October 07, 2024

Celsius Resources Limited (“CLA” or “Celsius”) (ASX, AIM: CLA) is pleased to announce that its Philippine affiliate, Makilala Mining Company, Inc. (“MMCI or the “Company”), has entered into a partnership agreement with the Technical Education and Skills Development Authority(“TESDA”) to develop local community skills for its flagship Maalinao-Caigutan-Biyog Copper�Gold Project (“MCB” or the “Project”).

HIGHLIGHTS

- Memorandum of Agreement signed between Makilala Mining Company, Inc., Celsius’ Philippine Affiliate, and the Regional Technical Education and Skills Development Authority to develop and enhance the skills of the host and neighboring communities’ workforce for employment and business opportunities during the construction and operations of the MCB Project

The Memorandum of Agreement (MOA) which was signed on 3 October 2024 aims to maximise the participation and build the capacity of qualified individuals from the local community for employment and business opportunities in preparation for the early works development anticipated to start this year and subsequently construction and operations of the MCB Project.

As a government agency mandated to provide technical manpower skills to the country’s workforce, the partnership is in line with TESDA’s Technical-Vocational Education and Training (TVET) Program1 goals of developing ‘world-class competence and positive work values’ among the Filipino workforce. It also aligns with MMCI’s synergistic approach for the efficient use of resources to achieve common goals.

Celsius Sustainability Director Attilenore Manero, said:

“Our partnership with TESDA is an important step towards empowering the local community by providing practical skills training that equips residents to better participate in the opportunities presented by the MCB Mining Project. This initiative helps ensure that community members are prepared to take advantage of job and business opportunities, thus fostering long-term growth.”

“This collaboration supports the national goal of building a skilled workforce that can contribute to the country’s sustainable economic growth. It also strengthens the project’s social foundations by optimising community engagement and reinforcing our belief that sustainable growth and community well-being can go hand-in-hand striking a balance between our economic objectivesand social development objectives.”

Under the Community-Based Skills Training Program, MMCI and TESDA Cordillera Administrative Region (TESDA-CAR) will jointly design, develop, and implement training programs that meet national competency standards and the requirements of the MCB Project.

Following the signing of the MOA, MMCI and TESDA-CAR will develop a workplan outlining the necessary human, material, and financial resources to effectively and efficiently operationalisethe agreement. Initially, the training program will prioritise construction skills such as carpentry, masonry, construction painting, tile setting, formworks installation, welding, reinforcing steel works, and plumbing.

Signing of the Memorandum of Agreement between Makilala Mining Company, Inc. and the Technical Education and Skills Development Authority with Kalinga Provincial Governor Hon. James S. Edduba

(From left to right: Ms. Procerphina P. Pacaydo, TESDA Kalinga Acting Provincial Director; Ms. Attilenore P. Manero, MMCI Corp. Affairs and Sustainability Director; Atty. Balmyrson M. Valdez, TESDA-CAR Regional Director; Hon. Alfredo B. Malannag, Jr., Pasil Municipal Mayor; Fr. Alberto Maiyao, Sr., Balatoc Council of Elders Chairperson; Peter Hume, MMCI Director;Sherwin C. Bali, Cordillera Institute of Technical Education-Kalinga Campus Administrator)

The Conversation (0)

2h

Jeff Clark: Gold Bull Market Running, These Stocks Getting Rewarded Now

Jeff Clark, founder of the Gold Advisor, shares his outlook for gold and silver.

However, he emphasizes that he's less concerned about prices and more interested in making sure his portfolio is prepared to weather global uncertainty.

That means having exposure to physical metal, as well as stocks.

Don't forget to follow us @INN_Resource for real-time updates!

Securities Disclosure: I, Charlotte McLeod, hold no direct investment interest in any company mentioned in this article.

Keep reading...Show less

6h

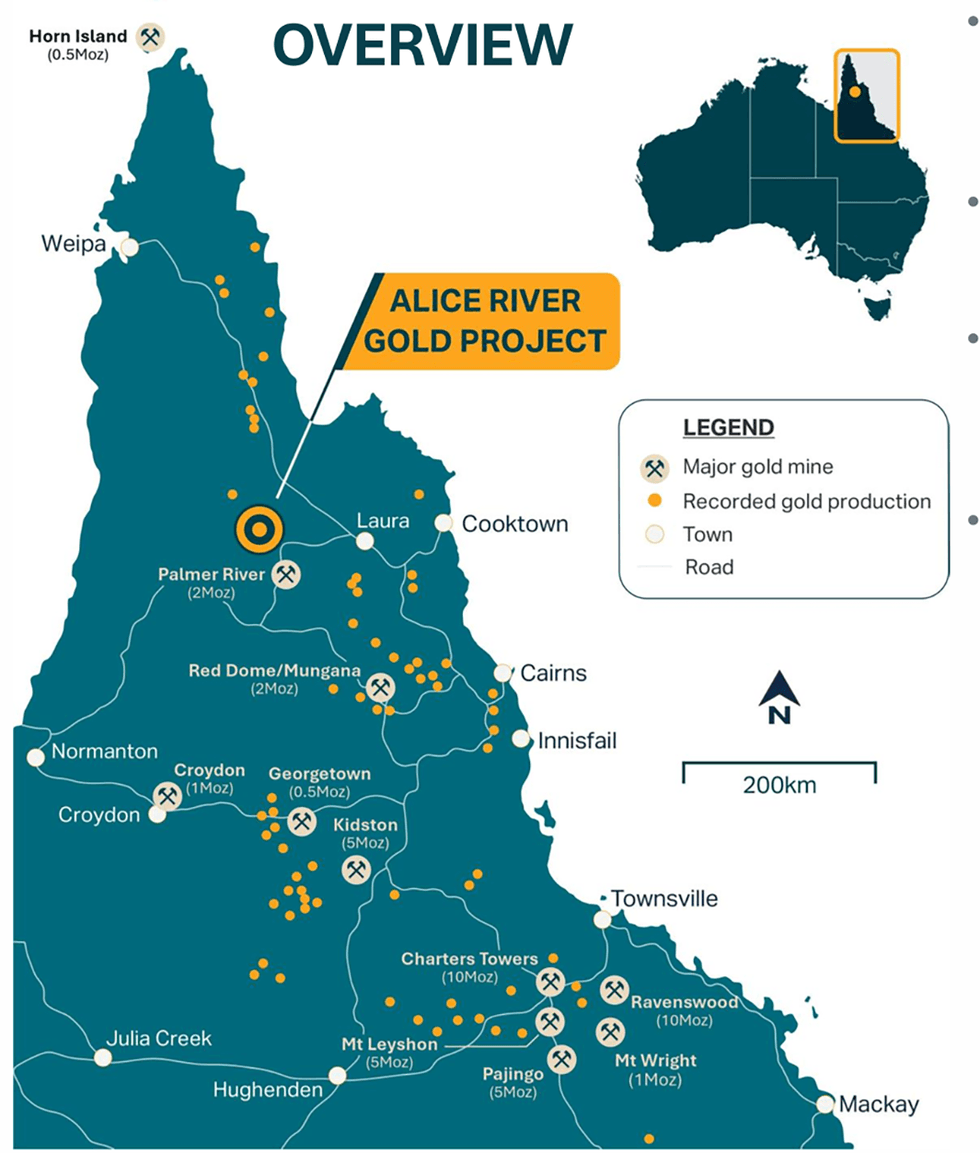

Pacgold: Advancing the Alice River Gold Project in Northern Queensland with Tier 1 Discovery Potential

Pacgold (ASX:PGO) is an Australian gold exploration company advancing the high-potential Alice River Gold Project in Northern Queensland. Led by a technically driven and experienced team with proven success across exploration, resource development, and capital markets, Pacgold is applying a systematic, discovery-focused approach to unlock the project’s value.

The company holds a dominant 377 sq km land package, including eight mining leases, along the highly prospective Alice River Fault Zone (ARFZ) — a major structural corridor interpreted to host an intrusion-related gold system analogous to globally significant deposits such as Fort Knox (USA) and Hemi (WA).

The Alice River Gold Project is a large-scale, greenstone-hosted gold system located in Northern Queensland, centered along the regionally significant Alice River Fault Zone (ARFZ). The project covers 377 sq km of contiguous tenure, including eight granted mining leases.

Pacgold controls over 30 km of strike length along the ARFZ — a major crustal-scale structure that has only recently been the focus of systematic exploration using modern techniques, offering significant untapped discovery potential.

Company Highlights

- District-scale Discovery Potential: Pacgold controls more than 377 sq km of tenure and more than 30 km of strike length across the Alice River Fault Zone (ARFZ), a fertile, underexplored structural corridor in Northern Queensland.

- Maiden Resource: In May 2025, the company published a 474,000 oz gold mineral resource estimate (MRE), covering just five percent of the total strike, confirming high-grade mineralization and strong potential for expansion.

- Aggressive Exploration Strategy: More than 10,000 metres of RC drilling campaign is underway, complemented by air-core and diamond programs, aimed at growing the Central Zone resource and testing multiple regional targets.

- Attractive Valuation Entry: With a market capitalization of just ~AU$10 million and an EV of AU$8.5 million (as of Q1 2025), Pacgold provides a low-cost entry into a potentially Tier 1 gold system.

- Experienced Leadership: The board includes proven mine developers and discovery geologists with prior success at Chalice, AngloGold Ashanti, BHP and Sibanye-Stillwater.

This Pacgold profile is part of a paid investor education campaign.*

Click here to connect with Pacgold (ASX:PGO) to receive an Investor Presentation

Keep reading...Show less

19h

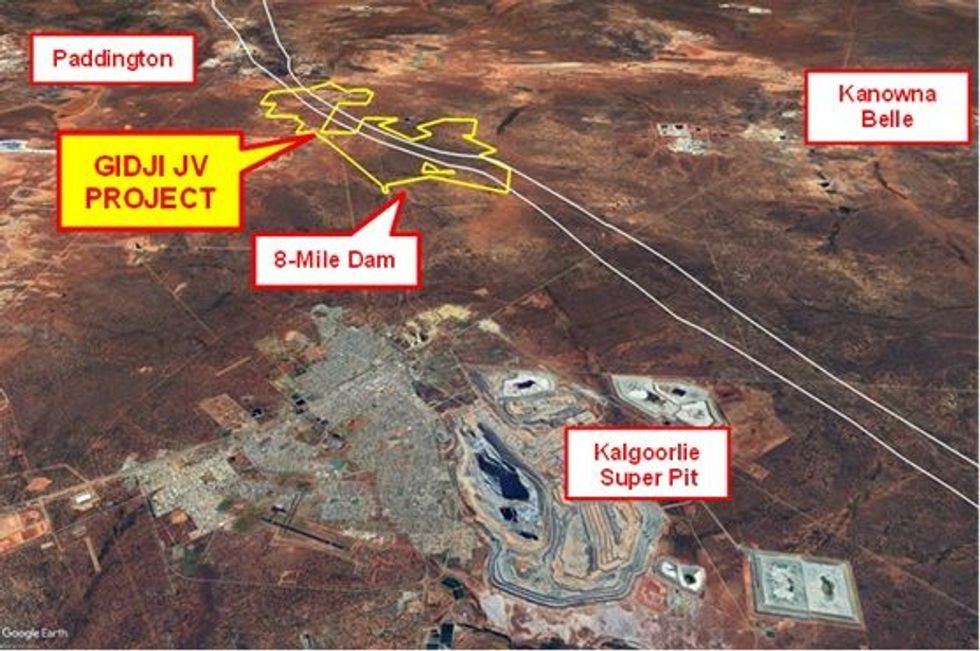

High-Grade Gold Discovery in First 8 Mile Drill Hole

Miramar Resources Limited (ASX:M2R, “Miramar” or “the Company”) is pleased to announce that the first RC drill hole at the 8 Mile target has intersected high-grade gold and ended in mineralisation.

- First RC hole at 8 Mile discovers high-grade gold and ends in mineralisation

- 8 Mile gold mineralisation extends 75m north of tenement boundary

The 8 Mile target is located within the Gidji JV Project (“Gidji” or “the Project”), approximately 15 kilometres north of Kalgoorlie and surrounded by multiple gold mining and processing operations, including Northern Star Resources Limited’s (“NST”) Kalgoorlie gold operations (Figure 1).

The 8 Mile Target is located immediately adjacent to NST’s “8-Mile Dam” gold deposit which, according to the most recent publicly available data, contains an estimated 7Mt @ 1.4g/t Au for 313,977 ounces1.

A limited number of fast-tracked results from the first RC hole, GJRC029, show a wide zone of gold mineralisation with a similar tenor to 8 Mile Dam (18m @ 0.94g/t Au from 480m including 1m @ 6.04g/t Au), approximately 75m north of the tenement boundary, and ended in mineralisation (3m @ 0.52g/t Au).

The Company is awaiting assay results from the remainder of the hole which are expected in 2-3 weeks.

Miramar’s Executive Chairman, Mr Allan Kelly, said the Company was excited to see gold mineralisation continuing onto Miramar’s ground for a significant distance.

“This is the first time we have discovered significant gold mineralisation on our side of the fence, even though the drill hole didn’t end up exactly where we planned it to. The flip side of this is that we have extended the strike of gold mineralisation for over 100m on to our tenements,” he said.

“We’ve also demonstrated a relationship between the IP anomalism and gold mineralisation, which makes the other IP anomalies we have outlined at Gidji even more prospective,” he said.

GJRC029 aimed to test an Induced Polarisation (IP) anomaly on the tenement boundary interpreted to represent the sulphide-rich gold mineralisation seen at the neighbouring 8 Mile Dam Deposit.

GJRC029 was collared approximately 10m north of the tenement boundary and mirrored MPGD008, a diamond hole drilled down-dip approximately 40m south of the tenement boundary by KCGM in 2013 and which intersected significant gold mineralisation related to the 8 Mile mafic unit.

Unfortunately, GJRC029 deviated significantly from the planned azimuth and, as a result, by the time the hole was terminated at the target depth of 504m, the drill trace ended up approximately 75m north of the tenement boundary (Figure 2). Despite this, the hole intersected a thick section of the steep westerly- dipping and highly altered 8 Mile mafic unit with widespread sulphide mineralisation, including disseminated magnetite and coarse-grained arsenopyrite, pyrrhotite and chalcopyrite, similar to the 8 Mile Dam Deposit (Figure 3).

Based on visual logging of RC drill chips, handheld portable XRF results and magnetic susceptibility measurements, samples from the bottom 56m of the hole were sent for priority analysis by fire assay at Bureau Veritas in Kalgoorlie.

The results from these initial samples confirm the relationship between the gold mineralisation and sulphides, and a relationship between the best gold mineralisation and coincident magnetic anomalism and elevated Arsenic as measured by handheld portable XRF. The first results also confirm that the IP anomaly is associated with potentially significant gold mineralisation, whilst the significant deviation of GJRC029 away from the planned target increases the potential strike length of gold mineralisation on Miramar’s ground.

Significant results are listed in Table 1, with assay results from the remainder of the hole expected in coming weeks.

The initial RC drilling programme, which also tested two other IP targets, is nearing completion and results will be reported once received and compiled.

Once all assays are received, the Company will plan further RC and/or diamond drill holes including to test the dip and strike extent of the mineralisation intersected in GJRC029.

The Company advises that the WA Department of Mines, Petroleum and Exploration (DMPE) has extended the main Gidji JV tenement, E26/214, for a further five years, and will now expire in March 2030.

Click here for the full ASX Release

This article includes content from Miramar Resources Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

Keep reading...Show less

23h

Rob McEwen: Gold to Go "Much Higher," Mining Stock Mania Not Here Yet

Rob McEwen, chairman and chief owner of McEwen Inc. (TSX:MUX,NYSE:MUX), outlines his gold price outlook as well as future plans for his company.

"If I look at history and the cycles gold has gone through, we have all the ingredients needed to drive it much higher," he told the Investing News Network.

Don't forget to follow us @INN_Resource for real-time updates!

Securities Disclosure: I, Charlotte McLeod, hold no direct investment interest in any company mentioned in this article.

Keep reading...Show less

23h

Gold to Hit US$4,000, Driver for Next Leg Up — West Red Lake's Shane Williams

Shane Williams, CEO, president and director at West Red Lake Gold Mines (TSXV:WRLG,OTCQB:WRLGF), shares his thoughts on gold's path to US$4,000 per ounce.

"It's established a base, and now as that new institutional money begins to move into gold, that's where I think we'll get that next leg up," he said.

Don't forget to follow us @INN_Resource for real-time updates!

Securities Disclosure: I, Charlotte McLeod, hold no direct investment interest in any company mentioned in this article.

Keep reading...Show less

Latest News

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00