TriStar Gold Inc. (TSXV: TSG) (OTCQX: TSGZF) (the Company or TriStar) is pleased to announce the results from closely-spaced drilling at the Castelo de Sonhos gold project in Pará State, Brazil. The results have confirmed that the reefs identified by 50m spaced drilling are continuous in 10m spaced drill holes. This is the first step towards a test grade control program and possible bulk sample analysis.

"This short-range continuity test is just one example of the many areas in which Castelo de Sonhos is now advancing towards the prefeasibility and permitting," says Nick Appleyard, TriStar's President and CEO. "As the infill drilling has now finished the drill rigs will be focused on exploration and looking to grow our resource base in parallel with aggressively moving forward towards completing the PFS."

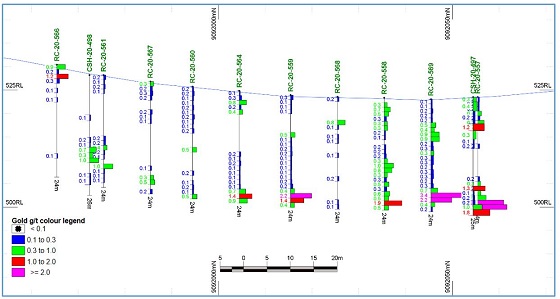

Figure 1 below shows a north-south cross section through the long-axis a cross of holes drilled 10m apart in an area of low-to-moderate grade in Esperança South. In addition to the 10m spaced RC drill holes, twin holes (within 5m of the original hole) were drilled to directly compare the performance of RC drilling versus core drilling. The results from these drill holes are not yet complete, although the partial data currently available appears consistent between the two drilling techniques. The significant intersections from the holes drilled in this program are shown in Table 1 below. Results are in line with expectations, in terms of grade, depth or thickness, given what has been seen in previous drill holes surrounding the closely-spaced drilling study area.

Figure 1, Closely-spaced drilling at Esperança South, showing gold grades (in g/t) numerically and as a histogram.

To view an enhanced version of this graphic, please visit:

https://orders.newsfilecorp.com/files/4509/80186_c8efec4fe4506a9e_005full.jpg

Detailed Discussion

TriStar initiated the program of closely-spaced drilling in an area where older drill holes showed resources with low to moderate grade (0.3 − 1.5 g/t Au) within 24m of the ground surface. The purpose of this program was to test the continuity of reefs encountered by the 50x50m drilling grid in order to better understand short-scale variation, an important consideration for the technical and economic viability that the upcoming PFS will assess. The maps in Figure 2 show the region chosen in Esperança South for 10x10m grid to a depth of 24m, using both RC and core holes. Assay results have now been reported by the lab for the 16 holes shown as open circles in Figure 2a; the colored circles show the average resource grade above 0.3 g/t in the top 24m of the drill holes that pre-date the closely-spaced drilling program. Figures 2b and 2c show the prediction of resource grade in the top 24m before and after the assays from the new drill holes are incorporated, using the lithogeochemical model to align the direction of maximum continuity with bedding.

Although the new drilling provides useful local detail, the predictions of the resource grade and tonnage for the entire study area change by less than ±5% from Figure 1b (old drilling) to Figure 1c (old drilling + new 10m drill cross), with the updated resource in this area being about 4% higher than previously thought. This provides strong confidence that current resource predictions already have the accuracy and precision expected for preliminary mine planning. One of the most reassuring findings of the new closely-spaced drilling in this area is that all 16 new holes encountered significant mineralisation in the top 24m; the grade continuity suggested by the five older drill holes, more widely spaced, has been confirmed by the new drilling. The drilling plan for 2021 contemplates completion of the 10x10m drilling in this area so that it could serve, in future, as the location for a bulk sample or test mining if such studies are recommended by the PFS.

Figure 2, a) Closely-spaced drilling study area with old holes (colored) and new holes (white), and bedding strike from lithogeochemical model; b) average gold grade of resource in top 24m using only the old, widely-spaced holes; c) average gold grade of resource in top 24m after assays from new drilling have been incorporated. Tonnes, grade and in-situ metal content of estimated resource change by less than 5% when the new drilling is incorporated.

To view an enhanced version of this graphic, please visit:

https://orders.newsfilecorp.com/files/4509/80186_c8efec4fe4506a9e_004full.jpg

| Hole | Azimuth | Dip | Depth (m) | From (m) | To (m) | Intersection |

| CSH-20-496 | 0° | -90° | 25.3 | 10.5 | 12 | 1.5m @ 0.6g/t |

| CSH-20-497 | 0° | -90° | 25.3 | 0 | 9 | 9.0m @ 0.5g/t |

| 19 | 25.3 | 6.3m @ 0.8g/t | ||||

| CSH-20-498 | 0° | -90° | 25.7 | 15.4 | 18.7 | 3.3m @ 0.7g/t |

| RC-20-557 | 0° | -90° | 24 | 3 | 7 | 4.0m @ 0.5g/t |

| 18 | 24 | 6.0m @ 1.3g/t | ||||

| RC-20-558 | 0° | -90° | 24 | 1 | 24 | 23.0m @ 0.4g/t |

| RC-20-559 | 0° | -90° | 24 | 8 | 9 | 1.0m @ 0.5g/t |

| 20 | 24 | 4.0m @ 1.1g/t | ||||

| RC-20-560 | 0° | -90° | 24 | 13 | 14 | 1.0m @ 0.5g/t |

| 23 | 24 | 1.0m @ 0.5g/t | ||||

| RC-20-561 | 0° | -90° | 24 | 15 | 20 | 5.0m @ 0.3g/t |

| RC-20-562 | 0° | -90° | 24 | 3 | 4 | 1.0m @ 0.4g/t |

| RC-20-563 | 0° | -90° | 24 | 13 | 18 | 5.0m @ 0.4g/t |

| 21 | 22 | 1.0m @ 0.3g/t | ||||

| RC-20-564 | 0° | -90° | 24 | 2 | 5 | 3.0m @ 0.4g/t |

| 21 | 24 | 3.0m @ 1.0g/t | ||||

| RC-20-565 | 0° | -90° | 24 | 1 | 24 | 23.0m @ 0.5g/t |

| RC-20-566 | 0° | -90° | 24 | 0 | 3 | 3.0m @ 0.8g/t |

| RC-20-567 | 0° | -90° | 24 | 0 | 1 | 1.0m @ 0.3g/t |

| 20 | 22 | 2.0m @ 0.4g/t | ||||

| RC-20-568 | 0° | -90° | 24 | 5 | 6 | 1.0m @ 0.8g/t |

| RC-20-569 | 0° | -90° | 24 | 5 | 12 | 7.0m @ 0.5g/t |

| 19 | 23 | 4.0m @ 1.7g/t |

Table 1, Significant Intersections from closely-spaced drill holes at Esperança South. Drill holes with CSH prefix are core holes and those with the RC prefix are reverse circulation.

Qualified Person

Mo Srivastava (P.Geo.) VP of TriStar the Qualified Person for the technical information presented in this press release, has approved its publication.

Assay methods, Quality Assurance and Quality Control (QA/QC)

Samples are collected from either ½ core in diamond drill holes or ¼ of the chips in reverse circulation holes collected using a splitter at the drill rig. Samples are transported by truck from site to the ALS lab in Goiania, Brazil, where they are dried, crushed, pulverized and packaged for shipment to the ALS analytical lab in Lima, Peru. All samples are analyzed using a 1kg Leachwell analysis.

The ALS preparation and analytical labs are accredited to ISO 17025:2005 UKAS ref 4028, and have internal QA/QC programs for monitoring accuracy and precision. In addition to this, TriStar uses standards, blanks and field duplicates in an external QA/QC program to provide independent monitoring of laboratory analyses.

About TriStar

TriStar Gold is an exploration and development company focused on precious metals properties in the Americas that have the potential to become significant producing mines. The Company's current flagship property is Castelo de Sonhos in Pará State, Brazil. The Company's shares trade on the TSX Venture Exchange under the symbol TSG and on the OTCQX under the symbol TSGZF. Further information is available at www.tristargold.com.

On behalf of the board of directors of the company:

Nick Appleyard

President and CEO

For further information, please contact:

TriStar Gold Inc.

Nick Appleyard

President and CEO

480-794-1244

info@tristargold.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release. No stock exchange, securities commission or other regulatory authority has approved or disapproved the information contained herein.

Forward-Looking Statements

Certain statements contained in this press release may constitute forward-looking statements under Canadian securities legislation which are not historical facts and are made pursuant to the "safe harbour" provisions under the United States Private Securities Litigation Reform Act of 1995. Generally, forward-looking information can be identified by the use of forward-looking terminology such as "expects" or "it is expected", or variations of such words and phrases or statements that certain actions, events or results "will" occur. Forward looking statements in this press release include, the scope and success of the planned exploration program at the Castelo de Sonhos project and the Company's opinion that it has clear title to the Castelo de Sonhos property Such forward-looking statements are based upon the Company's reasonable expectations and business plan at the date hereof, which are subject to change depending on economic, political and competitive circumstances and contingencies. Readers are cautioned that such forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause a change in such assumptions and the actual outcomes and estimates to be materially different from those estimated or anticipated future results, achievements or position expressed or implied by those forward-looking statements. Risks, uncertainties and other factors that could cause the Company's plans to change include changes in demand for and price of gold and other commodities (such as fuel and electricity) and currencies; changes or disruptions in the securities markets; legislative, political or economic developments in Brazil; the need to obtain permits and comply with laws and regulations and other regulatory requirements; the possibility that actual results of work may differ from projections/expectations or may not realize the perceived potential of the Company's projects; risks of accidents, equipment breakdowns and labour disputes or other unanticipated difficulties or interruptions; the possibility of cost overruns or unanticipated expenses in development programs; operating or technical difficulties in connection with exploration, mining or development activities; the speculative nature of gold exploration and development, including the risks of diminishing quantities of grades of reserves and resources; and the risks involved in the exploration, development and mining business. Although management of the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements or forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. The Company disclaims any intention or obligation to update or revise any forward-looking statements whether as a result of new information, future events or otherwise, except as required by applicable securities laws.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/80186