November 28, 2023

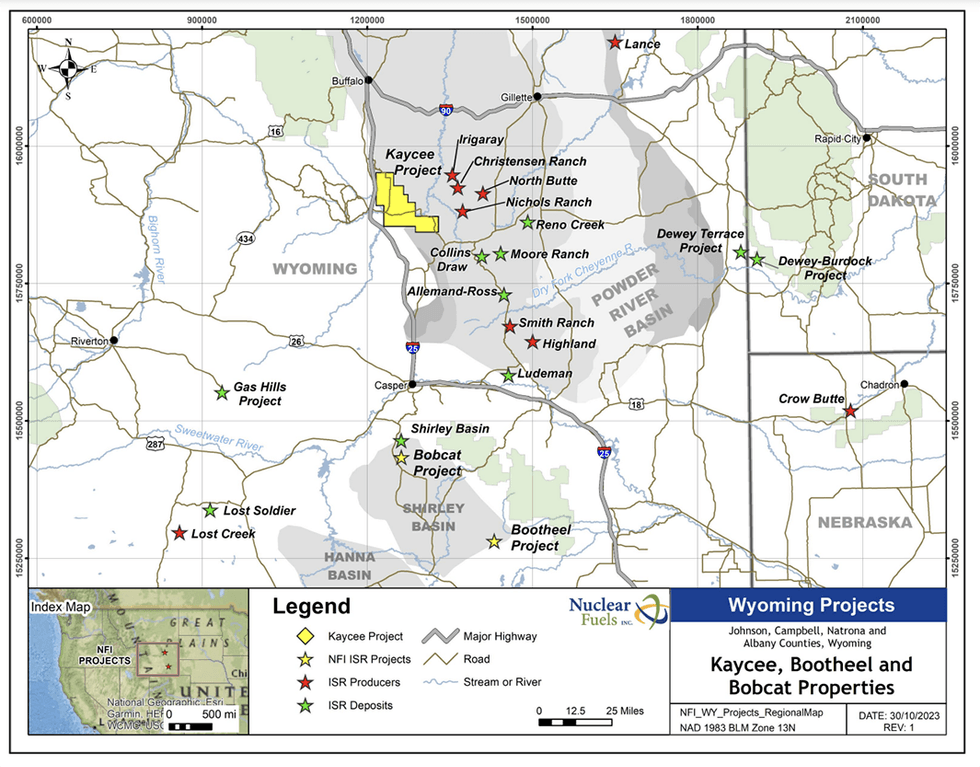

Nuclear Fuels (CSE:NF) focuses on the Kaycee Uranium Project in Wyoming seeking to prove up known historic resource and work towards a 43-101 compliant resource of 15 million pounds of uranium. Drilling at the Kaycee Uranium Project includes multiple uranium intercepts of ore-grade thickness and high-grade mineralization showing potential for ISR extraction, an environmentally responsible and economically superior uranium extraction process.

The company’s other assets include the Bootheel Project in Wyoming (uranium), the Moonshine Project in Arizona (uranium), and the LAB Project in Labrador (uranium and rare earth elements). Through this portfolio of projects, Nuclear Fuels is confident it can develop a safe, environmentally superior, and reliable source of domestic uranium, thereby reducing foreign supply dependence and ultimately contributing to the global energy transition.

Majority of the Kaycee Uranium Project is not well-explored, with drilling concentrated on approximately 10 percent of the area. The company has begun a 200-hole drill program focused on confirming and expanding historic uranium drill intersections as well as identifying new high-priority targets.

Company Highlights

- Nuclear Fuels is a uranium exploration company focused on district-scale in-situ recovery (ISR) projects in proven and prolific jurisdictions such as Wyoming.

- The company is focused on its flagship Kaycee Uranium Project, located in Wyoming’s Powder River Basin. Their goal is to prove up known historic resource and work towards a 43-101 compliant resource of 15 million pounds of uranium. The inaugural 200-hole drill program is currently underway at the Kaycee Project.

- Positive drill results at Kaycee Project to date, including multiple uranium intercepts of ore-grade thickness and high-grade mineralization showing potential for ISR extraction.

- Wyoming is the leading uranium-producing state in the US, home to the largest known uranium ore reserves in the country. It is also a jurisdiction that supports energy development, being among a handful of US states with an ‘Agreement State’ status, which provides a streamlined permitting program for new uranium projects.

- Nuclear Fuels acquired the Kaycee Project from enCore Energy which retains back-in right for a 51 percent stake in the project by paying 2.5 times the exploration expenditures and carrying it to production in case of any major discovery at Kaycee. This provides Nuclear Fuels with a pathway to production.

- The company is focused on exploring for uranium that is amenable to ISR technology, a process that is environmentally responsible and economically superior. It extracts the uranium in a non-invasive process through the use of natural groundwater and oxygen, coupled with a proven ion exchange process, to recover the uranium.

- enCore Energy Corp. is the company’s largest shareholder with a 19.9 percent stake, while management and other insiders hold approximately a 10 percent stake.

- The company is led by industry experts with extensive experience and credentials in uranium exploration and development, and all aspects of ISR uranium operations.

- In the rising global demand for carbon-free sources of energy production, Nuclear Fuels is well positioned to provide a reliable supply of domestic uranium and critical metal resources.

- The US is the world’s largest consumer of nuclear energy, with 20 percent of its electric grid fueled by nuclear energy, yet most of its uranium fuel is imported.

- Uranium prices continue to rise as the shortage of uranium supplies for the West continues to grow.

This Nuclear Fuels profile is part of a paid investor education campaign.*

Click here to connect with Nuclear Fuels (CSE:NF) to receive an Investor Presentation

NF:CC

The Conversation (0)

17 October 2024

Nuclear Fuels

Advancing district-scale In-Situ Recovery amenable uranium projects towards production in the United States.

Advancing district-scale In-Situ Recovery amenable uranium projects towards production in the United States. Keep Reading...

26 October 2023

Nuclear Fuels Announces Kaycee Uranium Project Expanded to 42+ Square Miles

(TheNewswire) Vancouver, British Columbia TheNewswire - October 26, 2023 Nuclear Fuels Inc. (CSE:NF) ("Nuclear Fuels" or the "Company") announced today that Nuclear Fuels has expanded its Kaycee Uranium Project ("the Kaycee Project") by over 25%. Newly acquired historic drill hole data led to... Keep Reading...

04 March

Cameco Signs US$2.6 Billion Uranium Deal With India to Fuel Nuclear Expansion

Cameco (TSX:CCO,NYSE:CCJ) has secured a nine-year uranium supply agreement with India worth an estimated US$2.6 billion, accelerating its nuclear power expansion as it deepens critical mineral ties with the country.The Saskatoon-based uranium producer will supply nearly 22 million pounds of... Keep Reading...

26 February

Definitive Agreement for the Sale of the Marshall Project

Basin Energy (BSN:AU) has announced Definitive agreement for the sale of the Marshall projectDownload the PDF here. Keep Reading...

26 February

Denison Greenlights First Major Canadian Uranium Mine in 20 Years

Denison Mines (TSX:DML,NYSEAMERICAN:DNN) has approved construction of what it says will be Canada’s first new large-scale uranium mine in more than 20 years, setting the stage for work to begin next month at its flagship Phoenix project in northern Saskatchewan.The company announced that its... Keep Reading...

25 February

Uranium American Resources

Uranium American Resources Inc. is a mining company. The Company maintains mining leases on properties in Nevada. The Company is engaged in mining activities in the mineable resource of gold and silver remains in the Comstock Mining District. Its Comstock project is located in northwestern... Keep Reading...

25 February

US Nuclear Growth at Risk as Enrichment Supply Gap Looms

A looming shortage of uranium enrichment services could threaten US nuclear expansion plans, according to the leader of Centrus Energy (NYSE:LEU), one of the country’s largest suppliers of enriched uranium.Amir Vexler, president and CEO of Centrus, is warning that rising demand from existing... Keep Reading...

24 February

Eagle Energy Metals and Spring Valley Acquisition Corp. II Announce Closing of Business Combination

Eagle Energy Metals Corp. (“Eagle”), a next-generation nuclear energy company with rights to the largest conventional, measured and indicated uranium deposit in the United States, today announced that it has completed its business combination with Spring Valley Acquisition Corp. II (OTC: SVIIF)... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00