February 28, 2024

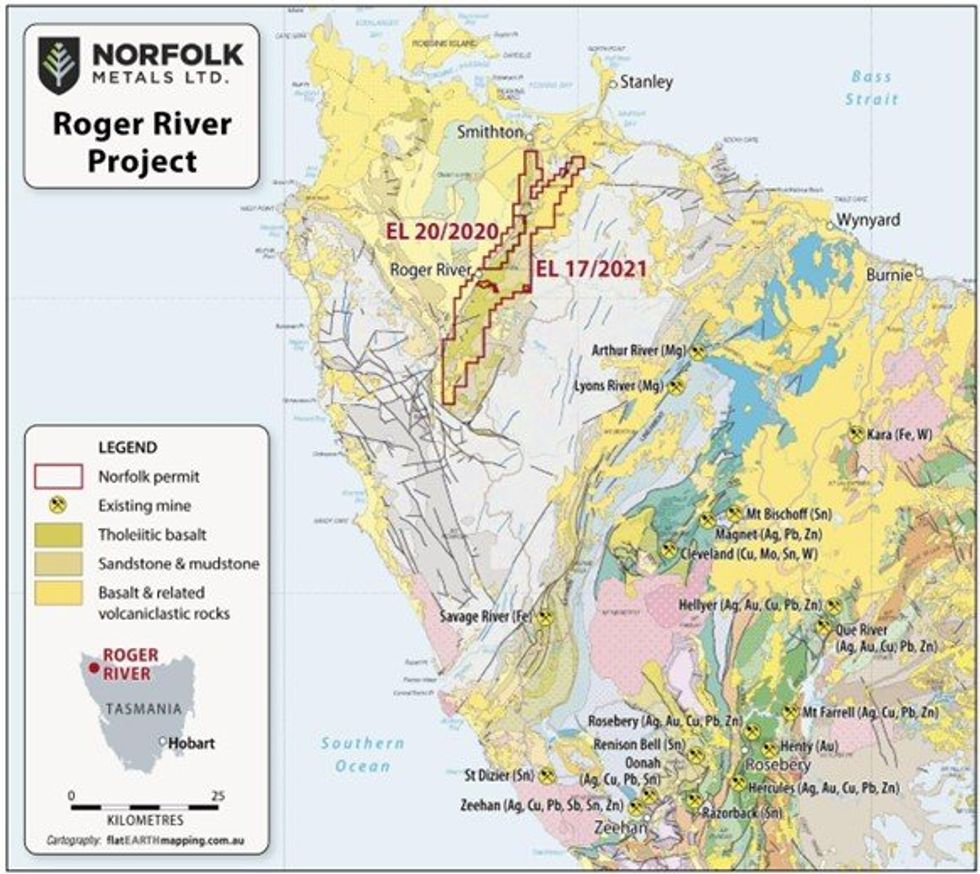

Norfolk Metals Ltd (ASX:NFL) (Norfolk or the Company) initiated a soil program at the Roger River Project (Tasmania) to obtain a better understanding of the copper and gold mineralisation to guide the next exploration phase and potential drilling.

- Roger River Project (Tasmania) soil study complete with successful reanalysis of historical samples

- Norfolk awarded permit EL6948 expanding both Orroroo and Johnburgh Projects (South Australia) further west

- Norfolk commences review of complimentary projects to the South Australian uranium project suite, amongst other projects elsewhere

- Strong cash position at A$3.49m December 2023 quarter

Roger River (Tasmania) Update

The program focus was to provide a lateral vector or a possible surface trend or strike to the native copper (Cu) mineralization intersected in hole 22RRD-001 at Anomaly 2 (A2). The soil program consisted of new surface samples and the re-analyses of selected historical samples (not previously sampled for Cu) being submitted for Cu (multi-elements) analysis.

New surface samples were collected on a 200 x 100m grid around A2 with a total of 98 samples collected covering an area of approximately 1.2km x 1.5km over the interpreted splay from the Roger River Fault. The results revealed a maximum of 11 ppb for gold (Au), 221 ppm for copper (Cu) and 35 ppm for arsenic (As). Gridding and plotting of both gold and arsenic results revealed linear anomalies that are coincident with the interpreted main structures (splays) considered as potential conduits for the mineralizing fluids in the Roger River epithermal system (Figure 1).

Click here for the full ASX Release

This article includes content from Norfolk Metals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

03 August 2021

Norfolk Metals

ASX-listed uranium explorer

ASX-listed uranium explorer Keep Reading...

12h

Mining’s New Reality: Strategic Nationalism, Gold Records and a Fractured Cost Curve

The era of “smooth globalization” is over, and mining is entering a more fragmented, politically charged phase defined by strategic nationalism, according to speakers at S&P Global’s latest webinar.Jason Holden, who opened the “State of the Market: Mining Q4 2025” session with a macro overview,... Keep Reading...

17h

Brazilian State Firm Seeks Injunction to Block Equinox Gold-CMOC Asset Sale

A Brazilian state-run mining company is seeking an emergency court injunction to block the sale of one of Equinox Gold's (TSX:EQX,NYSEAMERICAN:EQX) Brazilian assets. Bloomberg reported that Companhia Baiana de Produção Mineral (CBPM) has asked the Bahia State Court of Justice to immediately... Keep Reading...

19h

Silver Hammer Closes CDN$3,913,617 Non-Brokered Private Placement Pursuant to Listed Issuer Exemption

Silver Hammer Mining Corp. (CSE: HAMR,OTC:HAMRF) (the "Company" or "Silver Hammer") is pleased to announce that further to its news release dated February 2, 2026, it has closed its previously announced non-brokered private placement pursuant to the Listed Issuer Exemption ("LIFE") (the... Keep Reading...

22 February

High-Grade Near-Surface Graphite Intersected at Millennium

Metal Bank (MBK:AU) has announced High-Grade Near-Surface Graphite Intersected at MillenniumDownload the PDF here. Keep Reading...

22 February

Boundiali Resource Grows to 3Moz - Indicated Up 49%

Aurum Resources (AUE:AU) has announced Boundiali Resource Grows to 3Moz - Indicated Up 49%Download the PDF here. Keep Reading...

22 February

High-grade Assays incl 4m @ 26.7g/t Au in Sandstone Drilling

Brightstar Resources (BTR:AU) has announced High-grade assays incl 4m @ 26.7g/t Au in Sandstone drillingDownload the PDF here. Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00