(CSE: TRG)

Tarachi Gold Corp. (CSE: TRG) (PINK: TRGGF) ( Frankfurt : 4RZ) (" Tarachi " or the " Company ") is pleased to announce additional assay results from underground diamond drill hole JAB-20-06, completed at the historic La Dura mine on the Company's Jabali concession. The underground La Dura drill program will continue testing the down-dip and potential plunge orientation to the area of known gold bearing structures and potential new zones.

Tarachi's Vice President of Exploration, Lorne Warner stated "Drill hole JAB-20-06 is very exciting in that it continues to define the known Main Gold Zone but also encountered new gold mineralized structures beneath the Main Zone from the La Dura historic mine area. Currently, the Company has two diamond drill rigs turning, one at the La Dura historic mine and the other at the San Javier shear zone. At San Javier four drill holes have been completed with the discovery of replacement style massive sulphides encountered over several metres in one of these holes."

Table # 1: Diamond Drill Hole Composites

| Hole ID | From | To | Core Length | Gold |

| | (m) | (m) | (m) | (g/tonne) |

| JAB-20-06 | 2.25 | 10.25 | 8.0 | 3.95 |

| including | 22.25 | 43.00 | 20.75 | 5.05 |

| 27.65 | 33.75 | 6.10 | 14.50 | |

| New Zone L1 | 51.50 | 56.00 | 4.50 | 0.84 |

| New Zone L2 | 74.00 | 82.50 | 8.50 | 2.22 |

| *Assay results are in core length; true width is unknown. |

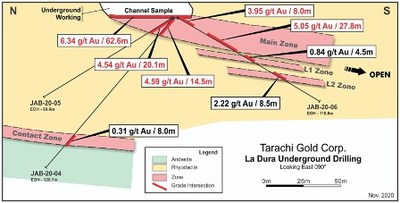

Drill results at La Dura are indicating the gold zones are trending approximately north-south with a gentle apparent south dip as shown on Figure # 2. Detailed mapping within the Main Zone from the underground workings shows a series of steeply south dipping, east-west striking crackle brecciated quartz veins contained within the zone. In order to further understand the nature of the mineralization, the Company will look to drill test to the south with inclined holes in order to properly test the Main Gold Zone and any other potential new zones.

Table # 2 – Drill hole orientations and length of hole

| Hole ID | Azimuth | Dip | Length |

| | (Degrees) | (Degrees) | (m) |

| JAB-20-03 | 15 | -48 | 91.1 |

| JAB-20-04 | 30 | -48 | 128.7 |

| JAB-20-05 | 30 | -30 | 99.6 |

| JAB-20-06 | 150 | -30 | 110.0 |

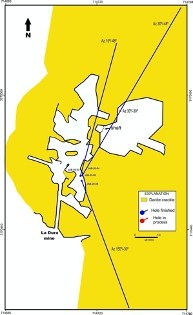

Figure # 1 is a plan view on the drill holes completed to date with assay results.

Figure # 2 – La Dura Cross-Section

Quality Assurance/Quality Control

Core samples were selected by a geologist and sawed in half. One half of the core remains in the core tray the other half is placed into a plastic bag. Sample tags were submitted into each bag before being sealed and stored at the campsite in a secure area and were later transported by company truck directly the Bureau Veritas Mineral Laboratories (BVM) in Hermosillo, Sonora, Mexico . At the laboratory, the samples were dried, crushed and pulverized with the pulps being sent airfreight for analysis to BVM in Vancouver, B.C. for 37-element ICP analysis after modified aqua regia digestion. Gold assays are done in Hermosillo by 50-gram fire assay with an atomic absorption spectroscopy finish.

Samples were checked using a 50-gram fire assay with a gravimetric finish for samples greater than 10ppm Au and 1Kg metallic fire assay with duplicate minus fraction analyzed. Both Hermosillo and Vancouver BVM facilities are ISO 9001 and ISO/IEC 17025 accredited. Laboratory control samples comprising certified reference samples, duplicates and blank samples were inserted by the laboratory into the sample stream and analyzed as part of the quality assurance/quality control protocol.

Tarachi Project Descriptions

The Tarachi Projects (the " Projects ") consist of the San Javier , Pretoria , Chivitas, Jabali , Juliana, Texana and Tarachi concessions for at total of 2,560 hectares in the prolific Mulatos gold belt. The Projects are approximately 220 km by air east of the City of Hermosillo , and 300 km south of the border between the United States of America and Mexico . The Jabali claim covers the La Dura historic mine and several other small-scale mines. The gold mineralization and geology at Jabali is believed to be similar in character to the gold mineralization at the Mulatos mine. Alamos Gold Inc., in a 2003 annual report, identifies the Jabali project as being part of the "Los Bajios" mineralized trend which the report suggests has the potential to host another Mulatos size resource. The Projects are an early stage exploration project and the mineralization hosted on adjacent and/or nearby properties is not necessarily indicative of mineralization hosted on the Company's property.

The Mulatos gold trend is part of the Sierra Madre gold and silver belt that also hosts the operating Mulatos gold mine immediately southeast of the La India property and the Pinos Altos mine and the Creston Mascota deposit 70 kilometres to the southeast. Mineralization occurs within silicified rhyodacite and is associated with vuggy silica alteration, and breccia with iron oxide (hematite and specularite). Native gold occurs along late-stage fracture coatings in the breccias and is locally associated with barite. Past exploration has returned values from trace to 30g/t Au in grab samples. Native gold has also been identified in outcrop on the southern extension of the La Dura mine trend.

Qualified Person

Lorne Warner , P.Geo, VP Exploration and Director of the Company is a qualified person as defined by National Instrument 43-101 and has reviewed and approved the scientific and technical disclosure in this news release.

SPECIAL NOTE REGARDING FORWARD LOOKING STATEMENTS

This news release includes certain "Forward–Looking Statements" within the meaning of the United States Private Securities Litigation Reform Act of 1995 and "forward–looking information" under applicable Canadian securities laws. When used in this news release, the words "anticipate", "believe", "estimate", "expect", "target", "plan", "forecast", "may", "would", "could", "schedule" and similar words or expressions, identify forward–looking statements or information. Forward-looking statements include, but are not limited to, statements with respect to: the terms and conditions of the proposed Acquisition; and the business and operations of the Company after the proposed Acquisition.

Forward–looking statements and forward–looking information relating to any future mineral production, liquidity, enhanced value and capital markets profile of Tarachi, future growth potential for Tarachi and its business, and future exploration plans are based on management's reasonable assumptions, estimates, expectations, analyses and opinions, which are based on management's experience and perception of trends, current conditions and expected developments, and other factors that management believes are relevant and reasonable in the circumstances, but which may prove to be incorrect. Assumptions have been made regarding, among other things, the price of silver, gold and other metals; costs of exploration and development; the estimated costs of development of exploration projects; Tarachi's ability to operate in a safe and effective manner and its ability to obtain financing on reasonable terms.

These statements reflect Tarachi's respective current views with respect to future events and are necessarily based upon a number of other assumptions and estimates that, while considered reasonable by management, are inherently subject to significant business, economic, competitive, political and social uncertainties and contingencies. Many factors, both known and unknown, could cause actual results, performance or achievements to be materially different from the results, performance or achievements that are or may be expressed or implied by such forward–looking statements or forward-looking information and Tarachi has made assumptions and estimates based on or related to many of these factors. Such factors include, without limitation: satisfaction or waiver of all applicable conditions to closing fluctuations in general macro–economic conditions; fluctuations in securities markets and the market price of Tarachi's common shares; and the factors identified under the caption "Risk Factors" in Tarachi's management discussion and analysis. Readers are cautioned against attributing undue certainty to forward–looking statements or forward-looking information. Although Tarachi has attempted to identify important factors that could cause actual results to differ materially, there may be other factors that cause results not to be anticipated, estimated or intended. Tarachi does not intend, and does not assume any obligation, to update these forward–looking statements or forward-looking information to reflect changes in assumptions or changes in circumstances or any other events affecting such statements or information, other than as required by applicable law.

SOURCE Tarachi Gold Corp.

![]() View original content to download multimedia: https://www.newswire.ca/en/releases/archive/December2020/03/c7912.html

View original content to download multimedia: https://www.newswire.ca/en/releases/archive/December2020/03/c7912.html