Sentinel Resources Corp. (CSE: SNL) (US OTCPINK: SNLRF) ("Sentinel" or the "Company ") is pleased to announce that it has acquired the Salama Gold Project, consisting of four gold focused mining concessions totaling approximately 2,700 hectares, located in western Peru .

Highlights of Acquisition:

- Potential for high and low sulfidation epithermal gold mineralization and breccia pipe stock-work style gold-silver deposits.

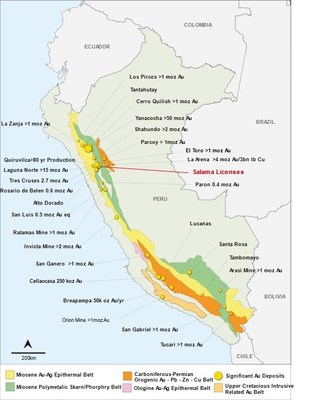

- Situated within the prolific gold-polymetallic Miocene skarn and porphyry belt — one of several coast-parallel metallogenic belts that host the larger and more significant deposits of Peru ( map link here ). This includes Lagunas Norte Gold Mine, Rasario De Belen Gold Mine , La Arena Gold Mine and La Virgen Mine, that together host over 20 Moz gold within a 45 km radius of the Salama Concessions.

- Highly experienced national and expatriate exploration team capable of carrying out exploration work on Salama Gold Project immediately.

- First reconnaissance visit planned for the week of 14 th October 2020 . First pass mapping and sampling will concentrate on areas of alteration hosting quartz veins and silicified breccias. Previous work by artisanal and small-scale miners provides additional vectors to areas of higher-grade mineralization.

Rob Gamley , President & CEO of Sentinel states, "The acquisition of four prospective gold concessions in this historical gold-silver producing region in Peru shows the ability of our exploration team to identify and acquire key gold assets notwithstanding current administrative challenges in Peru . With the skill and local knowledge of our in-country team, we are well placed to quickly build a robust portfolio of gold focused assets in this region of Peru ."

About Salama Gold Project

The Salama Gold Project consists of four gold focused exploration concessions totaling 2,700 hectares in the Anta province of Peru . Preliminary review indicates extensive areas of quartz veins with localized silicified breccias, that have been the focus of historic production by artisanal and small-scale miners. These miners targeted high grade areas where oxidation of bedrock resulted in formation of free gold amenable to gravity recovery.

Preliminary review of regional satellite imagery indicates that two major structures intersect in the northeast of the concession, in a similar geological setting to La Virgin gold mine 20 km to the north. Historic production at La Virgin was reported as 120,000 oz Au/annum.

Sentinel's field team will initially comprise three in-country geologists, allowing for rapid first pass reconnaissance and rock-chip grab sampling. The field team has robust project review and target generation experience, especially with respect to Peruvian low and high sulphidation epithermal deposits, such as Lagunas Norte, La Arena and Rosario De Belen . This will allow mineralization at Salama to be placed within the wider context of an epithermal deposits geological, structural and hydrothermal evolution, and thus allow key controls on mineralization and high value targets to be rapidly established. Sentinel will submit samples to ALS Lima for preparation and analysis.

Terms of Transaction

Sentinel entered into an assignment agreement (the "Assignment Agreement") with a third party (the "Assignor") whereby it assumed all of the right, title and interest in and to a purchase agreement (the "Purchase Agreement") with the holders of the Salama Gold Project.

Under the terms of the various agreements, Sentinel acquired a 100% interest in the Salama Gold Project, royalty free, and, in consideration of which, Sentinel paid US $35,000 and issued a total of 2,100,000 common shares. The shares issued are subject to restrictions on resale for a period of four months from the date of issued.

Stock Option Grant

Sentinel has also granted options to purchase 250,000 shares of Sentinel to its directors, officers and consultants. The options are exercisable at $0.67 per share for a period of five years from the date of grant.

Qualified Person

Christopher Wilson , Ph.D., FAusIMM (CP), FSEG, a Qualified Person, has reviewed and approved the scientific and technical information contained in this news release.

About Sentinel Resources

Sentinel Resources is a Canadian-based exploration company focused on the acquisition and exploration of gold and silver projects with world-class potential. Its current portfolio includes the Waterloo, Pass, and Little Bear projects in British Columbia and the Salama Gold Project in Peru . The Company's guiding principles are based on acquiring strategic exploration properties in mining-friendly jurisdictions with historical mining industries, low-cost of entry or acquisition, and easy access to infrastructure to minimize capital and operational costs in explorational periods. For more information, please go to the Company's website at www.sentinelexp.com .

Sentinel Resources Corp.

"Rob Gamley"

President and Chief Executive Officer

Forward-Looking Statements

Information set forth in this news release contains forward-looking statements that are based on assumptions as of the date of this news release. These statements reflect management's current estimates, beliefs, intentions and expectations. They are not guarantees of future performance. Sentinel cautions that all forward-looking statements are inherently uncertain and that actual performance may be affected by many material factors, many of which are beyond their respective control. Such factors include, among other things: risks and uncertainties relating to Sentinel's limited operating history, its proposed exploration and development activities on is mineral properties and the need to comply with environmental and governmental regulations. Accordingly, actual and future events, conditions and results may differ materially from the estimates, beliefs, intentions and expectations expressed or implied in the forward-looking information. Except as required under applicable securities legislation, Sentinel does not undertake to publicly update or revise forward-looking information.

Neither the Canadian Securities Exchange ("CSE") nor its Regulation Services Provider (as that term is defined in the policies of the CSE) accepts responsibility for the adequacy or accuracy of this news release.

SOURCE Sentinel Resources Corp.