Granada Gold Mine Inc. (TSXV: GGM) (the "Company" or "Granada") is pleased to provide an updated High-Grade Mineral Resource Estimate of the Granada Gold Deposit using narrow, rich, vein modelling and both open pit and underground resources and revised pit optimization parameters which are based on the possibility of off-site custom milling ore rather than constructing and using an on-site mill.

The National Instrument 43-101 Technical Report, including the updated mineral resources for Granada contained in this news release, is currently being completed by SGS and will be delivered and filed on SEDAR by GGM within 45 days. The objective of the SGS assignment is to update the MRE using the available data as of December 15, 2020 . The goal is to present resources with both open pit potential and underground potential. Also, gold prices have evolved significantly since the 2019 MRE and that has helped the MRE presented here.

The updated MRE focused on using a scenario with higher cut-off grades than that used in the 2019 MRE. Gold price used is 1600 US$ /oz.

Table 1 Updated Mineral Resource Estimate Base Case

| 1. | The 1930-1935 production was removed from these numbers (164,816 tonnes at 9.7 g/t Au / 51,400 ounces Au) |

| 2. | The Independent QP for this resources statement is Yann Camus, Eng., SGS Canada Inc. |

| 3. | The effective date is December 15, 2020 |

| 4. | CIM (2014) definitions were followed for Mineral Resources |

| 5. | Mineral resources which are not mineral reserves do not have demonstrated economic viability. An Inferred Mineral Resource has a lower level of confidence than that applying to a Measured and Indicated Mineral Resource and must not be converted to a Mineral Reserve. It is reasonably expected that the majority of Inferred Mineral Resources could be upgraded to Indicated Mineral Resources with continued exploration |

| 6. | No economic evaluation of the resources has been produced |

| 7. | A ll figures are rounded to reflect the relative accuracy of the estimate. Totals may not add due to rounding |

| 8. | Composites have been capped where appropriate. |

| 9. | Cut-off grades are based on a gold price of US$1,600 per ounce, a foreign exchange rate of US$0.76 for CA$1, a gold recovery of 93% |

| 10. | Pit constrained mineral resources are reported at a cut-off grade of 0.9 g/t Au within a conceptual pit shell |

| 11. | Underground mineral resources are reported at a cut-off grade of 3.0 g/t Au within reasonably mineable volumes |

| 12. | A fixed specific gravity value of 2.78 g/cm 3 was used to estimate the tonnage from block model volumes |

| 13. | There are no mineral reserves on the Property |

| 14. | The 2.5 m composites were capped at 21 g/t Au in the thin rich veins and at 7 g/t Au in the low-grade volumes |

| 15. | The deepest resources reported are at a depth of 760 m |

| 16. | SGS is not aware of any known environmental, permitting, legal, title-related, taxation, socio-political, marketing or other relevant issues that could materially affect the mineral resource estimate. |

Revised Parameters

Table 1 General Parameters Used for the Mineral Resource Estimate Update

| Parameter | Value | Unit |

| Gold Price | 1600 | US$ per oz |

| Exchange Rate | 0.76 US$ : 1 CA$ | |

| Pit Slope | 50 | Degrees |

| Open Pit Mining Cost | 6.00 | CA$ per tonne mined |

| Underground Mining Cost | 105.00 | CA$ per tonne mined |

| Processing, Transportation Cost and G&A | 35.00 | CA$ per tonne milled |

| Gold Recovery | 93 | Percent (%) |

| Open Pit and Underground Mining loss / Dilution | 10 / 20 | Percent (%) / Percent (%) |

| Open Pit Cut-off Grade | 0.9 | g/t Au |

| Underground Cut-off Grade | 3.0 | g/t Au |

About the Mineral Resource Estimate

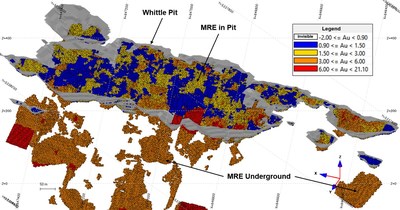

New drilling was achieved by GoldMinds Geoservices in 2020. While some of the results were still pending, SGS was mandated to create an updated resource estimation that shows both the potential for open pit resources and underground resources. In order to do that, the individual thin, rich veins had to be modelled individually. These veins are quite continuous (over distances of 800 m in strike and 900 m down dip). Mineralization is open at depth and on strike. The maximum distance between linked intervals is currently about 150 m . Some gaps of about 300 m have no drilling but should contain mineralization given the continuous nature of the deposit.

The database used for this mineral resource estimate includes drill results obtained from drill programs in 2009, 2010, 2011, 2012, 2016, 2017, 2018, 2019, 2020 and trenches from 2014 and 2015 plus many of the historic holes (1990's).

The thin, rich veins were modelled as a first step in the estimation process. A grade of 0.7 g/t over a length of 2.5 m was used as a minimum. While the 2.5 m constraint was always met, some intervals were considered under 0.7 g/t to allow to model continuous mineralized structures. We estimate that the final 56 thin, rich veins modelled contain 88% of the gold from intervals that meet the 0.7 g/t over 2.5 m criteria.

A large, low-grade zone was modelled around all intervals containing significant gold. This large, low-grade volume is similar in shape and size to the previous resource model.

Composites of 2.5 m were created inside the thin, rich veins and in the low-grade volume. All resulting 57 volumes were estimated as hard boundaries. The rich, thin vein composites were capped at 21 g/t. It has a similar impact on gold content as the previous estimate capping methodology. The low-grade composites were capped at 7 g/t.

A block model was created with blocks of 5 x 2.5 x 2.5 m to fill the rich, thin veins while using block centers as indicators for the block's nature. Both the kriging and inverse square distance estimation methods were tested with very similar results globally. The kriging is more conservative in grade and gold content once we apply the cut-off grades to report resources. Kriging was retained as the estimation method of choice for this project. Search ellipsoids used for the estimation are of 30 x 30 x 7.5 m , 60 x 60 x 15 m and 100 x 100 x 30 m respectively. A minimum of a single drillhole is needed to estimate blocks inside thin, rich veins. A minimum of 2 drillholes are needed to estimate blocks in the low-grade volume. Search ellipsoid orientations are variable depending on local orientation of the model.

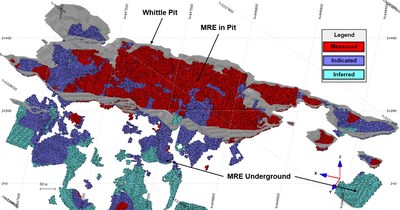

The classification in measured, indicated and inferred was done as a separate step with an algorithm with ellipsoids centered on composites. A drilling grid with a minimum of 3 drillholes within 30 m of each other or less defines measured resources (under 25 m most of the time) and a drilling grid with a minimum of 3 drillholes within 60 m of each other or less defines indicated resources (under 50 m most of the time). Measured resource extends only by 20 m around drillholes and indicated extends only by 40 m .

The mineral resource statement EXCLUDES the historical production of 51,476 ounces of gold (181,744 Tons @ 0.28 oz/Ton Au) from 1930 to 1935. These numbers were subtracted from the measured resources in the whittle open pit.

The supporting NI 43-101 Technical Report will be posted on SEDAR at www.sedar.com no later than 45 days after the date of this release.

All information pertaining to the resource estimates has been reviewed for accuracy and compliance under National Instrument 43-101 by Yann Camus , P.Eng., SGS Canada Inc. and Qualified Person.

Mineral Resource Estimate Details

The following tables show the separation of resources between the open pit portion and the underground portion of it.

|

Earlier this year, (Granada Gold Mine Press Release, August 11, 2020 ) the Company processed by conventional gravity concentration, a large 1220-kilogram grab sample taken over a 3-meter strike length in this stripped area, resulting in the recovery of 55.6 g/t native gold where the native gold component has been defined, for the Granada Gold Mine, to represent an average of 50% of the recoverable gold (43-101 Technical Report dated February 13, 2019 on the Granada Gold Project Mineral Resource Estimate, Rouyn Noranda, Quebec authored by the Qualified persons, Allan Armitage , Ph. D.., P. Geo and Maxime Dupere, B.SC ., Geo both of SGS Canada Inc. – Section 13.1). The gold-bearing sulphides were not recovered.

"This updated High-Grade Mineral Resource shows the Granada deposit has the potential for extensive custom milling as well as for an on-site mill. The current mineral resource was derived from near-surface drilling over 2 kilometers of an east-west 5.5-kilometer mineralized structure. Exploratory drilling to the north, near the Cadillac Break has encountered high-grade mineralization at a vertical depth of 1100 meters. Mineralization is open at depth and on strike. The company is targeting 2.5 to 3 million ounces with the current 120,000-meter drill program building on the existing 120,000 metres drilled to increase the density of holes on the property." said Frank J. Basa , P.Eng., President and CEO, "We are also fully permitted and shovel-ready as a shipper of ore to any local mill."

Qualified person

The technical information in this news release has been prepared by Yann Camus , P.Eng., independent qualified person of SGS and was reviewed by Claude Duplessis , P.Eng., GoldMinds Geoservices Inc. member of Québec Order of Engineers and a qualified person in accordance with National Instrument 43-101 standards.

About Granada Gold Mine Inc.

Granada Gold Mine Inc. continues to develop the Granada Gold Property near Rouyn-Noranda, Quebec . Approximately 120,000 meters of drilling has been completed to date on the property, focused mainly on the extended LONG Bars zone which trends 2 kilometers east-west over a potential 5.5 kilometers of mineralized structure. The highly prolific Cadillac Break, the source of more than 75 million plus ounces of gold production in the past century, cuts through the north part of the Granada property, but is not necessarily indicative of mineralization hosted on the company's property.

The Granada Shear Zone and the South Shear Zone contain, based on historical detailed mapping as well as from current and historical drilling, up to twenty-two mineralized structures trending east-west over five and a half kilometers. Three of these structures were mined historically from two shafts and two open pits. Historical underground grades were 8 to 10 grams per tonne gold from two shafts down to 236 m and 498 m with open pit grades from 5 to 3.5 grams per tonne gold.

The Company is in possession of all mining permits required to commence the initial mining phase, known as the "Rolling Start", which allows the company to mine up to 550 tonnes per day. Additional information is available at www.granadagoldmine.com .

"Frank J. Basa"

Frank J. Basa P. Eng .

President and Chief Executive Officer

Neither the TSX Venture Exchange nor its Regulation Service Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release. This news release may contain forward-looking statements including but not limited to comments regarding the timing and content of upcoming work programs, geological interpretations, receipt of property titles, potential mineral recovery processes, etc. Forward-looking statements address future events and conditions and therefore, involve inherent risks and uncertainties. Actual results may differ materially from those currently anticipated in such statements.

SOURCE Granada Gold Mine Inc.

![]() View original content to download multimedia: https://www.newswire.ca/en/releases/archive/January2021/29/c0309.html

View original content to download multimedia: https://www.newswire.ca/en/releases/archive/January2021/29/c0309.html