NV Gold Corporation (TSXV:NVX)(OTCQB:NVGLF) (Frankfurt:8NV) ("NV Gold" or the "Company") has completed detailed mapping and Leapfrog modeling at its 100% controlled Slumber Gold Project ("Slumber") located approximately 50 miles northwest of Winnemucca, Humboldt County, Nevada, USA. Permitting a 3rd drilling campaign and negotiations to secure adequate drilling equipment are underway. Drilling is expected to commence in October 2021

Key Highlights from previous Drilling Program at Slumber Gold Project

- Two drilling campaigns were completed in 2019/20 comprising 16 reverse circulation ("RC") drill holes, totaling 2,474 m (8,119 ft.).

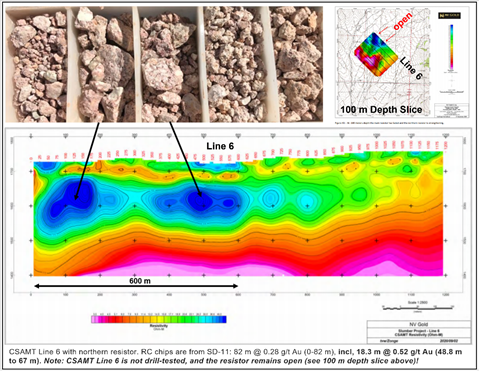

- Drilling has outlined a new 600-meter-wide, near-surface mineralized oxide gold zone with notable drill intercepts, including a very encouraging 18.3 m @ 0.52 g/t Au beginning at 48.7 m in Hole SL-11, hosted in an oxidized and silicified rhyolite correlating with a resistive blanket as seen in controlled sourced audio frequency magnetotellurics (CSAMT) data (see Figure 3 & 4). Another hole, SL-14, intersected 134.2m @ 0.14 g/t Au starting from the collar and was terminated in gold mineralization.

- This newly discovered zone is separate from that discovered during the 2019 drill program and will be prioritized for follow up in a Phase 3 drilling campaign in Q4 2021.

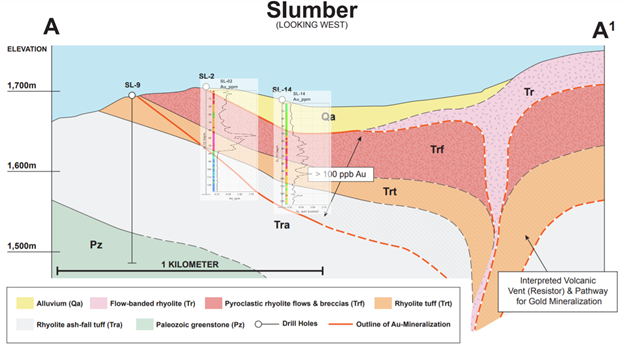

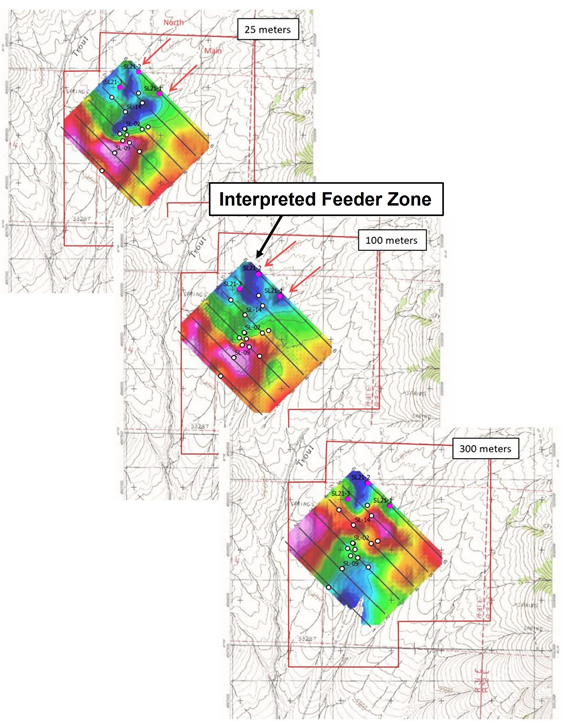

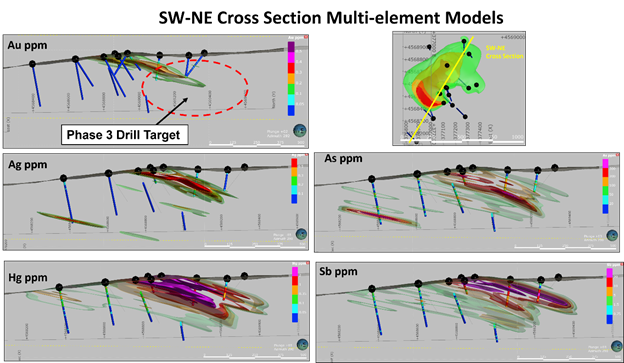

- The source of the mineralized CSAMT resistive blanket is believed to come from higher grade feeder structures at depth (see Figures 1, 2 & 6).

Mapping and Leapfrog Modeling Conclusions

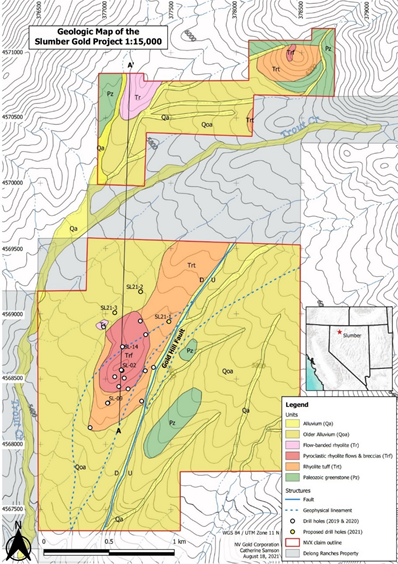

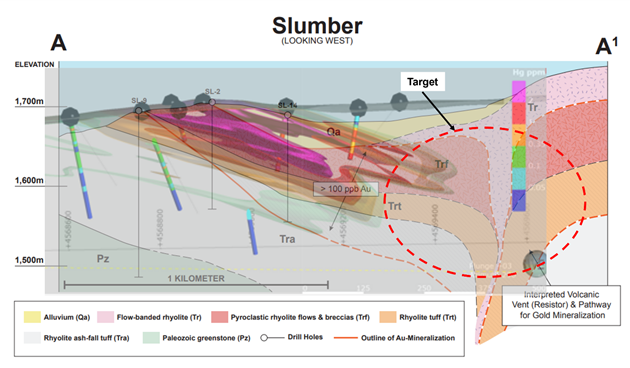

Mapping has identified extensive alteration favorable for gold mineralization in Upper Volcanic Package (UVP) rocks (Trf & Trt in Figure 1) further north of the gold zone defined by previous drilling. These findings are encouraging, suggesting the system is continuous and may be covered by unaltered flow-banded rhyolite domes (Tr in Figure 1) and Quaternary (Qoa) material.

Rhyolite breccias (tuff breccias and phreatomagmatic breccias of Trf) that were not identified in previous drilling were discovered during detailed mapping of the northern portion of the property. This mapping and specific rock textures and breccia descriptions were used as vectors to the feeder for the system. The feeder target is interpreted, based on the location of a large resistor and open gold mineralization, to be located in the northwest portion of the southern NVX claim block (see Figure 1, 4, 5 & 6).

Structural and geophysical observations indicate the UVP is bounded by graben structures and dips to the north, consistent with the extent of the CSAMT resistor blanket being open to the north (see Figure 4). This resistor anomaly is interpreted as a continuation of the gold system identified in the UVP from previous drilling and will be the main target for the next phase of drilling expected to commence in October (see Figure 1 & 4).

A recently completed three dimensional model completed in Leapfrog software was used to determine the gold volume encountered in the 2019/20 drilling campaigns. Comparing the gold distribution with the reinterpreted geological information it appears that previous drilling might have only peripherally intercepted the southwestern edges of two much larger, potentially mineralized CSMT resistor zones. Combining the known geology with the new mapping and Leapfrog modeling the silicified and mineralized system appears to have a strike-length of at least 1 kilometer and a width of 600 meters and correlates well with two open and north-plunging resistor zones (see Figure 4 & 5). The next drilling campaign will focus on this near-surface oxide and has potential to push Slumber towards a discovery stage.

"I am pleased and extremely excited about the outcome of the recent Slumber mapping and Leapfrog modeling. Slumber is advancing through comprehensive data collection and modeling. Encountering an open, near-surface oxide gold zone is very encouraging. The goal of the Q4 drilling will be to find the source and higher-grade pathways of this gold mineralization. These holes will focus on the north-plunging and open resistor zones. The geochemistry data as imaged in Leapfrog modeling is very impressive and strongly supportive of our goal of delineating an oxide gold resource during 2022 and to advance Slumber to a discovery stage." commented Thomas Klein, VP Exploration of NV Gold.

On behalf of the Board of Directors,

John E. Watson

President & CEO

For further information, visit the Company's website at www.nvgoldcorp.com or contact:

Freeform Communications at 604.245.0054

Neither the TSX Venture Exchange nor its Regulation Service Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward Looking Statements

This news release includes certain forward-looking statements or information. All statements other than statements of historical fact included in this release, including, without limitation, statements regarding the Company's planned exploration activities, the interpretation of the resistive blanket as having come from higher grade feeder structures and a continuation of the gold system identified in the UVP, the appearance that previous drilling only peripherally intercepted the southwestern edges of two much larger, potentially mineralized resistor zones, the interpretations of the mapping exercise and the dimensions of the strike length and width are forward-looking statements that involve various risks and uncertainties. There can be no assurance that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. Important factors that could cause actual results to differ materially from the Company's plans or expectations include regulatory issues, market prices, availability of capital and financing, general economic, market or business conditions, timeliness of government or regulatory approvals, the lack of continuity of mineralization, the extent to which mineralized structures extend on to the Company's Projects and other risks detailed herein and from time to time in the filings made by the Company with securities regulators. The Company disclaims any intention or obligation to update or revise any forward-looking statements whether because of new information, future events or otherwise, except as otherwise required by applicable securities legislation.

Figure 1 - Geologic map of the Slumber Gold Project in Humboldt County, Nevada. Drill holes from 2019 and 2020 are plotted. Only SL-09, SL-02 and SL-14 are projected on the cross-section A-A' (Figure 2). SL21-1,2 & 3 are planned for Q4 Program (To view the full-size image, please click here)

Figure 2 - Cross section of A to A'. The volcanic vent and potential feeder of the Slumber gold system is interpreted on the north end of the property. (SL-2 and SL-14 showing anomalous gold values) (To view the full-size image, please click here)

Figure 3 - Newly Discovered Resistor / Interpreted Near-Surface Oxide Gold Mineralization (To view the full-size image, please click here)

Figure 4 - CSAMT depth slices at different elevation levels with plotted 2010/20 drill holes and recently permitted new drill locations (pink). The blue colors represent resistive rocks versus conductive rocks in red. (To view the full-size image, please click here)

Figure 5 - Leapfrog modeling is showing north-plunging, open Au-mineralization, and trace-element geochemistry (To view the full-size image, please click here)

Figure 6 - Slumber Target with Hg overlay (To view the full-size image, please click here)

SOURCE: NV Gold Corporation

View source version on accesswire.com:

https://www.accesswire.com/662923/NV-Gold-Identifies-Near-Surface-Oxide-Gold-at-Slumber-High-Grade-Targets-Remain-Untested-at-Depth