- WORLD EDITIONAustraliaNorth AmericaWorld

May 08, 2023

Alvo Minerals Limited (ASX: ALV) (“Alvo” or the “Company”) is pleased to provide an update on its ongoing regional exploration program across the Palma Project (“Palma” or “the Project”) located in Central Brazil.

HIGHLIGHTS

- First comprehensive regional exploration program at Palma VMS Project identifies three high-priority near drill-ready targets through a combination of auger geochemistry sampling and geophysical surveys

- Urubu: FLEM survey results show an extensive and coherent conductor with similar conductive and thickness values to C3, which closely coincides with the soil geochemistry and IP results

- C5: Coincident soil sampling and IP anomalies, with historical CPRM reports referencing a single mineralised hole; to be followed up with FLEM surveys

- Condor: Auger geochemical anomaly to be followed up with IP

- Exploration to date has focused on only two of more than 20 late-time conductors identified through the VTEM survey flown in 2008 covering over 60km of prospective strike

- In-house equipment purchases of mechanical auger drill rig, Electromagnetic (“EM”), Induced Polarisation (“IP”) and X-Ray Fluorescence analysing (“XRF”) allows for flexible, fast and efficient exploration to progress targets

- First pass auger geochemical drilling planned at the new Afla VMS Project (earn-in recently announced 28 March 2023), covering the existing roads and open fence lines

- In CY2023 Alvo aims to incorporate Phase 1 & 2 drilling into expanding and upgrading the Palma Project MRE of 4.6Mt @ 1.0% Cu, 3.9% Zn, 0.4% Pb & 20g/t Ag

- Phase 1 drilling successfully confirmed and extended high-grade mineralisation at the C1 and C3 deposits, exceeding both grade and thickness expectations

- Ongoing Phase 2 extensional drilling at C1 and C3 (completed) testing conductors identified by DHEM surveys that highlight the potential to significantly expand known mineralisation

- Ongoing assessment of synergistic opportunities in proximity Palma to expand Alvo’s project portfolio

Rob Smakman, Alvo’s Managing Director commented on the exploration underway at Palma:

"Exploration is accelerating, we are generating and refining prospects with the clear aim of making new discoveries in CY2023. Regional prospects are being advanced through auger geochemistry and geophysics that is efficient and low-cost exploration through our use of in-house equipment.

Whilst Phase 2 diamond drilling is ongoing at the C1 deposit following the successful program at C3, we have delivered exciting advances at regional prospects; Urubu, C5, Afla, Condor and C1 South.

We are confident we will soon have a pipeline of new prospects to the stage where we are compelled to drill.”

Palma Regional Exploration Strategy

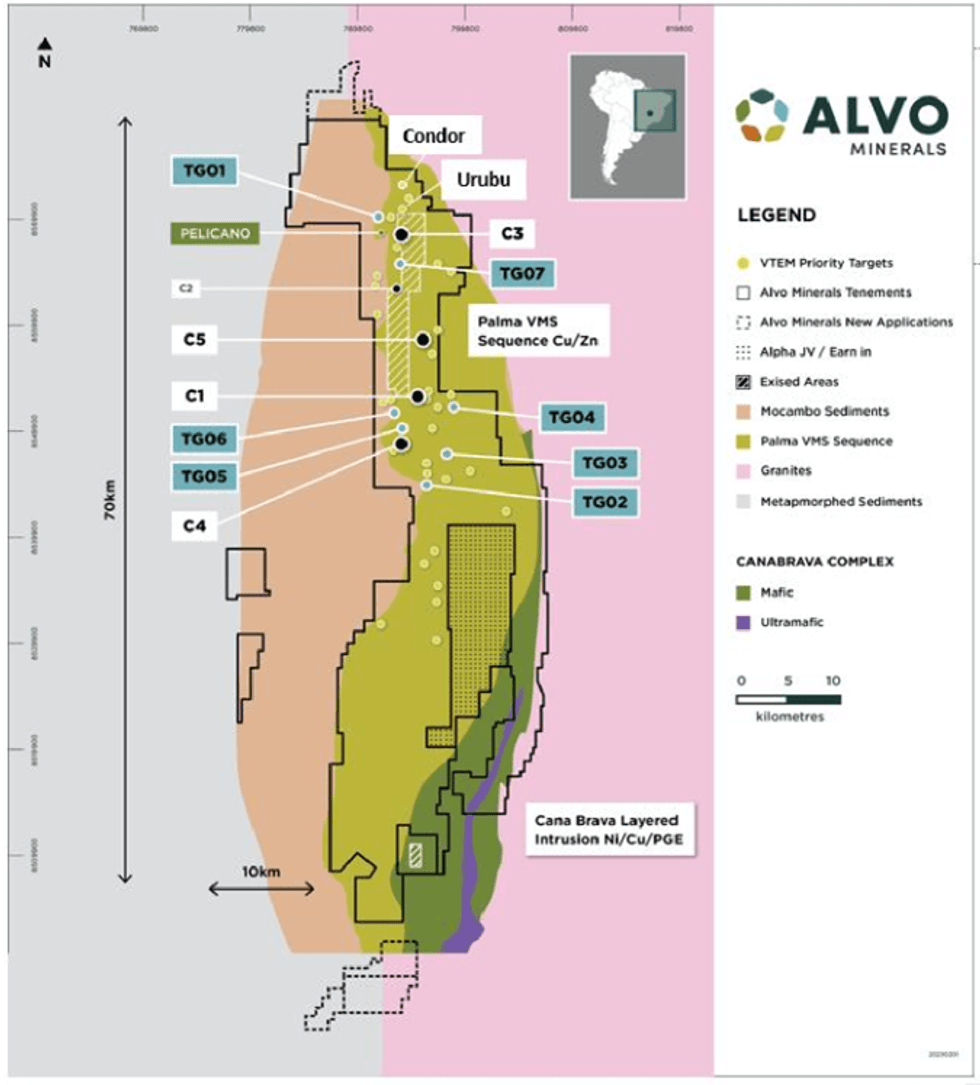

Alvo is advancing a regional exploration program across the Palma Project which covers over 850km2 of contiguous and highly prospective ground in a known Volcanogenic Massive Sulphides (“VMS”) district. The district is >80% controlled by Alvo has been largely idle for over 30 years since polymetallic mineralisation was first discovered in the 1970s. Exploration by the Brazilian Geological Survey (CPRM) was paused in the mid 1980’s, after which no modern exploration has been undertaken. Alvo firmly believes the large, highly prospective and under-explored district is an extraordinary opportunity to make new discoveries by applying modern and systematic exploration programs.

Exploration in CY2022 largely focused on successfully delivering exceptional results at the Company’s existing deposits, C1 and C3. These two existing deposits are only two of more than 20 late-time conductors identified through the VTEM survey flown in 2008 that covers over 60km of prospective strike.

VMS deposits typically occur in clusters, where multiple deposits can be located in similar geological districts. These districts can host tens of VMS deposits that range in size from less than 1Mt to exceeding 100Mt.

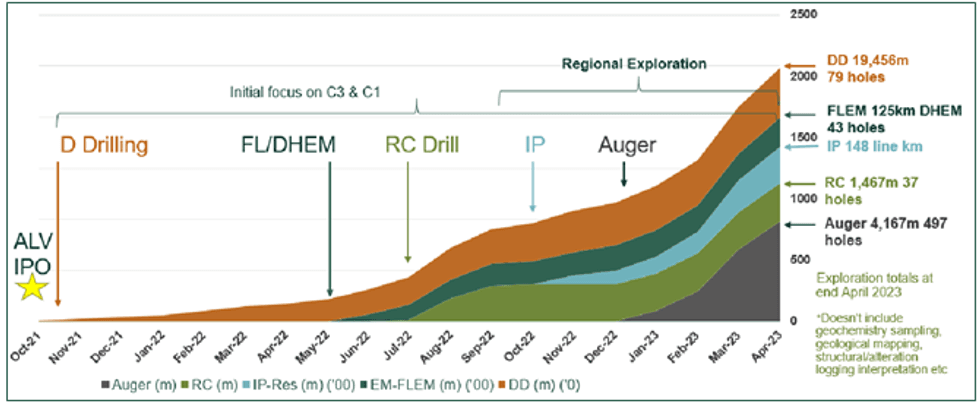

Since estimating the Maiden Mineral Resource Estimate1 (“MRE”) at IPO in 2021 of 4.6Mt @ 1.0% Cu, 3.9% Zn, 0.4% Pb & 20g/t Ag (based on historical drill results completed by the CPRM), Alvo has completed >19,500m of diamond drilling and 1,467m of Reverse Circulation (“RC”) drilling. In addition, the Company has completed extensive geological logging, multiple geophysical surveys (IP, FLEM and DHEM) and completed over 4,100m of regional auger geochemical drilling across the 70+ km of prospective geology.

This information gathered has enhanced Alvo’s technical team’s knowledge and understanding of the Palma VMS district, enabling the team to continue effective exploration across the regional target area.

Exploration work is underway across multiple prospects with the aim of advancing a pipeline of prospects to drill-ready status. Field activities including geological mapping, soil sampling, auger geochemical drilling (“Auger”), IP surveys and fixed loop electromagnetic surveys (“FLEM”) are being undertaken concurrently on various prospects within the district. Sampling (soils, trenching and auger geochemistry) is typically processed in Alvo’s core shed where preparation includes drying (several drying ovens have been built), screening and then samples are tested with a hand-held XRF. Utilising the Company’s in-house equipment allows for flexible, fast and efficient exploration that is significantly less expensive than contracted exploration, as the only material expense is labour.

Urubu Prospect – Possible Northern Extension of C3 Deposit

Exploration at the Urubu prospect has been ongoing over the last few months with recent data combining into a compelling near drill-ready exploration target. In Figure 3 below, a combined image of soil geochemistry and a series of IP surveys demonstrates the potential for Urubu to be an offset northern extension of the C3 deposit. The soil geochemical anomaly is weaker than C3, however transported cover in drainage (alluvium) inhibits effective soil sampling so auger geochemistry will be utilised.

Click here for the full ASX Release

This article includes content from Alvo Minerals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

ALV:AU

The Conversation (0)

08 August 2022

Alvo Minerals

District-Scale Copper-Zinc VMS Project in Brazil

District-Scale Copper-Zinc VMS Project in Brazil Keep Reading...

3h

Glencore Signs MOU with Orion Consortium on Potential US$9 Billion DRC Asset Deal

Glencore (LSE:GLEN,OTCPL:GLCNF) has entered into preliminary talks with a US-backed investment group over the potential sale of a major stake in two of its flagship copper and cobalt operations in the Democratic Republic of Congo (DRC).In a joint statement, Glencore and the Orion Critical... Keep Reading...

03 February

Drilling Ramping-up Following Oversubscribed Fundraise

Critical Mineral Resources plc (“CMR”, “Company”) is pleased to report that following the recently completed and heavily oversubscribed fundraise, diamond drilling with two rigs is ramping-up over the coming weeks as the weather improves. Drilling during H1 is designed to produce Agadir... Keep Reading...

02 February

Rick Rule: Oil/Gas Move is Inevitable, but Copper is Next Bull Market

Rick Rule, proprietor at Rule Investment Media, is positioning in the oil and gas sector, but thinks a bull market is two or two and a half years away. In his view, copper is likely to be the next commodity to begin a bull run.Click here to register for the Rule Symposium. Don't forget to follow... Keep Reading...

02 February

BHP Expands 2026 Xplor Program with Record 10 Companies

Mining major BHP (ASX:BHP,NYSE:BHP,LSE:BHP) has named the early stage explorers selected for its 2026 Xplor program, expanding the intake to a record 10 companies.According to a Monday (February 2) press release, the latest cohort is the largest since the initiative launched in 2023, surpassing... Keep Reading...

30 January

Top 5 Canadian Mining Stocks This Week: Vangaurd Mining Gains 141 Percent

Welcome to the Investing News Network's weekly look at the best-performing Canadian mining stocks on the TSX, TSXV and CSE, starting with a round-up of Canadian and US news impacting the resource sector.Statistics Canada released November’s gross domestic product (GDP) data on Friday (January... Keep Reading...

30 January

Quarterly Activities and Cashflow Report

Redstone Resources (RDS:AU) has announced Quarterly Activities and Cashflow ReportDownload the PDF here. Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00