TSX: SIL | NYSE American: SILV

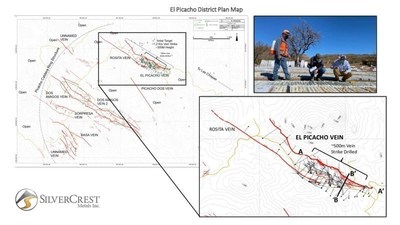

SilverCrest Metals Inc. ("SilverCrest" or the "Company") is pleased to announce the commencement of drilling, and initial results, at El Picacho Property ("El Picacho" or the "Property") located near its Las Chispas Project in Sonora, Mexico ( see attached Figures ).

Highlights for El Picacho Property and Veins:

- The best intercepts from initial drilling include;

- Hole PI-20-006 at 7.25 metres of estimated true width ("ETW") grading 40.49 grams per tonne ("gpt") gold ("Au") and 260.4 gpt silver ("Ag"), or 3,297 gpt silver equivalent ("AgEq", 75:1 Au:Ag ratio), and

- Hole PI-20-001 at 16.4 metres of ETW grading 8.50 gpt Au and 51.3 gpt Ag, or 689 gpt AgEq.

- 42 initial drill holes with 21 holes intercepting an average of 4.1 metres ETW grading 8.14 gpt Au and 49.7 gpt Ag, or 660 gpt AgEq for the El Picacho Vein;

- Excluding best intercept Hole PI20-006, the average is 3.9 metres ETW grading 5.12 gpt Au and 30.1 gpt Ag, or 414 gpt AgEq.

- Drilling has discovered a near parallel vein to El Picacho Vein, El Picacho HW Vein with 7 drill hole intercepts, and expanded the mineralized footprint from the previous historic unverified resource area.

- Three core drill rigs are active at El Picacho , as well as six core drill rigs at the Las Chispas Project as part of a US$42 million company-wide 2021 exploration program. A majority of this program will be focused on the Las Chispas Project.

El Picacho results being reported in this news release represent 42 drill holes totalling an estimated 11,420 metres. Drilling focused on El Picacho Vein and the near parallel discovery, El Picacho HW Vein (see Table below). Twenty-one (21) of these 42 holes intercepted El Picacho Vein with a cutoff grade of 150 gpt AgEq and minimum ETW of 0.50 metres. The program has successfully intercepted precious metal mineralization within El Picacho Vein across an area of approximately 500 metres along vein strike and 300 metres down vein dip from surface. This mineralized footprint is an expansion of the previous historic unverified resource area (see attached Figures and historic notes below). All access rights and necessary drill permits (5-year license) are in place for continued drilling.

The Company's initial drill hole on the Property, PI-20-001, intercepted 16.37 metres ETW grading 8.50 gpt Au and 51.3 gpt Ag, or 689 gpt AgEq (mostly gold in value), including 11.41 metres grading 11.56 gpt Au and 70.3 gpt Ag, or 937 gpt AgEq. This hole twinned a 2007 historic hole which previously intercepted 15.58 metres ETW grading 11.21 gpt Au and 26 gpt Ag, or 867 gpt AgEq.

N. Eric Fier , CPG, P.Eng, and CEO, remarked, "We acquired El Picacho only six months ago, and in this short time period, SilverCrest's exploration team has negotiated surface rights, completed preliminary geological surface and underground exploration work, received a five-year drilling permit, set up a COVID-19 isolation camp with strict protocols, and have already made some significant discoveries. Drilling will continue throughout the year, with an approved total 2021 exploration budget of US$42 million for mostly the Las Chispas Project with some allocated to El Picacho based on success."

The most significant high-grade intercept to date is in hole PI-20-006 with 7.25 metres ETW grading 40.49 gpt Au and 260.4 gpt Ag, or 3,297 gpt AgEq. The following tables summarize the most significant drill intercepts (uncapped, undiluted) above a cut-off of 150 gpt AgEq and with a minimum ETW of 0.50 metres:

El Picacho Vein

| Hole | From | To | Length | Est. | Au | Ag | AgEq* |

| PI-20-001 | 120.9 | 142.5 | 21.6 | 16.4 | 8.50 | 51.3 | 689 |

| incl. | 127.5 | 142.5 | 15.0 | 11.4 | 11.56 | 70.3 | 937 |

| incl. | 139.6 | 142.0 | 2.4 | 1.8 | 21.34 | 341.5 | 1,942 |

| PI-20-002 | 161.1 | 172.3 | 11.2 | 9.0 | 3.76 | 20.8 | 303 |

| incl. | 165.3 | 166.5 | 1.2 | 1.0 | 15.95 | 85.4 | 1,282 |

| PI-20-005 | 116.9 | 119.1 | 2.2 | 1.8 | 5.78 | 7.6 | 441 |

| PI-20-006 | 161.6 | 170.6 | 9.0 | 7.3 | 40.49 | 260.4 | 3,297 |

| incl. | 161.6 | 162.2 | 0.6 | 0.5 | 449.01 | 1975.0 | 35,651 |

| PI-20-007 | 144.9 | 146.1 | 1.2 | 0.7 | 2.07 | 3.1 | 158 |

| PI-20-012 | 68.9 | 73.6 | 4.7 | 4.0 | 3.54 | 11.9 | 278 |

| PI-20-013 | 181.4 | 193.2 | 11.8 | 6.7 | 2.98 | 10.8 | 234 |

| incl. | 190.0 | 191.3 | 1.3 | 0.7 | 9.45 | 10.0 | 719 |

| PI-20-014 | 241.1 | 242.7 | 1.6 | 1.1 | 2.40 | 27.1 | 207 |

| PI-20-016 | 133.4 | 134.7 | 1.3 | 1.0 | 1.97 | 3.9 | 152 |

| PI-20-017 | 114.6 | 120.2 | 5.6 | 3.5 | 2.02 | 11.5 | 163 |

| PI-20-018 | 210.0 | 212.0 | 2.0 | 1.5 | 1.69 | 29.2 | 156 |

| PI-20-019 | 80.6 | 88.1 | 7.5 | 5.9 | 4.01 | 12.1 | 361 |

| incl. | 81.3 | 82.0 | 0.7 | 0.6 | 15.85 | 28.6 | 1,217 |

| PI-20-020 | 246.3 | 248.7 | 2.4 | 1.5 | 3.25 | 51.7 | 296 |

| PI-20-021 | 119.3 | 121.1 | 1.9 | 1.6 | 3.46 | 10.3 | 270 |

| PI-20-024 | 104.1 | 116.7 | 12.6 | 6.9 | 2.31 | 12.6 | 186 |

| incl. | 113.6 | 116.7 | 3.1 | 1.7 | 5.66 | 17.8 | 442 |

| PI-21-026 | 82.9 | 88.3 | 5.4 | 4.3 | 2.13 | 22.9 | 183 |

| PI-21-027 | 263.9 | 265.2 | 1.3 | 0.8 | 3.07 | 13.4 | 244 |

| PI-21-029 | 288.8 | 293.8 | 5.0 | 2.7 | 10.78 | 193.3 | 1,002 |

| incl. | 292.6 | 293.8 | 1.2 | 0.7 | 39.80 | 752.0 | 3,737 |

| PI-21-035 | 7.0 | 12.5 | 5.5 | 5.0 | 8.06 | 10.5 | 615 |

| incl. | 7.0 | 7.8 | 0.8 | 0.7 | 48.10 | 36.3 | 3,644 |

| PI-21-036 | 54.4 | 56.6 | 2.2 | 1.4 | 1.94 | 10.2 | 156 |

| PI-21-041 | 41.0 | 43.6 | 2.6 | 2.0 | 15.81 | 52.3 | 1,238 |

| incl. | 41.6 | 42.9 | 1.3 | 1.0 | 29.77 | 94.7 | 2,328 |

| Weighted Average | 5.6 | 4.1 | 8.14 | 49.7 | 660 | ||

El Picacho HW Vein

| Hole | From | To | Length | Est. | Au | Ag | AgEq* |

| PI-20-006 | 153.8 | 154.6 | 0.8 | 0.7 | 2.59 | 19.9 | 214 |

| PI-20-011 | 160.8 | 162.4 | 1.6 | 0.6 | 2.40 | 4.0 | 184 |

| PI-20-017 | 106.5 | 109.2 | 2.7 | 1.7 | 2.87 | 8.6 | 224 |

| PI-20-021 | 109.7 | 111.3 | 1.6 | 1.4 | 1.88 | 27.5 | 169 |

| PI-20-024 | 94.9 | 96.4 | 1.5 | 0.8 | 1.80 | 21.0 | 156 |

| PI-21-027 | 243.9 | 245.4 | 1.5 | 0.9 | 3.56 | 82.5 | 349 |

| PI-21-030 | 256.7 | 258.9 | 2.2 | 1.2 | 4.37 | 72.3 | 400 |

| Weighted Average | 1.7 | 1.0 | 2.83 | 34.1 | 246 | ||

| Note: all numbers are rounded. Cutoff grade of 150 gpt AgEq with a minimum true width of 0.5 metres. |

| Duplicate hole numbers reflect holes that intersected both El Picacho and El Picacho HW veins. |

| *AgEq based on 75 (Ag):1 (Au) calculated using long-term silver and gold prices of US$20 per ounce |

| silver and US$1,500 per ounce gold. Insufficient metallurgical test work has been completed at |

| Picacho to formulate accurate recoveries. |

All assays were completed by ALS Chemex in Hermosillo, Mexico , and North Vancouver, BC , Canada .

The drill results also include holes; PI-20-003 and 004, PI-20-008 to 010, PI-20-015, PI-20-022 and023, PI-21-025, PI-21-028, PI-21-031 to PI-21-034, PI-21-037 to PI-21-039, PI-21-040, and PI-21-042 which intersected veining in El Picacho and EL Picacho HW veins but were below the Company's cutoff grade of 150 gpt AgEq.

El Picacho Property is located approximately 85 road kilometres (mostly paved) northeast of the Company's Las Chispas Project and is comprised of 11 mining concessions totalling approximately 7,060 hectares. Mineralization is hosted within multiple low-sulphidation epithermal veins (currently seven main veins) which include banded quartz, quartz-calcite breccia, quartz and calcite stockwork, and structures with pyrite, argentite and sphalerite being the predominant sulphide minerals. Approximately 13.6 kilometres of vein strike length is currently known.

The Property was a historic gold and silver producer, with the first noted production in late 1800s with grades greater than 15 gpt gold (Bird, 1904). Several companies have explored the Property over the past 30 years; most notably Yamana Gold Inc. ("Yamana") in 2012 which completed a total of 67 drill holes for 10,789 metres (37% reverse circulation and 63% core), including 24 holes for a total of an estimated 4,871 metres in El Picacho Vein. Over 1.7 kilometres of near surface historic underground workings are present in El Picacho Vein that are partially accessible by a 4 metre by 4 metre decline that exposes the mineralized vein.

Summary of Historical Drilling Results for EL Picacho Vein (Yamana, 2012)

| Hole | From | To (m) | Length | Est. True | Au | Ag (gpt) | AgEq* (gpt) |

| P12-002D | 165.3 | 179.9 | 14.6 | 14.0 | 4.19 | 6.4 | 321 |

| incl. | 165.3 | 166.0 | 0.7 | 0.7 | 4.30 | 3.5 | 326 |

| incl. | 168.9 | 169.8 | 0.8 | 0.8 | 13.30 | 18.0 | 1,016 |

| incl. | 171.8 | 175.4 | 3.6 | 3.5 | 7.36 | 8.3 | 560 |

| incl. | 176.3 | 179.9 | 3.6 | 3.5 | 4.23 | 7.9 | 325 |

| P12-003D | 189.3 | 193.1 | 3.8 | 3.5 | 2.16 | 13.3 | 175 |

| incl. | 191.1 | 193.1 | 2.0 | 1.8 | 3.30 | 18.1 | 266 |

| P12-004D | 217.8 | 219.5 | 1.7 | 1.4 | 2.64 | 8.8 | 207 |

| P12-005D | 123.2 | 126.1 | 2.9 | 2.4 | 1.83 | 3.2 | 140 |

| incl. | 124.3 | 126.1 | 1.8 | 1.5 | 2.43 | 4.0 | 186 |

| P12-010D | 195.7 | 197.2 | 1.5 | 1.5 | 1.52 | 2.0 | 116 |

| P12-011D | 244.7 | 245.6 | 0.9 | 0.7 | 1.51 | 22.0 | 135 |

| P12-012D | 111.2 | 112.7 | 1.5 | 1.4 | 7.49 | 8.5 | 570 |

| P12-017D | 148.7 | 150.3 | 1.5 | 1.3 | 1.71 | 0.5 | 129 |

| P12-022D | 210.9 | 212.5 | 1.5 | 1.2 | 3.29 | 32.0 | 279 |

| P12-024R | 13.2 | 20.3 | 7.1 | 6.8 | 3.00 | 6.8 | 232 |

| incl. | 14.2 | 15.2 | 1.0 | 1.0 | 5.41 | 21.0 | 427 |

| incl. | 18.3 | 19.3 | 1.0 | 1.0 | 11.30 | 10.0 | 858 |

| Weighted Average | 3.7 | 3.4 | 3.35 | 8.0 | 260 | ||

| Note: all numbers are rounded. Cutoff grade of 150 gpt AgEq with a minimum true width of 0.5 metres. |

| All holes are core except for hole P12-024R which is reverse circulation. |

| *AgEq based on 75 (Ag):1 (Au) calculated using long-term silver and gold prices of US$20 per ounce |

| silver and US$1,500 per ounce gold. Insufficient metallurgical test work has been completed at |

| Picacho to formulate accurate recoveries. |

El Picacho Vein has a historic unverified mineral resource estimate reported in 2010 ( Wheatley , 2010) using 14 drill holes, underground channel sampling results and a polygonal estimation method. The reported estimate had 364,381 tonnes grading 8.54 gpt Au and 40.38 gpt Ag, or 100,060 ounces of gold and 473,052 ounces of silver using a 1 gpt gold cutoff. A qualified person has not done sufficient work to classify the historical estimates as current mineral resources or mineral reserves. The Company is not treating this information as current mineral resources or reserves, has not verified this information and is not relying on it. The Company plans on using the historical drilling and estimates to help guide its exploratory drilling work.

Work by SilverCrest to date has included surface and underground mapping, sampling, surveys, drilling (described above) and underground rehabilitation of approximately 1.7 kilometre of historic lateral and vertical workings ( see attached Figures ).

The Company currently has three (3) core drills operating and is planning further expansion drilling in 2021 for the Picacho, Picacho HW veins, and other veins on the Property.

The Qualified Person under National Instrument 43-101 Standards of Disclosure for Mineral Projects for this news release is N. Eric Fier , CPG, P.Eng, and CEO for SilverCrest, who has reviewed and approved its contents.

ABOUT SILVERCREST METALS INC.

SilverCrest is a Canadian precious metals exploration and development company headquartered in Vancouver, BC , that is focused on new discoveries, value-added acquisitions and targeting production in Mexico's historic precious metal districts. The Company's top priority is on the high-grade, historic Las Chispas mining district in Sonora, Mexico , where it has completed a feasibility study on the Las Chispas Project and is proceeding with mine construction. Start up of production at the Las Chispas Mine is targeted for mid-2022. SilverCrest is the first company to successfully drill-test the historic Las Chispas Property resulting in numerous high-grade precious metal discoveries. The Company is led by a proven management team in all aspects of the precious metal mining sector, including taking projects through discovery, finance, on time and on budget construction, and production.

FORWARD-LOOKING STATEMENTS

This news release contains "forward-looking statements" and "forward-looking information" (collectively "forward-looking statements") within the meaning of applicable Canadian and United States securities legislation. These include, without limitation, statements with respect to: the strategic plans, timing and expectations for the Company's exploration programs at the Las Chispas Project and El Picacho Property and the start up of production at the Las Chispas Mine by mid-2022. Such forward looking statements or information are based on a number of assumptions, which may prove to be incorrect. Assumptions have been made regarding, among other things: impact of the COVID-19 pandemic; the reliability of mineralization estimates, the conditions in general economic and financial markets; availability of skilled labour; timing and amount of expenditures related to rehabilitation and drilling programs; and effects of regulation by governmental agencies. The actual results could differ materially from those anticipated in these forward-looking statements as a result of risk factors including: uncertainty as to the impact and duration of the COVID-19 pandemic; the timing and content of work programs; results of exploration activities; the interpretation of drilling results and other geological data; receipt, maintenance and security of permits and mineral property titles; environmental and other regulatory risks; project cost overruns or unanticipated costs and expenses; and general market and industry conditions. Forward-looking statements are based on the expectations and opinions of the Company's management on the date the statements are made. The assumptions used in the preparation of such statements, although considered reasonable at the time of preparation, may prove to be imprecise and, as such, readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date the statements were made. The Company undertakes no obligation to update or revise any forward-looking statements included in this news release if these beliefs, estimates and opinions or other circumstances should change, except as otherwise required by applicable law.

N. Eric Fier , CPG, P.Eng

Chief Executive Officer

SilverCrest Metals Inc.

![]() View original content to download multimedia: https://www.prnewswire.com/news-releases/silvercrest-announces-initial-drill-results-for-el-picacho-property-21-drill-hole-intercepts-average-4-1-metres-etw-grading-660-gpt-ageq-301234452.html

View original content to download multimedia: https://www.prnewswire.com/news-releases/silvercrest-announces-initial-drill-results-for-el-picacho-property-21-drill-hole-intercepts-average-4-1-metres-etw-grading-660-gpt-ageq-301234452.html

SOURCE SilverCrest Metals Inc.