July 08, 2025

Nobel Resources Corp. (TSX – V: NBLC) (the “Company” or “Nobel”) is pleased to provide an update on its ongoing exploration at the Cuprita Project (the “Project” or “Cuprita”) in Atacama Region, Chile. Following the recent identification by Nobel geologists of a leach cap with characteristics strongly associated with porphyry copper-(gold) deposits in the region at Cuprita, including associated highly anomalous copper in soils and bedrock, the Company has additionally confirmed:

- the existence of an IP chargeability and resistivity anomaly typical of porphyry copper deposits in the region; and

- the presence of highly anomalous copper chip samples from outcrops associated with the leach cap.

The geological features being identified by Nobel field work at Cuprita demonstrates the Project is highly prospective.

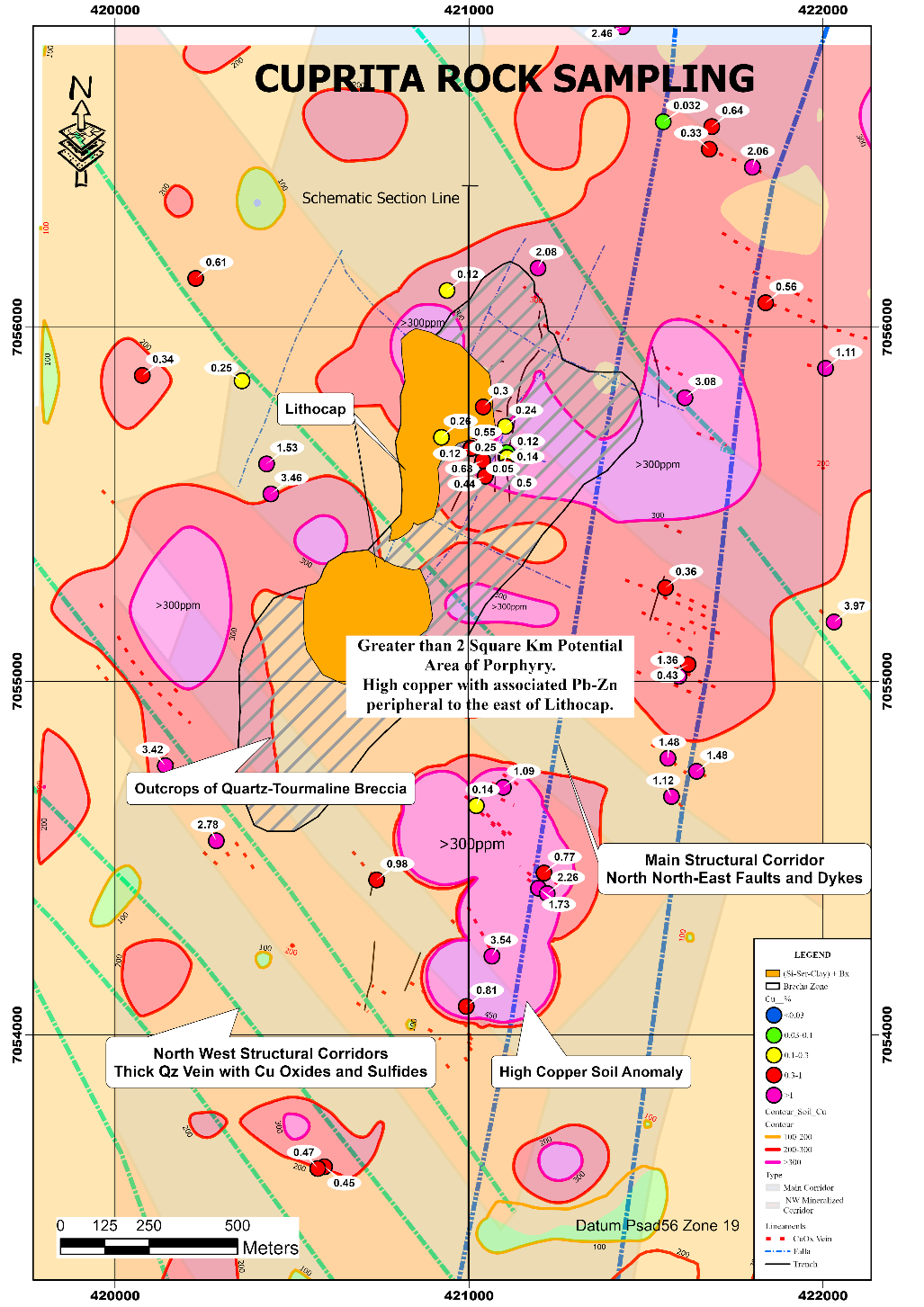

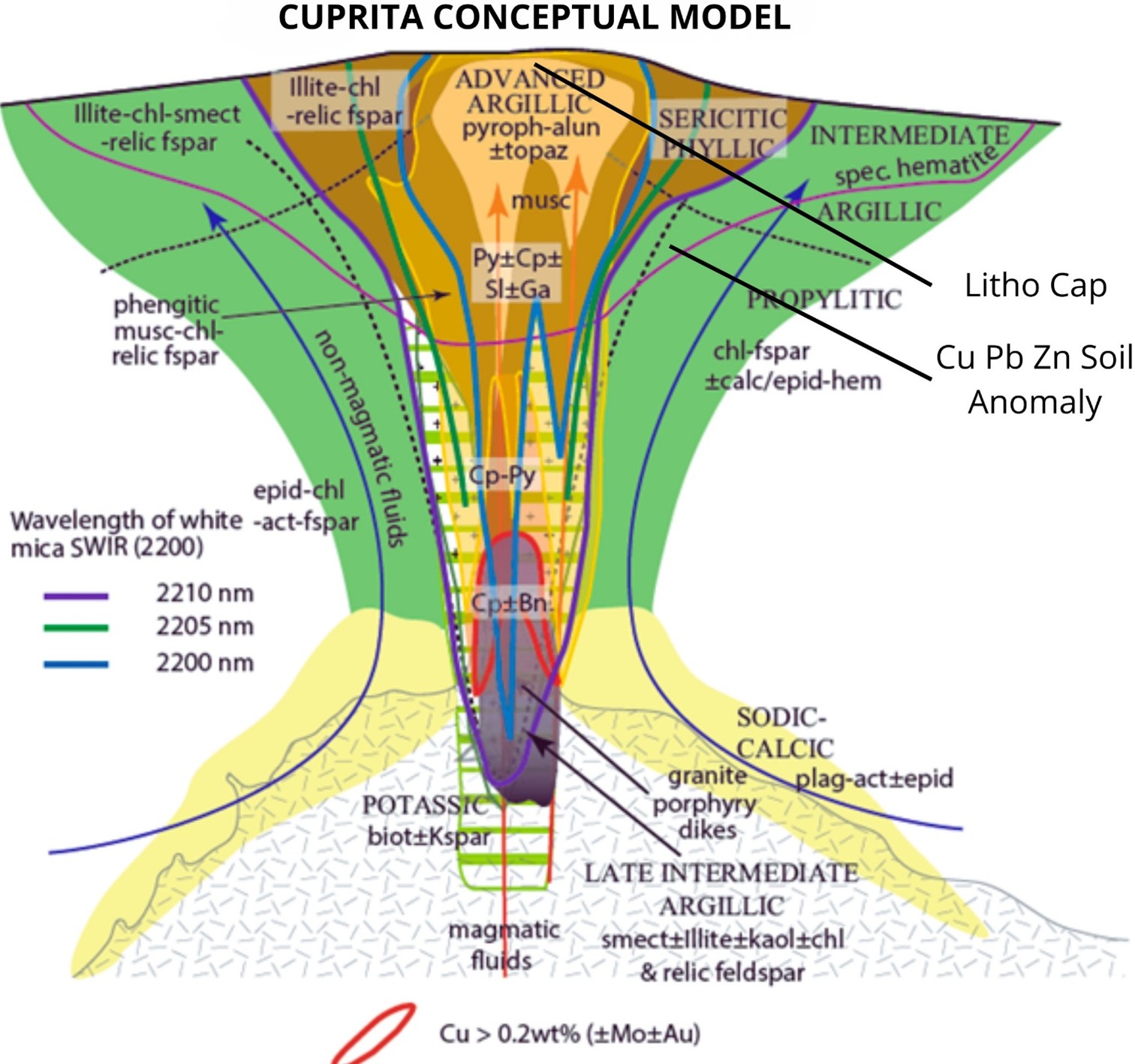

According to Vern Arseneau, COO of Nobel, “After only a few short weeks in the field, Nobel Geologists have identified key characteristics of a shallow mineralized porphyry system at Cuprita. The leach cap, IP anomaly, significant copper bearing rock chips and the copper in soil anomaly are all located adjacent to a ground magnetic low. These traits are situated near the intersection of a major north-northeast striking fault structure with numerous northwest striking quartz veins with copper oxides. Intersecting major faults is a common, if not essential, structural control for the emplacement of copper-gold porphyries in the region (Figure 3). This is essentially the complete suite of important indicators used when identifying productive porphyry copper systems, combined with a leach cap in one of the most important porphyry copper belts globally indicate excellent potential for a mineralized porphyry deposit at the Cuprita project.”

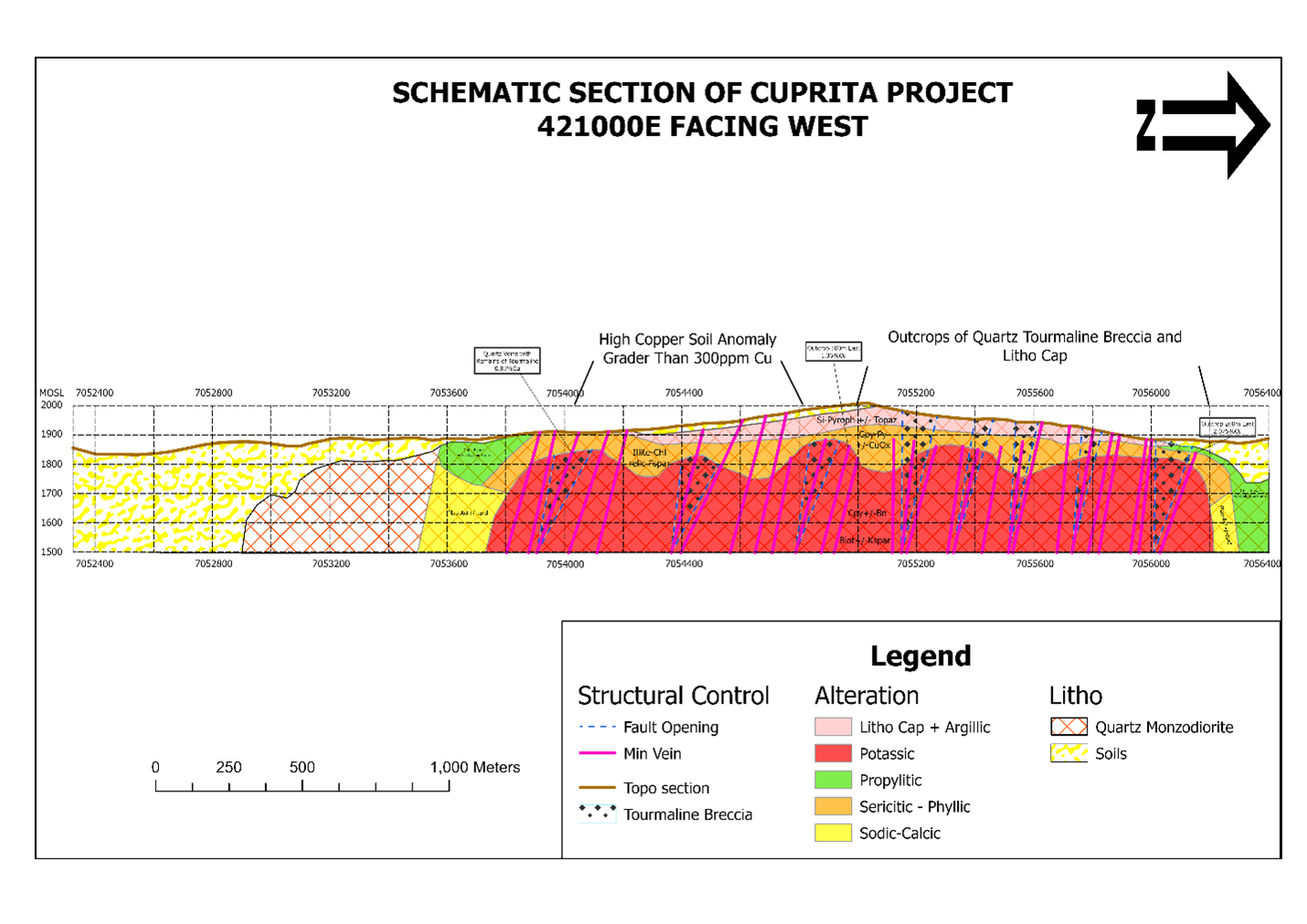

The IP survey was carried out by Argali Geophysical SA during November 2018 and consisted of three E-W lines across the area of the recently identified leach cap. Survey parameters were 100m spaced dipoles with an estimated depth penetration of 700m at N=27. The top of the IP anomaly, based on this data, is estimated to be approximately 200meters below surface. (Figure 3; line 7055700N). All three lines exhibit a similar chargeability/resistivity response and the anomaly remains open to the North and South.

The chargeability anomalies from 7 to 9 mV/V are in line with many of the porphyry copper deposits near Inca de Oro which are notoriously low in pyrite and therefore in chargeability. Chargeability of less than 10 mV/V has been observed at many deposits local to Cuprita. Similarly, field observations by Nobel geologists have also confirmed the general lack of pyrite in altered rocks at Cuprita.

Rock chip sampling of mineralized structures associated with the leach cap, anomalous soil samples and the ground magnetic anomalies returned highly anomalous copper values ranging from 0.25 to 3.46% Cu. Many of the rock samples contain remnant copper sulfides, such as Chalcocite, Chalcopyrite and locally Bornite (Figure 1). Additionally, a sample taken 500m to the northeast, where QZ vein stockwork with disseminated chrysocolla outcrops with a grade of 2.06% Cu (Figure 2) signifying the potential for a large extensive system.

Figure 1: Rock sample with Chalcopyrite and Bornite grading 1.36% copper associated with the leach cap.

Figure 2: Sample of copper-rich stockwork of quartz and chrysocolla grading 2.06% copper from 500 meters northeast of previous sample.

According to Larry Guy, CEO, “Nobel geologists believe that this newly identified geological / geochemical evidence along with the geophysical compilation points to potential for a large mineralized porphyry at shallow depth covering the area between the anomalous soil results to the South and extending more than 2 kilometers North to the previously reported ground magnetic lows. (Figures 3 and 4; map and cross section and Figure 5 conceptual geological model).

Geologically, Cuprita is part of the Metallogenic Paleocene Porphyry Copper Belt that hosts several major porphyry copper deposits, such as El Salvador, Cerro Colorado, Spence, Sierra Gorda, Fortuna, as well as several gold deposits. Recent field work at Cuprita has focused the targeting for forthcoming drill programs.

Figure 3: Compilation map showing the location of the extensive leached cap (lithocap) and associated structures, outcrop samples, quartz-copper veins, soil geochemical anomalies, tourmaline breccias associated with a magnetic low, that comprise the key criteria for a mineralized porphyry target.

Figure 4. Schematic Section showing the Conceptual Model of the Porphyry in Cuprita.

Figure 5. Conceptual model for the Cuprita porphyry target (modified after Halley et al., 2015) The key geological components for the classic mineralized Andean porphyry model have been identified at the Cuprita target.

Qualified Person

The scientific and technical information in this news release has been reviewed and approved by Mr. David Gower, P.Geo., as defined by National Instrument 43-101 of the Canadian Securities Administrators. Mr. Gower is a consultant of Nobel and is not considered independent of the Company.

About Nobel

Nobel Resources is a Canadian resource company focused on identifying and developing prospective mineral projects. The Company has a team with a strong background of exploration success.

For further information, please contact:

Lawrence Guy

Chairman and Chief Executive Officer

+1 647-276-0533

Vincent Chen

Investor Relations

vchen@nobel-resources.com

www.nobel-resources.com

Cautionary Note Regarding Forward-looking Information

This press release contains “forward-looking information” within the meaning of applicable Canadian securities legislation. Forward-looking information includes, without limitation, the mineralization and prospectivity of the Project, the Company’s ability to explore and develop the Project, the Company’s ability to obtain adequate financing and the Company’s future plans. Generally, forward-looking information can be identified by the use of forward-looking terminology such as “plans”, “expects” or “does not expect”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates” or “does not anticipate”, or “believes”, or variations of such words and phrases or state that certain actions, events or results “may”, “could”, “would”, “might” or “will be taken”, “occur” or “be achieved”. Forward- looking information is subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of Nobel, as the case may be, to be materially different from those expressed or implied by such forward-looking information, including but not limited to: general business, economic, competitive, geopolitical and social uncertainties; the actual results of current exploration activities; risks associated with operation in foreign jurisdictions; ability to successfully integrate the purchased properties; foreign operations risks; and other risks inherent in the mining industry. Although Nobel has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking information. Nobel does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

NEITHER TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/62309a33-4664-4149-92df-4891438fdf87

https://www.globenewswire.com/NewsRoom/AttachmentNg/63eb007a-2863-4dc7-99d8-f47d66583ae8

https://www.globenewswire.com/NewsRoom/AttachmentNg/3f84beb6-2d48-41e4-b0b0-6dca5442321a

https://www.globenewswire.com/NewsRoom/AttachmentNg/b512640a-ae96-4730-9d81-c3ea1ee96e90

https://www.globenewswire.com/NewsRoom/AttachmentNg/066dd95f-6cec-4cdb-ba39-f44238b70ac1

NBLC:CA

The Conversation (0)

07 September 2021

Nobel Resources

Developing The Next World-Class IOCG Project In Chile

Developing The Next World-Class IOCG Project In Chile Keep Reading...

17h

Nine Mile Metals Announces Phase 1 Bulk Sample Update at Nine Mile Brook High Grade Lens of 13.71% CuEq over 15.10m

Nine Mile Metals LTD. (CSE: NINE,OTC:VMSXF) (OTC Pink: VMSXF) (FSE: KQ9) (the "Company" or "Nine Mile") is pleased to announce that it is conducting Bulk Sample Metallurgical Analysis on the Nine Mile Brook VMS High Grade Lens with SGS Canada and Glencore Canada. Glencore and SGS will be... Keep Reading...

26 February

T2 Metals Acquires High-Grade Aurora Gold-Silver Project in the Yukon from Shawn Ryan

Past Drilling Results Include 3.4m @ 24.45 g/t Au at AJ Prospect

T2 Metals Corp. (TSXV: TWO) (OTCQB: TWOSF) (WKN: A3DVMD) ("T2 Metals" or the "Company") is pleased to announce signing of an Option Agreement (the "Option") with renowned explorer Shawn Ryan ("Ryan") and Wildwood Exploration Inc. (together with Ryan, the "Optionor") to earn a 100% interest in... Keep Reading...

25 February

Copper Prices Rally on Tariff Fears, Weak US Dollar

Copper prices continue to rise, driven by supply and demand fundamentals and boosted by tariff fears.Prices for the red metal reached a record high on January 29, and while they have since moderated somewhat, several factors have injected fresh concerns and volatility into the market.Among them... Keep Reading...

25 February

Top 10 Copper-producing Companies

Copper miners with productive assets have much to gain as supply and demand tighten. The price of copper reached new all-time highs in 2026 on both the COMEX in the United States and the London Metals Exchange (LME) in the United Kingdom. In 2025, the copper price on the COMEX surged during the... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00