April 21, 2022

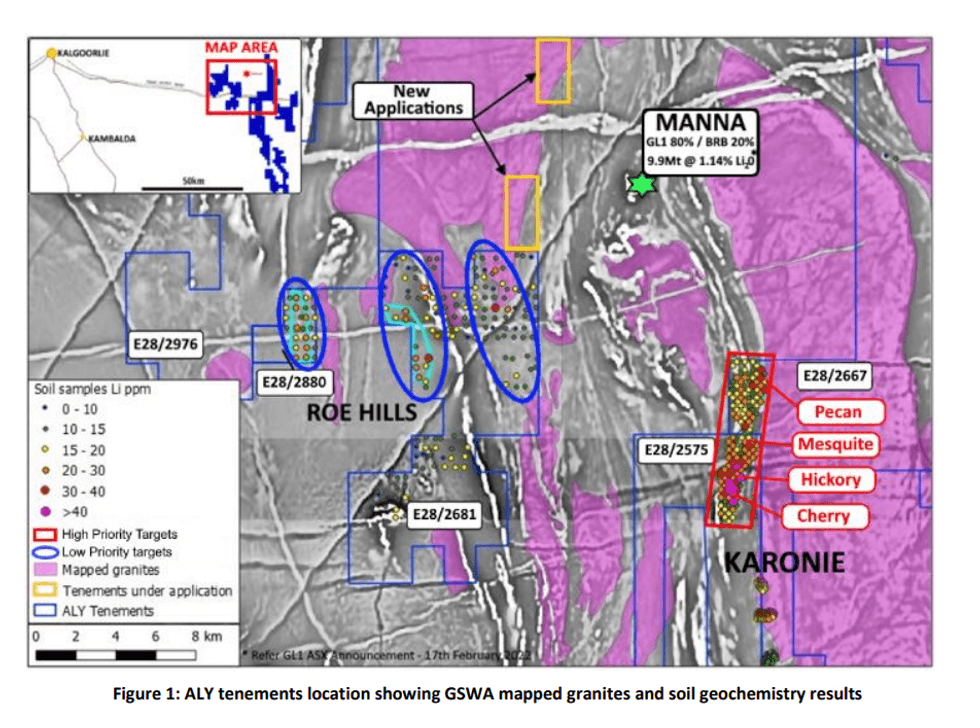

Alchemy Resources Limited (ASX: ALY) (“Alchemy” or “the Company”) is pleased to announce it has identified a new coherent lithium and pathfinder elements anomalous corridor at its 100% owned Karonie Gold Project located east of Kalgoorlie in Western Australia. The tenements sit contiguous and 8km along strike of the Manna Lithium Deposit owned by Global Lithium Resources Limited and Breaker Resources NL (ASX: GL1 80%, ASX:BRB 20%).

HIGHLIGHTS

- An in-depth review of multi-element soil and drillhole geochemistry sampling data has highlighted areas of lithium and coincident indicator anomalism at the 100% owned Karonie tenements 110km east of Kalgoorlie.

- The multi-element signatures of these soil anomalies are consistent with possible hard rock lithium mineralisation associated with lithium-caesiumtantalum (LCT) type pegmatites.

- Lithium and pathfinder anomalism defined over an area of 7km x 1km at the new “Pecan, Mesquite, Hickory and Cherry Prospects”.

- New anomalies sit 8km along strike and within contiguous tenure to Global Lithium Resources Limited’s (ASX: GL1) 80% owned Manna Lithium deposit (9.9Mt @ 1.14% Li20 1 ).

- Ground truthing of anomalies has discovered outcropping pegmatites with up to 1km length which were not previously mapped by Geological Survey of WA (GSWA).

- 4 new high priority lithium targets to test over an initial 7km x 1km zone of anomalism.

Chief Executive Officer Mr James Wilson commented: “The lithium and pathfinder anomalism identified by Alchemy’s soil sampling and recent rock chipping in proximity to Manna are an encouraging start. Mapping by our geologists has shown pegmatites in outcrop along strike of Manna which is made more significant by the fact that there’s been no pegmatites mapped in this region before. The geochemical review reaffirms the prospectivity of our large tenement package at Karonie in what has historically only ever seen gold and base metals exploration. Work is continuing to identify the other intrusive dykes in the vicinity through a program of detailed mapping and sampling.”

NEW LITHIUM PROSPECT IDENTIFICATION – CHERRY, HICKORY, MESQUITE AND PECAN

Alchemy conducted multi-element soil sampling at Pecan/Mesquite/Hickory/Cherry on a 400x400m offset grid (Figure 1, RHS) and formed part of a multi-commodity review. The analysis of lithium and pathfinder elements shows a strong pattern of anomalism over 7km long x 1km wide (Figure 2) with the northern zone having increasing levels of surface cover which could have obscured outcrops. Alchemy’s KZ5 deposit2 located in the southern portion and adjacent to Cherry Prospect is a gold deposit which is believed to be VMS hosted mineralisation with significant drilling being undertaken by Alchemy in 2021. The areas of lithium soil anomalism to the east of the KZ5 gold deposit have never been drill-tested.

The areas sit within the prospective “Goldilocks Zone”, a defined corridor in which LCT pegmatite exist. The zone lies outboard of the granitic terrain and within the greenstone belts.

Alchemy geologists have since conducted initial ground truthing of the anomalies which has revealed outcropping pegmatites at Hickory Prospect and was traced over 1km along strike (Figure 3). A second pegmatite outcrop was mapped at Cherry Prospect (Figure 3). Importantly, GSWA mapping had not mapped the pegmatite outcrops recently identified by Alchemy.

Click here for the full ASX Release

This article includes content from Alchemy Resources Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

ALY:AU

The Conversation (0)

19 February

Top Australian Mining Stocks This Week: Lithium Valley Results Boost Gold Mountain

Welcome to the Investing News Network's weekly round-up of the top-performing mining stocks listed on the ASX, starting with news in Australia's resource sector.Mining giant BHP (ASX:BHP,NYSE:BHP,LSE:BHP) reported strong half-year copper results, saying that its copper operations accounted for... Keep Reading...

17 February

Howard Klein Doubles Down on Strategic Lithium Reserve as Project Vault Takes Shape

Before the Trump administration revealed plans for Project Vault, Howard Klein, co-founder and partner at RK Equity, proposed the idea of a strategic lithium reserve. “The goal of a strategic lithium reserve is to stabilize prices and allow the industry to develop,” he told the Investing News... Keep Reading...

17 February

Sigma Lithium Makes New Lithium Fines Sale, Unlocks US$96 Million Credit Facility

Sigma Lithium (TSXV:SGML,NASDAQ:SGML) has secured another large-scale sale of high-purity lithium fines and activated a production-backed revolving credit facility as it ramps up operations in Brazil.The lithium producer announced it has agreed to sell 150,000 metric tons (MT) of high-purity... Keep Reading...

12 February

Albemarle Lifts Lithium Demand Forecast as Energy Storage Surges

Albemarle (NYSE:ALB) is raising its long-term lithium demand outlook after a breakout year for stationary energy storage, underscoring a shift in the battery materials market that is no longer driven solely by electric vehicles.The US-based lithium major reported fourth quarter 2025 net sales of... Keep Reading...

21 January

Official signing of the Portuguese State Grant

Savannah joins other grant recipient companies at official signing ceremony

Savannah Resources Plc, the developer of the Barroso Lithium Project in Portugal, a 'Strategic Project' under the European Critical Raw Materials Act and Europe's largest spodumene lithium deposit (the 'Project'), was delighted to join with other recipients of State grants yesterday at the... Keep Reading...

21 January

Excellent Results from 2025 Core Drilling Program at McDermitt

Jindalee Lithium Limited (Jindalee, or the Company; ASX: JLL, OTCQX: JNDAF) is pleased to report assay results from the drilling program at the McDermitt Lithium Project completed late 2025. All holes returned strong lithium and magnesium intercepts from shallow depths, including:R92: 36.5m @... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00