September 08, 2021

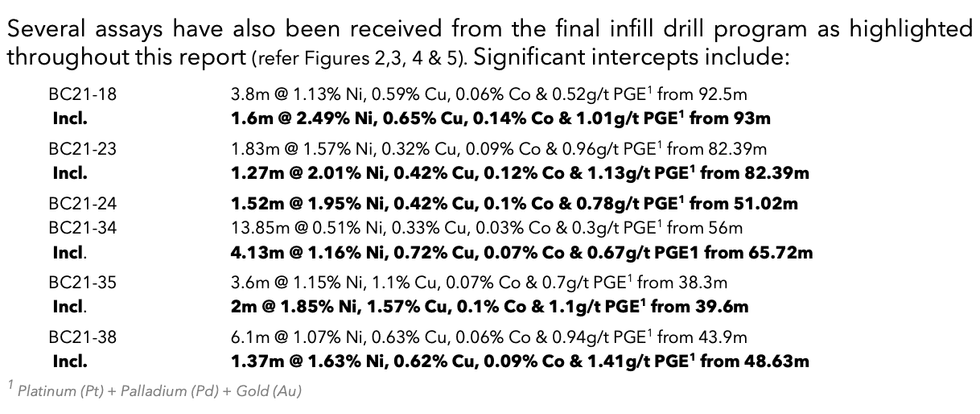

Blackstone Minerals Limited ("Blackstone" or the "Company") is pleased to provide an update on infill drilling at Ban Chang, the most advanced massive sulfide vein (MSV) target at the Ta Khoa Nickel – Copper- PGE Project in Northern Vietnam (refer Table 3, Table 4 & Appendix 1). Highlights include 5.35m of massive sulfide nickel intersected in drill hole BC21-66 (refer Image 1, Table 1 & Figure 6).

Blackstone Minerals' Managing Director Scott Williamson commented: "We look forward to presenting a maiden resource at Ban Chang and incorporating the successful outcomes of infill drilling into a mine plan as part of our Upstream Business Unit PFS. Drilling at Ban Chang is tightly spaced and has consistently intersected massive sulfide mineralisation, providing a high level of confidence as we progress through the next phases of mine development."

Ban Chang MSV Project

Ban Chang is located 2.5km south-east of the existing processing facility and the Ban Phuc DSS deposit adjacent to the Chim Van – Co Muong fault system. The prospect geology consists of massive and disseminated sulfides (DSS) hosted within a tremolitic dyke swarm which intruded into phyllites, sericite schists and quartzites of the Devonian Ban Cai Formation (refer Figure 1).

The known dyke swarm is approximately 900m long and varies between 5 and 60 meters wide. The dykes and massive sulfide are interpreted to be hosted within a splay (and subsidiary structures) off the major regional Chim Van – Co Muong fault system.

Drilling at Ban Chang has identified multiple massive sulfide lenses, which are often associated with broader disseminated sulfide zones. Preliminary mining studies suggest that Ban Chang is amenable to a modern mechanised underground mining.

As part of the ongoing work for the Upstream Business Unit (UBU) Pre-feasibility Study (PFS), Ban Chang is being assessed as an ore source for the existing 450ktpa concentrator and/or as a feedstock that complements processing of disseminated sulfide ore (i.e., from Ban Phuc) for the larger proposed concentrator.

Click here for the full ASX release.

BSX:AU

The Conversation (0)

25 July 2025

Blackstone Minerals

A diversified developer of battery-grade nickel and copper-gold assets in Southeast Asia

A diversified developer of battery-grade nickel and copper-gold assets in Southeast Asia Keep Reading...

27 January

Quarterly Activities/Appendix 5B Cash Flow Report

Blackstone Minerals (BSX:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

28 December 2025

Managing Director Resignation and Board Changes

Blackstone Minerals (BSX:AU) has announced Managing Director Resignation and Board ChangesDownload the PDF here. Keep Reading...

24 October 2025

Quarterly Activities/Appendix 5B Cash Flow Report

Blackstone Minerals (BSX:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

27 August 2025

BSX Secures JV Partner & Funding for Ta Khoa Nickel Project

Blackstone Minerals (BSX:AU) has announced BSX Secures JV Partner & Funding for Ta Khoa Nickel ProjectDownload the PDF here. Keep Reading...

25 August 2025

Trading Halt

Blackstone Minerals (BSX:AU) has announced Trading HaltDownload the PDF here. Keep Reading...

04 February

FPX Nickel Reports Confirmatory Results from Geotechnical Drilling at the Baptiste Nickel Project

FPX Nickel Corp. (TSX-V: FPX, OTCQX: FPOCF) ("FPX" or the "Company") is pleased to report assay results from select drill holes completed during its 2025 engineering field investigation program at the Baptiste Nickel Project ("Baptiste" or the "Project") in central British Columbia.As previously... Keep Reading...

08 January

Nickel Market Recalibrates After Explosive Trading Week

Nickel prices stabilized on Thursday (January 8) after a turbulent week that saw the market swing sharply higher before retreating as traders reassessed the balance between existing supply risks and a growing overhang of inventory.Three-month nickel on the London Metal Exchange (LME) hovered... Keep Reading...

05 January

Nusa Nickel Corp. Provides 2025 Year-End Corporate Update and 2026 Outlook

Nusa Nickel Corp. is pleased to provide a year-end update highlighting key achievements in 2025 and outlining strategic priorities for 2026 as the Company continues to build a vertically integrated nickel business in Indonesia.2025 Year-End Highlights-Successfully advanced into production during... Keep Reading...

22 December 2025

Nickel Price Forecast: Top Trends for Nickel in 2026

Nickel prices were stagnant in 2025, trading around US$15,000 per metric ton (MT) for much of the year.Weighing heavily on the metal was persistent oversupply from Indonesian operations. Meanwhile, sentiment remained weak amid soft demand growth from the construction and manufacturing sectors,... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Equity Metals Exhibiting at the 2026 PDAC

06 February

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00