Amex Exploration Inc. ("Amex or the Company") (TSXV:AMX)(FRA:MX0)(OTCQX:AMXEF) Amex is pleased to provide a review of the 2020 year

Highlights from the year include:

- Expanded the drill program from 100,000 m to 300,000 m going from 3 drills on site to 10 drills by mid November, making the Amex drilling campaign one of the largest and most aggressive exploration programs in Canada this year

- Expanded all three known gold zones along strike and to depth and identified the 3.2 km long Perron Gold Corridor along the 15 km of prospective thrust faults to be explored

- Identified high grade gold mineralization in the down to 1.1 km vertical depth at High Grade Zone (HGZ)

- Completed metallurgical testing on the HGZ of the Eastern Gold Zone (EGZ) showing recoveries of greater than 99% for gold and silver and demonstrated a simplified gold processing flow sheet

- Strengthened and diversified Board of Directors

- Completed 2 financings bringing more than $24M in cash, adding cornerstone investors, ending the year in a strong financial position

- Coverage initiated by 4 different well-known mining analysts

The Company began the year with three drills on the Perron project and ended 2020 with ten drills turning on the property. Approximately 120,000 m of drilling has been completed on the Perron project with about another 180,000 m to be completed on Perron in 2021. The drill program to date has focused on expanding the three main gold zones on the Perron project starting with the Gratien Gold Zone and the Grey Cat Gold Zone to the West and the Eastern Gold Zone to the East. Drilling has demonstrated that the property hosts at 3.2 km long Perron Gold Corridor. Regional exploration is currently under way on the 45 km2 property which host more than 15 km of major structural faults (Perron and Normetal Faults) which has seen very little drilling outside the Perron Gold Corridor. The Company is planning a significant 15,000 m regional exploration program for 2021 with a goal to identify additional gold zones at Perron. The Company began the year with three drills on the Perron project and ended 2020 with ten drills turning on the property. Approximately 120,000 m of drilling has been completed on the Perron project with about another 180,000 m to be completed on Perron in 2021. The drill program to date has focused on expanding the three main gold zones on the Perron project starting with the Gratien Gold Zone and the Grey Cat Gold Zone to the West and the Eastern Gold Zone to the East. Drilling has demonstrated that the property hosts at 3.2 km long Perron Gold Corridor. Regional exploration is currently under way on the 45 km2 property which host more than 15 km of major structural faults (Perron and Normetal Faults) which has seen very little drilling outside the Perron Gold Corridor. The Company is planning a significant 15,000 m regional exploration program for 2021 with a goal to identify additional gold zones at Perron.

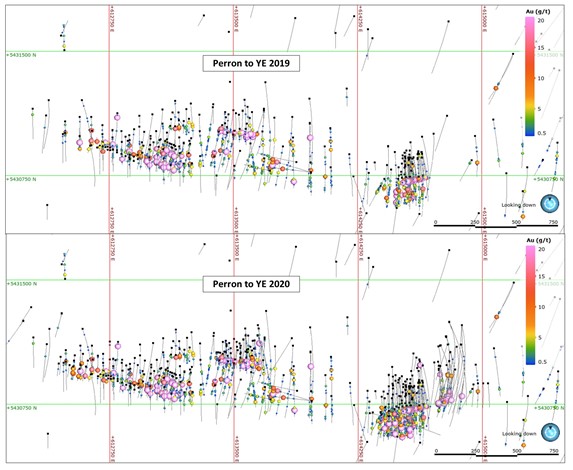

Figure 1 shows the significant expansion of the Perron Gold Corridor with an emphasis on the EGZ which consists of the High Grade Zone (HGZ) and the Denise Zone.

Figure 1: Drilling Progress on the Perron Project Plan View

For enhanced image, click here

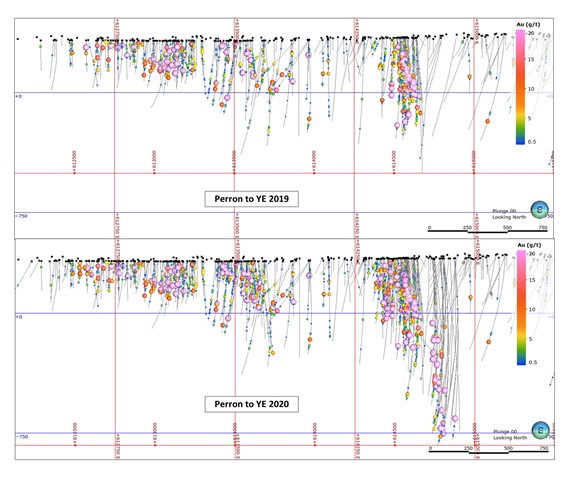

Figure 2: Drilling Progress on the Perron Project Long Section Looking North

For enhanced image, click here

Eastern Gold Zone

During the 2020 year, Amex expanded the EGZ down to a vertical depth of 1.1 km with Hole PE-20-187 intersecting 3.85 metres of 25.04 g/t Au. Essentially, during 2020, Amex doubled the vertical extension of the HGZ. Interpretation of the HGZ now suggests that gold mineralization has been traced over 350 metres along strike, from near surface to over 1.1 km vertically and averages approximately 7 metres of width (core length). The recent deep drilling on the HGZ is continually strengthening to depth. Of particular interest is that the highest grade core of the system, (i.e. with a metal factor greater than 100 g/t Au by meter as shown in pink on Figure 2) is more than double the vertical distance at depth in comparison to the near-surface portion of the HGZ. Drilling in 2021 on the HGZ will focus on definition drilling down to the 1.0 km level for a resource calculation starting at the end of 2021 as well as continued step out drilling to expand the strike length of the system at depth.

Highlight drill results from the HGZ in 2020 include:

- Hole PE-20-137 intersected 8.50 metres of 29.44 g/t Au at a vertical depth of approximately 570 metres (see Press Release of February 13, 2020)

- Hole PE-20-171 intersected 9.10 metres of 44.22 g/t Au at a vertical depth of approximately 775 metres (see Press Release of July 16, 2020)

- Hole PEM-20-001 intersected 11.80 metres of 27.70 g/t Au at a vertical depth of approximately 270 metres (see Press Release of August 5, 2020)

- Hole PEM-20-005 intersected 15.60 metres of 32.41 g/t Au at a vertical depth of approximately 150 metres (see Press Release of August 18, 2020)

- Hole PE-20-217 intersected 10.55 metres of 20.88 g/t Au a vertical depth of approximately 560 metres (See Press Release of December 3, 2020)

2020 also saw excellent progress on our understanding of the nearby Denise Zone which lies parallel and approximately 50 m to the south of the HGZ. Drilling at the latter part of 2020 has begun to demonstrate the potential to add significant near surface gold ounces to the project. Recent drilling has confirmed the presence of a high metal factor core of the Denise Zone within large intervals of gold mineralization as demonstrated in Hole PE-20-199 which intersected 81.50 metres of 1.51 g/t Au at a vertical depth of approximately 190 metres. Drilling has continued to encounter wide near surface gold mineralization at Denise which improves the open pit potential of the entire Eastern Gold Zone. Continuity and consistency of the gold mineralization is improving with more drilling.

Highlight drill results from the Denise Gold Zone in 2020 include:

- Hole PE-20-181 intersected 115.60 metres of 1.39 g/t Au at a vertical depth of approximately 260 metres (see Press Release of September 16, 2020)

- Hole PE-20-188 intersected 189.40 metres of 1.07 g/t Au at a vertical depth of approximately 300 metres (see Press Release of September 16, 2020)

- Hole PE-20-192 intersected 39.55 metres of 9.36 g/t at a vertical depth of approximately 225 metres (see Press Release of October 21, 2020)

- Hole PE-20-199 intersected 81.50 metres of 1.51 g/t Au at a vertical depth of approximately 190 metres (See Press Release of December 17, 2020)

- Hole PE-20-204 intersected 187.00 metres of 0.66 g/t Au at a vertical depth of approximately 180 metres (See Press Release of December 17, 2020)

The Company also completed metallurgy testing at the HGZ to illustrate the ease of recovery of the gold at Perron. Results demonstrated exceptional gold and silver recovery (+99%) using a 3-stage processing technique (gravity, flotation, and cyanidation). The Phase 2 metallurgy program determined that very high gold (+99%) and silver (89.5%) recoveries could be achieved using a simplified 2 stage process that eliminates floatation. Additional metallurgy testing is planned for the other gold zones at Perron following such exceptional recovery rates at the HGZ.

Gratien and Grey Cat Gold Zones

During the year Amex reported near surface gold mineralization on both the Gratien and Grey Cat Gold Zones and confirmed the open pit mining potential of Grey Cat. During 2020 Amex was successful in expanding and defining the near surface mineralization of both zones. Drilling is focused on defining the Gratien to approximately 250 metres vertical depth and while testing the depth of Grey Cat to approximately 500 metres vertically. The Grey Cat appears to have a high-grade core that dips at approximately 60 degrees to the East, similar to the Eastern Gold Zone.

Significant intercepts at Grey Cat included 1.22 g/t Au over 39.00 metres in hole PEG-20-143 at a vertical depth of approximately 80 metres as well as 4.54 g/t Au over 10.30 metres in hole PEG-20-150 at a vertical depth of approximately 70 metres. Mineralization is very planar and occurs in a single lens easily identifiable in three dimensions and simple to target.

Victor Cantore, CEO commented, "The drill results on the Perron Project for 2020 have exceeded our expectations. Our understanding of the mineralization and geology of the project has improved substantially throughout the year providing for a solid basis to develop the Perron Project to its fullest potential. I look forward to another year of continued drilling success, thanks to the great team we have in place."

Corporate Update

Amex recognizes the value of diversity in deliberation and took a number of steps to strengthen its Board by welcoming two new Board members in 2020, Mr. Bryan Coates and Ms. Anik Gendron. Both Bryan and Anik have played an active role on the Amex Board offering strategic insight to the management team over the past year.

From a financial perspective, Amex has never been stronger, ending the year with approximately $32 million in available cash, making the Company fully funded for its exploration program for 2021. During 2020 Amex also added cornerstone investor along side Mr. Eric Sprott, who increased his position and participated in each financing. Various well respected institutions from Canada, United States, Europe and the United Kingdom all participated in the 2020 financings. The shareholder profile of Amex shifted from primarily retail investors to institutional holders in 2020. Accordingly, the stock reflected the achievements of the Amex team and delivered a very strong performance and outperformed its peers. See Figure 3 below.

Figure 3: Stock chart showing Amex performance from January 1, 2019 to December 31, 2020 relative to high performing peers - AMX shown in bold black below

For enhanced image, click here

Cantore continued, "I am proud to say that each financing that we have completed since 2018 has been done at successively higher issue prices, thereby limiting the shareholder dilution while converting the capital raised into exponentially higher market cap value. This has been achieved through prudent financings and targeted exploration which has delivered exceptional results. Our management team are all shareholders of Amex and our interest are very much aligned with our shareholder base. As I look to 2021, I am confident in our exploration program, our leadership team and our ability to deliver results in this strong gold market."

Looking Forward to 2021

Amex intends to complete the balance of the drilling program which will take the majority of the year until the fall of 2021 at which time the Company will initiate a property wide NI43-101 compliant resource calculation. In addition, the technical team has identified several potential additional gold bearing structures outside the three known gold zones during its regional exploration program. Follow up drilling on these new structures will be part of the drill program in 2021 to determine if they constitute new gold zones.

Jacques Trottier, PhD Executive Chairman of Amex said, "I am excited to resume the year with an ambitious 10 drill program that aims to build ounces within the Perron Gold Corridor while discovering new gold zones on the property. With the benefit of having made several gold discoveries using predictive modeling and structural geology as our guide, I believe that Perron has much untapped potential that will be demonstrated in the coming year."

Qualified Person

Maxime Bouchard P.Geo. M.Sc.A., (OGQ 1752) and Jérôme Augustin P.Geo. Ph.D., (OGQ 2134), Independent Qualified Persons as defined by Canadian NI 43-101 standards, have reviewed and approved the geological information reported in this news release. The drilling campaign and the quality control program have been planned and supervised by Maxime Bouchard and Jérôme Augustin. Core logging and sampling were completed by Laurentia Exploration. The quality assurance and quality control protocol include insertion of blank or standard every 10 samples on average, in addition to the regular insertion of blank, duplicate, and standard samples accredited by Laboratoire Expert during the analytical process. Gold values are estimated by fire assay with finish by atomic absorption and values over 3 ppm Au are reanalyzed by fire assay with finish by gravimetry by Laboratoire Expert Inc, Rouyn-Noranda. Samples containing visible gold mineralization are analyzed by metallic sieve. For additional quality assurance and quality control, all samples were crushed to 90% less than 2 mm prior to pulverization, in order to homogenize samples which may contain coarse gold. Core logging and sampling were completed by Laurentia Exploration.

The Qualified Persons have not completed sufficient work to verify the historic information on the Property, particularly in regards to historical drill results. However, the Qualified Persons believe that drilling and analytical results were completed to industry standard practices. The information provides an indication of the exploration potential of the Property but may not be representative of expected results.

About Amex

Amex Exploration Inc. is a junior mining exploration company, the primary objective of which is to acquire, explore, and develop viable gold projects in the mining-friendly jurisdiction of Quebec. Amex is focused on its 100% owned Perron gold project located 110 kilometres north of Rouyn Noranda, Quebec, consisting of 116 contiguous claims covering 4,518 hectares. A number of significant gold discoveries have been made at Perron, including the Eastern Gold Zone, the Gratien Gold Zone, the Grey Cat Zone, and the Central Polymetallic Zone. High-grade gold has been identified in each of the zones. A significant portion of the project remains underexplored. In addition to the Perron project, the company holds a portfolio of three other properties focused on gold and base metals in the Abitibi region of Quebec and else where in the province.

For further information please contact:

Victor Cantore

President and Chief Executive Officer

Amex Exploration: +1-514-866-8209

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Statements:

This news release contains forward-looking statements. All statements, other than of historical facts, that address activities, events or developments that the Company believes, expects or anticipates will or may occur in the future including, without limitation, the planned exploration program on the HGZ and Denise Zone, the expected positive exploration results, the extension of the mineralized zones, the timing of the exploration results, the ability of the Company to continue with the exploration program, the availability of the required funds to continue with the exploration and the potential mineralization or potential mineral resources are forward-looking statements. Forward-looking statements are generally identifiable by use of the words "will", "should", "continue", "expect", "anticipate", "estimate", "believe", "intend", "to earn", "to have', "plan" or "project" or the negative of these words or other variations on these words or comparable terminology. Forward-looking statements are subject to a number of risks and uncertainties, many of which are beyond the Company's ability to control or predict, that may cause the actual results of the Company to differ materially from those discussed in the forward-looking statements. Factors that could cause actual results or events to differ materially from current expectations include, among other things, failure to meet expected, estimated or planned exploration expenditures, failure to establish estimated mineral resources, the possibility that future exploration results will not be consistent with the Company's expectations, general business and economic conditions, changes in world gold markets, sufficient labour and equipment being available, changes in laws and permitting requirements, unanticipated weather changes, title disputes and claims, environmental risks as well as those risks identified in the Company's annual Management's Discussion and Analysis. Should one or more of these risks or uncertainties materialize, or should assumptions underlying the forward-looking statements prove incorrect, actual results may vary materially from those described and accordingly, readers should not place undue reliance on forward-looking statements. Although the Company has attempted to identify important risks, uncertainties and factors which could cause actual results to differ materially, there may be others that cause results not to be as anticipated, estimated or intended. The Company does not intend, and does not assume any obligation, to update these forward-looking statements except as otherwise required by applicable law.

SOURCE: Amex Exploration Inc.

View source version on accesswire.com:

https://www.accesswire.com/623021/Amex-Exploration-Reviews-2020-Achievements