Trilogy Metals Inc. (TSX: TMQ) (NYSE American: TMQ) ("Trilogy" or the "Company") is pleased to announce the second set of drilling results from the 2021 summer field season at the Arctic Project, part of the Upper Kobuk Mineral Projects ("UKMP") located in northwestern Alaska managed by Ambler Metals LLC ("Ambler Metals"), the joint venture operating company equally owned by Trilogy and South32 Limited (ASX, LSE, JSE: S32; ADR: SOUHY) ("South32").

The 2021 Arctic drill program included 4,131 meters of diamond drilling, comprising 18 holes, that were designed to convert a portion of the resources from the Indicated category to the Measured category, and provide material for metallurgical testing and geotechnical information. The results contained in this news release are from the first two infill holes that were drilled early in the 2021 field season.

On November 22, 2021 , the Company released the assay results for holes AR21-0173 and AR21-0175, two geotechnical drill holes that intersected high-grade mineralization beyond the currently designed pit at Arctic. Please see this press release at the Company's website for more information on these drilling results.

The results of the remaining 14 holes are expected to come in over the next couple of months.

Highlights from the first two infill drill holes of the 2021 drill program

Based on a cut-off grade of 0.5% copper equivalent, significant zones of high-grade copper, zinc, lead, gold, and silver mineralization were intersected, including:

- AR21-0176 intersected three mineralized intervals, including 19.91 meters of 6.75% copper, 7.59% zinc, 1.68% lead, 1.26 g/t gold and 97.13 g/t silver for a copper equivalent grade of 11.76% and 6.76 meters of 1.55% copper, 6.61% zinc, 1.58% lead, 0.12 g/t gold and 20.68 g/t silver for a copper equivalent grade of 4.77% and,

- AR21-0174 intersected one mineralized interval of 10.12 meters of 3.21% copper, 6.14% zinc, 1.46% lead, 0.69 g/t gold and 49.74 g/t silver for a copper equivalent grade of 6.84%.

All reported intervals are thought to be close to the true width and therefore represent the actual thickness of mineralization.

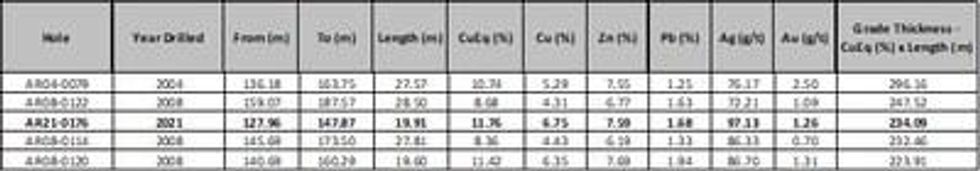

Drill hole AR21-0176, which contained 19.91 meters of 11.76% copper equivalent (a grade thickness of 234.09 %meters), represents the third highest ever grade-thickness intersect out of 178 holes drilled at the Arctic Project to date.

A comparison of the top five holes drilled at Arctic, including reference to the year drilled, is shown in Table 1 .

Table 1. Top Five Grade-Thickness Drill Holes from the Arctic Project

- All lengths are close to true thickness

- For more information on previous drilling carried out at the Arctic Project please refer to "Arctic Feasibility Study Alaska, USA

NI 43-101 Technical Report" which has an effective date of August 20, 2020

Tony Giardini , President and CEO of Trilogy, commented, ""The 2021 drilling campaign confirms that the Arctic Project has some of the highest grades of polymetallic mineralization in the world with copper-equivalent grades frequently in the double digits. The copper-equivalent grades at Arctic rival some of the high-grade copper projects in Africa , while being in one of the most stable mining jurisdictions in the world."

Richard Gosse , Vice President, Exploration at Trilogy stated, "These assays from the 2021 drill program are an exciting start to the infill drill program at Arctic. Grades of almost 12% copper equivalent over 20 meters, considered close to true width, is one of the best intervals at Arctic since the first hole was drilled in 1967. We are looking forward to seeing the results of the other 14 drill holes at Arctic as well as from the regional drill program."

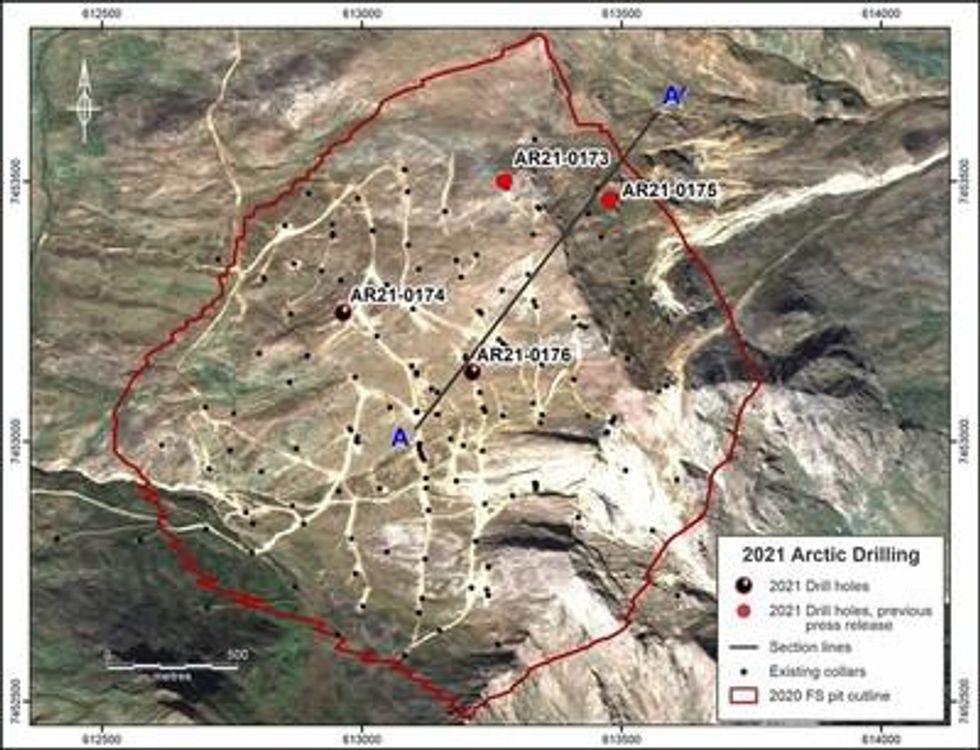

All four holes drilled so far during the 2021 program contain mineralized intervals consistent with previous drilling conducted within the resource area on the property. Significant mineralized intervals of high-grade mineralization at a cutoff of 0.5% copper equivalent are reported in Table 2 . The locations of the holes are shown in Figure 1 and Table 3 .

Of the 18 holes drilled at Arctic last summer, eight holes were for the geotechnical program. The 10 remaining drill holes were part of the infill/metallurgical program, with three of the 10 drill holes also being used for the hydrology program.

Table 2. Drill Intercepts from the 2021 Arctic Infill Drilling Program

| Hole | From (m) | To (m) | Length (m) | CuEq (%) | Cu (%) | Zn (%) | Pb (%) | Ag (g/t) | Au (g/t) | Zone |

| AR21-0174 | 84.98 | 95.10 | 10.12 | 6.84 | 3.21 | 6.14 | 1.46 | 49.74 | 0.69 | 5 |

| AR21-0176 | 127.96 | 147.87 | 19.91 | 11.76 | 6.75 | 7.59 | 1.68 | 97.13 | 1.26 | 5 |

| 164.65 | 171.41 | 6.76 | 4.77 | 1.55 | 6.61 | 1.58 | 20.68 | 0.12 | 3 | |

| 176.11 | 176.94 | 0.83 | 3.00 | 1.90 | 1.76 | 0.30 | 24.90 | 0.22 | 2.5 |

Notes:

- Copper equivalent (CuEq) calculations use metal prices assumptions of $3.00 /lb for copper, $1.10 /lb for zinc, $1.00 /lb for lead, $1,300 /oz for gold, and $18.00 /oz for silver.

- Results are core intervals and not true thickness; true widths have not been determined for the above intercepts but are believed to be representative of actual drill thicknesses.

- Significant interval defined as a minimum of 1.0 meter copper interval with average grade >0.5% CuEq.

- Cut-off grade of 0.5% CuEq.

- Internal dilution up to three meters of

- Intervals of

- Core recovery averaged 96%.

- Minimum sample length was 0.17m , average sample length was 2.4m overall and 1.7m within mineralized zones.

- Some rounding errors may occur.

The reported intervals are based on a copper-equivalent grade of 0.5% using metal prices from Trilogy's 2020 Arctic feasibility study ( $3.00 /lb copper, $1.10 /lb zinc, $1.00 /lb lead, $1,300 /oz gold, and $18.00 /oz silver) and a maximum of 3-meters internal dilution. All drill hole intercepts are close to true width.

Table 3. Drill Hole Locations at the Arctic Project

| Hole | East (m) | North (m) | Elevation (m) | Azimuth | Dip | Length (m) |

| AR21-0174 | 612968 | 7453248 | 829 | 35 | -60 | 120.70 |

| AR21-0176 | 613213 | 7453131 | 880 | 35 | -70 | 205.59 |

| Coordinates are in UTM Zone 4N (meters) coordinate system, NAD83 Datum. |

Drill hole AR21-0174, which is sized PQ3 (83 mm diameter), was drilled as part of the 2021 infill and metallurgical program. This hole was designed to provide metallurgical test material as well as to upgrade confidence in the resource model. The intercept from 84.98 meters to 95.10 meters, interpreted to be Zone 5, confirms both the grade and thickness of the model.

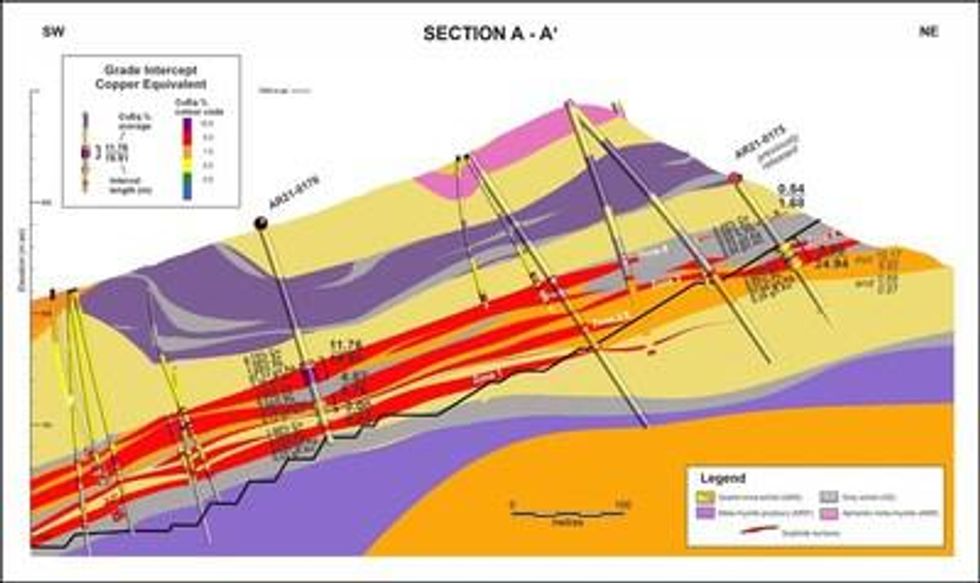

Drill hole AR21-0176, which is sized PQ3 (83 mm diameter), was also drilled as part of the 2021 infill and metallurgical program. This hole, also seen in Figure 2 , was designed to provide metallurgical test material as well as to upgrade confidence in the resource model. The hole was collared in the center of the Arctic deposit and intercepts multiple mineralized zones. The intercept from 127.96 meters to 147.87 meters is the intersection of Zone 5. The intercept from 164.65 meters to 171.41 meters is the intersection of Zone 3. Assay results for Zone 1, within AR21-0176, are still pending.

Mineralization within the high-grade portions (127.96 meters to 147.87 meters) of drill hole AR21-0176 consists of 20-40% chalcopyrite, 8-15% sphalerite, 2-5% galena and 10-20% pyrite. Barite is also present between 10-18%. All percentages are based off the visual estimations in the core. A photo of the high-grade mineralization in drill hole AR21-0176 is shown in Figure 3 .

Within the Arctic deposit, mineralization occurs as stratiform semi-massive sulphide to massive sulphide beds within primarily graphitic chlorite schists and fine-grained quartz schists. The sulphide beds average 4 meters in thickness but vary from less than 1 meter up to as much as 20 meters in thickness.

QA/QC Program

The drilling program, sampling and assaying protocol, and data verification were managed by qualified persons (QPs) employed by Ambler Metals. The diamond drill holes were completed using PQ3 or HQ3 diameter core, and recoveries averaged 95%. Drill core was cut lengthwise into halves using a diamond saw, and one-half was cut lengthwise to provide quarter core for sampling. The remainder of the core was retained in core trays and archived at site.

Samples were collected through mineralized zones using a 0.45 m minimum length and 3.07 m maximum length; average sample length is 1.47 m . Weights of the drill core samples range from 0.57 to 17.86 kg, depending on the size of core, rock type, and recovery.

Each core sample was placed into a bag with a numbered tag and quality control samples were inserted between core samples using the same numbering sequence. Then, samples were grouped into batches for shipping and laboratory submissions. Each batch of 20 samples contains three quality control (QC) samples that comprise one certified reference material (CRM), one core blank (BLK), and one core or crushed duplicate (DUP). Chain of custody records are maintained for sample shipments and the custody is transferred from Ambler Metals expeditor to the laboratory upon delivery.

Samples were shipped to ALS Minerals laboratory in Fairbanks, Alaska , USA, for sample preparation. ALS Minerals Fairbanks is a satellite sample preparation facility accredited under ALS Minerals. After preparation at ALS Minerals Fairbanks, split pulp samples were shipped to ALS Minerals in North Vancouver, B.C. , Canada , for assaying. ALS Minerals North Vancouver is an independent laboratory certified under ISO 9001:2008 and accredited under ISO/IEC 17025:2005 by the Standards Council of Canada . ALS Minerals includes its own internal quality control samples comprising certified reference materials, blanks, and pulp duplicates.

Drill core samples were weighed (WEI-21), dried if excessively wet (DRY-21), coarse jaw crushed to 70% passing 6 mm (CRU-21), fine jaw crushed to 70% passing 2 mm (CRU-31), riffle split to 250 g subsamples (SPL-21) and pulverized to 85% passing 75 μm (PUL-31). Crushed duplicates were created by riffle splitting crushed samples into two parts.

Gold analyses were completed using a 30 g lead fire assay and AAS finish (Au-AA23). Multi-element analyses for 48 elements were completed using a geochemical four acid digestion and ICP-ES/MS finish (ME-MS61). Over-range assays for Ag, Cu, Zn, and S were completed using an ore grade four-acid digestion and ICP-ES finish (ME-OG62). Additional analyses were completed for Ba and Hg.

Au, Ag, Cu, Pb, and Zn assays for QC samples were reviewed to ensure that CRMs are within tolerance limits specified on supplier certificates, BLKs are below acceptable thresholds, and DUPs display statistical patterns normally expected for sample types, methods, and elements. CRMs that returned assays outside of tolerance limits and BLKs with assays above thresholds were deemed to have failed. Sample batches containing failed QC samples were re-assayed to ensure that the QC samples returned acceptable results before release. All QC monitoring data are reviewed and signed off by an independent QAQC geologist.

There is no known relationship between core sample recoveries and assay grades. Ambler Metals will submit 5% of the assay intervals from prospective lithologies to a laboratory independent of ALS Minerals for check assaying.

Qualified Persons

Richard Gosse , P.Geo., Vice President Exploration for Trilogy, is a Qualified Person as defined by National Instrument 43-101. Mr. Gosse has reviewed the scientific and technical information in this news release and approves the disclosure contained herein.

About Trilogy Metals

Trilogy Metals Inc. is a metal exploration and development company which holds a 50 percent interest in Ambler Metals LLC which has a 100 percent interest in the Upper Kobuk Mineral Projects ("UKMP") in Northwestern Alaska . On December 19, 2019 , South32, a globally diversified mining and metals company, exercised its option to form a 50/50 joint venture with Trilogy. The UKMP is located within the Ambler Mining District which is one of the richest and most-prospective known copper-dominant districts located in one of the safest geopolitical jurisdictions in the world. It hosts world-class polymetallic volcanogenic massive sulphide ("VMS") deposits that contain copper, zinc, lead, gold and silver, and carbonate replacement deposits which have been found to host high-grade copper and cobalt mineralization. Exploration efforts have been focused on two deposits in the Ambler Mining District – the Arctic VMS deposit and the Bornite carbonate replacement deposit. Both deposits are located within a land package that spans approximately 172,636 hectares. Ambler Metals has an agreement with NANA Regional Corporation, Inc., an Alaska Native Corporation that provides a framework for the exploration and potential development of the Ambler Mining District in cooperation with local communities. Trilogy's vision is to develop the Ambler Mining District into a premier North American copper producer.

Cautionary Note Regarding Forward-Looking Statements

This press release includes certain "forward-looking information" and "forward-looking statements" (collectively "forward-looking statements") within the meaning of applicable Canadian and United States securities legislation including the United States Private Securities Litigation Reform Act of 1995. All statements, other than statements of historical fact, included herein, including, without limitation, statements relating to interpretation of drill results; our beliefs regarding the potential of the Arctic Project; our expectations regarding de-risking of the Arctic Project; are forward-looking statements. Forward-looking statements are frequently, but not always, identified by words such as "expects", "anticipates", "believes", "intends", "estimates", "potential", "possible", and similar expressions, or statements that events, conditions, or results "will", "may", "could", or "should" occur or be achieved. Forward-looking statements involve various risks and uncertainties. There can be no assurance that such statements will prove to be accurate, and actual results and future events could differ materially from those anticipated in such statements. Important factors that could cause actual results to differ materially from the Company's expectations include the uncertainties involving impact of the COVID-19 pandemic; success of exploration activities, permitting timelines, requirements for additional capital, government regulation of mining operations, environmental risks, prices for energy inputs, labour, materials, supplies and services, uncertainties involved in the interpretation of drilling results and geological tests, unexpected cost increases and other risks and uncertainties disclosed in the Company's Annual Report on Form 10-K for the year ended November 30, 2020 filed with Canadian securities regulatory authorities and with the United States Securities and Exchange Commission and in other Company reports and documents filed with applicable securities regulatory authorities from time to time. The Company's forward-looking statements reflect the beliefs, opinions, and projections on the date the statements are made. The Company assumes no obligation to update the forward-looking statements or beliefs, opinions, projections, or other factors, should they change, except as required by law.

SOURCE Trilogy Metals Inc.