NexGen Energy Ltd. ("NexGen" or the "Company") (TSX: NXE) (NYSE: NXE) (ASX: NXG) announces the commencement of a 30,000-meter exploration drill program that will test priority targets on NexGen's 100% owned properties that dominate the boundary of the proven high-grade uranium district of the southwest Athabasca Basin. The Company's 2024 program builds on 2023 exploration results, which advanced the geological investigation of previously unexplored corridors and produced priority targets for this 2024 campaign.

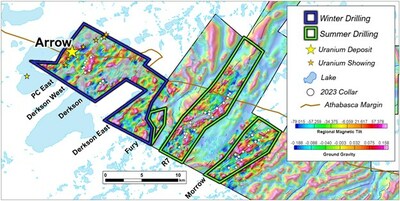

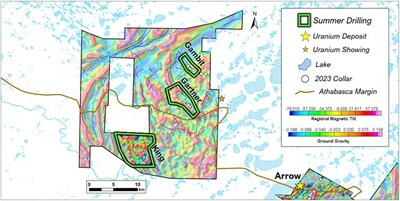

NexGen's 2023 exploration program applied high-resolution geophysical surveys across all properties, and 22,114.4 meters of drilling dedicated to SW 2 (Rook I) (Figure 1) and SW1 (Gambit, Gartner and King) (Figure 2). The results yielded a more comprehensive understanding of the geology in the highly prospective R7 and Morrow targets on the SW2 property; including brittle-reactivated structure and hydrothermal alteration indicative of high-grade uranium-bearing systems. Further, the 2023 program identified high prospectivity in the SW1 property (Gartner and Gambit corridors) where hydrothermal alteration associated with structure was discovered. In 2024, NexGen is increasing its exploration effort with a 30,000-meter drill program to follow up on these results and continue to systematically test the large and prospective land package NexGen holds. By refining targets through purpose-built geophysical coverage and drill testing priority areas, this exploration program is designed to strategically capitalize on the increasing global demand for clean, sustainably produced Canadian uranium.

Leigh Curyer, Chief Executive Officer, commented: "Nuclear power is critical to reliably achieving carbon neutrality by 2050, and uranium is the fuel that will power this necessary transition with the industry forecasting a 200-million-pound annual supply deficit by 2040. With our priority focus on concluding Federal permitting and project engineering, the commencement of the 2024 exploration drilling to identify additional zones of mineralization is an exciting arm of NexGen's operations. The team are employing the same innovative target generation and cost efficiency approach that led to the discovery Arrow."

2024 Drilling

This drill program – targeting ten (10) conductive trends – has a planned total of 30,000 meters with up to four (4) drill rigs in operation – 15,700 meters planned for SW2 (Rook I), and 14,300 meters planned for SW1.

Winter drilling will take place on prospective corridors in proximity to the Arrow deposit: Patterson Corridor East, Derksen West, Derksen, Derksen East, and Fury. During summer drilling, NexGen will target prospective corridors Gartner, Gambit, King on SW1 (Figure 1) and Fury, R7, Morrow on SW2 (Figure 2).

For a detailed summary of NexGen's 2024 exploration program, please visit: https://www.nexgenenergy.ca/exploration/overview/default.aspx

NexGen's cash reserves are approximately C$410 million available to fund the continuing development and further exploration of the Company's mineral properties, and for general corporate purposes.

About NexGen

NexGen Energy is a Canadian company focused on delivering clean energy fuel for the future. The Company's flagship Rook I Project is being optimally developed into the largest low-cost producing uranium mine globally, incorporating the most elite environmental and social governance standards. The Rook I Project is supported by an N.I. 43-101 compliant Feasibility Study, which outlines the elite environmental performance and industry-leading economics. NexGen is led by a team of experienced uranium and mining industry professionals with expertise across the entire mining life cycle, including exploration, financing, project engineering and construction, operations and closure. NexGen is leveraging its proven experience to deliver a Project that leads the entire mining industry socially, technically and environmentally. The Project and prospective portfolio in northern Saskatchewan will provide generational, long-term economic, environmental, and social benefits for Saskatchewan, Canada , and the world.

NexGen is listed on the Toronto Stock Exchange, the New York Stock Exchange under the ticker symbol "NXE," and on the Australian Securities Exchange under the ticker symbol "NXG," providing access to global investors to participate in NexGen's mission of solving three major global challenges in decarbonization, energy security and access to power. The Company is headquartered in Vancouver, British Columbia , with its primary operations office in Saskatoon, Saskatchewan .

Technical Disclosure

All technical information in this news release has been reviewed and approved by Grant Greenwood, P.Geo, NexGen's Vice President, Exploration, a qualified person under National Instrument 43-101.

A technical report in respect of the F.S. is filed on SEDAR ( www.sedar.com ) and EDGAR ( www.sec.gov/edgar.shtml ) and is available for review on NexGen Energy's website ( www.nexgenenergy.ca ).

Cautionary Note to U.S. Investors

This news release includes Mineral Reserves and Mineral Resources classification terms that comply with reporting standards in Canada and the Mineral Reserves and the Mineral Resources estimates are made in accordance with N.I. 43-101. N.I. 43-101 is a rule developed by the Canadian Securities Administrators that establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects. These standards differ from the requirements of the Securities and Exchange Commission ("SEC") set by the SEC's rules that are applicable to domestic United States reporting companies. Consequently, Mineral Reserves and Mineral Resources information included in this news release is not comparable to similar information that would generally be disclosed by domestic U.S. reporting companies subject to the reporting and disclosure requirements of the SEC Accordingly, information concerning mineral deposits set forth herein may not be comparable with information made public by companies that report in accordance with U.S. standards.

Forward-Looking Information

The information contained herein contains "forward-looking statements" within the meaning of applicable United States securities laws and regulations and "forward-looking information" within the meaning of applicable Canadian securities legislation. "Forward-looking information" includes, but is not limited to, statements with respect to mineral reserve and mineral resource estimates, the 2021 Arrow Deposit, Rook I Project and estimates of uranium production, grade and long-term average uranium prices, anticipated effects of completed drill results on the Rook I Project, planned work programs, completion of further site investigations and engineering work to support basic engineering of the Project and expected outcomes. Generally, but not always, forward-looking information and statements can be identified by the use of words such as "plans", "expects", "is expected ", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates", or "believes" or the negative connotation thereof or variations of such words and phrases or state that certain actions, events or results "may", "could", "would", "might" or "will be taken", "occur" or "be achieved" or the negative connotation thereof. Statements relating to "mineral resources" are deemed to be forward-looking information, as they involve the implied assessment that, based on certain estimates and assumptions, the mineral resources described can be profitably produced in the future.

Forward-looking information and statements are based on the then current expectations, beliefs, assumptions, estimates and forecasts about NexGen's business and the industry and markets in which it operates. Forward-looking information and statements are made based upon numerous assumptions, including among others, that the mineral reserve and resources estimates and the key assumptions and parameters on which such estimates are based are as set out in this news release and the technical report for the property , the results of planned exploration activities are as anticipated, the price and market supply of uranium, the cost of planned exploration activities, that financing will be available if and when needed and on reasonable terms, that third party contractors, equipment, supplies and governmental and other approvals required to conduct NexGen's planned exploration activities will be available on reasonable terms and in a timely manner and that general business and economic conditions will not change in a material adverse manner. Although the assumptions made by the Company in providing forward looking information or making forward looking statements are considered reasonable by management at the time, there can be no assurance that such assumptions will prove to be accurate in the future.

Forward-looking information and statements also involve known and unknown risks and uncertainties and other factors, which may cause actual results, performances and achievements of NexGen to differ materially from any projections of results, performances and achievements of NexGen expressed or implied by such forward-looking information or statements, including, among others, the existence of negative operating cash flow and dependence on third party financing, uncertainty of the availability of additional financing, the risk that pending assay results will not confirm previously announced preliminary results, conclusions of economic valuations, the risk that actual results of exploration activities will be different than anticipated, the cost of labour, equipment or materials will increase more than expected, that the future price of uranium will decline or otherwise not rise to an economic level, the appeal of alternate sources of energy to uranium-produced energy, that the Canadian dollar will strengthen against the U.S. dollar, that mineral resources and reserves are not as estimated, that actual costs or actual results of reclamation activities are greater than expected, that changes in project parameters and plans continue to be refined and may result in increased costs, of unexpected variations in mineral resources and reserves, grade or recovery rates or other risks generally associated with mining, unanticipated delays in obtaining governmental, regulatory or First Nations approvals, risks related to First Nations title and consultation, reliance upon key management and other personnel, deficiencies in the Company's title to its properties, uninsurable risks, failure to manage conflicts of interest, failure to obtain or maintain required permits and licences, risks related to changes in laws, regulations, policy and public perception, as well as those factors or other risks as more fully described in NexGen's Annual Information Form dated February 25, 2022 filed with the securities commissions of all of the provinces of Canada except Quebec and in NexGen's 40-F filed with the United States Securities and Exchange Commission, which are available on SEDAR at www.sedar.com and Edgar at www.sec.gov .

Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in the forward-looking information or statements or implied by forward-looking information or statements, there may be other factors that cause results not to be as anticipated, estimated or intended. Readers are cautioned not to place undue reliance on forward-looking information or statements due to the inherent uncertainty thereof.

There can be no assurance that forward-looking information and statements will prove to be accurate, as actual results and future events could differ materially from those anticipated, estimated or intended. Accordingly, readers should not place undue reliance on forward-looking statements or information. The Company undertakes no obligation to update or reissue forward-looking information as a result of new information or events except as required by applicable securities laws .

![]() View original content to download multimedia: https://www.prnewswire.com/news-releases/nexgen-initiates-30-000-meter-2024-uranium-exploration-program-302055426.html

View original content to download multimedia: https://www.prnewswire.com/news-releases/nexgen-initiates-30-000-meter-2024-uranium-exploration-program-302055426.html

SOURCE NexGen Energy Ltd.

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/February2024/07/c7936.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/February2024/07/c7936.html