Canex Metals Inc. ("CANEX" or the "Company") is pleased to announce that, through its 100% owned Arizona subsidiary CANEXCO Inc., it has signed and completed a definitive agreement to option the Excelsior Mine Property comprised of 11 lode mining claims and 2 patented mining claims covering 3 past producing historic gold mines. The Excelsior Mine Property sits within the boundaries of the Company's Gold Range Project in Arizona

Highlights

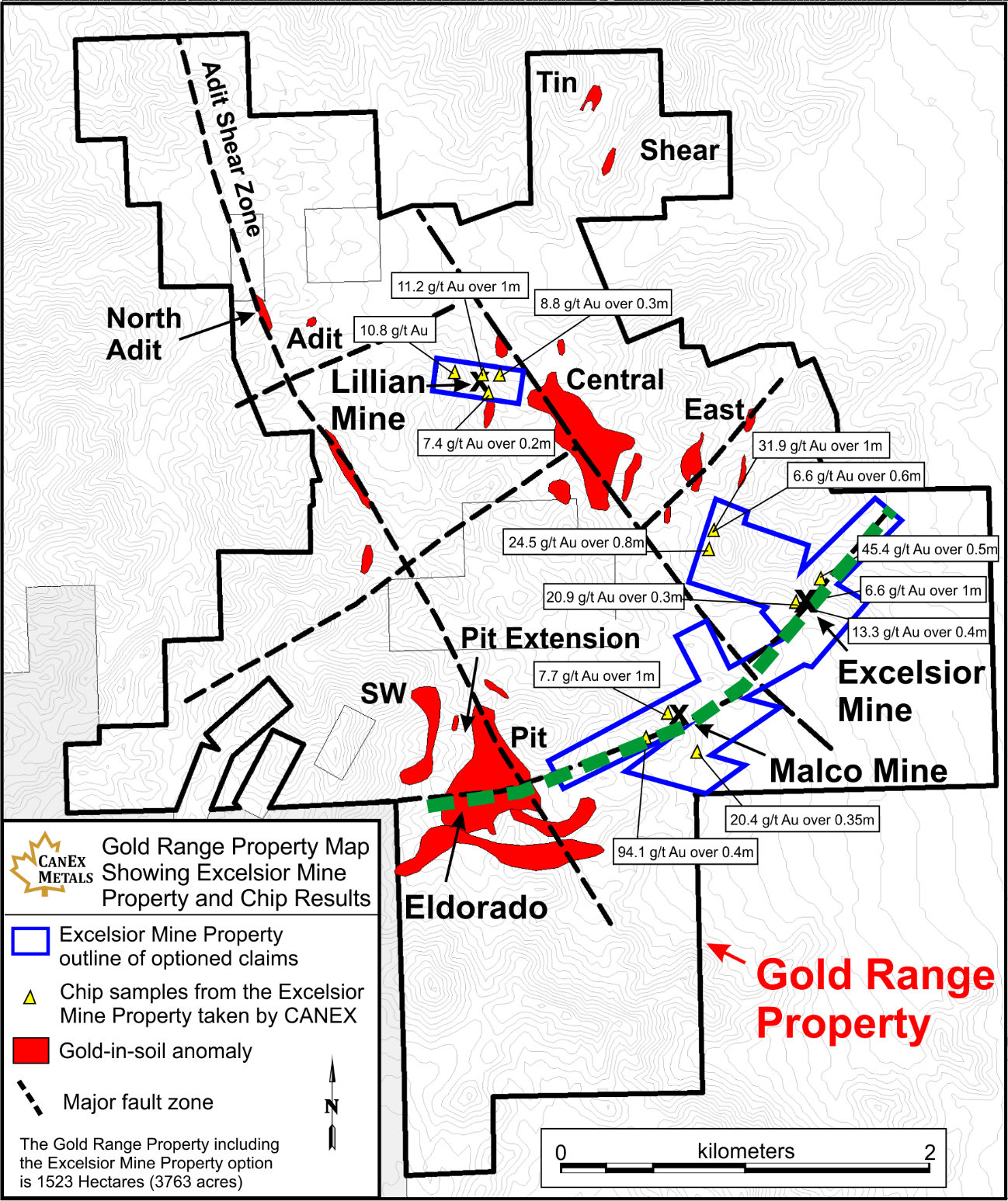

- The agreement gives CANEX control of an additional 2 kilometres of strike length of highly prospective ground along a major mineralized structure that runs from the Company's Eldorado bulk tonnage discovery to the past producing Excelsior Mine.

- In early 2021 CANEX drilled 18 holes into the Excelsior Mine Property with 14 holes testing the Excelsior Mine and 4 holes testing areas along strike. Assay results for these holes are pending.

- The agreement allows CANEX to earn a 90% interest in the Excelsior Mine Property by issuing 2,750,000 shares and spending US$4.5 million on exploration and development in 3 stages over 4.5 years. For the 1st stage of the agreement CANEX must issue 750,000 shares to the Vendors and spend US$500,000 on exploration within 2.5 years. Stages 2 and 3 require bonus payments based on gold equivalent ounces defined in resources and reserves.

Dr. Shane Ebert President of the Company stated, "Completing this option agreement and consolidating a large area of very prospective ground is a great step forward for the Gold Range project. With this deal CANEX now controls 3 kilometres of strike length along a mineralized corridor that is showing excellent potential for both bulk tonnage and high-grade gold targets. We look forward to the results from the initial drill test of the zone and will plan follow up surface work and additional drilling accordingly."

Terms of the Option

The option agreement allows CANEX to earn into the Excelsior Mine Property ("the Property") from the private Vendors over 3 stages. During stage 1 CANEX can earn a 25% interest in the Property by issuing 750,000 shares of CANEX and spending US$500,000 on exploration. During stage 2 CANEX can earn 51% interest in the Property by issuing 1 million shares of CANEX, spending US$2,000,000 on exploration including a resource estimate, and paying a bonus payment equivalent to 1% of the gold price on recoverable gold equivalent ounces defined in the measured and indicated resource categories. Stages 1 and 2 must be completed over 2.5 years.

During stage 3 CANEX can earn a 90% interest in the Property by issuing 1,000,000 shares and spending US$2,000,000 million on exploration and development including an economic study. To complete the stage 3 earn in CANEX must make another bonus payment to the Vendors equivalent to 1.5% of the gold price on recoverable gold equivalent ounces defined in the proven and probable reserve categories. CANEX has 2 years to complete the stage 3 earn in once Stage 2 is complete. Once CANEX has earned a 90% interest in the Property the Vendors can elect to maintain their 10% ownership by contributing their 10% share to exploration and development or give up 100% ownership to CANEX and revert to a 1.5% NSR. The transaction is subject to final TXS-V approval.

Figure 1. Map showing the Gold Range Property, the Excelsior Mine Property, and a 3km long mineralized trend (green dashed line).

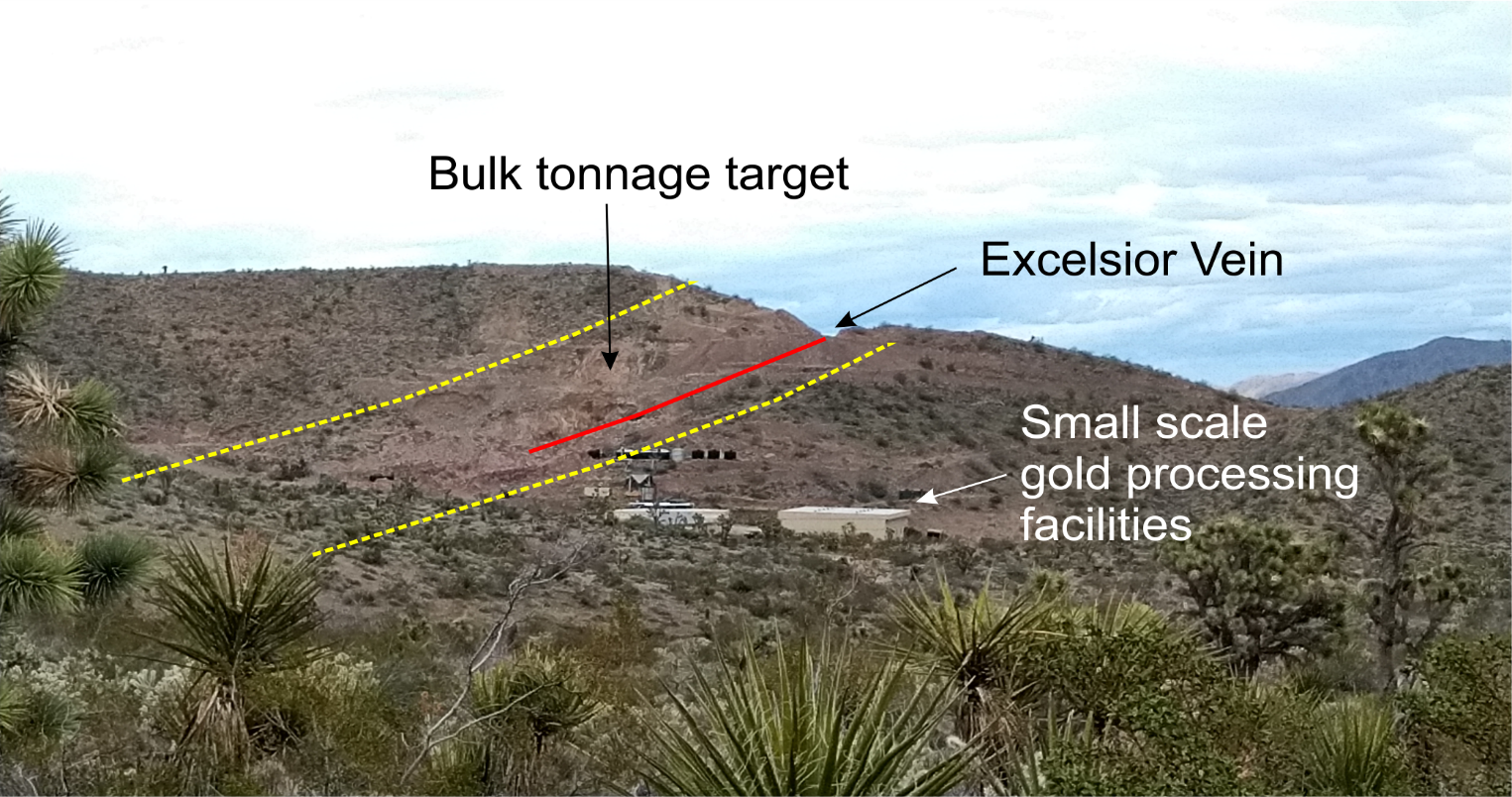

Figure 2. Photograph of the Excelsior Mine looking north showing the bulk tonnage target (between the yellow dashed lines) the Excelsior Vein, and existing mine production facilities.

January-February Gold Range Drill Program

In early 2021 the Company successfully completed 34 reverse circulation drill holes across 2.5 kilometres of strike length along the southern portion of the Gold Range Property. In total 2357.6 metres were drilled in holes ranging from 38 to 137 metres deep. Fifteen holes were drilled at the Eldorado Zone to test and expand the Company's previously announced bulk tonnage oxide discovery, 5 holes tested various targets across the southern part of the property and 14 holes tested the Excelsior Mine area.

Results for an additional 21 drill holes are pending and will be released as they are received, compiled, and interpreted.

About Canex Metals

Canex Metals (TSX.V:CANX) is a Canadian junior exploration company focused on advancing its Gold Range Project in Northern Arizona. Led by an experienced management team, which has made three notable porphyry and bulk tonnage discoveries in North America, CANEX has identified and tested several targets which host the potential for bulk tonnage oxide gold mineralization at its Gold Range Project. Recent drilling has identified near surface bulk tonnage gold potential at the Eldorado Zone with Hole GR21-25 returning 1.3 g/t gold over 21.3 metres including 5.1 g/t gold over 4.5 metres. The new discovery correlates with a strong gold in soil anomaly and sheeted quartz veinlets and stockworks within metamorphic rocks. The recent addition of the Excelsior Mine Property has added an additional 2 kilometres of strike along a 3 kilometre long highly prospective mineralized trend that extends from the Company's Eldorado discovery to the historic Excelsior Mine. The Excelsior Mine has seen historic underground and open pit mining along a zone 200 metres long and open along strike. Gold mineralization is centered along the shallow dipping high grade Excelsior Vein which is surrounded by a halo of sheeted quartz and quartz carbonate veins 20 to 50 metres wide.

The Company remains focused on testing and advancing key exploration targets on the Gold Range Property through continued exploration and drilling.

Dr. Shane Ebert P.Geo., is the Qualified Person for Canex Metals and has approved the technical disclosure contained in this news release.

"Shane Ebert",

Shane Ebert

President/Director

For Further Information Contact:

Shane Ebert at 1.250.964.2699 or

Jean Pierre Jutras at 1.403.233.2636

Web: https://www.canexmetals.ca

Neither the TSX Venture Exchange nor its regulation services provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Except for the historical and present factual information contained herein, the matters set forth in this news release, including words such as "expects", "projects", "plans", "anticipates" and similar expressions, are forward-looking information that represents management of Canex Metals Inc. internal projections, expectations or beliefs concerning, among other things, future operating results and various components thereof or the economic performance of CANEX. The projections, estimates and beliefs contained in such forward-looking statements necessarily involve known and unknown risks and uncertainties, which may cause CANEX's actual performance and financial results in future periods to differ materially from any projections of future performance or results expressed or implied by such forward-looking statements. These risks and uncertainties include, among other things, those described in CANEX's filings with the Canadian securities authorities. Accordingly, holders of CANEX shares and potential investors are cautioned that events or circumstances could cause results to differ materially from those predicted. CANEX disclaims any responsibility to update these forward-looking statements.

SOURCE: Canex Metals Inc.

View source version on accesswire.com:

https://www.accesswire.com/650233/Canex-Signs-Definitive-Option-Agreement-for-the-Excelsior-Mine-Property-at-the-Gold-Range-Project-Arizona