Northern Lights Resources Corp. (CSE:NLR)(the "Company" or "Northern Lights") is pleased to announce an update to exploration work at the Company's 100% owned Secret Pass Gold Project ("Secret Pass" of the "Project") located in Mohave County, northwestern Arizona

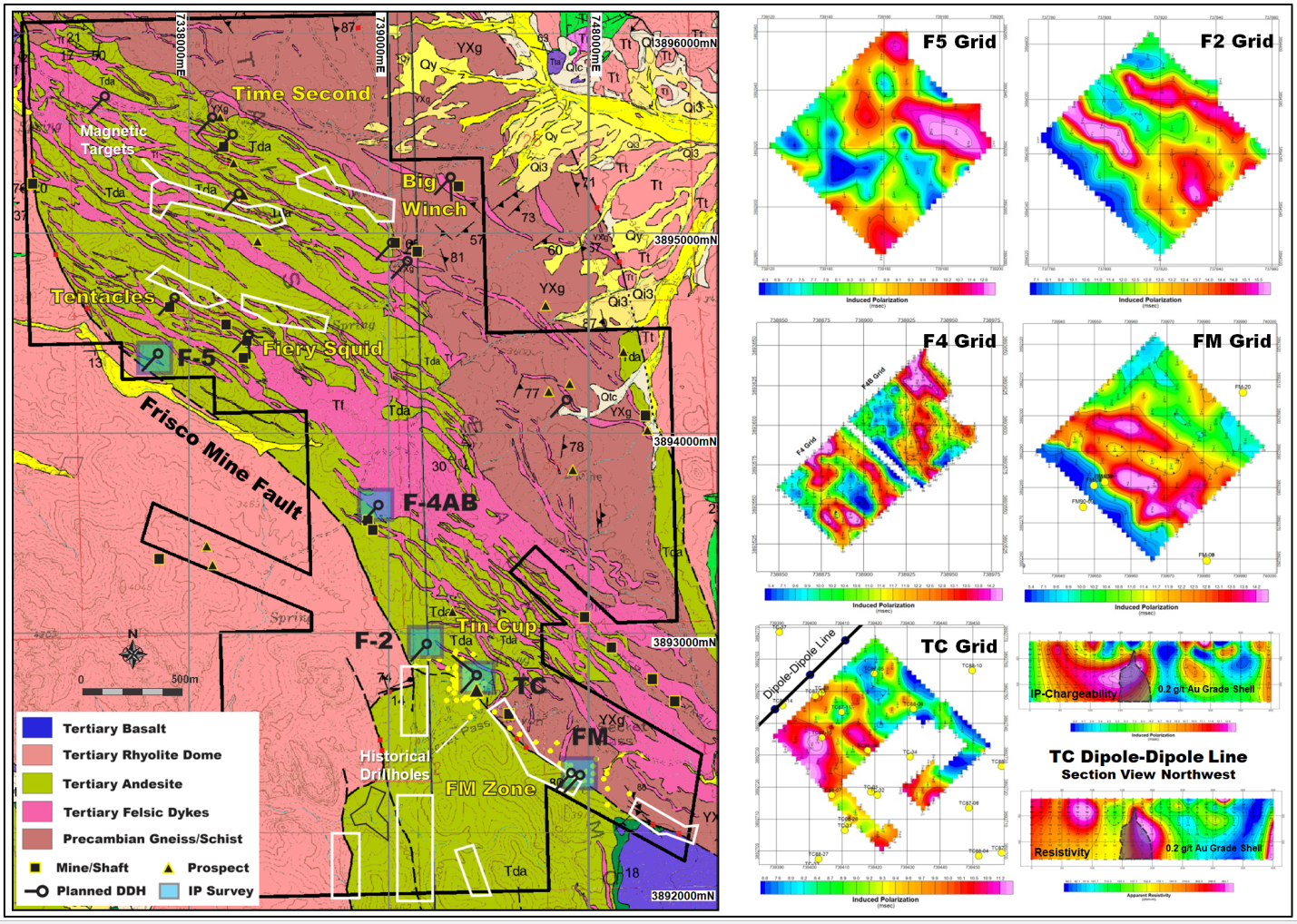

Northern Lights has completed a reinterpretation and review of Induced Polarization (IP) and Resistivity survey data that was initially collected by Santa Fe Mining in 1992. The results complement the magnetic survey and fieldwork that Northern Lights has completed on the property to date, which has resulted in the generation of over 20 targets in previously unexplored areas on the Secret Pass property.

The primary objective of the survey was to determine if IP and Resistivity were effective in detecting the silica-clay-pyrite alteration associated with gold mineralization observed at the Tin Cup and FM prospects. The results highlight the importance of the Frisco Mine Fault (FMF) as a geological control for the gold mineralization at Secret Pass.

With reference to Figure 1, five small Gradient Array grids were completed and a single Dipole-Dipole profile located in proximity to the FMF and in areas exhibiting strong surface alteration and mineralization. The reinterpretation of the geophysical data demonstrates that the Secret Pass gold mineralization exhibits a positive coincident IP and Resistivity response. The geophysical study was undertaken by Steven McMullan, an experienced geophysical consultant that wrote the Secret Pass aeromagnetic report for NLR in August of 2020. (see https://www.northernlightsresources.com/site/assets/files/4976/nlr_new_release_-_secret_pass_-_airborne_geophysics.pdf)

The study completed by Northern Lights involved the digitization of historical geophysical IP and Resistivity data, geo-referencing the survey grids, and undertaking 2D inversion of the data.

Figure 1: Secret Pass Historical IP-Resistivity Survey Grids and Geology

To view an enhanced image click the following link: https://storage.googleapis.com/accesswire/media/618858/NORTHERNLIGHTS-FIGURE120120.jpg

Reinterpretation Summary

The important observations and conclusions for each grid and Dipole-Dipole profile are summarized below.

F2 Grid

- Moderate strength IP anomaly likely represents sulphide mineralization, and the resistivity high map represents silicification.

F5 Grid

- Collinear bands of high IP and Resistivity fit the conceptual model response of quartz veins/silicification (high resistivity) and sulphides associated with gold mineralization (high IP response).

F4+F4B Grid

- The irregular IP anomaly on the north side of the grid likely represents the intersection of structures/dykes.

FM Grid

- Multiple high IP anomalies in the footwall of the FMF may be related sulphide mineralization similar to Tin Cup and have not been drill tested.

TC (Tin Cup) Grid

- The high IP anomaly in the northwest corner of the grid has not been tested.

- FMF interpreted from 2020 aeromagnetic survey passes through the centre of the grid, which places high IP and high Resistivity (indicative of both sulphides and silicification) in the hangwall of the FMF.

TC (Tin Cup) Dipole-Dipole Profile

- Two structures are evident, i) east structure steeply west-dipping with low Resistivity and no correlating IP response, ii) central structure manifested by sub-vertical Resistivity high that is indicative of silicification and quartz veining and is coincident with a high IP response that continues into hangingwall. The IP anomaly is indicative of sulphides associated with mineralization developed in the FMF.

Discussion

Although the IP survey grids were limited in size, their location was optimal for studying the geophysical characteristics of the Secret Pass gold mineralization and its relationship with the Frisco Mine Fault system.

A single Dipole-Dipole line transected the main zone of mineralization at Tin Cup that was extensively drilled. With reference to the Dipole-Dipole profile in Figure 1, the 0.2 g/t gold grade shell is associated a strong IP response that has not to be closed off by drilling to the west. The IP response is related disseminated pyrite that is associated with strong silica-clay-carbonate alteration. The sub-vertical Resistivity high is indicative of silicification and quartz veining, which was commonly observed in the drill holes.

In conclusion, the IP-Resistivity technique is effective in mapping the style of gold mineralization observed at Secret Pass. Based on the results from this study, Northern Lights plans to conduct additional IP-Resistivity surveying in areas that display strong alteration and are proximal to the Frisco Mine Fault.

The scientific and technical data contained in this news release was reviewed and approved by Gary Artmont (Fellow Member AUSIMM #312718), Head of Geology and qualified person to Northern Lights Resources, who is responsible for ensuring that the geologic information provided in this news release is accurate and who acts as a "qualified person" under National Instrument 43-101 Standards of Disclosure for Mineral Projects.

For further information, please contact:

Albert Timcke, Executive Chairman and President

Email: rtimcke@northernlightsresources.com

Tel: +1 604 608 6163

Jason Bahnsen, Chief Executive Officer

Email: Jason@northernlightsresources.com

Tel: +1 604 608 6163

About Northern Lights Resources Corp.

Northern Lights Resources Corp is a growth-oriented exploration and development company that is advancing two projects: The 100% owned Secret Pass Gold Project located in Arizona; and the Medicine Springs silver-zinc-lead Project located in Elko County Nevada, where Northern Lights, in joint venture with Reyna Silver is earning 100% ownership.

Northern Lights Resources trades under the ticker of "NLR" on the CSE. This and other Northern Lights Resources news releases can be viewed at www.sedar.com and www.northernlightsresources.com.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION: This news release includes certain "forward-looking statements" under applicable Canadian securities legislation. Forward-looking statements include, but are not limited to, statements with respect to the terms and conditions of the proposed private placement, use of funds, the business and operations of the Company after the proposed closing of the Offering. Forward-looking statements are necessarily based upon a number of estimates and assumptions that, while considered reasonable, are subject to known and unknown risks, uncertainties, and other factors which may cause the actual results and future events to differ materially from those expressed or implied by such forward-looking statements. Such factors include, but are not limited to general business, economic, competitive, political, and social uncertainties; delay or failure to receive board, shareholder, or regulatory approvals; and the uncertainties surrounding the mineral exploration industry. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. The Company disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise, except as required by law.

SOURCE: Northern Lights Resources Corp.

View source version on accesswire.com:

https://www.accesswire.com/618858/Secret-Pass-IP-Res-Interpretation