More than 2,000 gold grains per 10kg of material

Nuvau Minerals Inc. (TSXV: NMC) (the "Company" or "Nuvau"), is pleased to share a highlight from its fall 2023 sonic drilling program at the Matagami Mining Camp that has delineated an exciting new gold target on the Company's large-scale property.

- Hole PD-23-030s delivered a gold grain anomaly with more than 2,000 gold grains per 10 kg of material, supported by a near-contiguous sample with 295 gold grains

"This anomaly is of prime significance as potential evidence of an eroded gold occurrence, likely located within a kilometre north-east of the hole collar," said Peter van Alphen, President and CEO. "The Matagami camp has a long history of base metal mining, and yet the property's location in the Abitibi also makes it a prime location for gold mineralisation. At over 2,000 grains of gold per 10kg of material, this is an anomaly of regional significance, likely higher than any previous results known in the Abitibi. The Borden Gold Mine in Chapleau was discovered through the same means of mapping overburden till anomalies, and the highest concentration seen in that case was only about 800 grains per 10kg."

About the 2023 Sonic Drill Program at the Matagami Property

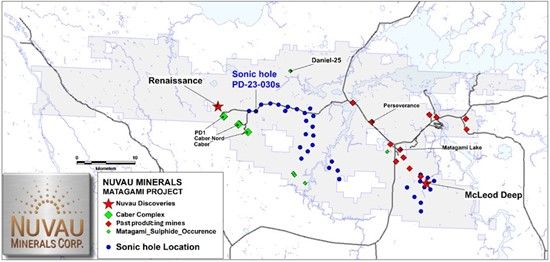

Following a successful proof-of-concept survey conducted in spring 2023, a first phase of a property scale overburden drilling program was conducted on the Matagami property, approximately 30 kilometres to the west of the Matagami Mill complex, in late 2023. The sonic drill program consisted of 24 holes totaling 726 metres of core and was conducted to evaluate the potential dispersion of gold and base metal minerals in glacial sediments buried underneath the Ojibway clay belt. Part of the survey was aimed at confirming a gold-in-till anomaly first detected by Newmont Mining in 1987.

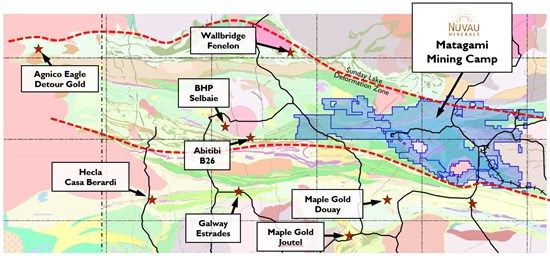

The Matagami Property is located in a part of the northern Abitibi greenstone belt that is host to numerous gold and base metal mines, however, very little effort was previously focused on the gold potential of this large property. Canada's largest producing gold mine, Agnico's Detour Mine, is located on-trend to the west (see figure 2). The Casa Berardi Mine is located to the southwest of the Matagami Property and was discovered through a combination of geological exploration techniques, including prospecting based on regional geological mapping, airborne geophysical surveys, and subsequent ground-based exploration including soil and till sampling.

A total of 151 samples of glacial sediments were collected and submitted for gold grains and indicator mineral counting with the use of automated ARTGold technology by IOS Geosciences from Saguenay, QC, plus multi-element chemical analysis of the fine fraction (-170 um) of the sediments. A total of 9 samples are deemed anomalous, with gold grain counts in excess of 30 grains per 10kg of material.

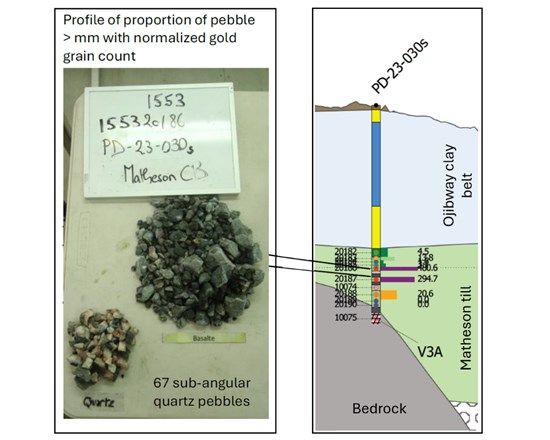

Hole PD-23-030s - Of these, one sample from hole PD-23-030s produced a notable gold grain anomaly. The anomaly was detected at depth between 29.26 to 29.87 metres in the overburden (sample 155320186), and featured more than 2,000 gold grains per 10 kg of material. In addition, a near-contiguous sample with 295 gold grains per 10 kg of material between 31.12 to 32.00 metres (sample 155320187) was also encountered. The interval between these two samples consisted of a large locally derived boulder.

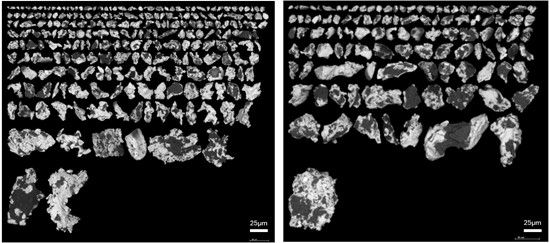

The bulk of these gold grains bear very delicate (pristine) form, with enshrined silicate minerals, suggestive of minimal glacial transport. No chemical anomalies and no abnormal abundance of indicator minerals were detected.

Pebbles in these samples consist uniquely of andesitic basalts, along with a significant proportion of quartz veins fragments. This suggests the presence of an auriferous quartz vein system invading the meta-andesite, believed to possibly be within a kilometre to the north-east of the collar.

This anomaly is located approximately 5 metres above the bedrock, meaning it has been displaced by glacial movement. Since no previous drilling or outcrop is available in the north-east up-ice direction, displacement cannot be accurately estimated.

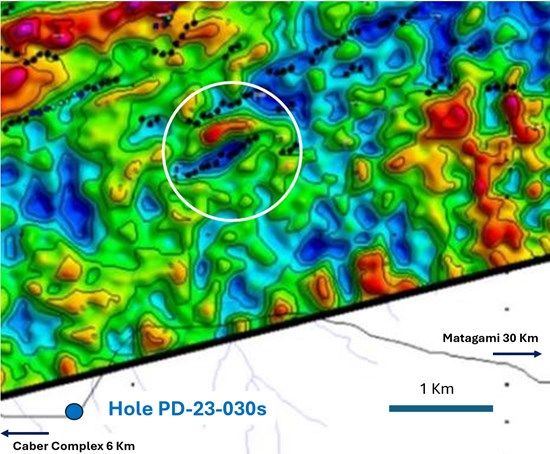

Additional analysis is still required to understand the follow-up action required, however; a second-order structure highlighted by a VTEM geophysical anomaly beside a high-gravity distinct anomaly is present 2 kilometres in this direction, which is tentatively suggested as potential source and is currently considered as a priority diamond drill target.

Figure 1 : Nuvau's Matagami property, General Location

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/11236/243224_nuvauimg1.jpg

Figure 2: Matagami Property Location relative to the gold producers of the region. Results from adjacent property(ies) are not necessarily indicative of the mineralization on Nuvau's property.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/11236/243224_a80e63aa64427b4c_004full.jpg

Figure 3: Location of hole PD-23-030s with airborne gravity map (color) and VTEM pick (black dots)

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/11236/243224_a80e63aa64427b4c_005full.jpg

Figure 4: Mosaic of backscattered electron images of gold grain. Notice the delicate textures and silicate attachments. LEFT: Image of 230 gold grains found in sample 155320186, hole PD-23-030s, RIGHT: Image of 112 gold grains found in adjacent sample 155320187.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/11236/243224_nuvauimg4.jpg

Figure 5: (Left) Pebble composition of sample 155320186 showing 2,000 grains of gold per 10kg, and (right) section of Hole PD-23-030s indicating samples 155320186 and 155320187 (shown as 20186 and 20187 for brevity).

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/11236/243224_a80e63aa64427b4c_012full.jpg

About Nuvau Minerals Inc.

Nuvau is a Canadian mining company focused on the Abitibi Region of mine-friendly Québec. Nuvau's principal asset is the Matagami Property that is host to significant existing processing infrastructure and multiple mineral deposits and is being acquired from Glencore.

Qualified Person and Quality Assurance

Gilles Roy, P. Geo. (Qc), Director of Exploration of Nuvau and a "qualified person" as is defined by National Instrument 43-101, has verified the scientific and technical data disclosed in this news release, and has otherwise reviewed and approved the scientific and technical information in this news release.

Core has been quicklogged on drilling site and shipped by truck to IOS facilities in Saguenay for detailed logging and sampling by a qualitifed quartenary geologist. Hole core from selected intervals has been bagged and queued for processing in the same facility, where samples were sifted and gold grain concentrated with a proprietary fluidized bed. Concentrates were then dry sifted at 50 μm, the +50 μm being examined under optical microscope while -50 μm being scanned by automated electron microscope. Every suspected gold grain has been analysed by Energy Dispersive X-Ray Spectrometer (EDS) and high magnification back-scattered images have been acquired in order to classify morphology. Quality control is ensured via various mass balance calculations and EDS analysis of all grains of interest, prior to results being cross-examined by experienced geologists. In the course of sifting, an aliquot of the sample has been saved and shipped for analysis to Activation Laboratories in Ancaster, Ontario, for ICP-MS-QQQ ultra-trace analyses after aqua-regia digestion. Quality control has been conducted by a certified chemist and includes approximately 15% blanks, certified reference materials and internal reference materials.

Cautionary Statements

This news release contains forward-looking statements and forward-looking information (collectively, "forward-looking statements") within the meaning of applicable securities laws. Any statements that are contained in this news release that are not statements of historical fact may be deemed to be forward-looking statements. Forward-Looking statements are often identified by terms such as "may", "should", "anticipate", "will", "estimates", "believes", "intends" "expects" and similar expressions which are intended to identify forward-looking statements. More particularly and without limitation, this news release contains forward-looking statements concerning drill results relating to the Matagami Property, the results of the PEA, the potential of the Matagami Property, the timing and commencement of any production, the restart of the Bracemac-McLeod Mine, the completion of the earn-in of the Matagami Property and the timing and completion of any technical studies, feasibility studies or economic analyses. Forward-Looking statements are inherently uncertain, and the actual performance may be affected by a number of material factors, assumptions and expectations, many of which are beyond the control of the Company, including expectations and assumptions concerning the Company and the Matagami Property. Readers are cautioned that assumptions used in the preparation of any forward-looking statements may prove to be incorrect. Events or circumstances may cause actual results to differ materially from those predicted as a result of numerous known and unknown risks, uncertainties, and other factors, many of which are beyond the control of the Company. Readers are further cautioned not to place undue reliance on any forward-looking statements, as such information, although considered reasonable by the management of the Company at the time of preparation, may prove to be incorrect and actual results may differ materially from those anticipated.

The forward-looking statements contained in this news release are made as of the date of this news release, and are expressly qualified by the foregoing cautionary statement. Except as expressly required by securities law, neither the Company nor Nuvau undertakes any obligation to update publicly or to revise any of the included forward-looking statements, whether as a result of new information, future events or otherwise.

For further information please contact:

Nuvau Minerals Inc.

Peter van Alphen

President and CEO

Telephone: 416-525-6023

Email: pvanalphen@nuvauminerals.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release. No stock exchange, securities commission or other regulatory authority has approved or disapproved the information contained herein.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/243224