January 20, 2025

Dundas Minerals Limited (ASX: DUN) (“Dundas Minerals”, “Dundas” or “the Company”) is pleased to announce highly encouraging 1 metre sample assay results from its recently completed drilling campaign within granted Mining Lease M 24/974 (‘’Rockland’’), at the Windanya Gold Project.

Highlights

- High grade gold assays from individual 1 metre samples include:

- 6m @ 3.3g/t gold from 78m, including 1m @7.5g/t from 78m, 1m @7.1g/t from 83m (24RKRC005)

- 5m @ 2.3g/t gold from 109m, including 1m @8.1g/t from 113m (24RKRC013)

- 2m @ 5.6g/t gold from 74m, including 1m @9.4g/t from 74m (24RKRC015)

- 2m @ 2.8g/t gold from 130m, including 1m @5.2g/t from 130m (24RKRC022)

- 1m @14.9g/t gold from 80m (24RKRC015)

- 9m @ 1.4g/t gold from 69m (24RKRC012)

- 5m @ 1.4g/t gold from 65m (24RKRC019)

- Assay results indicate a new gold mineralised zone within the Rockland ML at the Windanya Gold Project

- An approximate 1km long trend of significant gold mineralisation

- Detailed three dimensional modelling of these latest results is in progress, and will provide the foundation to plan follow-up drilling

- Assay results from recently completed RC drilling at the Baden-Powell Gold Project are expected within two weeks

Dundas is actively exploring for gold at the Windanya and Baden- Powell gold projects, located adjacent to the Goldfields Highway ~60km north of Kalgoorlie, Western Australia, and ~15km north of the Paddington gold mill.

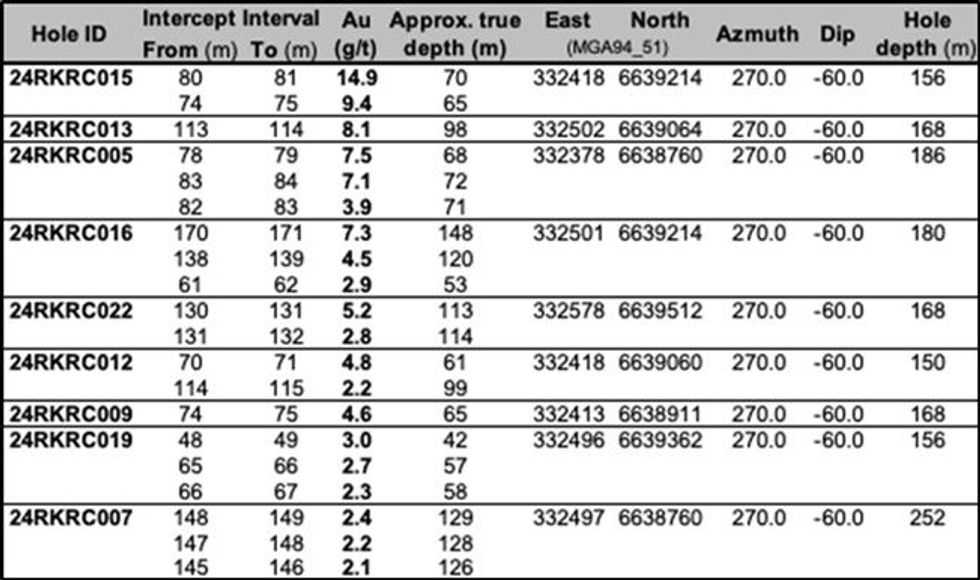

Assay results from 1 metre sample intervals – Rockland

On 12 December 2024, Dundas Minerals announced the discovery of a new 1 km zone of gold mineralisation from its maiden RC drilling program at Rockland, based on assay results from 4 metre composite samples. Subsequently, individual 1 metre samples relating to the mineralised portions of drill holes were submitted for assay.

Results from these assays highlighted multiple intercepts of high grade gold mineralisation at Rockland, with several gold grades significantly higher than the initial composite samples.

Of the 1 metre samples that were submitted, twenty returned gold assays of greater than 2g/t (Table 1), and 67 samples returned gold assays of between 0.5g/t and 2g/t. Significant gold assay results (above 1 gram per tonne) are provided in Appendix 1.

Importantly, these latest assay results confirms the approximate 1km long trend of significant gold mineralisation at Rockland, and indicates a new gold mineralised zone located between the historic Milford and Windanya North prospects. The mineralisation spans the entire length of the granted Mining Lease, and potentially extends north to the Aquarius gold deposit.

Mineralisation comprises an oxide supergene zone in the deeply weathered mafic host lithologies, above a series of stacked structures interpreted to dip shallowly to moderately to the east in the transitional to fresh rock. As illustrated in Figure 1, gold mineralisation is interpreted as trending north – south, which is consistent with the regional trend.

Detailed three dimensional modelling of these latest results is in progress to assess the orientation of mineralisation in fresh rock (below the oxide zone) and will provide the foundation to plan follow-up drilling.

Commenting on the one metre gold assays from the Rockland drilling, Dundas managing director Shane Volk said:

‘’As indicated by the assay results from the initial 4-metre composite samples, results from these 1- metre samples confirm the presence of wide-spread gold mineralisation within the granted Rockland Mining Lease. In many instances the mineralisation is at relatively shallow depth (100 metres or less), with some very nice high grade results returned in several holes – up to 14.9 grams per tonne.’’

‘’Three dimensional modelling of these latest results is in progress. The latest drilling results, combined with available historical drill data within the lease will enable us to make an updated interpretation of the mineralisation trend and develop an exploration model to assist with the planning of further exploration both within the highly prospective M 24/974 and the broader Windanya Gold Project area.’’

Background: Rockland Mining Lease

On 8 October 2024, Dundas Minerals announced that it had executed an exclusive 12-month option to acquire 100% of granted mining lease (ML) M24/974 (Rockland).

Rockland is strategically situated between the Aquarius and Scorpio gold prosects (Figure 1), where on 6 February 2024, Dundas announced high grade gold intercepts from an initial drilling program, including: Aquarius (3m @ 10.2 g/t from 109m; 2m @ 6.5g/t from 70m); and Scorpio (2m@ 3.2 g/t from 9m; 1m @ 6.5g/t from 49m).

The area comprising the Rockland ML has been subject to historic shallow drilling during the 1980s, which was mostly to a maximum depth of 50m (RAB). Also, a series of RAB holes to a maximum depth of ~90m was drilled in the early 2000s, plus 12 RC holes at the Windanya North prospect. More recently the current tenement owner drilled 3 RC holes at depths between 140m and 173m, also at Windanya North. However, the drilling recently completed by Dundas Minerals is the first to systematically test for gold mineralisation at Rockland to depths beyond 50m.

Click here for the full ASX Release

This article includes content from Dundas Minerals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

5h

Ole Hansen: Next Gold Target is US$6,000, What About Silver?

Ole Hansen, head of commodity strategy at Saxo Bank, believes US$6,000 per ounce is in the cards for gold in the next 12 months; however, silver may not enjoy the same price strength. "If gold moves toward US$6,000, I would believe that ... silver at some point will struggle to keep up, and... Keep Reading...

5h

Kinross’ Great Bear Gold Project Accelerated Under Ontario’s 1P1P Framework

Ontario is moving to accelerate one of Canada’s largest emerging gold projects, cutting permitting timelines in half for Kinross Gold's (TSX:K,NYSE:KGC) Great Bear development in the Red Lake district.The province announced that Great Bear will be designated under its new One Project, One... Keep Reading...

6h

Massan Indicated Conversion Programme Continues to Deliver

Asara Resources (AS1:AU) has announced Massan indicated conversion programme continues to deliverDownload the PDF here. Keep Reading...

12h

Winston Tailings: Traxys Letter of Interest Signed

Panther Metals PLC (LSE: PALM), an exploration company focused on mineral projects in Canada, is pleased to announce that it has signed a letter of interest ("LOI") with Traxys Europe SA, a division of Traxys Group ("Traxys"), a global commodity trading and marketing market leader.The... Keep Reading...

13h

Selta Project - Exploration Update

Rare-Earth Element Stream Sediment Sampling Results and Target Refinement

First Development Resources plc (AIM: FDR), the UK-based, Australia-focused exploration company with mineral interests in Western Australia and the Northern Territory, is pleased to provide results and interpretation from the December 2025 stream sediment sampling programme completed at its... Keep Reading...

13h

Drilling preparation commenced at Roy on the Sunbeam Property

First Class Metals PLC ("First Class Metals" "FCM" or the "Company") the UK listed company focused on the discovery of economic metal deposits across its exploration properties in Ontario, Canada, is pleased to provide an update on preparations for the forthcoming drill programme at the Roy... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00