July 08, 2024

Multiple wide, high-grade intercepts with grades of up to 126g/t Au from final batch of in-fill and extensional assays from the first half of 2024 drilling.

Spartan Resources Limited (“Spartan” or “Company”) (ASX: SPR) is pleased to provide an update on exploration results and development activities at its 100%-owned Dalgaranga Gold Project (“DGP”), located in the Murchison region of Western Australia.

HIGHLIGHTS

- Never Never Gold Deposit – strong in-fill drilling results strengthen deeper Resource extents:

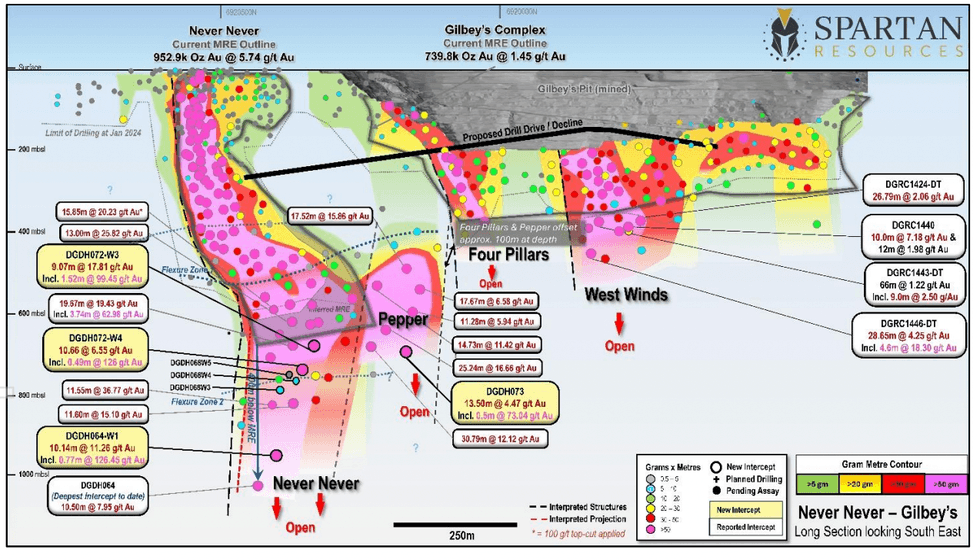

- 10.14m @ 11.26g/t gold from 966.90m down-hole, incl. 0.77m @ 126.45g/t (DGDH064-W1)

- 9.07m @ 17.81g/t gold from 760.55m down-hole, incl. 1.52m @ 99.45g/t (DGDH072-W3)

- 10.66m @ 6.55g/t gold from 798.02m down-hole, incl. 0.49m @ 126.00g/t (DGDH072-W4)

- Pepper Gold Prospect – new deepest intercept expands potential high-grade Resource extent:

- 13.50m @ 4.47g/t gold from 679.50m down-hole, incl. 0.5m @ 73.04g/t (DGDH073)

- Mineral Resource Estimate updates for the Never Never and Sly Fox Gold Deposits, as well as maiden standalone MRE’s for the Four Pillars, West Winds and Pepper Gold Prospects due for imminent release.

- Underground Exploration Drill Drive – finalisation of approvals and support activities for the underground development are well in train with development to commence in Q3 2024.

This release contains new assay results from recent surface drilling targeting the high-potential and very high-grade Pepper Gold Prospect, as well as the immediately adjacent and ever growing high-grade Never Never Gold Deposit.

Management Comment

Spartan Managing Director and Chief Executive Officer, Simon Lawson, said: “These latest intercepts demonstrate the incredible potential of what we have found right in front of our processing plant at Dalgaranga. With the Never Never Gold Deposit we have really shown what can happen with a change in mindset and the more recent discovery of the Pepper Gold Prospect has demonstrated that we are really onto something very special in this under-explored greenstone belt.

“Our drill teams are taking a well-earned rest at the moment while we catch up on the frantic pace of drilling and discovery. Our geology team is now finalising the new Mineral Resource Estimate to collate our drilling efforts in the first half of this calendar year and update the Spartan value proposition. While we take a brief drilling hiatus, we are planning and prioritising our second half exploration program so that we increase our momentum and keep driving the Spartan juggernaut forward!”

Click here for the full ASX Release

This article includes content from Spartan Resources, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

SPR:AU

The Conversation (0)

03 April 2024

Spartan Resources

Focused on Growing High-grade Gold Ounces in front of established infrastructure in Prolific Western Australia

Focused on Growing High-grade Gold Ounces in front of established infrastructure in Prolific Western Australia Keep Reading...

18h

Aurum Hits High-Grade Gold at Napie, Cote d'Ivoire

Aurum Resources (AUE:AU) has announced Aurum Hits High-Grade Gold at Napie, Cote d'IvoireDownload the PDF here. Keep Reading...

19h

Precious Metals Price Update: Gold, Silver, PGMs Fall on Escalating US-Iran War

Precious metals prices are down on potential for economic fallout from escalating US-Iran War.Volatility has returned to the precious metals market this past week. All eyes are on the breakout of a full-scale war across the Middle East prompted by a coordinated assault on Iran by the United... Keep Reading...

04 March

SSR Mining to Sell Çöpler Gold Mine Stake in US$1.5 Billion Deal

SSR Mining (NASDAQ:SSRM,TSX:SSRM,OTCPL:SSRGF) has agreed to sell its majority stake in the Çöpler gold mine in Turkey for US$1.5 billion in cash, shifting the company’s portfolio towards the Americas as the yellow metal continues to surge amid rising geopolitical tensions.The Denver-based miner... Keep Reading...

04 March

Blackrock Silver Announces the Appointment of Bernard Poznanski and Susan Mathieu to the Board of Directors

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") is pleased to announce the appointment of Bernard Poznanski and Susan Mathieu as independent directors to the Board of Directors of the Company (the "Board of Directors").In conjunction with... Keep Reading...

03 March

Fortune Bay: Exploration Underway, Fully Funded Program at the Goldfields Project in Saskatchewan

While Saskatchewan has long been recognized for uranium, its geology and historical exploration also make it a promising place for gold. Canadian company Fortune Bay (TSXV:FOR,OTCQB:FTBYF) seeks to maximize this potential with its flagship Goldfields project. Fortune Bay’s 100 percent owned... Keep Reading...

03 March

RUA GOLD Files 43-101 Technical Reports for the Reefton and Glamorgan Projects in New Zealand

Rua Gold INC. (TSX: RUA,OTC:NZAUF) (NZX: RGI) (OTCQX: NZAUF) ("Rua Gold" or the "Company") is pleased to announce the filing on SEDAR+ of independent Technical Reports for its Reefton Project ("Reefton Technical Report") on the South Island and Glamorgan Project ("Glamorgan Technical Report") on... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00