November 01, 2024

Mawson Finland (TSXV:MFL) is a mining development company focused on gold-cobalt in northern Finland advancing its the Rajapalot gold-cobalt project in the Lapland region. Driven by a highly experienced local management and technical team, and supported by a strong Finnish investor ownership, the company is poised to become a key player in the gold-cobalt market.

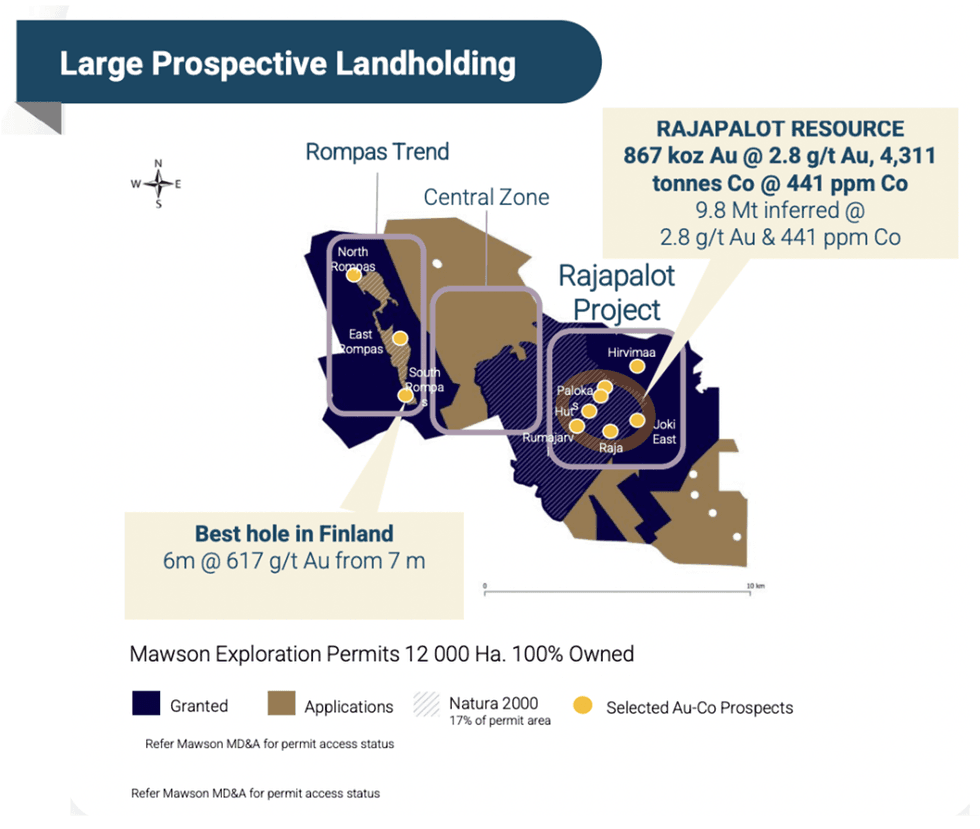

Mawson Finland's Rajapalot project spans 18,000 hectares and boasts an inferred resource of 9.8 Mt consisting of 867,000 oz gold at 2.8 g/t and 4,311 tonnes of cobalt at 441 parts per million (ppm). A completed preliminary economic assessment (PEA) estimated a net present value (NPV) of US$211 million and a 27 percent internal rate of return (IRR) based on US$1,700 gold price, with significant upside from greenfield exploration.

The Rajapalot gold-cobalt project is the company's cornerstone asset. Covering approximately 18,000 hectares, Rajapalot is distinguished by its significant gold and cobalt mineralization, making it one of the notable dual-commodity projects in Europe.

Company Highlights

- Mawson Finland is a newly listed exploration company focused on advancing its gold-cobalt project in the Lapland Region of Finland, a tier 1 mining jurisdiction.

- The project hosts multiple high-grade zones, which have been the focus of extensive exploration activities.

- The completed PEA on Rajapalot has an inferred resource of 9.78 million tonnes containing 867,000 ounces of gold and 4,311 tonnes of cobalt with grades of 2.8 g/t and 441 ppm, respectively. Additionally, the PEA includes an NPV (5 percent) of US$ 211 million with a 27 percent IRR.

- Cobalt, a key by-product of the Rajapalot project, is crucial for the manufacturing of electric vehicle (EV) batteries and renewable energy storage solutions.

This Mawson Finland's profile is part of a paid investor education campaign.*

Click here to connect with Mawson Finland (TSXV:MFL) to receive an Investor Presentation

MFL:CC

The Conversation (0)

31 October 2024

Mawson Finland Limited

Gold and cobalt exploration in Tier 1 Lapland Region in Northern Finland

Gold and cobalt exploration in Tier 1 Lapland Region in Northern Finland Keep Reading...

11h

Gold and Silver Prices Take a U-Turn on Trump's Fed Chair Nomination

Gold and silver prices have experienced one of their most savage corrections in decades. After hitting a record high of close to US$5,600 per ounce in the last week of January, the price of gold took a dramatic U-turn on January 30, dropping as low as US$4,400 in early morning trading on Monday... Keep Reading...

12h

Bold Ventures Kicks Off 2026 with Diamond Drilling Program at Burchell Base and Precious Metals Project

Bold Ventures (TSXV:BOL) has launched a diamond drilling program at its Burchell base and precious metals property in Ontario, President and COO Bruce MacLachlan told the Investing News Network.“We just started drilling a couple of weeks ago, and we’ll be drilling for a while,” MacLachlan said,... Keep Reading...

12h

Providence Gold Mines CEO Highlights Growth Catalysts at La Dama de Oro Gold Property

In an interview during the Vancouver Resource Investment Conference, Providence Gold Mines (TSXV:PHD,OTCPL:PRRVF) President, CEO and Director Ron Coombes said 2026 will be a pivotal year for the company. Providence Gold Mines is entering a key growth phase as funding, permitting and technical... Keep Reading...

18h

Randy Smallwood: The Case for Gold Streaming in Today's Price Environment

Gold streaming took center stage at the Vancouver Resource Investment Conference last week as Randy Smallwood, president and CEO of Wheaton Precious Metals (TSX:WPM,NYSE:WPM), laid out why the model is drawing renewed investor attention amid today's high gold and silver prices.Speaking during a... Keep Reading...

01 February

Matthew Piepenburg: Gold, Silver Going Higher, but Expect Volatility

Matthew Piepenburg, partner at Von Greyerz, breaks down what's really driving the gold price, going beyond headlines to the ongoing debasement of the US dollar. He also discusses silver market dynamics. Don't forget to follow us @INN_Resource for real-time updates!Securities Disclosure: I,... Keep Reading...

31 January

Jeff Clark: Gold, Silver Price Drop — Cash is Key in Corrections

Jeff Clark, founder of Paydirt Prospector, remains bullish on the outlook for gold and silver, emphasizing that cash is key when prices correct. "Even though I'm very long, and even though I haven't taken profits on a lot of things, the number one antidote to a crash or a correction is your cash... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00