- WORLD EDITIONAustraliaNorth AmericaWorld

May 19, 2025

Advance Metals Limited (“Advance” or “the Company”) is pleased to provide an update on its ongoing exploration program at the Myrtleford Project in the Victorian Goldfields, Australia. Advance recently entered into a binding agreement with Serra Energy Metals Corp. (CSE:SEEM and OTCQB:ESVNF) to acquire an 80% interest via joint venture on the high grade Myrtleford and Beaufort Gold Projects1.

HIGHLIGHTS:

- Advance’s initial exploration program at Myrtleford is now complete with eight holes drilled for a total of 1,665.4 metres

- Results for the first four holes from the Happy Valley prospect were recently released, with high grade intervals including 8.2 metres at 22.4g/t Au in AMD0012, 2.G metres at 6.7g/t Au in AMD0023, 7.5 metres at 47.Gg/t Au in AMD0033 and 1.1 metres at 18.2g/t Au in AMD0044

- Results are currently pending for four holes (AMD005-008) drilled in the Twist Creek region at Myrtleford, with final assays expected in June

- Advance’s Board have now approved a significantly expanded, ten-hole follow-up program for the Happy Valley Trend that will comprise:

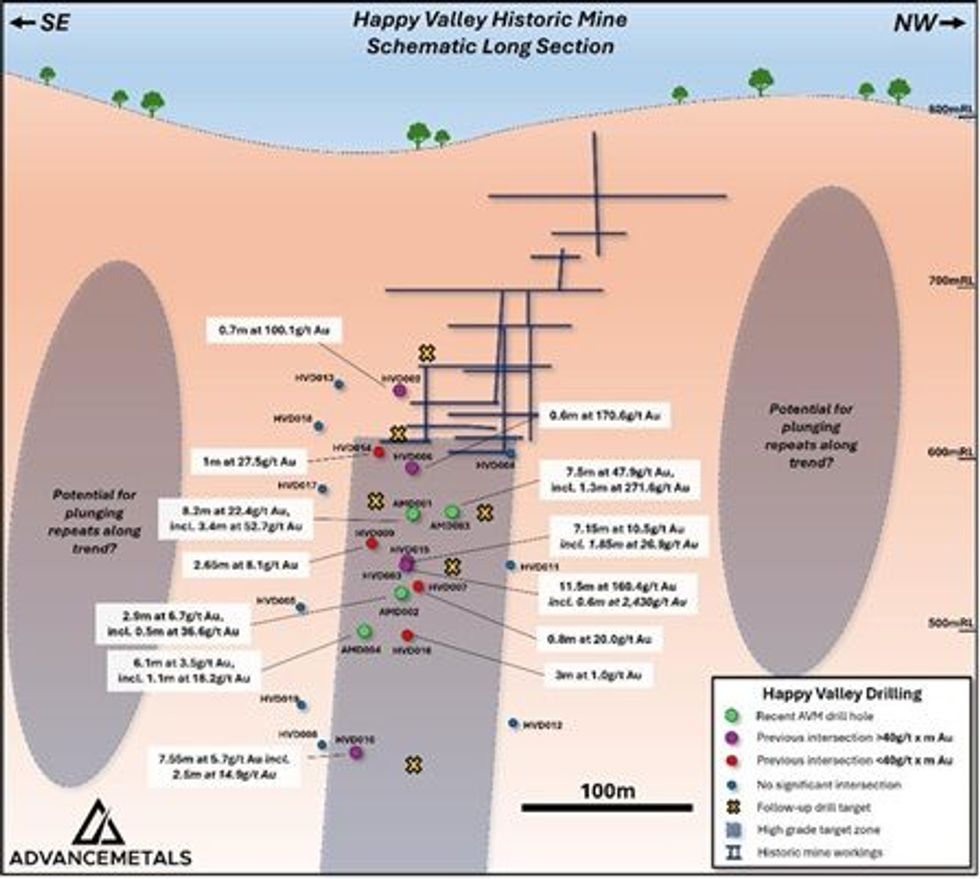

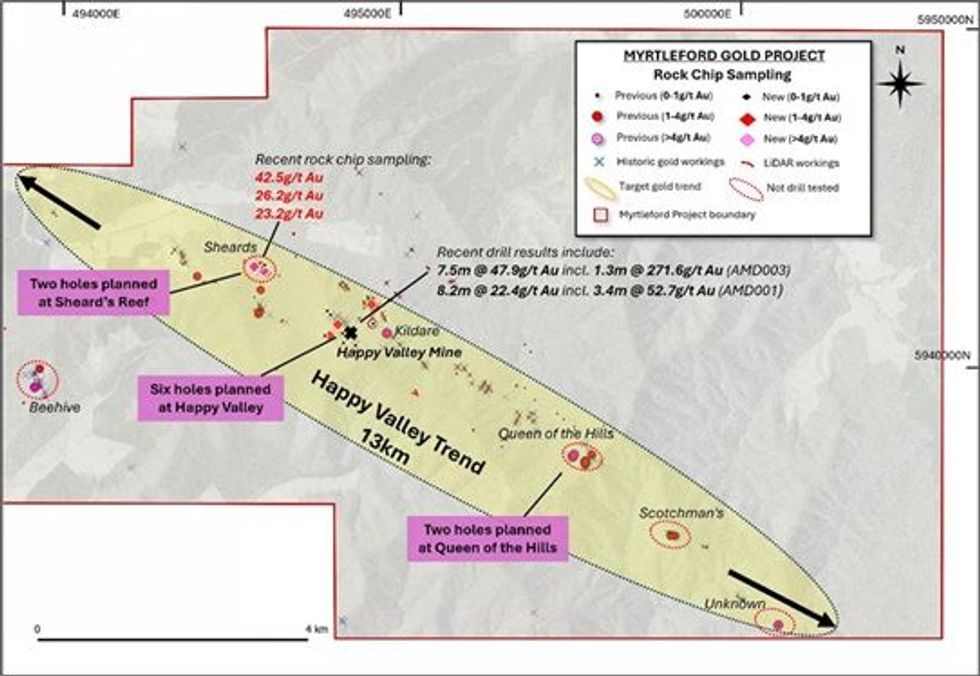

- Six additional diamond holes at the Happy Valley Prospect targeting extensions to the known high grade gold mineralisation up and down plunge and along strike (Figure 1)

- Maiden drilling at Sheard’s Reef (two holes) and Queen of the Hills (two holes), extending drilling over a six-kilometre portion of the Happy Valley Trend

- Drilling is expected recommence in approximately four weeks, subject to the receipt of requisite approvals

- Additional drilling at regional targets in the Barwidgee and Twist Creek areas is also currently being investigated, with these targets to be finalised upon receipt of the pending drilling results at the latter

New drilling program to extend high grade zone at Happy Valley

After commencing its maiden drilling campaign in late February 2025, Advance Metals has now completed an eight hole program at the Myrtleford Project in the northeastern Victorian Goldfields. A total of 1,665.4 metres was drilled in the initial program, with impressive high grade gold results recently released for the first four holes completed at the Happy Valley Prospect (Figure 1). This included 8.2 metres at 22.4g/t Au incl. 3.2 metres at 54.7g/t Au in AMD001, 2.G metres at 6.7g/t Au in AMD002, 7.5 metres at 47.Gg/t Au incl. 1.3 metres at 271.6g/t Au in AMD003 and 1.1 metres at 18.2g/t Au in AMD0042,3,4.

The intersection of high to very high grade gold mineralisation in all four of the initial holes at Happy Valley has given the Company significant confidence in the ongoing potential of the system. The Company’s Board have now approved a significant follow-up drilling program that will target extensions to the known gold mineralisation both up and down plunge and along strike in both directions (Figure 1). The program is currently expected to comprise an additional six holes in the immediate Happy Valley Prospect area, with drilling to recommence at the site in approximately four weeks - subject to the receipt of requisite government approvals.

The proposed program will also feature maiden diamond holes at new prospects in both directions along strike of the Happy Valley Mine, extending drilling to a six-kilometre portion of the broader Happy Valley Trend. Two holes are currently planned for existing historic workings at Sheard’s Reef, located approximately 1.5km to the west-northwest of the current drilling, targeting beneath high grade rock chips of up to 42.5g/t Au4. Two holes are also planned at Queens of the Hills 4.5 kilometres to the east-southeast (Figure 2). These holes are currently expected to be completed immediately following the drilling at the Happy Valley Mine.

Click here for the full ASX Release

This article includes content from Advance Metals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

41m

High-Grade Extensions at BD Deposits for Resource Growth

Aurum Resources (AUE:AU) has announced High-Grade Extensions at BD Deposits for Resource GrowthDownload the PDF here. Keep Reading...

3h

Centurion Minerals Ltd. Announces Revocation of MCTO

CENTURION MINERALS LTD. (TSXV: CTN) ("Centurion" or the "Company") announces that the British Columbia Securities Commission ("BCSC") has revoked the management cease trade order ("MCTO") previously issued on December 1, 2025 under National Policy 12-203 - Management Cease Trade Orders.The... Keep Reading...

03 February

Fabi Lara: What to Do When Commodities Prices Go Parabolic

Speaking against a backdrop of record-high gold and silver prices, Fabi Lara, creator of the Next Big Rush, delivered a timely reality check at this year’s Vancouver Resource Investment Conference. Addressing a packed room that included a noticeable influx of first-time attendees, she urged... Keep Reading...

03 February

Joe Cavatoni: Gold Price Drop — Why it Happened, What's Next

Joe Cavatoni, senior market strategist, Americas, at the World Gold Council, breaks down gold's record-setting run past US$5,500 per ounce as well as its correction. "At the end of this, you're looking at a lot of people who were pushing the price higher — speculative in nature — pulling back... Keep Reading...

03 February

Gold-Copper Consolidation Continues as Eldorado Moves to Acquire Foran

Eldorado Gold (TSX:ELD,NYSE:EGO) and Foran Mining (TSX:FOM,OTCQX:FMCXF) have agreed to combine in a share-based transaction that will create a larger, diversified gold and copper producer with two major development projects that are set to enter production in 2026.Following completion under a... Keep Reading...

03 February

Stellar AfricaGold Intersects Multiple Gold-Bearing Zones and Confirms Structural Controls at Tichka Est, Morocco - Drilling Resumed on January 30, 2026

(TheNewswire) Vancouver, BC TheNewswire - February 3rd, 2026 Stellar AfricaGold Inc. ("Stellar" or the "Company") (TSX-V: SPX | FSE: 6YP | TGAT: 6YP) is pleased to report additional assay results and an updated interpretation from its ongoing diamond drilling program at the Tichka Est Gold... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00