Tartisan Nickel Corp. (CSE:TN; OTCQX:TTSRF; FSE:A2D) ("Tartisan", or the "Company") is pleased to provide diamond drill core assay results and an update for its diamond drilling program at the 100% owned Kenbridge Nickel Project located in the Kenora Mining District, Ontario

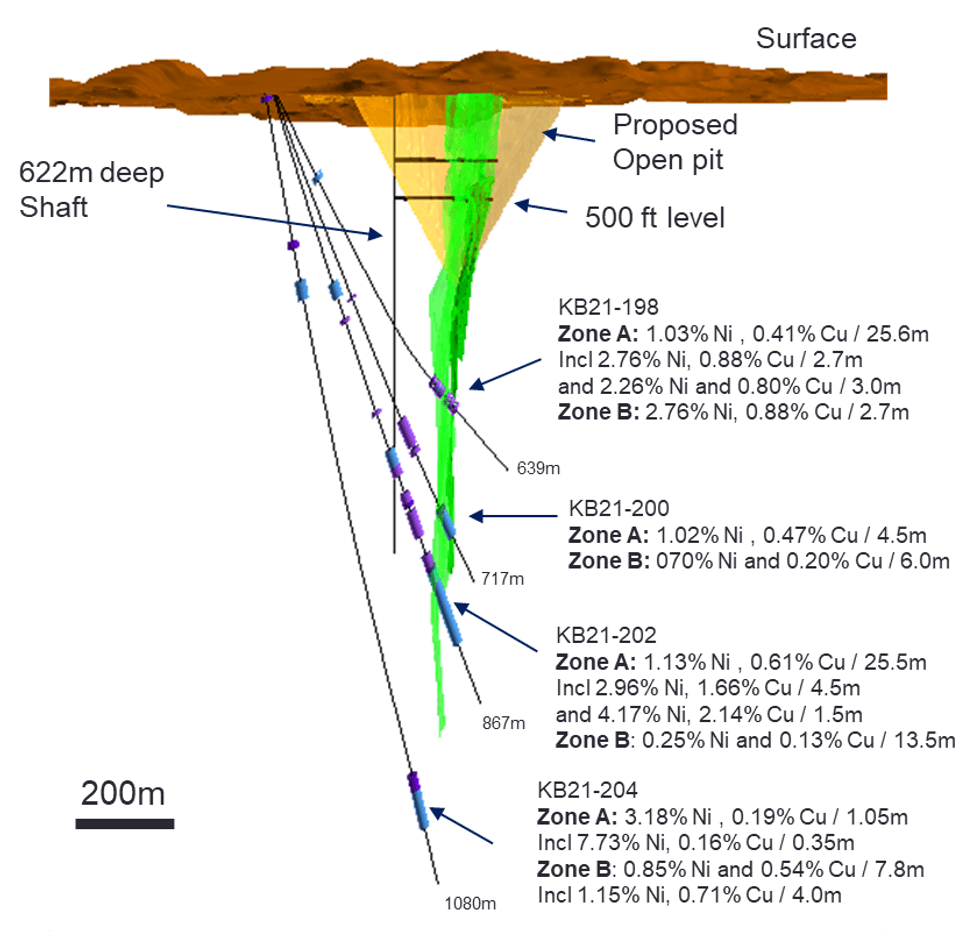

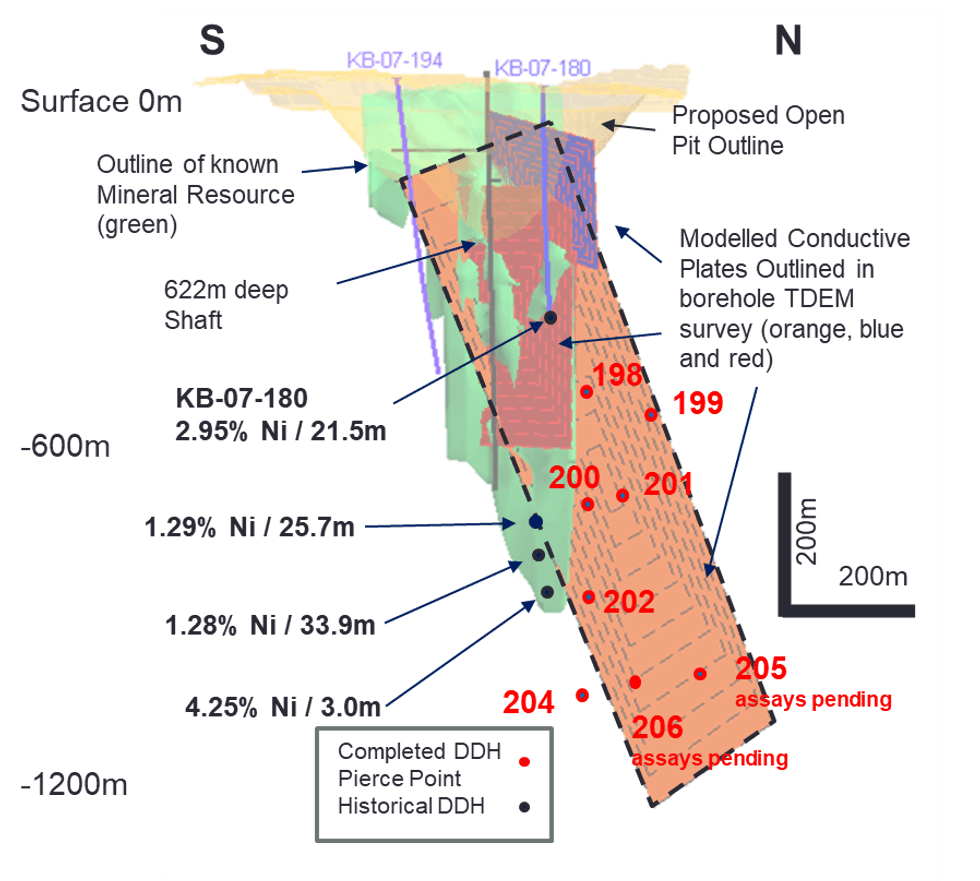

Hole KB21-204 intersected two nickel-copper zones at a drill depth of 993.55 metres and 1,002 metres. The two zones are interpreted to represent the downdip extension of two horizons (Zone A and Zone B) intersected in holes KB21-198, KB21-200 and KB21-202. In KB21-204 Zone A returned 1.05 metres of 3.18% Ni and 0.19% Cu including a higher-grade section of 0.35 metres of 7.73% Ni and 0.16% Cu. In the same hole Zone B returned 7.8 metres of 0.85% Ni and 0.54% Cu including 4.0 metres of 1.15% Ni and 0.71% Cu. Hole 204 is located approximately 150m below the deepest drill hole intersection completed in the 1950's (Drill hole K2011- 4.25% Ni over 3m) and is the deepest drill intersection on the project (see Figures 2 and 3). Holes KB21-205 and KB21-206 have also been completed and have been submitted to the laboratory for assays.

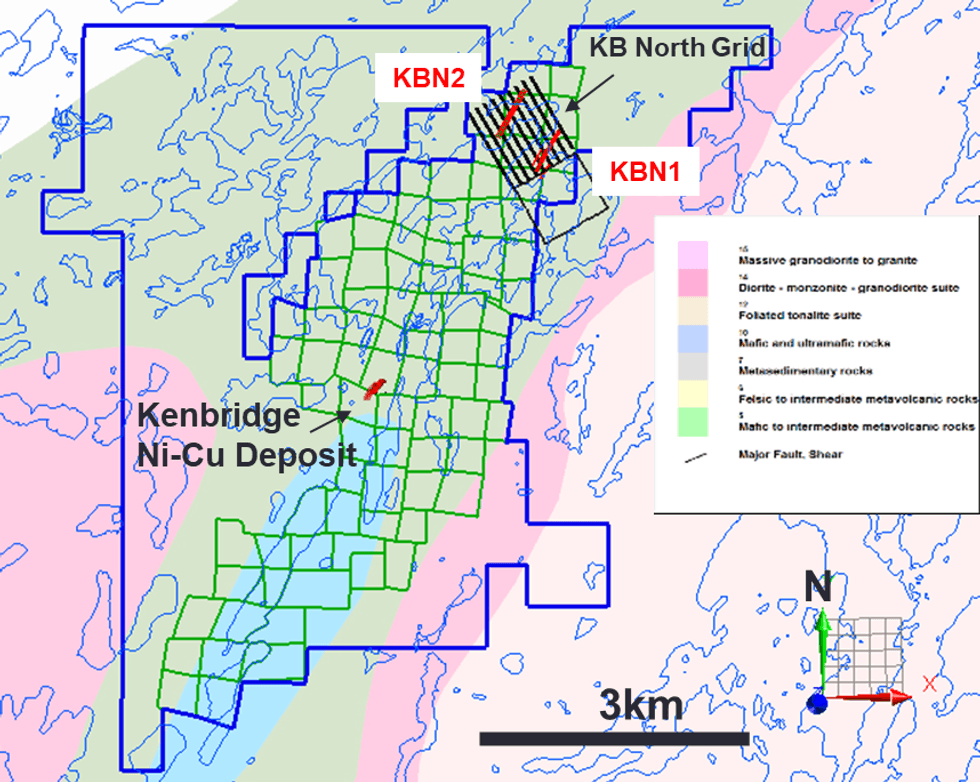

The Phase 1 drill campaign has now been completed for a cumulative total of 10,737 metres of diamond drilling (planned 10,000 metres). Nine holes were drilled at the Kenbridge Deposit (one hole abandoned) for a total of 8,318 metres. Four holes were completed on the Kenbridge North target (conductor KBN1, see Figure 1) for a total of 2,419 metres of drilling. The Kenbridge North target is located approximately 2.5 kilometres north of the Kenbridge Nickel Deposit and was identified from a ground-based Time Domain Electromagnetic (TDEM) survey completed in early 2021. Drilling at Kenbridge North intersected similar rock types that host the Kenbridge Nickel Deposit. Weakly disseminated sulphide was intersected and those zones have been sent out for assays.

All drill holes completed at the Kenbridge Deposit have been surveyed with a downhole TDEM system. Interpretation of all available data including recently acquired borehole TDEM and drill core assays will be incorporated into the existing geological model to aid in guiding additional diamond drilling, particularly downdip of the known mineralization. Borehole TDEM surveys could not be completed on the Kenbridge North target due to deteriorating weather and unsafe conditions on the surrounding lakes. Those 4 holes will be surveyed in the winter once freeze up conditions have set in and will be combined with a ground TDEM survey over 2 additional identified targets to the east and west of the Kenbridge North Grid.

Mark Appleby, President and CEO of the Company commented "what is of interest from hole KB21-204 is the high-grade nickel section. This is the deepest intersection with assay results on the Kenbridge Deposit to date. Although the high-grade is narrow in this hole it suggests there is a high-grade nickel tenor when intersecting semi-massive sulphide. Our hope is that the TDEM survey can point us towards these higher-grade, higher conductivity zones. We'll review all the data once the final assay results are received and then plan our next drill program. During the 2021 work program the Company also worked at enhancing the infrastructure of the project including improving all season access into the property and upgrading the core processing facilities. We believe this will allow us to move towards doing year-round work programs."

Figure 1: Location of the Kenbridge Ni-Cu Deposit and Kenbridge North Grid Drill Target

Figure 2. Section of the Kenbridge Deposit looking south. Green outline is the current Mineral Resource. Blue and purple are associated gabbro pyroxenite favorable host rocks. Hole 204 is located approximately 150m below the deepest drill hole intersection completed in the 1950's (Drill hole K2011- 4.25% Ni over 3m).

Figure 3. Long Section of the Kenbridge Deposit looking west showing drill hole pierce points and modelled TDEM anomalies. Green outline is the current Mineral Resource.

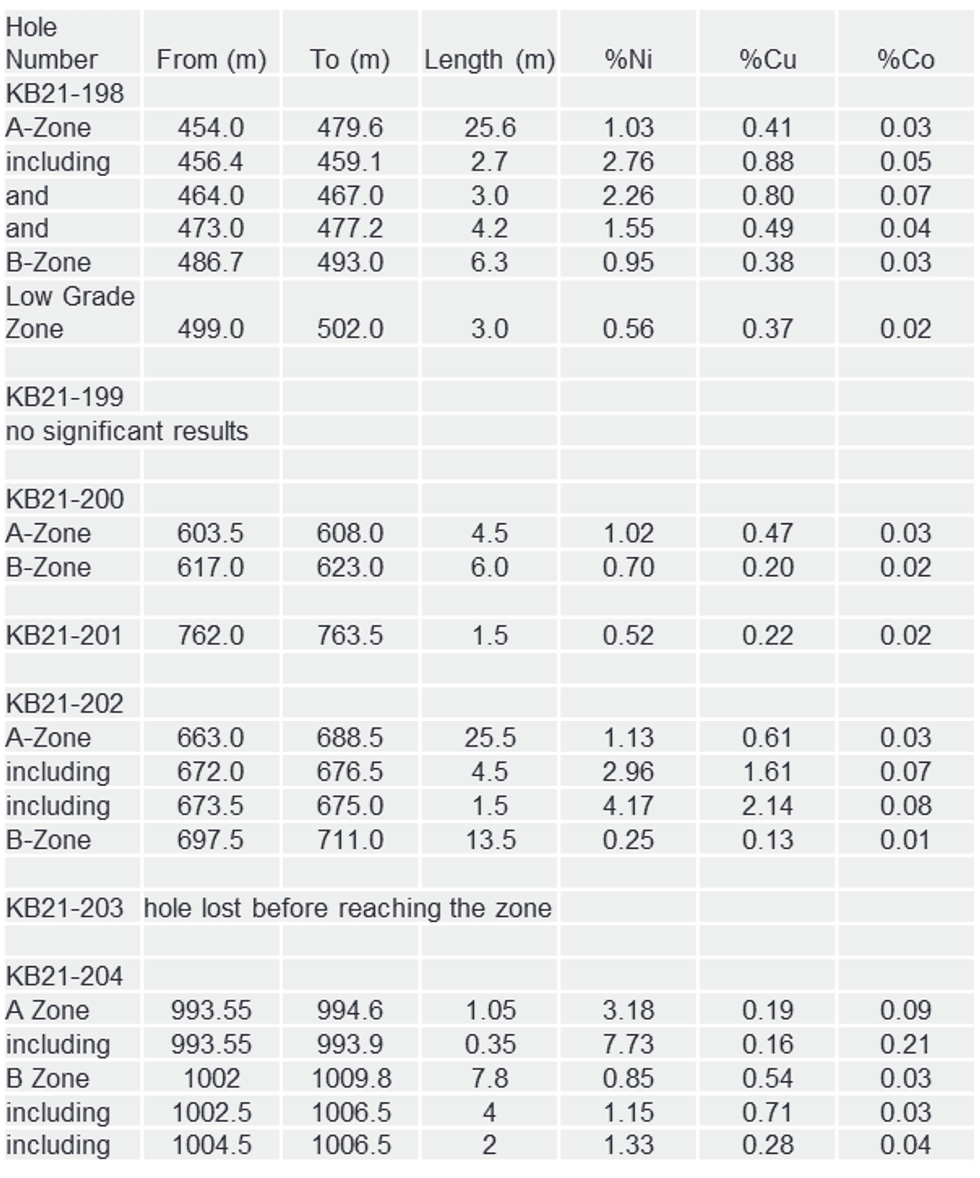

Table 1.

Drill hole intersections for holes drilled at the Kenbridge Deposit received to date. Assays for hole KN21-205 and 206 are pending. Four holes drilled at Kenbridge North (KBN21-01, 02, 03 and 04) have had samples submitted for analysis. (SEDAR 2021)

The Company previously released an Updated Mineral Resource Estimate (MRE) of the Kenbridge Nickel-Copper-Cobalt Project, Atikwa Lake Area, Northwestern Ontario (SEDAR June 1, 2021).

About Tartisan Nickel Corp.

Tartisan Nickel Corp. is a Canadian based mineral exploration and development company whose flag ship asset is the Kenbridge Nickel Deposit located in the Kenora Mining District, Ontario. Tartisan also owns; the Sill Lake Silver Property in Sault St. Marie, Ontario as well as the Don Pancho Manganese-Zinc-Lead-Silver Project in Peru.

Tartisan Nickel Corp. owns an equity stake in; Eloro Resources Limited, Class 1 Nickel and Technologies Limited, Peruvian Metals Corp., and Silver Bullet Mines Inc.

Tartisan Nickel Corp. common shares are listed on the Canadian Securities Exchange (CSE:TN; OTCQX:TTSRF; FSE:A2D). Currently, there are 110,817,303 shares outstanding (122,113,344 fully diluted).

Dean MacEachern P.Geo. is the Qualified Person under NI 43-101 and has read and approved the technical content of this News Release.

For further information, please contact Mark Appleby, President & CEO, and a Director of the Company, at 416-804-0280 (info@tartisannickel.com). Additional information about Tartisan Nickel Corp. can be found at the Company's website at www.tartisannickel.comor on SEDAR at www.sedar.com.

This news release may contain forward-looking statements including but not limited to comments regarding the timing and content of upcoming work programs, geological interpretations, receipt of property titles, potential mineral recovery processes, etc. Forward-looking statements address future events and conditions and therefore, involve inherent risks and uncertainties. Actual results may differ materially from those currently anticipated in such statements.

The Canadian Securities Exchange (operated by CNSX Markets Inc.) has neither approved nor disapproved of the contents of this press release.

SOURCE: Tartisan Nickel Corp.

View source version on accesswire.com:

https://www.accesswire.com/674962/Tartisan-Nickel-Corp-Drills-Deepest-Hole-To-Date-at-The-Kenbridge-Nickel-Project-and-Intersects-318-Ni-019-Cu-Over-105-Metres-Updates-Progress-at-The-Kenbridge-Nickel-Copper-Cobalt-Project-NW-Ontario