August 19, 2024

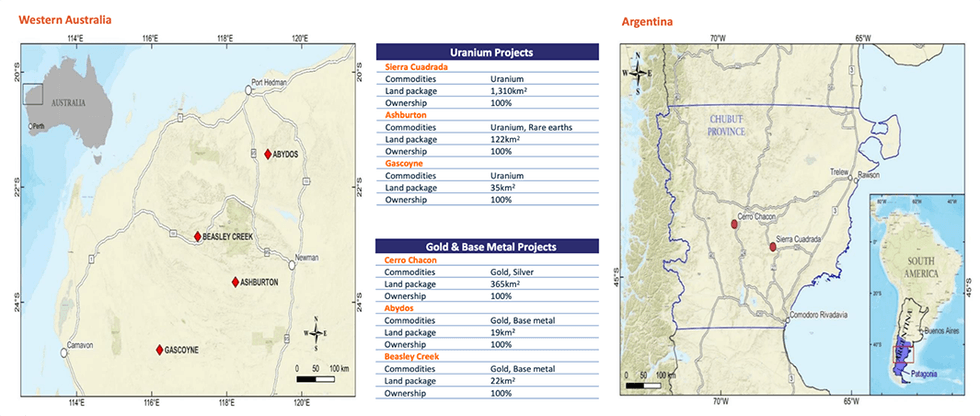

With high-quality, drill-ready assets, with world-class discovery potential, Piche Resources (ASX:PR2) is a compelling business case for investors looking to leverage a bull market for uranium and gold. The company holds a portfolio of drill-ready uranium and gold assets in Argentina and Australia which include the Ashburton uranium project in the Pilbara region; the Sierra Cuadrada uranium project in Argentina; and the Cerro Chacon gold project which shares geological similarities with the Cerro Negro mine.

The Ashburton uranium project comprises three exploration licences and has the potential to host uranium mineral deposits similar to the Pine Creek Geosyncline in Australia’s Northern Territory, and the Athabasca Basin in Saskatchewan, Canada.

iche has an internationally recognized board focused on creating long-term shareholder value, and an in-country technical team in Argentina with a proven track record of taking projects from discovery through to development.

Company Highlights

- The company’s Australian asset is the Ashburton uranium project which has been drilled previously and recorded high-grade uranium intersections over significant widths.

- In Argentina, the company’s Sierra Cuadrada uranium project in the San Jorge Basin has a significant history of high-grade, near-surface uranium mining operations.

- The company is currently drilling one of its prospects at Sierra Cuadrada and has announced visible uranium in numerous holes. Multiple other prospects are drill-ready and have the potential to host tier 1 uranium deposits.

- Exposure to gold with high-quality precious metal projects in Argentina that boast surface outcrop samples with gold grade up to 13 g/t gold.

- Internationally renowned board and management team with extensive uranium and gold exploration and development experience.

This Piche Resources profile is part of a paid investor education campaign.*

Click here to connect with Piche Resources (ASX:PR2) to receive an Investor Presentation

PR2:AU

Sign up to get your FREE

Piche Resources Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

30 July 2025

Piche Resources

Targeting globally significant uranium and gold discoveries in Australia and Argentina

Targeting globally significant uranium and gold discoveries in Australia and Argentina Keep Reading...

29 January

Quarterly Activities/Appendix 5B Cash Flow Report

Piche Resources (PR2:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

04 December 2025

Commences Maiden RC Drilling at Cerro Chacon Gold Project

Piche Resources (PR2:AU) has announced Commences Maiden RC Drilling at Cerro Chacon Gold ProjectDownload the PDF here. Keep Reading...

06 November 2025

Reinstatement to Quotation

Piche Resources (PR2:AU) has announced Reinstatement to QuotationDownload the PDF here. Keep Reading...

06 November 2025

$2million placement to advance Argentine exploration

Piche Resources (PR2:AU) has announced $2million placement to advance Argentine explorationDownload the PDF here. Keep Reading...

30 October 2025

Quarterly Appendix 5B Cash Flow Report

Piche Resources (PR2:AU) has announced Quarterly Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

8h

Jaime Carrasco: Gold at US$7,000 is "Conservative," Plus Silver Outlook

Jaime Carrasco, senior portfolio manager and senior financial advisor at Harbourfront Wealth Management, explains what's driving gold and silver prices. "The real question here is not how high silver is going — forget about that," he said. "The right question is how high does gold have to go to... Keep Reading...

9h

Precious Metals Price Update: Another Week of Volatility for Gold, Silver, PGMs

It's been another week of strong volatility in precious metals prices.Gold, silver and platinum have posted new all-time highs in 2026, but so far February has been more choppy seas than smooth sailing. A complex web of push-and-pull factors are at play in the precious metals market. Let’s take... Keep Reading...

9h

55 North Mining: The Economic Upside of US$5,000 Gold and High-grade Project Next to Alamos Gold

With gold prices maintaining their historic trajectory toward US$5,000 per ounce, gold exploration companies with high-grade assets offer immediate economic leverage. 55 North Mining (CSE:FFF,FWB:6YF) is emerging as a primary beneficiary of this. We sat down with CEO Bruce Reid as he discussed... Keep Reading...

10 February

Flow Metals to Acquire the Monster IOCG Project in Yukon

Flow Metals Corp. (CSE: FWM) ("Flow Metals" or the "Company") is pleased to report that it has entered into an option agreement dated February 9, 2026 (the "Option Agreement") with Go Metals Corp. ("Go Metals") to acquire the Monster IOCG project (the "Monster Project"), located approximately 90... Keep Reading...

Latest News

Sign up to get your FREE

Piche Resources Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00