May 25, 2022

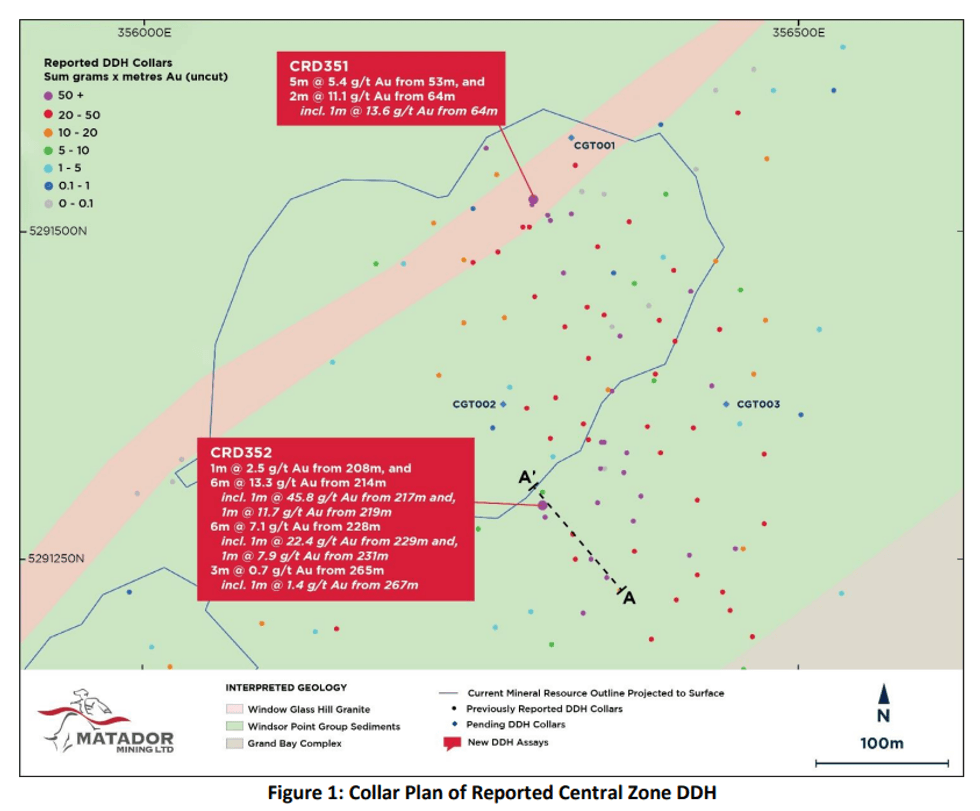

Matador Mining Limited (ASX: MZZ; OTCQX: MZZMF; FSE: MA3) (“Matador” or the “Company”) is pleased to announce the first assay results from the winter 2022 diamond drilling program at the Central Zone in the Cape Ray Gold Project (the “Project”) Newfoundland, Canada.

Highlights:

- Matador has received the first assays from the inaugural winter drill program, conducted between February 2022 and April 2022.

- CRD352:

- 6 metres at 13.3 g/t Au from 214m (incl. 1 metre at 45.8 g/t Au from 217 metres and 1 metre at 11.7 g/t Au from 219 metres); and

- 6 metres at 7.1 g/t Au from 228m (incl. 1 metre at 22.4 g/t Au from 229 metres)

- CRD351:

- 5 metres at 5.4 g/t Au from 53 metres (incl. 2.9 metres at 8.9 g/t Au from 53 metres); and

- 2 metres at 11.1 g/t Au from 64m (incl. 1 metre at 13.6 g/t Au from 64 metres)

- Results are still pending for 29 exploration diamond holes at the Window Glass Hill Granite, PW East and Stag Hill targets; four Central Zone geotechnical drill holes; remainder of the Stag Hill Power Auger sampling program1 and 96 gold grain samples from the Malachite greenfield reconnaissance program2 .

Matador’s Chief Geologist Warren Potma commented:

“We are very pleased with the initial set of drill results from the first winter diamond campaign completed by Matador. Drilling at Central Zone has returned positive results from drill hole CRD352 with two separate zones of high-grade mineralisation recorded in an 80 metre gap in the previous Mineral Resource drilling. It appears some of the historic drilling in this area may have reported anomalously low grades relating to variable core recovery associated with the highly sheared host rocks. These new results indicate potential for higher grades and increased widths compared to the current Mineral Resource estimate. The Central Zone drill results have increased our understanding of the structural controls of gold mineralisation at Cape Ray, which is particularly important as we step out to explore new Greenfields targets such as Malachite.”

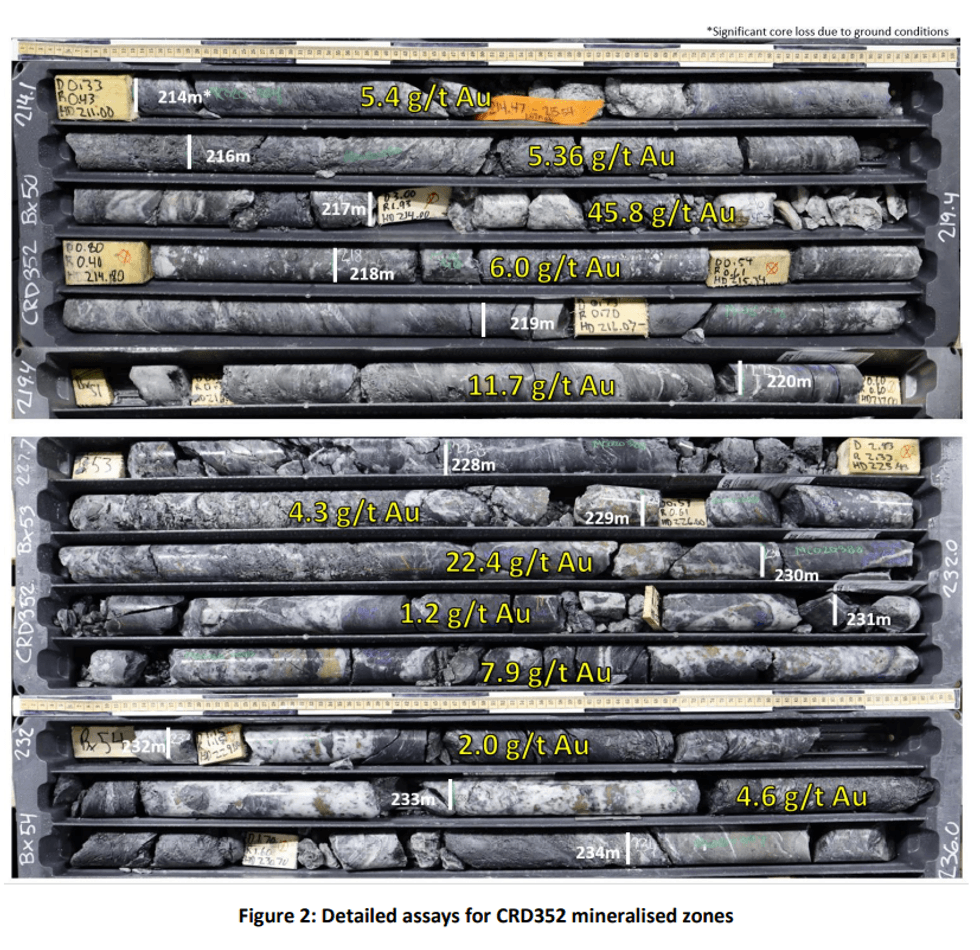

Drill Hole CRD352

Gold mineralisation at the Central Zone deposits occurs as quartz veins and vein arrays parallel to and splaying off the Cape Ray Shear Zone. The gold bearing quartz veins dip moderately to steeply towards the south-east, and typically develop within sediments at or near the contact with a footwall graphitic schist, as can be observed in Figure 3.

Drill hole CRD352 tested an identified 80 metre wide gap within the current mineral resource drilling. The drill hole successfully returned multiple intercepts with assays totaling 130.4 sum grams x metres Au (uncut3 ), confirming the interpreted upward continuation of a wide mineralised zone encountered at depth (see cross section Figure 3).

Two significant zones of mineralisation were intersected, reporting 6 metres at 13.3 g/t Au from 214m (incl. 1 metre at 45.8 g/t Au from 217 metres and 1 metre at 11.7 g/t Au from 219 metres), and 6 metres at 7.1 g/t Au from 228m (incl. 1 metre at 22.4 g/t Au from 229 metres and 1 metre at 7.9 g/t Au from 231 metres).

Click here for the full ASX Release

This article includes content from Matador Mining, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

MZZ:AU

The Conversation (0)

27 February

Lahontan Gold Eyes Resource Update as Production Nears

Lahontan Gold (TSXV: LG,OTCQB:LGCXF) is drawing investor attention as it advances toward renewed production at its historic Santa Fe Mine in Nevada. A revised mineral resource estimate is expected soon, offering a potential catalyst, according to a recent report by News Financial.... Keep Reading...

27 February

Peruvian Metals Invites Shareholders and Investment Community to Visit Them at Booth 2624B at PDAC 2026 in Toronto, March 3-4

Peruvian Metals Corp (TSXV: PER,OTC:DUVNF) (OTC Pink: DUVNF) ("Peruvian Metals" or the "Company") is pleased to invite investors and shareholders to Booth #2624B at the Prospectors & Developers Association of Canada's (PDAC) Convention at the Metro Toronto Convention Centre (MTCC) from Tuesday,... Keep Reading...

27 February

OTC Markets Group Welcomes RUA GOLD INC. to OTCQX

OTC Markets Group Inc. (OTCQX: OTCM), operator of regulated markets for trading 12,000 U.S. and international securities, today announced Rua Gold INC. (TSX: RUA,OTC:NZAUF; OTCQX: NZAUF), an exploration company, has qualified to trade on the OTCQX® Best Market. Rua Gold INC. upgraded to OTCQX... Keep Reading...

27 February

RUA GOLD Begins Trading on the OTCQX Best Market in the United States

Rua Gold INC. (TSX: RUA,OTC:NZAUF) (NZ: RGI) (OTCQX: NZAUF) ("Rua Gold" or the "Company") is pleased to announce that that its common shares have begun trading today on the OTCQX® Best Market under the symbol 'NZAUF'. U.S. investors can find current financial disclosure and Real-Time Level 2... Keep Reading...

27 February

American Eagle Expands South Zone 750 Metres to the East and Further Demonstrates Continuity Within High-Grade Core, Intersecting 618 Metres of 0.77% CuEq from Surface

Highlights: 618 m of 0.77% CuEq from surface in NAK25-80, linking high grade, at-surface gold rich mineralization to high-grade core at depth. Continuity from surface to depth: NAK25-80 builds on prior long-intervals, including NAK25-78: 802 m of 0.71% CuEq from surface, and strengthens... Keep Reading...

26 February

Pause in Trading

Zeus Resources Limited (ZEU:AU) has announced Pause in TradingDownload the PDF here. Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Obonga Project: Wishbone VMS Update

27 February

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00