October 18, 2021

Okapi Resources Limited (ASX: OKR) (Okapi or the Company) is pleased to announce its Maiden JORC 2012 Mineral Resource estimate for its Tallahassee Uranium Project located in Colorado, USA.

Highlights

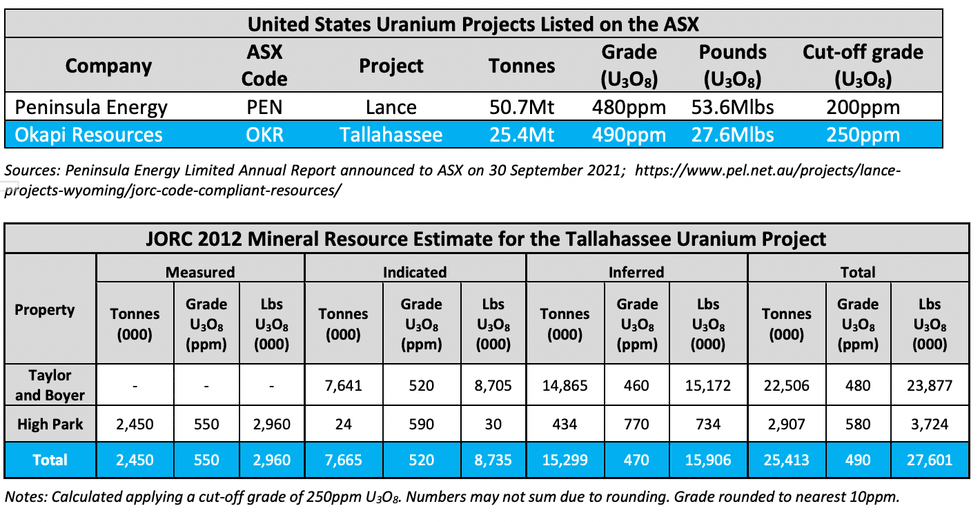

- Okapi's Maiden JORC 2012 Resource of 27.6 million pounds of U3O8 at 490ppm U3O8 for the Tallahassee Uranium Project, Colorado, USA

- Includes Measured, Indicated and Inferred resource categories

- Planning of maiden drill program well advanced

- Significant scope to increase pounds through exploration and accretive acquisitions

- Clear strategy to become a new leader in North American carbon-free nuclear energy

Okapi's Maiden 2012 Mineral Resource for the Tallahassee Uranium Project has been estimated at 25.4Mt @ 490ppm U3O8 for 27.6 million pounds of U3O8using a 250ppm cut-off grade.

Okapi Resources Executive Director David Nour commented:

"This is yet another significant milestone for Okapi, achieving a Maiden JORC 2012 Mineral Resource that provides a robust platform on which to add further pounds via exploration within our current landholdings and through further value-accretive acquisitions."

"The team is also well advanced in planning a maiden drilling program of circa 10,000m at the Tallahassee Uranium Project."

Read the full article here.

OKR:AU

The Conversation (0)

05 February

Ranger Uranium Mine Rehabilitation Gets Green Light from Australia

Minister for Resources and Northern Australia Madeleine King has issued a new rehabilitation authority to Energy Resources Australia (ASX:ERA) for the continuation of rehabilitation activities at the Ranger uranium mine in the Northern Territory.“This new authority means that Energy Resources... Keep Reading...

04 February

Uranium Bull Market Isn’t Over, but Volatility Lies Ahead

Uranium’s resurgence has been one of the resource sector's most durable stories of the past five years, but as prices hover near multi-year highs, investors are increasingly asking the same question: How late is it?At the Vancouver Resource Investment Conference (VRIC), panelists Rick Rule, Lobo... Keep Reading...

02 February

Eagle Energy Metals Corp. and Spring Valley Acquisition Corp. II Announce Effectiveness of Registration Statement and Record and Meeting Dates for Extraordinary General Meeting of Shareholders to Approve Proposed Business Combination

Eagle, a next-generation nuclear energy company with rights to the largest open pit-constrained measured and indicated uranium deposit in the United States, and SVII, a special purpose acquisition company, today announced that the SEC has declared effective the Registration Statement, which... Keep Reading...

30 January

Spot Uranium Passes US$100, Extends Year-Long Rally

Uranium prices surged back above US$100 a pound this week, extending a year-long rally that is reshaping the uranium market after more than a decade of underinvestment.Spot price of uranium climbed US$7.75 to US$101 a pound after the Sprott Physical Uranium Trust... Keep Reading...

29 January

Quarterly Activities/Appendix 5B Cash Flow Report

Basin Energy (BSN:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00