- WORLD EDITIONAustraliaNorth AmericaWorld

October 13, 2021

Auroch Minerals Limited (ASX:AOU) (Auroch or the Company) is pleased to announce that it has commenced sampling as part of the assessment of the lithium-caesium-tantalum (LCT) mineralisation potential at the Nepean Project in Western Australia (Auroch Minerals 80%).

Highlights

- Abundant pegmatites identified at the Nepean Project to be sampled for lithium-caesiumtantalum (LCT) mineralisation

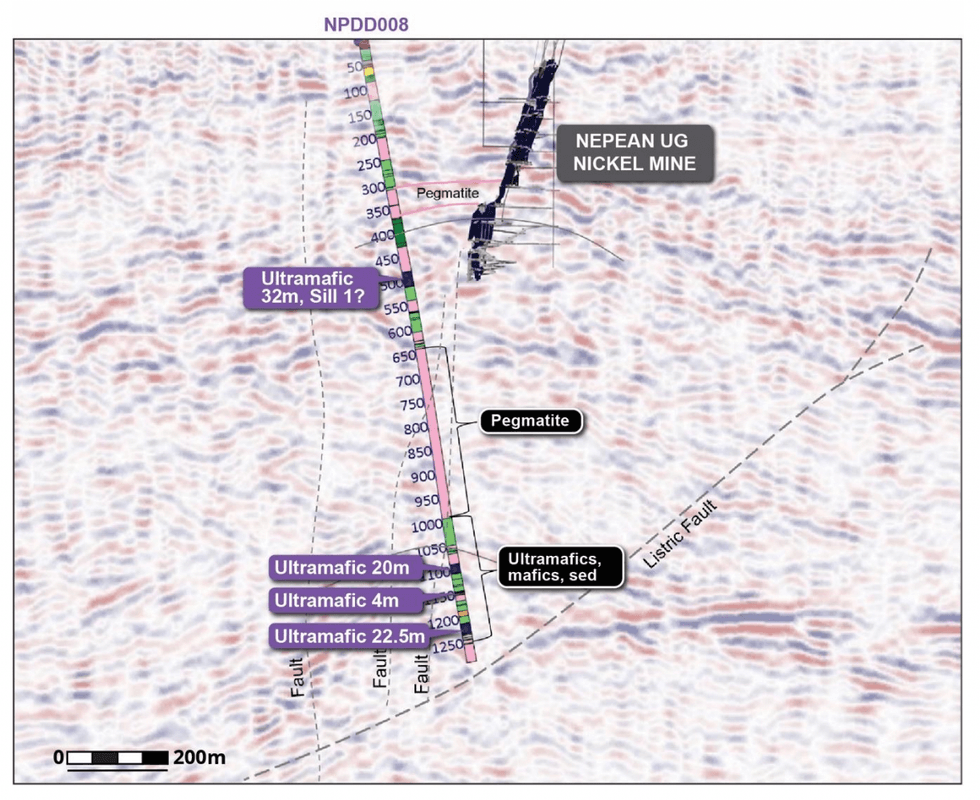

- Recent drill-hole NPDD008 testing the Nepean Deeps nickel exploration target intersected a total of 700m of pegmatite intrusions, including one 350m thick pegmatite in the hanging-wall below the historic nickel mine workings1

- Multiple commodities including lithium and tantalum were historically mined from pegmatite intrusions at the Londonderry deposits only 6km north of the historic Nepean nickel mine

- Down-hole geophysical surveys are currently being completed on drill-hole NPDD008 to identify potential nickel sulphide targets for the ongoing Nepean Deeps drill programme

Pegmatite intrusions have been identified throughout the project area, including at the historic Nepean nickel mine itself, where multiple pegmatites intruded the mine sequence but were not historically assessed for any economic potential.

The abundance of pegmatites was also identified in the recently-completed first diamond drill-hole into the Nepean Deeps target, which was designed to test for down-plunge extensions to the highgrade nickel sulphide mineralisation below the historic Nepean mine. The drill-hole successfully intersected 46m of komatiitic ultramafics over three lower intervals which are highly prospective for nickel sulphide mineralisation (Figure 1)1 . In addition the hole intersected approximately 700m of pegmatite intrusions, including one 350m thick pegmatite in the hanging-wall below the historic nickel mine workings (Figure 1, Photograph 1)1 .

The Company has initiated sampling of the pegmatites from the diamond core to be submitted for assaying for LCT mineralisation.

AOU:AU

The Conversation (0)

23 September 2021

Auroch Minerals

Exploring High-Grade Nickel Sulfides in Western Australia

Exploring High-Grade Nickel Sulfides in Western Australia Keep Reading...

12 February

Bahia Metals Corp. Completes Initial Public Offering of $5,750,000, with Full Exercise of Over-Allotment Option

Bahia Metals Corp. (CSE: BMT) ("Bahia" or the "Company") is pleased to announce that it has successfully completed its initial public offering (the "IPO") of 11,500,000 units of the Company (the "Units") at a price of $0.50 per Unit, inclusive of the full exercise of the 15% over-allotment... Keep Reading...

04 February

FPX Nickel Reports Confirmatory Results from Geotechnical Drilling at the Baptiste Nickel Project

FPX Nickel Corp. (TSX-V: FPX, OTCQX: FPOCF) ("FPX" or the "Company") is pleased to report assay results from select drill holes completed during its 2025 engineering field investigation program at the Baptiste Nickel Project ("Baptiste" or the "Project") in central British Columbia.As previously... Keep Reading...

16 January

Top 5 Canadian Mining Stocks This Week: Homeland Nickel Gains 132 Percent

Welcome to the Investing News Network's weekly look at the best-performing Canadian mining stocks on the TSX, TSXV and CSE, starting with a round-up of Canadian and US news impacting the resource sector.The Ontario government said Tuesday (January 13) that it is accelerating permitting and... Keep Reading...

08 January

Nickel Market Recalibrates After Explosive Trading Week

Nickel prices stabilized on Thursday (January 8) after a turbulent week that saw the market swing sharply higher before retreating as traders reassessed the balance between existing supply risks and a growing overhang of inventory.Three-month nickel on the London Metal Exchange (LME) hovered... Keep Reading...

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00