- WORLD EDITIONAustraliaNorth AmericaWorld

May 22, 2025

Great Boulder Resources (“Great Boulder” or the “Company”) (ASX: GBR) is pleased to provide an update on exploration at the Company’s flagship Side Well Gold Project (“Side Well”) near Meekatharra in Western Australia which hosts a Mineral Resource Estimate (“MRE”) of 668,000oz @ 2.8 g/t Au.

HIGHLIGHTS

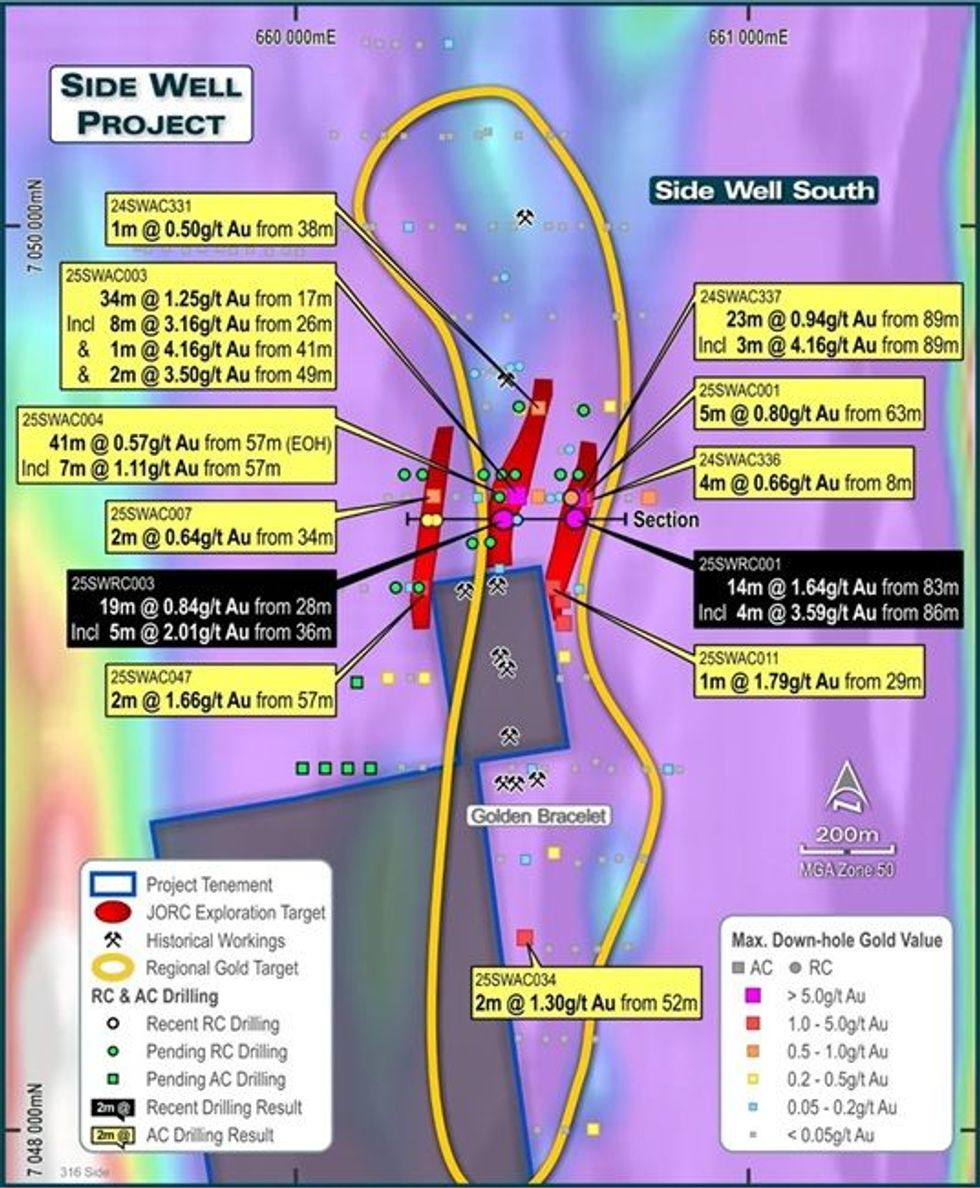

- RC drilling beneath recent gold discoveries (announced 20/01/25, 25/02/25 & 12/03/25) at Side Well South has confirmed additional gold mineralisation, with highlights including:

- 14m @ 1.64g/t Au from 83m, including 4m @ 3.59g/t Au from 86m in 25SWRC001

- 19m @ 0.84g/t Au from 28m, including 5m @ 2.01g/t Au from 36m, & 4m @ 1.77g/t Au from 53m in 25SWRC003

- 8m @ 1.68g/t Au from 107m in 25SWRC004

- Assay results are pending for a further 16 RC holes in this program

- AC drilling has extended the Eaglehawk deposit by a further 200m, remaining open to the south, with significant results including:

- 8m @ 2.19g/t from 60m, including 4m @ 4.23g/t Au from 64m in 25SWAC137

- Drilling is continuing at Side Well South, with the rig completing a Phase 2 AC program

- The Ironbark scoping study is on track to be delivered during the current quarter

Great Boulder’s Managing Director, Andrew Paterson commented:

“It’s really exciting to see immediate progress at Side Well South, hitting a broad intersection of shallow gold in our first RC hole. We’ve now confirmed primary gold mineralisation on two of the initial AC discoveries announced earlier in the year, with assays pending from another 16 RC holes.”

“Side Well South is shaping up as an important target for future resource growth at the project. Our initial AC program intersected gold in four new areas with geological settings analogous to our Ironbark and Saltbush deposits, which is very promising. We also have several large, coherent geochemical targets further south in the Tal Val area that are yet to be drill tested.”

“Our AC drilling in the central corridor has extended the Eaglehawk deposit by approximately 200m, and it still remains open to the north. We also drilled six AC holes into the Mulga Bill East area - which hasn’t been drilled for two years – and found more gold along that trend, so there will be more follow-up work in both areas.”

“We have also formalised our near-term growth expectations at Side Well in the form of an Exploration Target, which is based upon upside expectations within our current resources and active gold prospects. The target doesn’t include any of the high-priority geochemical targets that we’ve not yet drilled, so I think it’s a fairly conservative number for what we can see right now. It’s an Exploration Target and not a resource estimate, so please read the disclaimers.”

“There is huge upside potential beyond these current target areas, and we look forward to illustrating that as our exploration programs unfold.”

Click here for the full ASX Release

This article includes content from Great Boulder Resources, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

GBR:AU

The Conversation (0)

11h

Fabi Lara: What to Do When Commodities Prices Go Parabolic

Speaking against a backdrop of record-high gold and silver prices, Fabi Lara, creator of the Next Big Rush, delivered a timely reality check at this year’s Vancouver Resource Investment Conference. Addressing a packed room that included a noticeable influx of first-time attendees, she urged... Keep Reading...

12h

Joe Cavatoni: Gold Price Drop — Why it Happened, What's Next

Joe Cavatoni, senior market strategist, Americas, at the World Gold Council, breaks down gold's record-setting run past US$5,500 per ounce as well as its correction. "At the end of this, you're looking at a lot of people who were pushing the price higher — speculative in nature — pulling back... Keep Reading...

19h

Gold-Copper Consolidation Continues as Eldorado Moves to Acquire Foran

Eldorado Gold (TSX:ELD,NYSE:EGO) and Foran Mining (TSX:FOM,OTCQX:FMCXF) have agreed to combine in a share-based transaction that will create a larger, diversified gold and copper producer with two major development projects that are set to enter production in 2026.Following completion under a... Keep Reading...

21h

Stellar AfricaGold Intersects Multiple Gold-Bearing Zones and Confirms Structural Controls at Tichka Est, Morocco - Drilling Resumed on January 30, 2026

(TheNewswire) Vancouver, BC TheNewswire - February 3rd, 2026 Stellar AfricaGold Inc. ("Stellar" or the "Company") (TSX-V: SPX | FSE: 6YP | TGAT: 6YP) is pleased to report additional assay results and an updated interpretation from its ongoing diamond drilling program at the Tichka Est Gold... Keep Reading...

02 February

Gold and Silver Prices Take a U-Turn on Trump's Fed Chair Nomination

Gold and silver prices have experienced one of their most savage corrections in decades. After hitting a record high of close to US$5,600 per ounce in the last week of January, the price of gold took a dramatic U-turn on January 30, dropping as low as US$4,400 in early morning trading on Monday... Keep Reading...

02 February

Bold Ventures Kicks Off 2026 with Diamond Drilling Program at Burchell Base and Precious Metals Project

Bold Ventures (TSXV:BOL) has launched a diamond drilling program at its Burchell base and precious metals property in Ontario, President and COO Bruce MacLachlan told the Investing News Network.“We just started drilling a couple of weeks ago, and we’ll be drilling for a while,” MacLachlan said,... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00