February 20, 2025

Targeting high-demand copper-gold projects, Metal Bank (ASX:MBK) offers a compelling investment opportunity by exploring assets in Australia, Saudi Arabia and Jordan. The company focuses on optimizing and divesting the Livingstone gold project to generate capital for expanding its copper projects in the Middle East. Metal Bank's strong regional presence, particularly in Saudi Arabia and Jordan, is underpinned by deep industry relationships and extensive operating experience.

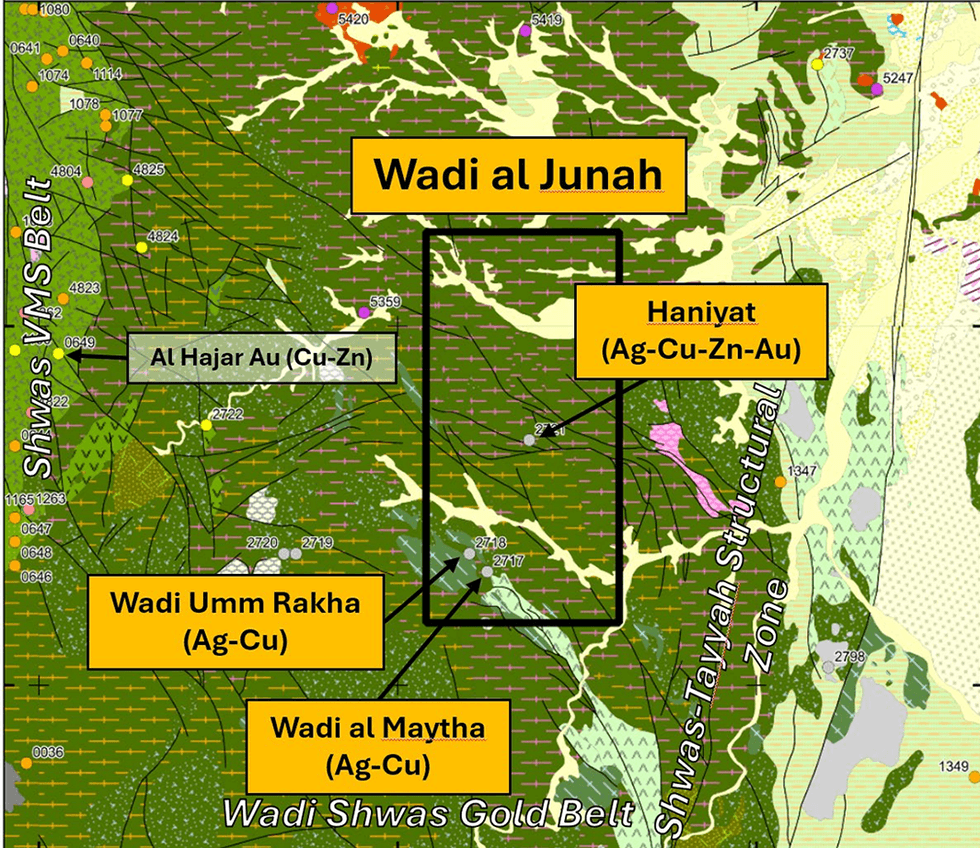

The company is securing copper and other critical minerals projects in Saudi Arabia, through its joint venture company, Consolidated Mining Company (CMC). CMC is 60 percent owned by MBK and 40 percent by Central Mining Holding Company. Its first project, Wadi Al Junah, has been awarded exploration licences in November 2024.

Wadi Al Junah is a joint venture through Consolidated Mining Company (CMC, MBK 60 percent). Exploration activities include regional geochemical surveys, surface mapping, and shear-zone anomaly identification. Phase 1 drilling is planned for Q2 2025.

Company Highlights

- Strategically focused on copper exploration and development, leveraging extensive experience and partnerships in the MENA region. Aiming for long-term growth from copper assets.

- Focused on the Livingstone gold project divestment, with ongoing JORC resource optimization, and strong corporate acquisition interest. If divested, proceeds are earmarked to fast-track exploration on the company’s copper projects.

- Expanding in Saudi Arabia by progressing the Wadi Al Junah copper project through a joint venture with Central Mining Holding Company.

- Disciplined capital allocation approach focused on low overheads and in-ground exploration investment.

- The company’s leadership team brings a proven track record in Saudi Arabia and Australia of exploration success and project execution, positioning the company for long-term value creation in the critical minerals market.

This Metal Bank profile is part of a paid investor education campaign.*

Click here to connect with Metal Bank (ASX:MBK) to receive an Investor Presentation

MBK:AU

Sign up to get your FREE

Metal Bank Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

19 February 2025

Metal Bank

Copper and gold-focused exploration in Australia and the Middle East

Copper and gold-focused exploration in Australia and the Middle East Keep Reading...

27 January

Quarterly Cash Flow Report

Metal Bank (MBK:AU) has announced Quarterly Cash Flow ReportDownload the PDF here. Keep Reading...

27 January

Quarterly Activities Report

Metal Bank (MBK:AU) has announced Quarterly Activities ReportDownload the PDF here. Keep Reading...

15 December 2025

Maiden Gold Resource for Seven Leaders Starter Pit

Metal Bank (MBK:AU) has announced Maiden Gold Resource for Seven Leaders Starter PitDownload the PDF here. Keep Reading...

26 November 2025

Millennium Drilling Commenced

Metal Bank (MBK:AU) has announced Millennium Drilling CommencedDownload the PDF here. Keep Reading...

16 November 2025

HAS:Drilling-High Grade Gold Mineralisation at Seven Leaders

Metal Bank (MBK:AU) has announced HAS:Drilling-High Grade Gold Mineralisation at Seven LeadersDownload the PDF here. Keep Reading...

18h

Flow Metals to Acquire the Monster IOCG Project in Yukon

Flow Metals Corp. (CSE: FWM) ("Flow Metals" or the "Company") is pleased to report that it has entered into an option agreement dated February 9, 2026 (the "Option Agreement") with Go Metals Corp. ("Go Metals") to acquire the Monster IOCG project (the "Monster Project"), located approximately 90... Keep Reading...

09 February

Investor Presentation

Aurum Resources (AUE:AU) has announced Investor PresentationDownload the PDF here. Keep Reading...

09 February

Dr. Adam Trexler: Physical Gold Market Broken, Crisis Unfolding Now

Dr. Adam Trexler, founder and president of Valaurum, shares his thoughts on gold, identifying a key issue he sees developing in the physical market. "There's a crisis in the physical gold market," he said, explaining that sector participants need to figure out how to serve investors who want to... Keep Reading...

09 February

Trevor Hall: Bull Markets Don’t Always Mean Big Returns

Clear Commodity Network CEO and Mining Stock Daily host Trevor Hall opened his talk at the Vancouver Resource Investment Conference (VRIC) with a strong message: It is still possible to go broke in a bull market.“I want to start with the simple but uncomfortable truth: most investors don't lose... Keep Reading...

09 February

How Near-term Production is Changing the Junior Gold Exploration Model

Junior gold companies have traditionally been defined by exploration: identifying prospective ground, drilling to delineate a resource and, ideally, monetising that discovery through a sale or joint venture with a larger producer. While this model has delivered success in the past, changing... Keep Reading...

09 February

Gold Exploration in Guinea: An Emerging Opportunity in West Africa

While much of West Africa’s gold exploration spotlight has historically fallen on countries like Ghana and Mali, Guinea is increasingly emerging as a quiet outlier — a country with proven gold endowment, expansive underexplored terrain and a growing number of active exploration programs. Despite... Keep Reading...

Latest News

Sign up to get your FREE

Metal Bank Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00