...

04 March

Funding to Advance 2026 Development Milestones

Provaris Energy (PV1:AU) has announced Funding to Advance 2026 Development MilestonesDownload the PDF here. Keep Reading...

02 March

Trading Halt

Provaris Energy (PV1:AU) has announced Trading HaltDownload the PDF here. Keep Reading...

27 February

Appendix 4D & Half-Year Accounts 31 December 2025

Provaris Energy (PV1:AU) has announced Appendix 4D & Half-Year Accounts 31 December 2025Download the PDF here. Keep Reading...

05 February

LCO2 Tank FEED Achieves Key Milestones

Provaris Energy (PV1:AU) has announced LCO2 Tank FEED Achieves Key MilestonesDownload the PDF here. Keep Reading...

01 February

MOU with Yinson and Himile to Advance LCO2 Tank Production

Provaris Energy (PV1:AU) has announced MOU with Yinson and Himile to Advance LCO2 Tank ProductionDownload the PDF here. Keep Reading...

25 February

Acquisition of Critical Infrastructure Services Platform

European Green Transition plc (AIM: EGT) announces that in line with its strategy set out at IPO, EGT has entered into a share purchase agreement ("SPA") to acquire an established, EBITDA profitable onshore wind turbine operating, maintenance, repairing, and remote monitoring business (the "O&M... Keep Reading...

25 February

CHARBONE confirme de nouvelles commandes en hydrogene UHP et une premiere commande en oxygene UHP aux Etats-Unis

(TheNewswire) Brossard, Quebec, le 25 février 2026 TheNewswire - CORPORATION Charbone (TSXV: CH,OTC:CHHYF; OTCQB: CHHYF; FSE: K47) (« Charbone » ou la « Société »), un producteur et distributeur nord-américain spécialisé dans l'hydrogène propre Ultra Haute Pureté (« UHP ») et les gaz industriels... Keep Reading...

25 February

CHARBONE Confirms New UHP Hydrogen Orders and its First UHP Oxygen Order in the United States

(TheNewswire) Brossard, Quebec, February 25, 2026 TheNewswire - Charbone CORPORATION (TSXV: CH,OTC:CHHYF; OTCQB: CHHYF; FSE: K47) ("Charbone" or the "Company"), a North American producer and distributor specializing in clean Ultra High Purity ("UHP") hydrogen and strategic industrial gases, is... Keep Reading...

24 February

Carbonxt Secures $500,000 Convertible Note Funding

Carbonxt Group (CG1:AU) has announced Carbonxt Secures $500,000 Convertible Note FundingDownload the PDF here. Keep Reading...

23 February

CHARBONE Presente a la Conference Emerging Growth le 25 fevrier 2026

(TheNewswire) Brossard, Quebec TheNewswire - le 23 février 2026 CORPORATION Charbone (TSXV: CH,OTC:CHHYF; OTCQB: CHHYF; FSE: K47) (« Charbone » ou la « Société »), un producteur et distributeur nord-américain spécialisé dans l'hydrogène propre Ultra Haute Pureté (« UHP ») et les gaz industriels... Keep Reading...

Latest News

Sign up to get your FREE

Provaris Energy Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00