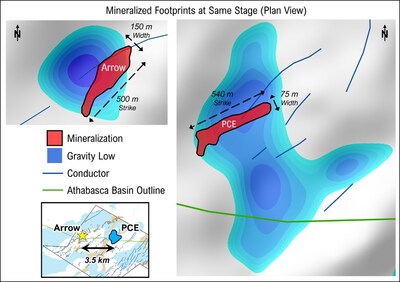

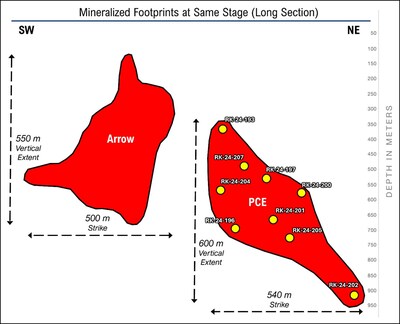

NexGen Energy Ltd. ("NexGen" or the "Company") ( TSX: NXE) (NYSE: NXE) (ASX: NXG ) is pleased to announce the mineralized zone at Patterson Corridor East (PCE) has materially expanded since the original discovery in the 2024 Winter Program (see NexGen News Release dated March 11, 2024 ). The Summer Drill Program commenced May 21st with eight (8) out of twelve (12) drillholes intersecting mineralization to date (Figures 1 and 2, Table 1). Extensive mineralization plunges to the east with a span of 540 m along strike and 600 m vertical extent, showing wide intervals of elevated radioactivity that remain open at depth and along strike. In comparison, previously reported holes from PCE had identified two mineralized holes, 275 m apart.

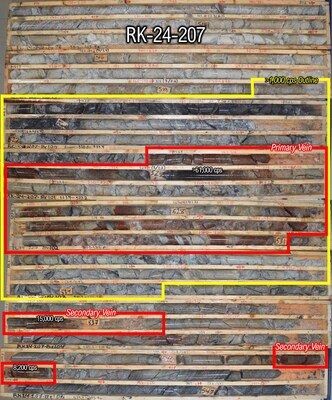

Off-scale (>61,000 cps) high-grade uranium mineralization has been intersected in four drillholes to date, including RK-24-183, -197, -202, and -207. The most recent intersection in RK-24-207 contains the first instance of massive replacement by uraninite, a key indicator of a strongly mineralized system (Figures 3 and 4, Table 1) with 1.5 m >10,000 cps (including 0.3 m >61,000 cps) within cumulative interval mineralization of 26.2 m > 500 cps (Table 2).

Results include the best and most recent intercept in RK-24-207, that confirms continuity of mineralization, massive replacement uranium and significant high grade at PCE (Table 1). The high-intensity style mineralization is indicative of exceptional formation conditions linked to significant orebodies within the Athabasca Basin and most notably the Arrow Deposit 3.5 km to the west. In addition, this zone of high-intensity mineralization in RK-24-207 is at a similar depth to Arrow's A2 high-grade heart. PCE, like Arrow, is contained solely in the competent basement rock which is the ideal underground setting. The mineralized signature is expressed as very analogous to Arrow, localized veins (up to off-scale >61,000 cps) within elevated radioactivity that extends over more than 100 m .

Summer drilling to date totals 10,045.5 m of the planned 22,000 m from 12 completed drillholes. Assays from disclosed mineralized intersections are pending and due in Q4 2024.

As a consequence of these results, the focus of the summer program has substantially elevated with two primary objectives:

- continue to test the extent of the mineralized system through bold step outs, and

- vector in on the high-grade zones within the broader mineralized system.

Leigh Curyer, Chief Executive Officer, commented: "In the first two months of the summer program, the results have rapidly indicated an expansive, mineralized footprint with remarkable continuity. Geological characteristics are very analogous to Arrow indicating a large, pervasive and high-grade system. The summer program has been purposely bold with very large drill step outs and has intersected mineralization in an additional 8 of the 12 holes drilled. Important to note, PCE has currently hit 4 holes with intense mineralization >61,000 cps, with this occurring at Arrow for the first time in the 15 th hole - which led to subsequently delineating broad ultra-high grade zones in the A2 shear of Arrow.

Discoveries of the calibre of Arrow all take their own path in terms of time and extent of drilling to fully define. PCE is now commencing its path showing all the characteristics of Arrow at the same stage. PCE validates the continued prospectivity of the NexGen land package is immense and underpins the southwest Athabasca Basin as the future of Canada's uranium industry growth over the balance of this century.

NexGen is at an incredibly exciting stage, focused on concluding the Federal Environmental Assessment for the Rook I Project, construction readiness on receipt of final approvals and in parallel drilling a newly discovered zone of mineralization."

Mineralization is hosted as semi-massive to massive pitchblende veins, fracture coatings, and disseminations. Structures focus the mineralization via reactivated shears and faults while competent wall rock (silicified orthogneiss) acts as a physical trap. The mineralization and alteration patterns depict a well-developed hydrothermal fluid system. Typical alteration associated with the mineralization includes the formation of iron-rich minerals (hydrothermal hematite), iron oxide (limonite), clay, and chlorite. These characteristics combined with the size of the mineralized footprint, as well as the presence of >61,000 cps, demonstrates the similarities between PCE and Arrow at the same stage.

Table 1: 2024 Summer program spectrometer results to date

| Drillhole | Unconformity | Handheld Spectrometer Results (RS-125) | ||||||

| Hole ID | Azimuth | Dip | Total | From (m) | To (m) | Width (m) | CPS Range | |

| RK-24-195 | 310 | -70 | 588.0 | N/A | 171.5 | 172.0 | 0.5 |

|

| | | | | | 172.0 | 172.5 | 0.5 |

|

| | | | | | 192.0 | 192.5 | 0.5 |

|

| | | | | | 216.0 | 216.5 | 0.5 |

|

| RK-24-196 | 310 | -70 | 841.0 | 103.4 | 701.5 | 703.0 | 1.5 |

|

| | | | | | 703.0 | 703.5 | 0.5 | 1,600 - 2,500 |

| | | | | | 703.5 | 704.0 | 0.5 |

|

| | | | | | 704.0 | 704.5 | 0.5 | 570 - 1,320 |

| | | | | | 705.5 | 706.0 | 0.5 |

|

| | | | | | 723.5 | 724.0 | 0.5 |

|

| | | | | | 731.0 | 731.7 | 0.7 |

|

| | | | | | 731.7 | 731.8 | 0.1 | 3,380 - 4,180 |

| | | | | | 731.8 | 731.9 | 0.1 | 10,000 - 14,000 |

| | | | | | 731.9 | 732.0 | 0.1 |

|

| | | | | | 732.0 | 732.1 | 0.1 |

|

| | | | | | 732.5 | 736.5 | 4.0 |

|

| | | | | | 741.0 | 741.5 | 0.5 |

|

| | | | | | 742.5 | 743.0 | 0.5 |

|

| | | | | | 744.5 | 745.0 | 0.5 |

|

| | | | | | 745.0 | 745.5 | 0.5 |

|

| | | | | | 745.5 | 746.0 | 0.5 |

|

| | | | | | 746.0 | 746.5 | 0.5 |

|

| | | | | | 746.5 | 747.0 | 0.5 |

|

| | | | | | 747.0 | 748.0 | 1.0 |

|

| | | | | | 748.5 | 749.0 | 0.5 |

|

| | | | | | 749.5 | 750.0 | 0.5 |

|

| | | | | | 750.0 | 750.5 | 0.5 |

|

| | | | | | 757.0 | 757.5 | 0.5 |

|

| | | | | | 758.0 | 758.5 | 0.5 |

|

| | | | | | 760.0 | 760.5 | 0.5 |

|

| | | | | | 765.5 | 766.6 | 1.1 |

|

| RK-24-197 | 310 | -70 | 792.0 | 117.7 | 241.0 | 241.5 | 0.5 |

|

| | | | | | 518.0 | 521.5 | 3.5 |

|

| | | | | | 523.5 | 524.0 | 0.5 |

|

| | | | | | 524.0 | 524.5 | 0.5 |

|

| | | | | | 524.5 | 525.0 | 0.5 |

|

| | | | | | 525.0 | 525.5 | 0.5 |

|

| | | | | | 525.5 | 526.0 | 0.5 |

|

| | | | | | 526.0 | 526.4 | 0.4 |

|

| | | | | | 526.4 | 526.6 | 0.2 | 10,000 - 13,050 |

| | | | | | 526.6 | 527.0 | 0.4 | 510 - 6,550 |

| | | | | | 527.0 | 527.5 | 0.5 | 1,040 - 9,560 |

| | | | | | 527.5 | 527.6 | 0.1 | 9,580 - 10,000 |

| | | | | | 527.6 | 527.8 | 0.2 | 10,000 - 26,400 |

| | | | | | 527.8 | 528.5 | 0.7 |

|

| | | | | | 528.5 | 528.8 | 0.3 | 940 - 10,000 |

| | | | | | 528.8 | 528.9 | 0.1 | 10,000 - 46,400 |

| | | | | | 528.9 | 529.0 | 0.1 | 865 - 2,250 |

| | | | | | 529.0 | 529.5 | 0.5 |

|

| | | | | | 530.5 | 535.5 | 5.0 |

|

| | | | | | 536.0 | 536.5 | 0.5 |

|

| | | | | | 546.0 | 546.5 | 0.5 |

|

| | | | | | 546.5 | 547.0 | 0.5 |

|

| | | | | | 547.0 | 547.5 | 0.5 |

|

| | | | | | 547.5 | 548.0 | 0.5 |

|

| | | | | | 548.0 | 548.5 | 0.5 |

|

| | | | | | 548.5 | 548.6 | 0.1 | 1,000 - 8,200 |

| | | | | | 548.6 | 548.8 | 0.2 | 21,200 - 33,800 |

| | | | | | 548.8 | 549.0 | 0.2 | 42,600 - 52,800 |

| | | | | | 549.0 | 549.5 | 0.5 | 600 - 1,500 |

| | | | | | 549.5 | 550.0 | 0.5 | 2,200 - 4,400 |

| | | | | | 550.0 | 550.5 | 0.5 |

|

| | | | | | 550.5 | 551.0 | 0.5 |

|

| | | | | | 551.0 | 551.5 | 0.5 |

|

| | | | | | 551.5 | 552.0 | 0.5 |

|

| | | | | | 552.0 | 552.5 | 0.5 | 1,300 - 2,000 |

| | | | | | 552.5 | 552.6 | 0.1 | 25,000 - 32,000 |

| | | | | | 552.7 | 552.9 | 0.2 | 40,100 - >61,000 |

| | | | | | 552.9 | 553.0 | 0.1 | 17,100 - 25,000 |

| | | | | | 553.0 | 553.5 | 0.5 |

|

| RK-24-198 | 310 | -70 | 743.2 | 117.3 | 333.5 | 334.0 | 0.5 |

|

| | | | | | 669.5 | 670.0 | 0.5 |

|

| RK-24-199 | 310 | -70 | 807.0 | 107.1 | No Significant Intersections | |||

| RK-24-200 | 310 | -70 | 804.0 | 112.6 | 339.0 | 339.5 | 0.5 |

|

| | | | | | 354.0 | 354.5 | 0.5 |

|

| | | | | | 465.5 | 466.0 | 0.5 |

|

| | | | | | 611.0 | 611.5 | 0.5 |

|

| | | | | | 612.0 | 612.5 | 0.5 |

|

| | | | | | 613.0 | 613.5 | 0.5 |

|

| | | | | | 619.0 | 619.5 | 0.5 |

|

| | | | | | 619.5 | 620.0 | 0.5 |

|

| | | | | | 623.0 | 623.5 | 0.5 |

|

| RK-24-201 | 310 | -70 | 939.0 | 108.9 | 412.5 | 413.0 | 0.5 |

|

| | | | | | 673.5 | 674.0 | 0.5 |

|

| | | | | | 674.5 | 675.0 | 0.5 |

|

| | | | | | 675.0 | 675.5 | 0.5 |

|

| | | | | | 675.5 | 676.0 | 0.5 |

|

| | | | | | 677.5 | 678.0 | 0.5 |

|

| | | | | | 678.5 | 679.0 | 0.5 | 650 - 700 |

| | | | | | 679.0 | 679.5 | 0.5 |

|

| | | | | | 680.0 | 681.0 | 1.0 |

|

| | | | | | 693.5 | 694.0 | 0.5 | 700 - 800 |

| | | | | | 694.0 | 695.0 | 1.0 |

|

| | | | | | 695.0 | 695.5 | 0.5 | 700 - 900 |

| | | | | | 695.5 | 696.0 | 0.5 |

|

| | | | | | 696.0 | 696.5 | 0.5 | 500 - 1,800 |

| | | | | | 696.5 | 697.0 | 0.5 | 500 - 2,600 |

| | | | | | 697.0 | 699.0 | 2.0 |

|

| | | | | | 699.5 | 700.5 | 1.0 |

|

| | | | | | 700.5 | 701.0 | 0.5 | 650 - 700 |

| | | | | | 701.0 | 701.5 | 0.5 |

|

| | | | | | 701.5 | 702.0 | 0.5 |

|

| | | | | | 702.0 | 702.5 | 0.5 |

|

| | | | | | 703.0 | 703.5 | 0.5 |

|

| | | | | | 708.0 | 709.0 | 1.0 |

|

| | | | | | 721.5 | 722.0 | 0.5 |

|

| | | | | | 741.0 | 741.5 | 0.5 |

|

| | | | | | 765.5 | 766.0 | 0.5 |

|

| | | | | | 819.0 | 819.5 | 0.5 |

|

| | | | | | 822.5 | 823.0 | 0.5 |

|

| | | | | | 837.5 | 838.0 | 0.5 |

|

| | | | | | 867.5 | 868.0 | 0.5 |

|

| RK-24-202 | 310 | -70 | 1138.2 | 106.3 | 622.5 | 623.0 | 0.5 |

|

| | | | | | 623.5 | 624.0 | 0.5 |

|

| | | | | | 732.0 | 732.5 | 0.5 |

|

| | | | | | 780.5 | 781.0 | 0.5 |

|

| | | | | | 846.0 | 850.3 | 4.3 |

|

| | | | | | 886.0 | 886.2 | 0.2 |

|

| | | | | | 886.2 | 886.3 | 0.1 | 10,000 - 14,100 |

| | | | | | 886.3 | 886.5 | 0.2 |

|

| | | | | | 887.5 | 888.0 | 0.5 |

|

| | | | | | 895.5 | 896.0 | 0.5 |

|

| | | | | | 907.0 | 908.0 | 1.0 |

|

| | | | | | 922.5 | 923.0 | 0.5 |

|

| | | | | | 926.5 | 927.0 | 0.5 |

|

| | | | | | 928.0 | 928.5 | 0.5 |

|

| | | | | | 931.0 | 931.5 | 0.5 |

|

| | | | | | 931.5 | 932.0 | 0.5 |

|

| | | | | | 932.0 | 932.5 | 0.5 |

|

| | | | | | 933.5 | 934.0 | 0.5 |

|

| | | | | | 934.0 | 934.3 | 0.3 |

|

| | | | | | 934.3 | 934.4 | 0.1 | 55,500 - >61,000 |

| | | | | | 934.4 | 934.5 | 0.1 |

|

| | | | | | 936.0 | 936.3 | 0.3 |

|

| | | | | | 936.3 | 936.4 | 0.1 | 12,000 - >61,000 |

| | | | | | 936.4 | 936.5 | 0.1 | 530 - 650 |

| | | | | | 943.5 | 944.0 | 0.5 |

|

| | | | | | 944.0 | 944.5 | 0.5 |

|

| | | | | | 947.0 | 947.5 | 0.5 |

|

| | | | | | 948.5 | 949.0 | 0.5 |

|

| | | | | | 951.0 | 951.5 | 0.5 |

|

| | | | | | 951.5 | 951.7 | 0.2 | 850 - 3,200 |

| | | | | | 951.7 | 952.0 | 0.3 | 10,000 - 17,200 |

| | | | | | 952.0 | 952.5 | 0.5 |

|

| | | | | | 952.5 | 953.0 | 0.5 |

|

| | | | | | 953.0 | 953.5 | 0.5 |

|

| | | | | | 953.5 | 954.0 | 0.5 |

|

| | | | | | 954.0 | 954.5 | 0.5 | 600 - 2,020 |

| | | | | | 954.5 | 955.0 | 0.5 | 500 - 8,500 |

| | | | | | 955.0 | 955.5 | 0.5 |

|

| | | | | | 955.5 | 956.0 | 0.5 | 500 - 2,250 |

| | | | | | 956.0 | 956.5 | 0.5 |

|

| | | | | | 957.0 | 957.5 | 0.5 |

|

| | | | | | 957.5 | 958.0 | 0.5 | 500 - 1,000 |

| | | | | | 958.0 | 958.5 | 0.5 |

|

| | | | | | 958.5 | 959.0 | 0.5 |

|

| | | | | | 959.0 | 959.5 | 0.5 |

|

| | | | | | 959.5 | 960.0 | 0.5 |

|

| | | | | | 961.0 | 961.5 | 0.5 |

|

| | | | | | 961.5 | 962.0 | 0.5 |

|

| | | | | | 963.0 | 964.0 | 1.0 |

|

| | | | | | 964.0 | 964.5 | 0.5 |

|

| | | | | | 965.0 | 965.5 | 0.5 |

|

| | | | | | 965.5 | 966.0 | 0.5 | 3,000 - 8,000 |

| | | | | | 966.0 | 966.5 | 0.5 |

|

| | | | | | 966.5 | 967.0 | 0.5 | 5,000 - 6,000 |

| | | | | | 967.0 | 967.3 | 0.3 | 5,000 - 6,000 |

| | | | | | 967.3 | 967.5 | 0.2 | 10,000 - 49,000 |

| | | | | | 967.5 | 968.0 | 0.5 | 1,700 - 8,100 |

| | | | | | 968.0 | 968.5 | 0.5 |

|

| | | | | | 968.5 | 969.0 | 0.5 |

|

| | | | | | 969.0 | 969.5 | 0.5 |

|

| | | | | | 980.0 | 980.5 | 0.5 |

|

| | | | | | 981.0 | 981.5 | 0.5 |

|

| | | | | | 981.5 | 982.0 | 0.5 |

|

| | | | | | 983.0 | 983.5 | 0.5 |

|

| | | | | | 983.5 | 984.0 | 0.5 |

|

| | | | | | 984.0 | 984.5 | 0.5 | 1450 - 1,820 |

| | | | | | 984.5 | 985.0 | 0.5 | 800 - 3,700 |

| | | | | | 985.0 | 985.5 | 0.5 |

|

| | | | | | 985.5 | 986.0 | 0.5 |

|

| | | | | | 996.5 | 997.0 | 0.5 |

|

| | | | | | 997.5 | 998.0 | 0.5 |

|

| | | | | | 998.0 | 998.5 | 0.5 |

|

| | | | | | 1005.0 | 1006.5 | 1.5 |

|

| | | | | | 1008.5 | 1009.5 | 1.0 |

|

| | | | | | 1016.5 | 1017.0 | 0.5 |

|

| | | | | | 1026.5 | 1027.0 | 0.5 |

|

| RK-24-203 | 310 | -70 | 738.0 | 103.7 | 360.5 | 361.0 | 0.5 |

|

| | | | | | 363.5 | 364.0 | 0.5 |

|

| | | | | | 470.0 | 471.5 | 1.5 |

|

| | | | | | 472.0 | 472.5 | 0.5 |

|

| RK-24-204 | 290 | -70 | 822.0 | 110.1 | 471.5 | 472.0 | 0.5 |

|

| | | | | | 553.0 | 553.5 | 0.5 |

|

| | | | | | 554.0 | 555.0 | 1.0 |

|

| | | | | | 555.0 | 555.5 | 0.5 |

|

| | | | | | 555.5 | 556.0 | 0.5 |

|

| | | | | | 556.0 | 556.5 | 0.5 | 680 - 1,900 |

| | | | | | 556.5 | 557.0 | 0.5 |

|

| | | | | | 557.0 | 557.5 | 0.5 |

|

| | | | | | 557.5 | 558.0 | 0.5 |

|

| | | | | | 558.0 | 558.5 | 0.5 | 580 - 900 |

| | | | | | 558.5 | 559.0 | 0.5 |

|

| | | | | | 559.0 | 560.0 | 1.0 |

|

| | | | | | 574.0 | 574.5 | 0.5 |

|

| | | | | | 574.5 | 575.0 | 0.5 |

|

| | | | | | 575.0 | 575.5 | 0.5 |

|

| | | | | | 575.5 | 576.0 | 0.5 |

|

| | | | | | 576.0 | 576.5 | 0.5 |

|

| | | | | | 576.5 | 577.5 | 1.0 |

|

| | | | | | 578.0 | 578.5 | 0.5 |

|

| | | | | | 579.0 | 579.5 | 0.5 |

|

| | | | | | 579.5 | 580.0 | 0.5 |

|

| | | | | | 580.0 | 580.5 | 0.5 |

|

| | | | | | 580.5 | 580.8 | 0.3 | 2,100 - 2,800 |

| | | | | | 580.8 | 581.0 | 0.2 | 10,000 - 11,000 |

| | | | | | 581.0 | 581.5 | 0.5 | 3,600 - 8,000 |

| | | | | | 581.5 | 582.0 | 0.5 | 550 - 8,700 |

| | | | | | 582.0 | 582.5 | 0.5 |

|

| | | | | | 582.5 | 583.0 | 0.5 | 800 - 2,200 |

| | | | | | 583.0 | 583.5 | 0.5 |

|

| | | | | | 583.5 | 584.0 | 0.5 |

|

| | | | | | 584.0 | 584.5 | 0.5 |

|

| | | | | | 585.5 | 586.0 | 0.5 |

|

| | | | | | 587.0 | 587.5 | 0.5 |

|

| | | | | | 587.5 | 588.0 | 0.5 | 900 - 7,200 |

| | | | | | 588.0 | 588.5 | 0.5 |

|

| | | | | | 588.5 | 590.0 | 1.5 |

|

| | | | | | 595.5 | 596.5 | 1.0 |

|

| | | | | | 597.0 | 597.5 | 0.5 |

|

| | | | | | 598.5 | 599.0 | 0.5 |

|

| | | | | | 599.0 | 599.5 | 0.5 |

|

| | | | | | 599.5 | 600.0 | 0.5 |

|

| | | | | | 600.0 | 600.5 | 0.5 |

|

| | | | | | 600.5 | 601.0 | 0.5 |

|

| RK-24-205 | 320 | -70 | 1032.0 | 109.1 | 459.5 | 464.0 | 4.5 |

|

| | | | | | 464.0 | 464.5 | 0.5 | 500 - 1,000 |

| | | | | | 464.5 | 465.0 | 0.5 |

|

| | | | | | 741.5 | 742.0 | 0.5 |

|

| | | | | | 742.0 | 742.5 | 0.5 | 1,600 - 7,500 |

| | | | | | 742.5 | 743.0 | 0.5 |

|

| | | | | | 746.5 | 747.0 | 0.5 |

|

| | | | | | 747.0 | 748.0 | 1.0 |

|

| | | | | | 766.0 | 766.5 | 0.5 |

|

| | | | | | 768.0 | 768.5 | 0.5 |

|

| | | | | | 769.0 | 769.5 | 0.5 |

|

| | | | | | 769.5 | 770.0 | 0.5 | 500 - 1,300 |

| | | | | | 770.0 | 770.5 | 0.5 |

|

| | | | | | 770.5 | 771.0 | 0.5 | 700 - 1,200 |

| | | | | | 771.0 | 771.5 | 0.5 |

|

| | | | | | 771.5 | 772.0 | 0.5 |

|

| | | | | | 772.5 | 773.5 | 1.0 |

|

| | | | | | 779.5 | 780.0 | 0.5 |

|

| | | | | | 780.0 | 780.5 | 0.5 |

|

| | | | | | 784.0 | 784.5 | 0.5 |

|

| | | | | | 784.5 | 785.0 | 0.5 |

|

| | | | | | 785.0 | 785.5 | 0.5 |

|

| | | | | | 786.0 | 786.5 | 0.5 | 600 - 1,400 |

| | | | | | 786.5 | 787.0 | 0.5 |

|

| | | | | | 787.0 | 787.5 | 0.5 | 500 - 950 |

| | | | | | 787.5 | 788.0 | 0.5 |

|

| | | | | | 788.0 | 788.5 | 0.5 |

|

| | | | | | 788.5 | 789.0 | 0.5 |

|

| | | | | | 789.0 | 789.5 | 0.5 | 800 - 4,200 |

| | | | | | 789.5 | 790.0 | 0.5 | 900 - 4,800 |

| | | | | | 790.0 | 790.5 | 0.5 |

|

| | | | | | 791.0 | 791.5 | 0.5 |

|

| | | | | | 791.5 | 792.0 | 0.5 |

|

| | | | | | 792.0 | 792.5 | 0.5 |

|

| | | | | | 792.5 | 793.0 | 0.5 |

|

| | | | | | 793.0 | 793.5 | 0.5 |

|

| | | | | | 793.5 | 793.6 | 0.1 |

|

| | | | | | 793.6 | 794.0 | 0.4 |

|

| | | | | | 794.0 | 794.5 | 0.5 |

|

| | | | | | 794.5 | 795.0 | 0.5 |

|

| | | | | | 795.0 | 795.5 | 0.5 |

|

| | | | | | 802.0 | 802.5 | 0.5 |

|

| | | | | | 804.0 | 804.5 | 0.5 |

|

| | | | | | 804.5 | 805.5 | 1.0 |

|

| | | | | | 807.0 | 807.5 | 0.5 |

|

| | | | | | 807.5 | 808.0 | 0.5 |

|

| | | | | | 808.0 | 808.5 | 0.5 |

|

| | | | | | 851.0 | 851.5 | 0.5 |

|

| | | | | | 853.5 | 854.0 | 0.5 |

|

| RK-24-206 | 298 | -75 | TBD | 96.5 | In progress | |||

| RK-24-207 | 330 | -70 | 801.0 | 114.9 | 505.0 | 510.5 | 5.5 |

|

| | | | | | 514.5 | 515.5 | 1.0 |

|

| | | | | | 515.5 | 516.0 | 0.5 |

|

| | | | | | 516.0 | 516.5 | 0.5 |

|

| | | | | | 516.5 | 517.0 | 0.5 |

|

| | | | | | 517.0 | 517.5 | 0.5 |

|

| | | | | | 517.5 | 518.0 | 0.5 |

|

| | | | | | 518.0 | 518.5 | 0.5 |

|

| | | | | | 519.0 | 519.5 | 0.5 |

|

| | | | | | 519.5 | 520.0 | 0.5 | 550 - 8,500 |

| | | | | | 520.0 | 520.5 | 0.5 | 1,000 - 1,750 |

| | | | | | 520.5 | 521.0 | 0.5 | 750 - 1,500 |

| | | | | | 521.0 | 521.5 | 0.5 |

|

| | | | | | 521.5 | 522.0 | 0.5 |

|

| | | | | | 522.0 | 522.5 | 0.5 | 700 - 8,500 |

| | | | | | 522.5 | 523.0 | 0.5 | 900 - 1,400 |

| | | | | | 523.0 | 523.5 | 0.5 | 800 - 1,700 |

| | | | | | 523.5 | 524.0 | 0.5 | 600 - 8,200 |

| | | | | | 524.0 | 524.5 | 0.5 | 10,000 - 32,000 |

| | | | | | 524.5 | 525.0 | 0.5 | 5,000 - 22,000 |

| | | | | | 525.0 | 525.1 | 0.1 | 30,000 - 60,000 |

| | | | | | 525.1 | 525.4 | 0.3 | >61,000 |

| | | | | | 525.4 | 525.5 | 0.1 | 22,000 - 60,000 |

| | | | | | 525.5 | 526.0 | 0.5 | 600 - 6,200 |

| | | | | | 526.0 | 526.5 | 0.5 |

|

| | | | | | 526.5 | 527.0 | 0.5 | 1,700 - 9,800 |

| | | | | | 527.0 | 527.5 | 0.5 | 2,800 - 20,000 |

| | | | | | 527.5 | 528.0 | 0.5 | 500 - 24,000 |

| | | | | | 528.0 | 528.5 | 0.5 | 750 - 1,200 |

| | | | | | 528.5 | 529.0 | 0.5 | 2,800 - 9,500 |

| | | | | | 529.0 | 529.5 | 0.5 | 1,100 - 6,500 |

| | | | | | 529.5 | 530.0 | 0.5 | 1,100 - 2,900 |

| | | | | | 530.0 | 530.5 | 0.5 | 550 - 1,600 |

| | | | | | 530.5 | 531.0 | 0.5 | 1,500 - 4,300 |

| | | | | | 531.0 | 531.5 | 0.5 | 550 - 900 |

| | | | | | 531.5 | 532.0 | 0.5 |

|

| | | | | | 532.0 | 532.5 | 0.5 |

|

| | | | | | 533.0 | 533.5 | 0.5 |

|

| | | | | | 533.5 | 534.0 | 0.5 | 950 - 1,800 |

| | | | | | 534.0 | 534.5 | 0.5 | 600 - 1,500 |

| | | | | | 534.5 | 535.0 | 0.5 |

|

| | | | | | 536.0 | 536.5 | 0.5 |

|

| | | | | | 536.5 | 537.0 | 0.5 |

|

| | | | | | 537.0 | 537.5 | 0.5 |

|

| | | | | | 538.0 | 538.5 | 0.5 |

|

| | | | | | 538.5 | 539.0 | 0.5 |

|

| | | | | | 539.0 | 539.5 | 0.5 |

|

| | | | | | 540.0 | 540.5 | 0.5 |

|

| | | | | | 540.5 | 541.0 | 0.5 | 4,600 - 8,200 |

| | | | | | 550.5 | 551.0 | 0.5 |

|

| | | | | | 552.0 | 552.5 | 0.5 |

|

| | | | | | 554.0 | 554.5 | 0.5 |

|

| | | | | | 558.5 | 559.0 | 0.5 |

|

| | | | | | 560.0 | 561.0 | 1.0 |

|

| | | | | | 567.5 | 568.0 | 0.5 |

|

| | | | | | 572.5 | 573.0 | 0.5 |

|

| | | | | | 578.5 | 579.0 | 0.5 |

|

| | | | | | 581.5 | 582.0 | 0.5 |

|

| | | | | | 583.5 | 584.5 | 1.0 |

|

| | | | | | 585.5 | 586.0 | 0.5 |

|

| | | | | | 586.0 | 587.0 | 1.0 |

|

| | | | | | 595.0 | 595.5 | 0.5 |

|

| | | | | | 595.5 | 596.0 | 0.5 |

|

| | | | | | 596.0 | 597.0 | 1.0 |

|

| | | | | | 600.5 | 601.0 | 0.5 |

|

| | | | | | 610.5 | 611.0 | 0.5 |

|

| | | | | | 619.0 | 620.0 | 1.0 |

|

| | | | | | 625.8 | 627.0 | 1.2 |

|

| | | | | | 636.8 | 641.0 | 4.2 |

|

| | | | | | 644.0 | 645.5 | 1.5 |

|

| | | | | | 717.5 | 718.5 | 1.0 |

|

| | | | | | 729.0 | 732.0 | 3.0 |

|

- All depths and intervals are meters downhole, true thicknesses are yet to be determined.

- "Off-scale" refers to >61,000 cps total readings by gamma spectrometer type RS-125.

- Unconformity of 'N/A' denotes a lack of visible contact between Athabasca sandstone and basement rock.

- Maximum internal dilution 2.0 m downhole.

- Minimum thickness of 0.5 m downhole.

- All depths and intervals are metres downhole, true thicknesses are yet to be determined. Resource modelling in conjunction with an updated mineral resource estimate is required before true thicknesses can be determined.

Table 2: Cumulative mineralization from 2024 summer program to date

| Hole ID | Cumulative | Maximum |

| RK-24-195 | 0.5 | 1,500 |

| RK-24-196 | 10.3 | 14,000 |

| RK-24-197 | 10.2 | >61000 |

| RK-24-198 | 0 | N/A |

| RK-24-199 | 0 | N/A |

| RK-24-200 | 1.5 | 970 |

| RK-24-201 | 7 | 3,800 |

| RK-24-202 | 23.6 | >61000 |

| RK-24-203 | 0 | N/A |

| RK-24-204 | 16 | 11,000 |

| RK-24-205 | 17 | 25,000 |

| RK-24-207 | 26.2 | >61000 |

- All depths and intervals are meters downhole, true thicknesses are yet to be determined.

- Radioactivity measured by gamma scintillometer type RS-120 and gamma spectrometer type RS-125.

- Maximum readings stated as 'N/A' had no radioactivity >500 cps.

About NexGen

NexGen Energy is a Canadian company focused on delivering clean energy fuel for the future. The Company's flagship Rook I Project is being optimally developed into the largest low cost producing uranium mine globally, incorporating the most elite standards in environmental and social governance. The Rook I Project is supported by a NI 43-101 compliant Feasibility Study which outlines the elite environmental performance and industry leading economics. NexGen is led by a team of experienced uranium and mining industry professionals with expertise across the entire mining life cycle, including exploration, financing, project engineering and construction, operations, and closure. NexGen is leveraging its proven experience to deliver a Project that leads the entire mining industry socially, technically, and environmentally. The Project and prospective portfolio in northern Saskatchewan will provide generational long-term economic, environmental, and social benefits for Saskatchewan, Canada , and the world.

NexGen is listed on the Toronto Stock Exchange, the New York Stock Exchange under the ticker symbol "NXE" and on the Australian Securities Exchange under the ticker symbol "NXG" providing access to global investors to participate in NexGen's mission of solving three major global challenges in decarbonization, energy security and access to power. The Company is headquartered in Vancouver, British Columbia , with its primary operations office in Saskatoon, Saskatchewan .

Technical Disclosure*

All technical information in this news release has been reviewed and approved by Jason Craven, NexGen's Manager, Exploration, a qualified person under National Instrument 43-101.

Natural gamma radiation in drill core reported in this news release was measured in counts per second (cps) using a Radiation Solutions Inc. RS-125 gamma spectrometer. The reader is cautioned that total count gamma readings may not be directly or uniformly related to uranium grades of the rock sample measured; they should be used only as a preliminary indication of the presence of radioactive minerals.

A technical report in respect of the FS is filed on SEDAR ( www.sedar.com ) and EDGAR ( www.sec.gov/edgar.shtml ) and is available for review on NexGen Energy's website ( www.nexgenenergy.ca ).

Cautionary Note to U.S. Investors

This news release includes Mineral Reserves and Mineral Resources classification terms that comply with reporting standards in Canada and the Mineral Reserves and the Mineral Resources estimates are made in accordance with NI 43-101. NI 43-101 is a rule developed by the Canadian Securities Administrators that establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects. These standards differ from the requirements of the Securities and Exchange Commission ("SEC") set by the SEC's rules that are applicable to domestic United States reporting companies. Consequently, Mineral Reserves and Mineral Resources information included in this news release is not comparable to similar information that would generally be disclosed by domestic U.S. reporting companies subject to the reporting and disclosure requirements of the SEC Accordingly, information concerning mineral deposits set forth herein may not be comparable with information made public by companies that report in accordance with U.S. standards.

Forward-Looking Information

The information contained herein contains "forward-looking statements" within the meaning of applicable United States securities laws and regulations and "forward-looking information" within the meaning of applicable Canadian securities legislation. "Forward-looking information" includes, but is not limited to, statements with respect to mineral reserve and mineral resource estimates, the 2021 Arrow Deposit, Rook I Project and estimates of uranium production, grade and long-term average uranium prices, anticipated effects of completed drill results on the Rook I Project, planned work programs, completion of further site investigations and engineering work to support basic engineering of the project and expected outcomes. Generally, but not always, forward-looking information and statements can be identified by the use of words such as "plans", "expects", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates", or "believes" or the negative connotation thereof or variations of such words and phrases or state that certain actions, events or results "may", "could", "would", "might" or "will be taken", "occur" or "be achieved" or the negative connotation thereof. Statements relating to "mineral resources" are deemed to be forward-looking information, as they involve the implied assessment that, based on certain estimates and assumptions, the mineral resources described can be profitably produced in the future.

Forward-looking information and statements are based on the then current expectations, beliefs, assumptions, estimates and forecasts about NexGen's business and the industry and markets in which it operates. Forward-looking information and statements are made based upon numerous assumptions, including among others, that the mineral reserve and resources estimates and the key assumptions and parameters on which such estimates are based are as set out in this news release and the technical report for the property , the results of planned exploration activities are as anticipated, the price and market supply of uranium, the cost of planned exploration activities, that financing will be available if and when needed and on reasonable terms, that third party contractors, equipment, supplies and governmental and other approvals required to conduct NexGen's planned exploration activities will be available on reasonable terms and in a timely manner and that general business and economic conditions will not change in a material adverse manner. Although the assumptions made by the Company in providing forward looking information or making forward looking statements are considered reasonable by management at the time, there can be no assurance that such assumptions will prove to be accurate in the future.

Forward-looking information and statements also involve known and unknown risks and uncertainties and other factors, which may cause actual results, performances and achievements of NexGen to differ materially from any projections of results, performances and achievements of NexGen expressed or implied by such forward-looking information or statements, including, among others, the existence of negative operating cash flow and dependence on third party financing, uncertainty of the availability of additional financing, the risk that pending assay results will not confirm previously announced preliminary results, conclusions of economic valuations, the risk that actual results of exploration activities will be different than anticipated, the cost of labour, equipment or materials will increase more than expected, that the future price of uranium will decline or otherwise not rise to an economic level, the appeal of alternate sources of energy to uranium-produced energy, that the Canadian dollar will strengthen against the U.S. dollar, that mineral resources and reserves are not as estimated, that actual costs or actual results of reclamation activities are greater than expected, that changes in project parameters and plans continue to be refined and may result in increased costs, of unexpected variations in mineral resources and reserves, grade or recovery rates or other risks generally associated with mining, unanticipated delays in obtaining governmental, regulatory or First Nations approvals, risks related to First Nations title and consultation, reliance upon key management and other personnel, deficiencies in the Company's title to its properties, uninsurable risks, failure to manage conflicts of interest, failure to obtain or maintain required permits and licences, risks related to changes in laws, regulations, policy and public perception, as well as those factors or other risks as more fully described in NexGen's Annual Information Form dated March 6, 2024 filed with the securities commissions of all of the provinces of Canada except Quebec and in NexGen's 40-F filed with the United States Securities and Exchange Commission, which are available on SEDAR at www.sedar.com and Edgar at www.sec.gov .

Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in the forward-looking information or statements or implied by forward-looking information or statements, there may be other factors that cause results not to be as anticipated, estimated or intended. Readers are cautioned not to place undue reliance on forward-looking information or statements due to the inherent uncertainty thereof.

There can be no assurance that forward-looking information and statements will prove to be accurate, as actual results and future events could differ materially from those anticipated, estimated or intended. Accordingly, readers should not place undue reliance on forward-looking statements or information. The Company undertakes no obligation to update or reissue forward-looking information as a result of new information or events except as required by applicable securities laws .

![]() View original content to download multimedia: https://www.prnewswire.com/news-releases/nexgen-announces-best-hole-rk-24-207-to-date-and-material-expansion-of-mineralized-zone-at-patterson-corridor-east-302217775.html

View original content to download multimedia: https://www.prnewswire.com/news-releases/nexgen-announces-best-hole-rk-24-207-to-date-and-material-expansion-of-mineralized-zone-at-patterson-corridor-east-302217775.html

SOURCE NexGen Energy Ltd.

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/August2024/08/c9516.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/August2024/08/c9516.html