November 06, 2025

High-grade results from La Morocha, La Negra SE and La Morocha SE confirm Joaquin as a district-scale silver-gold system.

Unico Silver Limited (“USL” or the “Company”) is pleased to report assay results for 21 holes (3587m) as part of an ongoing drill program at the Company’s 100%-owned Joaquin Project in Santa Cruz, Argentina. This includes exceptional high-grade silver gold intercepts at three prospects – La Morocha, La Negra SE and La Morocha SE.

HIGHLIGHTS

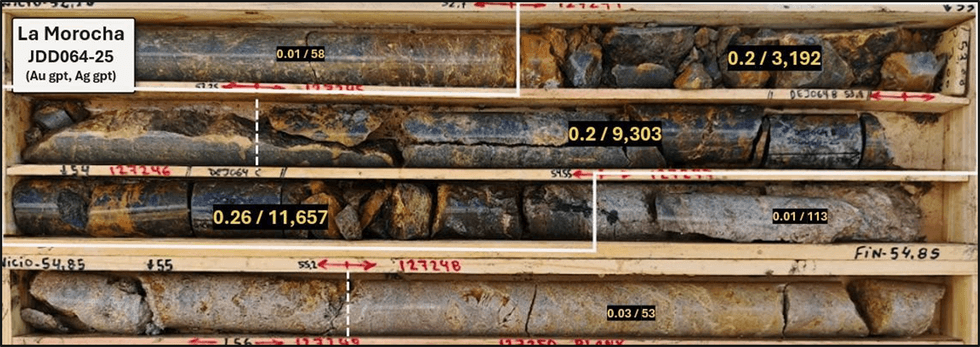

- Infill drilling at La Morocha defines the up-dip projection of high-grade mineralisation.

| JDD064-25 | 42.4m at 437gpt AgEq (0gpt Au, 437gpt Ag) from 49.6m, including:

|

- At La Negra SE, drilling has extended mineralisation a further 200m to the southeast, as defined by exploration hole JDD047-25 that returned 34.7m at 110gpt AgEq (0.4gt Au, 69gpt Ag) from 121.5m.

- Significant silver gold assay results from extensional and infill drilling within La Negra SE, include:

| JDD048-25 | 43m at 256gpt AgEq (1.8gpt Au, 74gpt Ag) from 75m, including:

|

| JDD052-25 | Gm at 787gpt AgEq (7.7gpt Au, 38gpt Ag) from 162m

|

| JDD056-25 | 34m at 170gpt AgEq (0.5gpt Au, 121gpt Ag) from 177m, including:

|

| JDD061-25 | 8.4m at 413gpt AgEq (1.2gpt Au, 290gpt Ag) from 51.6m, including:

|

| JDD063-25 | 71m at 131gpt AgEq (0.7gpt Au, 62gpt Ag) from 7m, including:

|

- Mineralisation is now defined over 725m of strike and 150m of vertical extent and remains open to the southeast and at depth. True thickness of 10m to 75m and increases at structural intersections.

- Significant follow up silver-gold assay results from the La Morocha SE discovery include:

| JDD070-25 | 20m at 160gpt AgEq (0.6gpt Au, 120gpt Ag) from 175m, including:

|

| JDD071-25 | 36m at 130gpt AgEq (0.5gpt Au, 84gpt Ag) from 127m, including:

|

| JDD075-25 | 17m at 200gpt AgEq (1.2gpt Au, 79gpt Ag) from 215m, including:

|

- Mineralisation is currently defined over 400m strike and 175m vertical extent and is open to the southeast and at depth. True thickness ranges from 15 to 60 metres.

Managing Director Todd Williams states:

“The Joaquin Project continues to deliver exceptional results. Infill drilling at La Morocha has confirmed that bonanza-grade silver mineralisation—typical of that previously mined underground by Pan American Silver— extends far closer to surface than previously understood. A standout intercept of 1.8 metres at 8,335gpt AgEq from 52 metres demonstrates the potential for early, near-surface ounces and strengthens the case for open- pit development.

At La Negra SE, step-out drilling has extended mineralisation a further 200 metres to the southeast, with hole JDD047-25 returning 34.7 metres at 110 gpt AgEq, while infill holes continue to intersect broad zones of silver- gold mineralisation close to surface, including 43 metres at 25C gpt AgEq (JDD048-25) and 71 metres at 131 gpt AgEq (JDD0c3-25). Deeper drilling has successfully extended mineralisation to over 1c0 metres vertical, with 34 metres at 170 gpt AgEq (JDD05c-25), and the system remains open in all directions.

Early follow-up drilling at La Morocha SE has also confirmed a new discovery, with strong mineralisation returned across multiple holes, including 20 metres at 1C0 g/t AgEq (JDD070-25). Visible gold continues to be observed in several recent holes with assays pending, highlighting the robust scale and continuity of this emerging district-wide system. With multiple discoveries and shallow, high-grade intercepts now defined across the Joaquin district, Unico is rapidly advancing the Company’s PLUS 150 and BEYOND 300 development and exploration growth strategies.”

Click here for the full ASX Release

This article includes content from Unico Silver Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

27 February

Obonga Project: Wishbone VMS Update

Panther Metals Plc (LSE: PALM), the exploration company focused on mineral projects in Canada, is pleased to provide an update for the Obonga Project's Wishbone Prospect which is an emerging and highly prospective base metal volcanogenic massive sulphide ("VMS") system in Ontario,... Keep Reading...

26 February

Agadir Melloul Mining Licence

Critical Mineral Resources is pleased to announce that a Mining Licence has been awarded for Agadir Melloul, marking an important step forward as the Company accelerates development towards production.The Mining License is 14.6km 2 and covers Zone 1 North and Zone 2, which remain the focus of... Keep Reading...

26 February

EIA Approval for Agdz Cu-Ag Project and Funding

Aterian plc (AIM: ATN), the Africa-focused critical metals exploration company, is pleased to announce the approval of it's recently commissioned Environmental Impact Assessment (''EIA'') for the 100%-owned Agdz Mining Licence, part of the Agdz ("Cu-Ag") Project ("Agdz" or the "Project") in the... Keep Reading...

25 February

Clem Chambers: I Sold My Gold and Silver, What I'm Buying Next

Clem Chambers, CEO of aNewFN.com, explains why he sold his gold and silver, and where he's looking next, mentioning the copper and oil sectors. He also speaks about the importance of staying positive as an investor: "The media negativity is the most wealth-crushing thing you can fall for. So be... Keep Reading...

25 February

What Was the Highest Price for Silver?

Like its sister metal gold, silver has been attracting renewed attention as a safe-haven asset. Although silver continues to exhibit its hallmark volatility, a silver bull market is well underway. Experts are optimistic about the future, and as the silver price's momentum continues in 2026,... Keep Reading...

23 February

Stefan Gleason: Silver Wakeup in the West — What's Happening, What's Next

Stefan Gleason, CEO of Money Metals, breaks down recent silver and gold dynamics, discussing trends in the US retail market, as well as backups at refineries. While the situation has begun to normalize, he sees potential for further disruptions in the future. Don't forget to follow us... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Obonga Project: Wishbone VMS Update

27 February

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00