- 1,630-hectare property located in an underexplored part of the same geological terrane as Newmont's Coffee Gold project and White Gold's projects

- Mineralized rock samples up to 6.8 g/t gold and up to 1,146 g/t silver over a 15 kilometre area

- Multiple open-ended soil anomalies at least 2.1 kilometres in length with highlight soil concentrations of 5.8 g/t gold and 62.1 g/t silver

SNOWLINE GOLD CORP. (CSE:SGD)(OTC PINK:SNWGF) (the "Company" or "Snowline") is pleased to provide additional information on its 100% owned, 1,630-hectare Tosh Gold Project (the "Tosh Project"). Precious metal mineralization at the Tosh Project is found along kilometre-scale shear zones, in quartz-carbonate veins, breccias and silicified shales, with assay results up to 6.8 gt Au and 1,146 gt Ag in rock grab samples over an area spanning 15 kilometres

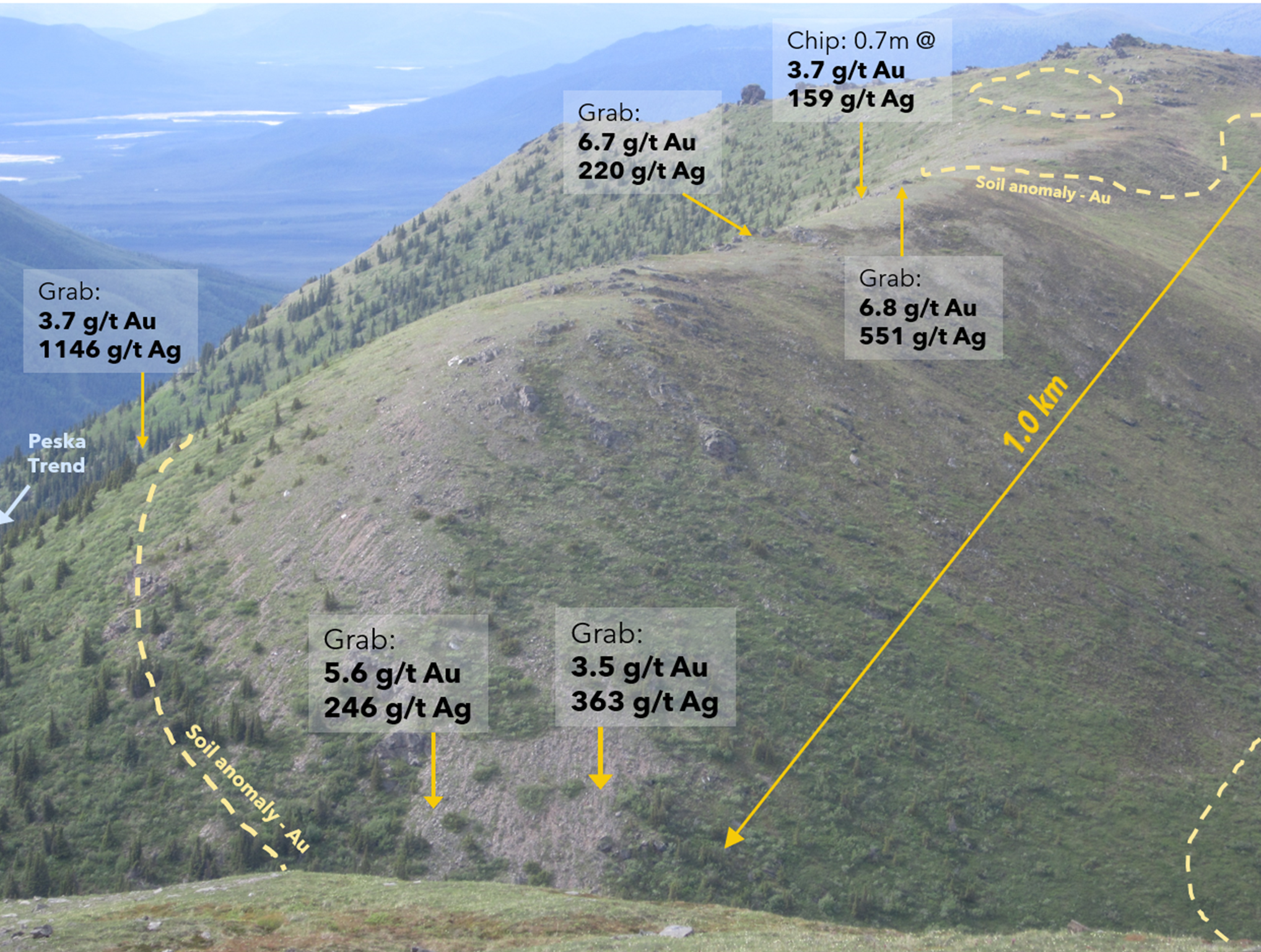

Figure 1: Historical exploration highlights on the Tosh Project's "Yarrow" zone, where gold-bearing breccias are accompanied by high silver concentrations. Note that grab samples are selective in nature and do not necessarily reflect overall grades. Dashed lines roughly outline a zone of soil concentrations generally exceeding 10 ppb Au, to a local maximum of 90.2 ppb Au. The soil anomaly, along with that of the adjacent "Peska" trend, is shown in more detail in Figure 2.

"The Tosh Project speaks to the depth of Snowline's exploration portfolio," said Scott Berdahl, Snowline's COO. "Widespread prospecting discoveries accompanied by kilometres-scale, multi-element soil anomalies in a geological and structural setting similar to White Gold's camp attests to the Tosh Project's scale and potential. The encouraging historical results justify advanced exploration."

Snowline is reviewing its newly acquired project portfolio and is focused on planning and prioritizing its exploration to maximize shareholder value. Specifically, it is examining multiple options for its non-core assets, including targeted exploration and joint venture arrangements.

The Tosh Project bears many hallmarks of a significant orogenic gold camp. Host rocks are high-strain schists and intercalated marbles of the Yukon Tanana terrane, the geologic province that hosts two recently discovered million-ounce-plus gold deposits (including Newmont's "Coffee" deposit, ~115 km to the north of the Tosh Project) and from which over 12.5 million ounces of placer gold has been recovered in the Klondike goldfields. Importantly, major regional faults cut Cretaceous and Paleogene intrusive rocks in the vicinity of the Tosh Project.

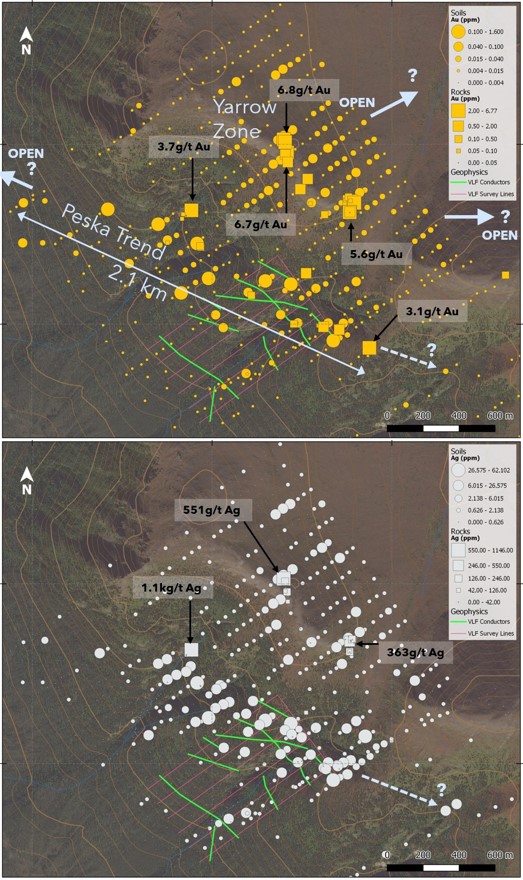

Grid soil sampling (1,379 samples) at the Tosh Project revealed two prominent NW-SE trending zones of anomalous (defined by 90th percentile gold values >27 ppb Au) multi-element geochemistry, "Peska" and "Koose," separated by 12 kilometres of prospective ground. Gold in soil values assay up to 5.8 g/t Au at Koose and 1.6 g/t Au at Peska. These zones extend roughly 2 kilometres each and remain open in both directions on trend. A historical ground-based VLF electromagnetic geophysical survey over part of the Peska zone suggests the presence of continuous conductive structures. These structures may correspond to an anomaly that spans at least 500 metres, extending along trend off both edges of the survey. Out of 66 rock samples at Peska and Yarrow, 14 assayed higher than 1.0 g/t Au and 9 above 100 g/t Ag. Additional prospective areas at Tosh have yet to be thoroughly explored.

The Tosh Project is located 20 kilometres from the paved, all-season Alaska Highway. Follow up exploration at the Tosh Project will focus on delineating high priority drill targets.

Figure 2: Gold and silver values on the adjacent Peska and Yarrow Zones. Circles represent soil samples, highlighted by values of 1.6 g/t Au and 62.1 g/t Ag along the Peska trend. Squares represent rock samples. Green lines are interpreted conductors from a VLF electromagnetic geophysical survey.

Qualified Person

The scientific and technical information contained in this news release has been reviewed and approved by Scott Berdahl, P. Geo., Chief Operating Officer of Snowline and a Qualified Person for the purpose of NI 43-101.

ON BEHALF OF THE BOARD

Nikolas Matysek

CEO & Director

About Snowline Gold Corp.

Snowline Gold Corp. is a Yukon Territory based gold exploration company. The Company is exploring its flagship Einarson and Rogue gold projects that cover ~64,000 hectares in the prospective yet underexplored Selwyn Basin. Snowline's projects all lie in the prolific Tintina gold province that hosts multiple million-ounce-plus gold mines and deposits, from Kinross' Fort Knox to Newmont's Coffee. Snowline's first-mover claim position presents a unique opportunity to explore and expand a new greenfield, district-scale gold system.

For further information, please contact:

Snowline Gold Corp.

Nikolas Matysek, CEO

+1 (778) 228-3020

info@snowlinegold.com

Cautionary Note Regarding Forward-Looking Statements

This news release contains certain forward-looking statements, including statements about the Company reviewing its newly acquired project portfolio to maximize value, reviewing options for its non-core assets, including targeted exploration and joint venture arrangements, conducting follow-up prospecting and mapping this summer and plans for exploring and expanding a new greenfield, district-scale gold system. Wherever possible, words such as "may", "will", "should", "could", "expect", "plan", "intend", "anticipate", "believe", "estimate", "predict" or "potential" or the negative or other variations of these words, or similar words or phrases, have been used to identify these forward-looking statements. These statements reflect management's current beliefs and are based on information currently available to management as at the date hereof.

Forward-looking statements involve significant risk, uncertainties and assumptions. Many factors could cause actual results, performance or achievements to differ materially from the results discussed or implied in the forward-looking statements. Such factors include, among other things: risks related to uncertainties inherent in drill results and the estimation of mineral resources; and risks associated with executing the Company's plans and intentions. These factors should be considered carefully and readers should not place undue reliance on the forward-looking statements. Although the forward-looking statements contained in this news release are based upon what management believes to be reasonable assumptions, the Company cannot assure readers that actual results will be consistent with these forward-looking statements. These forward-looking statements are made as of the date of this news release, and the Company assumes no obligation to update or revise them to reflect new events or circumstances, except as required by law.

SOURCE: Snowline Gold Corp.

View source version on accesswire.com:

https://www.accesswire.com/636846/Snowline-Gold-Corp-Introduces-100-Owned-Tosh-Gold-Project-Southwest-Yukon