Maritime Resources Corp. (TSXV: MAE) ("Maritime" or the "Company") is pleased to provide an update for the Hammerdown Gold Project, located in the Baie Verte mining district of Newfoundland and Labrador ("Hammerdown"), near the towns of King's Point and Springdale.

Highlights:

Additional grade control drilling south of the historic mine workings confirms the presence of a new orientation in mineralized trends with substantial gold grades and widths starting at surface

24.5 grams per tonne ("gpt") gold ("Au") over 13.9 metres ("m"), including 42.2 gpt Au over 8.0 m in drill hole HDGC-25-272

34.4 gpt Au over 2.5 m, 5.2 gpt Au over 2.9 m and 1.3 gpt Au over 7.0 m in drill hole HDGC-25-274

7.2 gpt Au over 13.5 m, including 12.7 gpt Au over 3.8 m in drill hole HDGC-25-276

1.7 gpt Au over 36.0 m, including 1.9 gpt Au over 15.4 m in drill hole HDGC-25-273

1.7 gpt Au over 23.0 m, including 25.1 gpt Au over 1.0 m in drill hole HDGC-25-271

53.9 gpt Au over 3.5 m in channel sample HDFN-CH-25-03 and 31.2 gpt Au over 3.2 m in channel sample HDFN-CH-25-02

"Following the successful grade control program completed earlier this year, additional drilling has targeted a new orientation in gold trends south of the historic underground mine workings. This north-south zone begins at surface and lies within the planned open pit footprint with results demonstrating high grade gold mineralization across significant widths and remains open at depth. This presents an attractive opportunity for early development and cash flow by now having all permitting completed for the Hammerdown Gold Project and our Pine Cove mill now fully operational. It also highlights the potential for additional mineral resources in the immediate area of the deposit," comments Garett Macdonald, President and Chief Executive Officer.

Discussion of Results

As part of the 2025 definition drilling program that refined the Hammerdown geological model, a high-grade ore shoot was identified with a structural orientation distinct from the rest of the deposit. This ore shoot was intersected in grade control drill holes HDGC-25-122 and HDGC-25-038 which intersected 12.0 gpt Au over 28.0 m and 43.6 gpt Au over 6.3 m respectively (Maritime Press Release Dated January 27, 2025). Historical mining immediately north of the area had indicated that the east-west trending Hammerdown vein system may be translated into a north-south direction due to shearing along the Wisteria/Rumbullion shear zone.

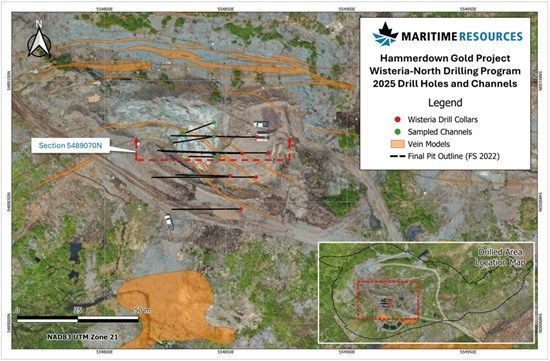

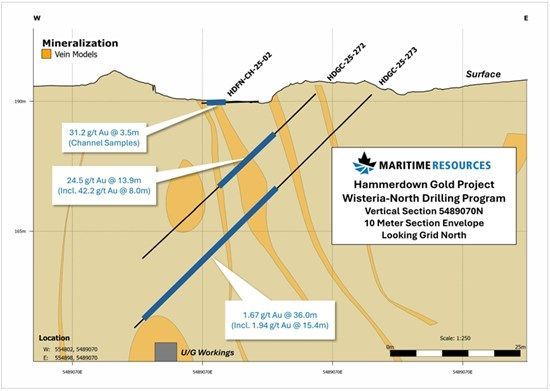

Channel sampling and six short diamond drill holes (totalling 292 m) were completed to test the orientation of the mineralized veins in the footwall within the proposed first year of open pit mining. Results from channel sampling included 31.2 gpt Au over 3.2 m in HDFN-CH-25-02 and 53.9 gpt Au over 3.5 m in HDFN-CH-25-03. Following up on these channel samples several drill holes were completed to test the depth extents of the mineralization including HDGC-25-272 that returned 24.5 gpt Au over 13.9 m, including 42.2 gpt Au over 8.0 m. A 10 m step-back drill hole, HDGC-25-273, returned 1.7 gpt Au over 36.0 m, including 1.94 gpt Au over 15.4 m and drill hole HDGC-25-271 that was drilled 10 m south of HDGC-25-272 returned 1.7 gpt Au over 23.0 m, including 25.1 gpt Au over 1.0 m. Additionally, drill hole HDGC-25-276 was drilled 10 m north of HDGC-25-272 intersecting the zone with 7.2 gpt Au over 13.5 m, including 12.7 gpt Au over 3.8 m.

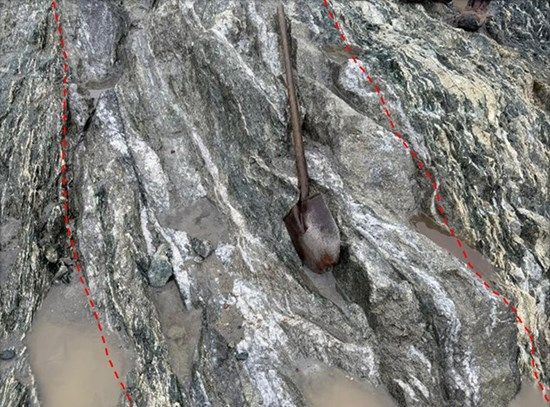

Maritime completed trenching which revealed a change in the orientation of high-grade gold zones, providing new insights into local structural controls and the deformation of the mineralized system in the Wisteria area of the deposit. The mineralized veins mapped in trenching is represented by base metal rich quartz/sulphide veins and mineralized felsic intrusions along with low grade disseminated mineralization in the host rock that strikes north south rather than the general east-west trend defined in the remainder of the deposit.

The broader mineralized intersections reflect the disseminated nature of the mineralization in the sericite altered felsic/mafic host and felsic intrusions which also had not been adequately tested by the north south drilling in the area. Maritime noted the consistent high-grade nature of the vein intersection while drilling from both directions, although structurally disrupted and having been drilled from two directions the vein intersection consistently carried exceptionally high gold grades while the encompassing shear zone and quartz feldspar porphyries often carried broad intervals disseminated gold mineralization.

Figure 1. Outcrop in newly trenched area with high-grade vein orientated north-south

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/4548/255920_1be1848c34204ac9_001full.jpg

Figure 2. Hammerdown Site Plan Map

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/4548/255920_1be1848c34204ac9_002full.jpg

Figure 3. Cross Section 548907 N

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/4548/255920_1be1848c34204ac9_003full.jpg

Table 1. Assay results for new drilling and channel sampling

| Hole | From | To | Length | Au gpt | Comments |

| HDFN-CH-25-01 | 1.50 | 2.00 | 0.50 | 3.33 | Channel Sample |

| HDFN-CH-25-02 | 6.50 | 10.00 | 3.50 | 31.18 | Channel Sample |

| HDFN-CH-25-03 | 2.30 | 5.50 | 3.20 | 7.76 | Channel Sample |

| And | 9.00 | 12.50 | 3.50 | 53.94 | Channel Sample |

| HDFN-CH-25-04 | 4.50 | 7.00 | 2.50 | 5.15 | Channel Sample |

| And | 11.50 | 12.50 | 1.00 | 8.09 | Channel Sample |

| HDFN-CH-25-05 | 0.00 | 0.50 | 0.50 | 95.76 | Channel Sample |

| HDFN-CH-25-06 | 0.00 | 0.20 | 0.20 | 168.59 | Channel Sample |

| HDGC-25-271 | 7.00 | 31.00 | 24.00 | 1.65 | |

| Including | 7.50 | 8.48 | 0.98 | 25.09 | |

| HDGC-25-272 | 11.07 | 25.00 | 13.93 | 24.54 | |

| Including | 17.00 | 25.00 | 8.00 | 42.23 | |

| HDGC-25-273 | 25.66 | 61.62 | 35.96 | 1.67 | |

| Including | 39.14 | 54.58 | 15.44 | 1.94 | |

| HDGC-25-274 | 14.35 | 17.21 | 2.86 | 5.18 | |

| And | 24.29 | 26.83 | 2.54 | 34.40 | |

| Including | 26.54 | 26.83 | 0.29 | 256.20 | |

| And | 44.95 | 52.00 | 7.05 | 1.31 | |

| HDGC-25-275 | 30.50 | 33.00 | 2.50 | 1.23 | |

| And | 37.00 | 40.00 | 3.00 | 1.09 | |

| HDGC-25-276 | 22.50 | 36.00 | 13.50 | 7.18 | |

| Including | 29.70 | 33.45 | 3.75 | 12.71 | |

| Lengths reported relative to core access are estimated to be approximately 70% true thickness | |||||

Table 2. Drill hole details for new trench and drilling

| Hole ID | Type | Easting | Northing | Elevation | Total Length | Azimuth | Dip |

| HDFN-CH-25-01 | Channel Sample | 554846.5 | 5489069.5 | 189.7 | 2.0 | 273.0 | 7 |

| HDFN-CH-25-02 | Channel Sample | 554845.8 | 5489068.5 | 190.0 | 11.0 | 271.0 | 2 |

| HDFN-CH-25-03 | Channel Sample | 554845.1 | 5489077.0 | 188.7 | 17.0 | 261.0 | 4 |

| HDFN-CH-25-04 | Channel Sample | 554845.1 | 5489082.7 | 188.6 | 12.5 | 250.0 | 5 |

| HDFN-CH-25-05 | Channel Sample | 554832.8 | 5489078.1 | 189.7 | 1.0 | 197.0 | 6 |

| HDFN-CH-25-06 | Channel Sample | 554832.2 | 5489078.2 | 189.7 | 1.0 | 170.0 | 2 |

| HDGC-25-271 | Drill hole | 554851.7 | 5489060.7 | 191.3 | 31.0 | 270.0 | -45 |

| HDGC-25-272 | Drill hole | 554856.8 | 5489070.0 | 191.5 | 46.0 | 270.0 | -45 |

| HDGC-25-273 | Drill hole | 554867.5 | 5489070.3 | 191.3 | 64.0 | 270.0 | -45 |

| HDGC-25-274 | Drill hole | 554862.5 | 5489060.2 | 191.7 | 61.0 | 270.0 | -45 |

| HDGC-25-275 | Drill hole | 554856.3 | 5489047.1 | 194.8 | 40.0 | 270.0 | -45 |

| HDGC-25-276 | Drill hole | 554863.0 | 5489076.8 | 191.4 | 49.0 | 271.0 | -45 |

Qualified Person

Exploration activities at the Hammerdown Gold Project are administered on site by the Company's Exploration Manager, Larry Pilgrim, P.Geo. In accordance with National Instrument 43-101 - Standards of Disclosure for Mineral Projects, Larry Pilgrim, P.Geo. Exploration Manager, is the Qualified Person for the Company and has prepared, validated and approved the technical and scientific content of this press release. The Company strictly adheres to CIM Best Practices Guidelines in conducting, documenting, and reporting its exploration activities on its exploration projects.

Analytical Procedures

All samples assayed and pertaining to this press release were completed by Eastern Analytical Limited (EAL) located at Springdale, Newfoundland and Labrador. EAL is an ISO 17025:2005 accredited laboratory for a defined scope of procedures. EAL has no relationship to Maritime. Drill core samples are collected from NQ sized diamond drill core and sawn in half. The half core samples are delivered in sealed plastic bags to EAL by Maritime field crews where they are dried, crushed, and pulped. Samples are crushed to approximately 80% passing a minus 10 mesh and split using a riffle splitter to approximately 250 grams. A ring mill is used to pulverize the sample split to 95% passing a minus 150 mesh. Sample rejects are securely stored at the EAL site for future reference. A 30-gram representative sample is selected for analysis from the 250 grams after which EAL applies a fire assay fusion followed by acid digestion and analysis by atomic absorption for gold analysis. Other metals were analyzed by applying an acid digestion and 34 element ICP analysis finish. EAL runs a comprehensive QA/QC program of standards, duplicates and blanks within each sample stream.

About Maritime Resources Corp.

Maritime (TSXV: MAE) (OTC Pink: MRTMF) is a gold exploration and development company focused on advancing the Hammerdown Gold Project in the Baie Verte District of Newfoundland and Labrador, a top tier global mining jurisdiction. Maritime holds a 100% interest directly and subject to option agreements entitling it to earn 100% ownership in the Green Bay Property which includes the former Hammerdown gold mine and the Orion gold project. Maritime controls over 439 km2 of exploration land including the Green Bay, Whisker Valley, Gull Ridge and Point Rousse projects. Mineral processing assets owned by Maritime in the Baie Verte mining district include the Pine Cove mill and the Nugget Pond gold circuit.

On Behalf of the Board:

Maritime Resources CORP.

Garett Macdonald, MBA, P.Eng.

President and Chief Executive Officer

info@maritimegold.com

www.maritimeresourcescorp.com

Twitter

Facebook

LinkedIn

YouTube

Caution Regarding Forward-Looking Statements:

Certain of the statements made and information contained herein is "forward-looking information" within the meaning of National Instrument 51-102 - Continuous Disclosure Obligations. Forward-looking statements are often identified by terms such as "will", "may", "should", "anticipate", "expects", "intends", "indicates" "plans" and similar expressions. Forward-looking statements include, but are not limited to, statements concerning the Hammerdown mineralization, its' metallurgical response, precious metal extraction based on the ongoing metallurgical testwork, sampling programs, the grade control drilling program, location and grade of underground workings and backfill material, construction elements planned for Hammerdown, production ramp up at Hammerdown, preparation of an updated technical report for Hammerdown, investments to be made to and plans for the Pine Cove mill, growth of the Company and the creation of long-term value for shareholders, exploration plans at the Company's properties, amongst other things, which involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company, or industry results, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking information. All forward-looking statements and forward-looking information are based on reasonable assumptions that have been made by the Company in good faith as at the date of such information. Such assumptions include, without limitation, the price of and anticipated costs of recovery of, base metal concentrates, gold and silver, the presence of and continuity of such minerals at modeled grades and values, the capacities of various machinery and equipment, the use of ore sorting technology will produce positive results, the availability of personnel, machinery and equipment at estimated prices, mineral recovery rates, and others. Forward-looking information is subject to a variety of risks and uncertainties which could cause actual events or results to differ from those reflected in the forward-looking information, including, without limitation, the ability of the Company to continue to be able to access the capital markets for the funding necessary to acquire, maintain and advance exploration properties or business opportunities; global financial conditions, including competition within the industry to acquire properties of merit or new business opportunities, and competition from other companies possessing greater technical and financial resources; difficulties in advancing towards a development decision and executing exploration programs on the Company's proposed schedules and within its cost estimates, whether due to weather conditions, availability or interruption of power supply, mechanical equipment performance problems, natural disasters or pandemics in the areas where it operates; increasingly stringent environmental regulations and other permitting restrictions or maintaining title or other factors related to exploring of its properties, such as the availability of essential supplies and services; factors beyond the capacity of the Company to anticipate and control, such as the marketability of mineral products produced from the Company's properties; uncertainty as to whether mineral resources will ever be converted into mineral reserves once economic considerations are applied; uncertainty as to whether inferred mineral resources will be converted to the measured and indicated categories through further drilling, or into mineral reserves, once economic considerations are applied; government regulations relating to health, safety and the environment, and the scale and scope of royalties and taxes on production; and the availability of experienced contractors and professional staff to perform work in a competitive environment and the resulting adverse impact on costs and performance and other risks and uncertainties, including those described in each MD&A of financial condition and results of operations. In addition, forward-looking information is based on various assumptions including, without limitation, assumptions associated with exploration results and costs and the availability of materials and skilled labour. Should one or more of these risks and uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described in forward-looking statements. Accordingly, readers are advised not to place undue reliance on forward-looking information. Except as required under applicable securities legislation, Maritime undertakes no obligation to publicly update or revise forward-looking information, whether as a result of new information, future events or otherwise.

Neither the TSX Venture Exchange ("TSX-V") nor its Regulation Services Provider (as that term is defined in the policies of the TSX-V) accepts responsibility for the adequacy or accuracy of this release.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/255920