- WORLD EDITIONAustraliaNorth AmericaWorld

May 29, 2024

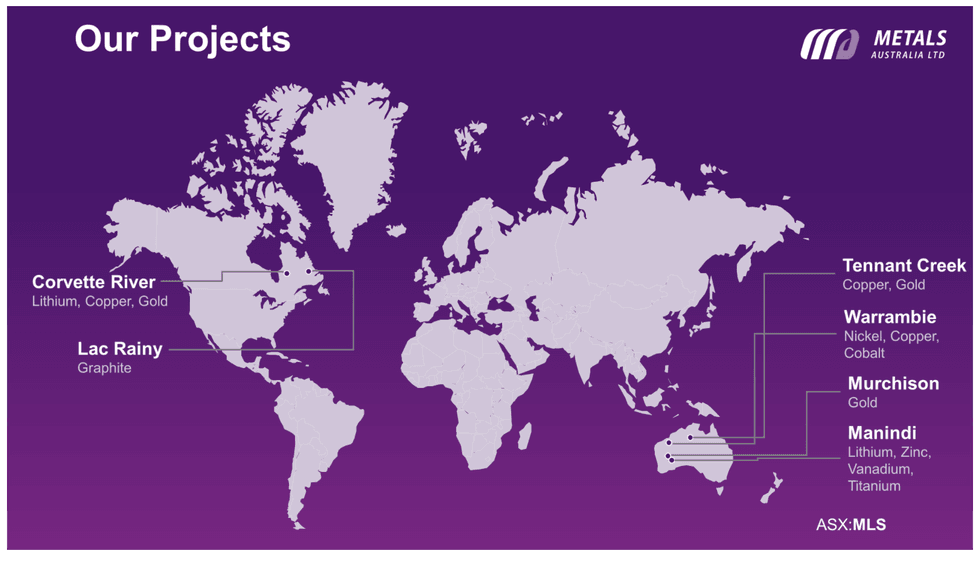

Metals Australia (ASX:MLS) rapidly advances its high-quality portfolio of advanced battery minerals and metals projects in Tier 1 mining jurisdictions of Western Australia and Canada. Comprised of two critical minerals projects in Quebec, Canada, the portfolio includes the Lac Carheil flake graphite project and the Corvette River lithium (and gold) project. The company also explores four other projects in Australia: Tennant Creek (copper-gold) in the Northern Territory and Warrambie (lithium, nickel-copper, gold), Murchison (gold) and Manindi (lithium, vanadium-titanium, zinc) – all in Western Australia.

Metals Australia is progressing with its flagship Lac Carheil flake graphite project in Quebec, Canada. Lac Carheil is well-positioned to supply high-quality graphite products, including battery-grade graphite to the North American market – including for lithium-ion and EV battery production. The company has planned a drilling program to test new high-grade zones identified from the sampling program, which will form the basis for upgrading the existing Lac Carheil mineral resource.

Location of Metals Australia’s projects in the Tier 1 Mining Jurisdictions in Quebec, Canada and Australia’s Western Australia and the Northern Territory.

The Lac Carheil graphite project in eastern Quebec, Canada has access to excellent infrastructure, including hydroelectric power facilities. The project hosts an existing JORC 2012 mineral resource of 13.3 million tons (Mt) @ 11.5 percent graphitic carbon, which was announced in 2020 and a scoping study was completed and reported on in early 2021.

Company Highlights

- Metals Australia is rapidly advancing its flag ship Lac Carheil Graphite Project in Quebec, Canada. In addition, the company has a suite of high-quality exploration projects – including Lithium, Gold and Silver in Quebec, Canada and Lithium, Gold, Copper & Vanadium in Western Australia (WA) and the Northern Territory (NT).

- All projects are in Tier-1 mining jurisdictions (Canada and Australia) with world-class prospectivity and stable geo-politically.

- The company has six key exploration and development projects:

- two in Canada: the Lac Carheil high-grade flake graphite project and the Corvette River lithium and gold-silver-copper exploration project, and,

- four in Australia: Warrambie (lithium, nickel-copper, gold), Murchison (gold) and Manindi (lithium, vanadium-titanium, zinc-silver) in WA, and Tennant Creek (Warrego East copper-gold) in the NT.

- The focus is to rapidly advance its flagship Lac Carheil Graphite Project towards development. A drilling program is already contracted to substantially increase the existing JORC 2012 Mineral Resource of 13.3 Mt @ 11.5 percent graphitic carbon (Cg) and test the potential of the many other identified high-grade graphite trends.

- The 2020 Scoping Study on Lac Carheil based on the existing resource, representing only 1km of drilling out of the total 36kms of identified graphite trends, indicates a 14-year mine life with a production of 100,000 tons per annum and a pre-tax NPV @ 8 percent of US$123 million (~AUD$190 million).

- There are multiple catalysts at Lac Carheil in the near term including a pre-feasibility study (PFS) (underway), a scoping study on downstream battery (anode) - grade graphite production, and planned drilling aiming to at least double the resource as well as test other identified high-grade graphite trends.

- Furthermore, other projects in Canada including the Corvette River lithium and gold targets, and exploration in Australia at Manindi, Warrambie, Murchison and Warrego – are all seeing active progress.

- The company is well-funded to complete all its planned exploration and project studies. The cash position at the end of Q1 2024 was AU$17.86 million.

- Metals Australia is led by a seasoned board and management team possessing extensive mining sector experience and a proven track record of successful discoveries and project developments. With funding in place, the company is well-positioned to capitalise on growth prospects.

This Metals Australia profile is part of a paid investor education campaign.*

Click here to connect with Metals Australia (ASX:MLS) to receive an Investor Presentation

MLS:AU

Sign up to get your FREE

Metals Australia Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

02 July 2025

Metals Australia

High-quality graphite development project with an accelerated pathway to production, complemented by a diversified portfolio of critical, precious and base metals assets in tier-1 jurisdictions across Canada and Australia.

High-quality graphite development project with an accelerated pathway to production, complemented by a diversified portfolio of critical, precious and base metals assets in tier-1 jurisdictions across Canada and Australia. Keep Reading...

17 February

High Grade Assays Verify the Emerging Manindi VTM Project

Metals Australia (MLS:AU) has announced High Grade Assays Verify the Emerging Manindi VTM ProjectDownload the PDF here. Keep Reading...

29 January

Quarterly Activities/Appendix 5B Cash Flow Report

Metals Australia (MLS:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

27 January

Graphite Project Links to Quebec's Critical Minerals Plan

Metals Australia (MLS:AU) has announced Graphite Project Links to Quebec's Critical Minerals PlanDownload the PDF here. Keep Reading...

18 December 2025

High Copper Anomalies Show Deeper Potential at Warrego East

Metals Australia (MLS:AU) has announced High Copper Anomalies Show Deeper Potential at Warrego EastDownload the PDF here. Keep Reading...

16 December 2025

Titanium-Vanadium-Magnetite Discovery Extended over 1km

Metals Australia (MLS:AU) has announced Titanium-Vanadium-Magnetite Discovery Extended over 1kmDownload the PDF here. Keep Reading...

4h

Iyan Deposit Delivers Further Significant Graphite Intercepts from Surface in the Final Release of Assays

Final Assay Batch Again Reinforces Bulk Blending Strategy, Resource Growth and Imminent JORC

Blencowe Resources Plc (LSE: BRES) is pleased to report the final set of assay results completed from the 87 shallow holes drilled at the Iyan deposit, part of the Company's Orom-Cross Graphite Project in Uganda. These results represent the third batch from the Stage 7 drilling programme, with... Keep Reading...

18 February

US Slaps Higher Tariffs on Chinese Graphite Imports After Final Commerce Determination

The US Department of Commerce has sharply increased trade penalties on Chinese graphite anode materials, concluding that producers in China engaged in unfair pricing and subsidy practices that harmed the US market.In a final determination issued February 11, 2026, Commerce raised countervailing... Keep Reading...

27 January

Top 5 Canadian Graphite Stocks (Updated January 2026)

Graphite stocks and prices have experienced volatility in recent years recently due to bottlenecks in demand for electric vehicles, as graphite is used to create lithium-ion battery anode materials. One major factor experts are watching is the trade war between China and the US.China introduced... Keep Reading...

09 December 2025

Greenland Government Grants Exploitation Licence for Amitsoq

GreenRoc Strategic Materials Plc (AIM: GROC), a company focused on the development of critical mineral projects in Greenland, is delighted to announce that the Government of Greenland has granted an Exploitation Licence for the Amitsoq Graphite Project to Greenland Graphite a/s ("Greenland... Keep Reading...

30 November 2025

Altech - Board Renewal and Strategic Focus

Altech Batteries (ATC:AU) has announced Altech - Board Renewal and Strategic FocusDownload the PDF here. Keep Reading...

Latest News

Sign up to get your FREE

Metals Australia Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00