Nevada Silver Corporation ("NSC" or the "Company") (TSXV:NSC)(OTCQB:NVDSF) is pleased to provide a further update on assay results from the 2021 diamond drill program at its 100% owned Corcoran Silver-Gold project ("Corcoran" or the "Project") in Nevada, USA

NSC has received analytical results from five additional diamond (HQ) drill holes (CC21-17, CC21-02, CC21-03, CC21-13, and CC21-14) of the company's maiden drill campaign. Highlights include:

CC21-17

- 62.29 meters from 87.56 meters @94g/t AgEq (75g/t Ag, 0.25g/t Au)

Including: 1.14 meters @3542g/t AgEq (3470g/t Ag, 0.96g/t Au)

CC21-02

- 3.45 meters from 73.00 meters @ 163g/t AgEq (98g/t Ag, 0.87g/t Au)

- 26.60 meters from 98.27 meters @ 94g/t AgEq (75g/t Ag, 0.28g/t Au)

Including: 2.10 meters @832g/t AgEq (788g/t Ag, 0.59g/t Au)

CC21-03

- 65.82 meters from 8.18 meters @27g/t AgEq (10g/t Ag, 0.23g/t Au)

CC21-14

- 42.97 meters from 59.55 meters @56g/t AgEq (30g/t Ag, 0.35g/t Au)

Including: 8.30 meters @152g/t AgEq (96g/t Ag, 0.74g/t Au); and

7.27 meters @76g/t AgEq (65g/t Ag, 0.15g/t Au)

The results are from finalized assay data in NSC's recently completed 3,040-meter drilling program at the outcropping epithermal Corcoran Silver-Gold deposit located 80 miles north of Tonapah in southern Nevada.

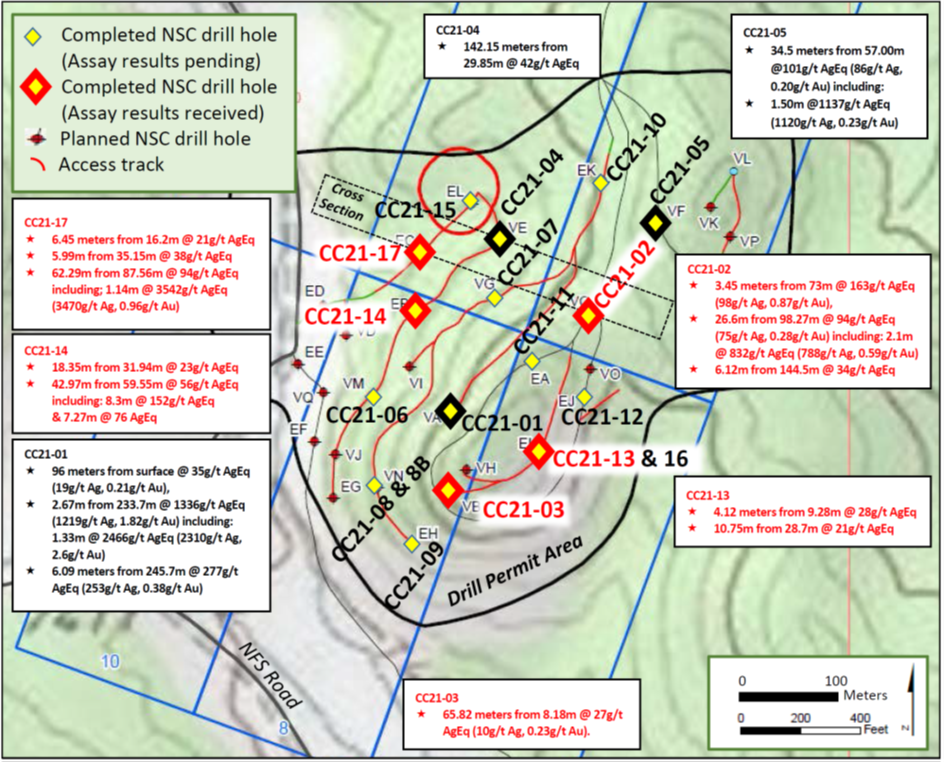

Mineralized intervals from holes CC21-01, CC21-04 and CC21-05 were recently reported (10th November 2021 and 15th December 2021) and the results from these together with the new data are summarized in Figure 1 and Table 1. Drill hole location data are provided in Table 2.

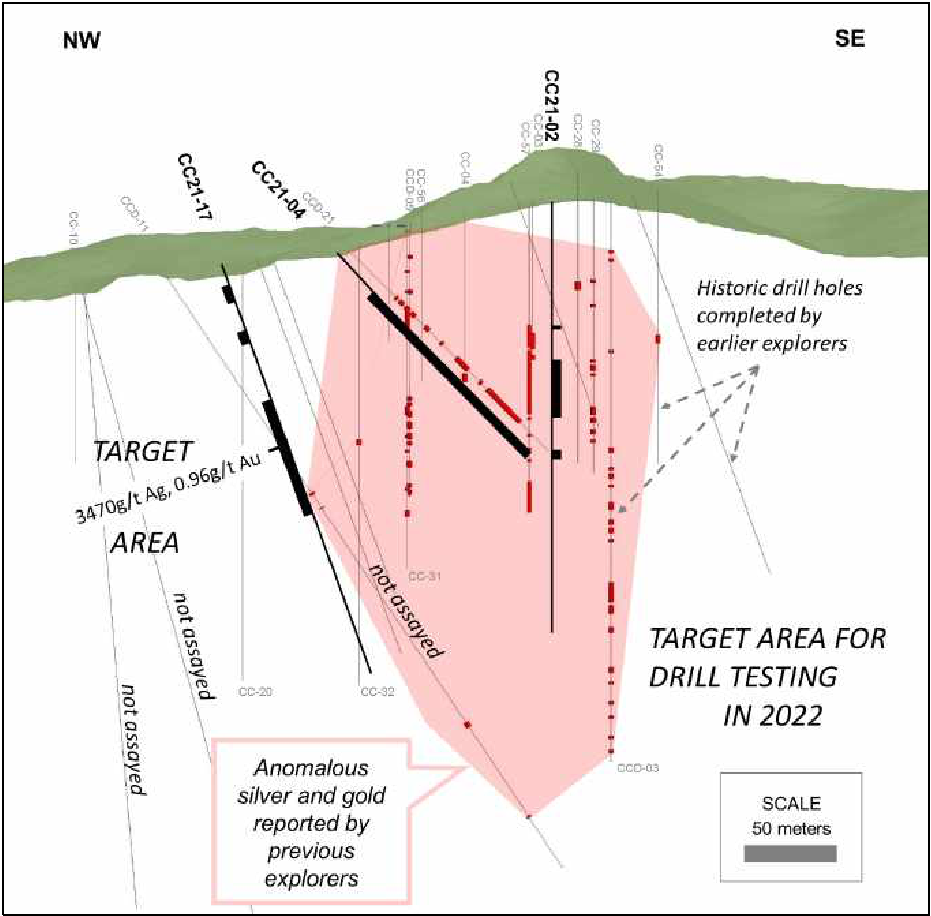

The collar of vertical drill hole CC21-02 is located midway between CC21-01 and CC21-05. The hole intersected a high-grade mineralized structural zone between 114.4-116.5 meters (832g/t AgEq) within a wide interval of lower-grade mineralization (26.6 meters of 94g/t AgEq). The CC21-02 intersections confirm the thick mineralized zone reported by a previous explorer in CC57 (Figure 2) and extend the anomalous silver zone in CC21-04 (142.15 meters of 42g/t AgEq) to the southeast where drilling planned in 2022 will test for depth extensions (Figure 2).

CC21-03 is located 80 meters south of CC21-01. This vertical hole intersected a thick interval of lower-grade gold-silver mineralization from near surface almost to the bottom of the hole which was completed to 75.74 meters.

CC21-13 was drilled at 70 degrees towards the southeast and the near-surface lower-grade mineralization in this hole is consistent with northwest dipping mineralization.

Figure 1. Drill hole location map of the Corcoran Ag-Au deposit showing completed NSC drill holes. New assay data for drill holes CC21-02, CC21-03 CC21-13, CC21-14 and CC21-17 are highlighted in red.

Both CC21-14 and CC21-17 were collared on the northern slopes of Sliver Reef Hill and drilled towards the southeast. Both holes intersected wide zones of silver-gold mineralization (61.32 meters of combined intervals of mineralization in CC-21-14 and 74.73 meters in CC21-17). These intercepts are interpreted as the approximate true thickness. They also show that near-surface mineralization extending to the northwest was not recorded by previous explorers (Figure 2) and this target area will be tested by planned drilling in 2022.

A bonanza-grade silver interval of 3470g/t silver and 0.96g/t gold in CC21-17 (between 117.41 meters and 118.55 meters) is the highest-grade silver result received to date for the 2021 drilling program.

The drill core assay results confirm the lateral extent of the deposit for more than 350 meters (SW-NE) and the mineralization trend remains open to the north and south as well as at depth.

Assay results for the remaining nine holes of the 2021 drill program are expected during coming weeks and will be reported after they are received.

NSC's CEO Gary Lewis commented, "All holes cut thick zones of near-surface silver and gold and have confirmed the continuity of mineralization over a trend extending for many hundreds of meters. The exceptional high silver grades in both CC21-02 and CC21-17 indicate widespread high values of silver with appreciable gold, relatively close to the surface. As geochemical results from the remaining holes are returned from the laboratory, we will have a much better idea of the orientation and continuity of structures which appear to host these bonanza grades."

Figure 2. Cross section showing drill traces for drill holes CC21-02, CC21-04 and CC21-17 with anomalous zones of silver. The location of this section is shown on Figure 1.

Figure 3. A portion of uncut wet HQ drill core in strongly fractured breccia between 114.40 - 116.50 meters (788g/t Ag, 0.59g/t Au) in drill hole CC21-02.

Table 1. Significant mineralized intervals in drill holes CC21-02, CC21-03, CC21-13, CC21-14 and CC21-17 (red) as well as previously reported data from CC21-01, CC21-04 and CC21-05

| Hole ID | From | To | Interval | Ag | Au | Ag grade x width | AgEq† |

meters | meters | meters | g/t | g/t | g/m | g/t | |

CC21-01 | 0 | 96.00 | 96.00 | 19 | 0.21 | 1824 | 35 |

including | 81.10 | 91.70 | 10.60 | 82 | 0.4 | 869 | 111 |

| 86.07 | 88.70 | 2.63 | 187 | 0.48 | 492 | 220 |

CC21-01 | 233.70 | 236.37 | 2.67 | 1219 | 1.82 | 3255 | 1336 |

including | 233.70 | 235.03 | 1.33 | 2310 | 2.6 | 3072 | 2466 |

CC21-01 | 245.67 | 251.76 | 6.09 | 253 | 0.38 | 1541 | 277 |

|

| ||||||

CC21-02 | 73.00 | 76.45 | 3.45 | 98 | 0.87 | 338 | 163 |

CC21-02 | 98.27 | 124.87 | 26.6 | 75 | 0.28 | 1995 | 94 |

including | 114.4 | 116.5 | 2.1 | 788 | 0.59 | 1655 | 832 |

CC21-02 | 144.5 | 150.62 | 6.12 | 12 | 0.29 | 73 | 34 |

|

| ||||||

CC21-03 | 8.18 | 74.00 | 65.82 | 10 | 0.23 | 658 | 27 |

|

| ||||||

CC21-04 | 29.85 | 172 | 142.15 | 13 | 0.38 | 1848 | 42 |

including | 29.85 | 44.5 | 14.65 | 4 | 0.62 | 59 | 51 |

including | 89.42 | 112.08 | 22.66 | 16 | 0.63 | 363 | 64 |

including | 132.5 | 149 | 16.5 | 57 | 0.41 | 941 | 87 |

|

| ||||||

CC21-05 | 57 | 91.5 | 34.5 | 86 | 0.2 | 2967 | 100 |

including | 70 | 71.5 | 1.5 | 1120 | 0.23 | 1680 | 1117 |

| |||||||

CC21-13 | 9.28 | 13.4 | 4.12 | 7 | 0.29 | 29 | 28 |

CC21-13 | 28.7 | 39.45 | 10.75 | 1 | 0.27 | 11 | 21 |

|

|

|

|

|

| 0 |

|

CC21-14 | 31.94 | 50.29 | 18.35 | 3 | 0.26 | 55 | 23 |

CC21-14 | 59.55 | 102.52 | 42.97 | 30 | 0.35 | 1289 | 56 |

including | 76.4 | 84.7 | 8.3 | 96 | 0.74 | 797 | 152 |

including | 113.51 | 120.78 | 7.27 | 65 | 0.15 | 473 | 76 |

|

|

|

|

|

|

|

|

CC21-17 | 16.2 | 22.65 | 6.45 | 6 | 0.2 | 39 | 21 |

CC21-17 | 35.15 | 41.14 | 5.99 | 20 | 0.23 | 120 | 38 |

CC21-17 | 87.56 | 149.85 | 62.29 | 75 | 0.25 | 4672 | 94 |

including | 117.41 | 118.55 | 1.14 | 3470 | 0.96 | 3956 | 3542 |

| Intervals are core length. True width of mineralization is unknown until more drill data is available. | |||||||

| Drill location, altitude, azimuth and dip of drill holes are provided in Table 2. | |||||||

| Quality control, Assay laboratory and analytical methods are detailed in the text of this report. | |||||||

| A cut-off grade of 20g/t silver equivalent (AgEq) has been applied to calculate the length-weighted intercepts. | |||||||

| Numbers are rounded. | |||||||

| † Silver equivalent values (AgEq) - Metal prices follow the NI 43-101 Resource report on the Corcoran Canyon Project by Mosher and Smith (October, 2020) which used USD1460/ounce gold and USD17/ounce silver as well as a cut-off grade of 20g/t AgEq which has been applied to these results. Precious metal recoveries off 98.2% Ag and 88.6% Au were determined by laboratory tests by ALS (USA) in December 2018 (reference RE18305962), the most recent metal recovery data available. AgEq has been calculated as follows: AgEq = (gold price/silver price) x (gold assay x 0.886) + (silver assay x 0.982). | |||||||

Table 2. Drill hole details for CC21-01 to CC21-05, CC21-13, CC21-14 and CC21-17

Drill hole | Drill collar location | Azimuth | Dip | Collar | Final | Start | Finish | |

WGS84 E | WGS84 N | degrees | degrees | meters | meters | |||

CC21-01 | 515611 | 4282554 | 0 | -90 | 2319 | 354.16 | 9/04/21 | 9/10/21 |

CC21-02 | 515745 | 428649 | 0 | -90 | 2324 | 245.66 | 9/11/21 | 9/16/21 |

CC21-03 | 515614 | 428475 | 0 | -90 | 2339 | 75.74 | 9/17/21 | 9/18/21 |

CC21- 04 | 515659 | 4282725 | 110 | -47.5 | 2295 | 217.62 | 9/19/21 | 9/25/21 |

CC21-05 | 515816 | 4282741 | 0 | -90 | 2343 | 166.72 | 9/26/21 | 9/30/21 |

CC21-13 | 515700 | 4282520 | 135 | -70 | 2337 | 345.00 | 10/29/21 | 10/30/21 |

CC21-14 | 515579 | 4282656 | 125 | -70 | 2290 | 187.40 | 10/31/21 | 11/02/21 |

CC21-17 | 515582 | 4282712 | 135 | -70 | 2288 | 214.90 | 11/11/21 | 11/13/21 |

Quality Assurance, Sampling and Assay Determinations

The diamond drilling was undertaken by Falcon Drilling, Inc, Nevada, using industry standard equipment and procedures. All drill core was HQ size. Drilling supervision and drill core logging and sampling was carried out by Ethos Geological, Inc under the direction of Mr Scott Close (President and Chief Geologist, Ethos Geological).

Drill hole orientation, down-hole survey data and collar coordinates were routinely gathered and drill core was logged (geological and geotechnical) and photographed prior to sampling. Drill core samples were collected at variable lengths (averaging 1 meter) and saw-sampled on-site prior to storage in a secure compound.

Collected intervals including quality control samples (duplicates, blanks and international standards) were forwarded by secure freight to ALS Chemex Labs, Inc in Reno, NV. Analytical procedures used four acid ICP-AES (code ME-ICP61) for silver and 32 elements and additional assays for ore-grade samples (Ag-OG62, ME-OG62). High silver grades (over 1500g/t Ag) were determined using fire assay method Ag-GRA21.

Qualified Person

The scientific and technical data contained in this news release was reviewed and approved by Ian James Pringle PhD, who is a Qualified Person under National Instrument 43-101 Standards of Disclosure for Mineral Projects.

For further Information please contact:

Gary Lewis

Group CEO & Director

T: +1 (416) 941 8900

gl@nevadasilvercorp.com

About Nevada Silver Corporation

Nevada Silver Corporation (TSXV: NSC) (OTCQB: NVDSF) is a multi-commodity resource company with two exploration projects in the USA. NSC's principal asset is the Corcoran Silver-Gold Project in Nevada. In addition, NSC has management and ownership rights over the Emily Manganese Project in Minnesota, which has been the subject of considerable technical studies, with US$24 million invested to date. Both Corcoran and Emily have been the subject of National Instrument 43-101 compliant mineral resource estimates.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Information

This news release contains "forward-looking information" and "forward-looking statements" (collectively, "forward-looking information") within the meaning of applicable securities laws. Forward-looking information is generally identifiable by use of the words "believes," "may," "plans," "will," "anticipates," "intends," "could", "estimates", "expects", "forecasts", "projects" and similar expressions, and the negative of such expressions.

Forward-looking information is subject to known and unknown risks, uncertainties and other factors that may cause the Company's actual results, level of activity, performance or achievements to be materially different from those expressed or implied by such forward-looking information, including, without limitation, risks as a result of the Company having a limited operating history and may have a wide variance from actual results, risks concerning the ability to raise additional equity or debt capital to continue its business, uncertainty regarding the inclusion of inferred mineral resources in the mineral resource estimate which are too speculative geologically to be classified as mineral reserves, uncertainty regarding the ability to convert any part of the mineral resource into mineral reserves, uncertainty involving resource estimates and the ability to extract those resources economically, or at all, uncertainty involving exploration (including drilling) programs and the Company's ability to expand and upgrade existing resource estimates, risks involved in any future regulatory processes and actions, risks from making a production decision (if any) without any feasibility study completed on the Company's properties, risks applicable to mining exploration, development and/or operations generally, and risk as a result of the Company being subject to certain covenants with respect to its activities by creditors, as well as other risks.

Forward-looking information is based on the reasonable assumptions, estimates, analysis and opinions of management made in light of its experience and perception of trends, current conditions and expected developments, and other factors that management believes are relevant and reasonable in the circumstances at the date such statements are made. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated. There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such information. Accordingly, readers should not place undue reliance on forward-looking information.

All forward-looking information herein is qualified in its entirety by this cautionary statement, and the Company disclaims any obligation to revise or update any such forward-looking information or to publicly announce the result of any revisions to any of the forward-looking information contained herein to reflect future results, events or developments, except as required by law.

SOURCE: Nevada Silver Corporation

View source version on accesswire.com:

https://www.accesswire.com/683103/Nevada-Silver-Corporation-Hits-3470gt-Silver-in-Drilling-at-Its-Corcoran-Silver-Gold-Project-Nevada-USA