- WORLD EDITIONAustraliaNorth AmericaWorld

November 27, 2025

Blencowe Resources Plc (LSE: BRES) is pleased to announce the completion of the updated JORC 2012 Mineral Resource and Ore Reserve Statement ("JORC") for its 100%-owned Orom-Cross Graphite Project in Uganda. This upgrade incorporates all the infill drilling undertaken in 2025 across the Camp Lode and Northern Syncline/Eastern Limb deposits and represents the final key technical input into the Company's Definitive Feasibility Study ("DFS"), to be published shortly.

The updated JORC confirms a substantial increase in Ore Reserves and a meaningful uplift in Indicated Resources, further validating Orom-Cross as a large-scale, long-life, low-cost graphite project with significant future expansion potential. This upgrade comes at a strategically important time for the graphite sector as global demand for secure ex-China supply accelerates.

This update covers only infill drilling results from 39 holes at Camp Lode and Northern Syncline.

A further 192 step-out holes, drilled across the wider mining license area at the new Iyan and Beehive deposits, including the six deep drillholes (each of which terminated in graphite mineralisation at depths of ~100 metres), are yet to be incorporated. These results collectively demonstrate the broader system scale potential and are expected to support an additional JORC expansion post-DFS in 2026, providing a powerful growth runway for the Project.

JORC Resource & Reserve Statement (2025 Update)

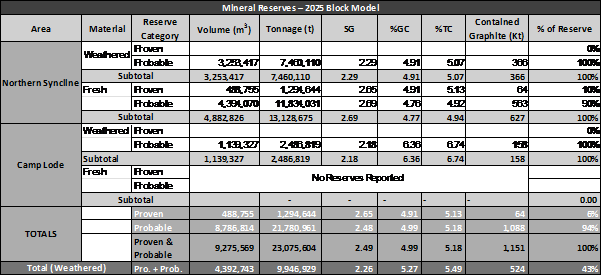

Total JORC Ore Reserves (Proven + Probable):

- Proven Reserve: 1.29 Mt @ 5.13% TGC

- Probable Reserve: 21.78 Mt @ 5.18% TGC

- Total Ore Reserves: 23.08 Mt @ 5.18% TGC

This represents a significant uplift of 47% or 7.36Mt versus previous JORC Ore Reserve Estimate reported in 2022

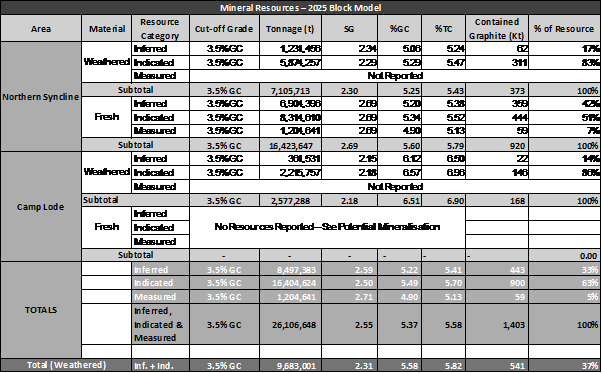

Total JORC Mineral Resource (Measured + Indicated + Inferred at a 3.5%GC cut-off):

- Measured Resource: 1.20 Mt @ 5.13% TGC

- Indicated Resource: 16.40 Mt @ 5.70% TGC

- Inferred Resource: 8.50 Mt @ 5.41% TGC

- Total Resource: 26.10 Mt @ 5.58% TGC

This represents a 7% increase on previous JORC estimate, including a 33% (4.1Mt) in Indicated Resources. A detailed breakdown of Reserves and Resources by deposit (Camp Lode and Northern Syncline) is provided in the further below.

Key Results and Significance of the Upgrade

- 47% uplift in Ore Reserves - major de-risking milestone for DFS.

- 33% increase in Indicated Resources - improves early-life mine confidence and enhances project bankability.

- Strong geological continuity across both primary deposits, reaffirming Orom-Cross as a rare, large-scale, low-strip, shallow graphite system.

- High-quality metallurgical consistency fully aligned with prior test work, supporting both concentrate quality and downstream USPG processing.

Exceptional growth runway remains, with:

- 192 step-out holes (83% of full Stage 7 drill program) ready to be integrated into second major JORC upgrade post-DFS in 2026.

- Majority of remaining holes drilled across new Iyan and Beehive deposits.

- Geology at the new Iyan and Beehive deposits closely mirror Northern Syncline and Camp Lode deposits respectively, signalling potential to double the JORC Resource once incorporated.

- Deep drilling to ~100 metres, with all hole sending in mineralisation, indicating significant vertical expansion potential.

- Only ~2% of the licence area at Orom-Cross is drilled to date.

This JORC update marks the most significant technical advancement to date and sets the stage for the DFS to present a robust, scalable development pathway.

Strategic Context

The strengthened JORC underpins Orom-Cross at a strategically important moment for the graphite sector:

- Western governments (UK, USA, EU) are accelerating efforts to secure non-China graphite supply.

- The UK Government's new Critical Minerals Strategy - Vision 2035 classifies graphite as a Critical and Growth mineral with sharply rising demand forecast.

- Global supply is tightening, with very few advanced projects nearing financing and construction.

The upgraded Reserve base is expected to significantly enhance financing momentum for the Company's P1 Production. The DFS, which integrates both the mining operation and the in-country USPG purification facility, will now reflect the improved long-term feedstock base.

This JORC together with the upcoming DFS, will provide the technical platform from which Blencowe will engage with development finance institutions, strategic partners and MSP-aligned organisations as it moves toward construction and first production.

Cameron Pearce, Executive Chairman commented:

"This upgraded JORC is transformational for Orom-Cross. The substantial increase in Ore Reserves and Indicated Resources confirms the quality, scale and longevity of the project as we move into the DFS and financing phase.

The remaining 192 exploration holes and the deep drilling results, which all ended in mineralisation, highlight the huge potential for further JORC Resource upgrades still ahead of us in early 2026.

With the DFS due to be published shortly, we will be able to demonstrate the strengthened technical and economic foundations of Orom-Cross at a time when secure, high-quality graphite supply is becoming increasingly important to Western governments."

Next Steps

- DFS release (imminent) incorporating the upgraded Reserve base.

- Launch of the P1 Production financing process.

- Assessment and integration of the remaining 192 step-out holes into a future JORC expansion.

- Integration of deep mineralisation into long-term expansion scenarios.

- Further updates on downstream USPG development and offtake progression.

APPENDIX

Deposit Breakdown

Camp Lode:

- Ore Reserves: 2.49 Mt @ 6.74% TGC

- Indicated Resource: 2.22 Mt @ 6.96% TGC

- Inferred Resource: 0.36 Mt @ 6.50% TGC

Notes: Excellent near-surface continuity, consistent grades, and strong metallurgical performance reinforce Camp Lode as the core source of early mine feed.

Northern Syncline - Eastern Limb:

- Ore Reserves: 20.59 Mt @ 4.99% TGC

- Measured Resource: 1.20 Mt @ 5.13% TGC

- Indicated Resource: 14.19 Mt @ 5.50% TGC

- Inferred Resource: 8.14 Mt @ 5.36% TGC

Notes: Broad mineralised zones, shallow dip and thick intersections strengthen the long-term mine schedule. As the majority of the Inferred material is internal to the lodes it is well placed for upgrade through additional grade control drilling.

MINERAL RESOURCE TABULATION

- GC - Graphitic carbon, TC - Total carbon.

- No geological loses applied.

- A conservative cut-off grade of 3.5% GC has been applied based on metallurgical testing & preliminary mining parameters.

- Mineralised tonnes have been rounded off and contained graphite metal tonnages have been rounded off to the nearest 1000 (Kt).

- Contained graphite has been reported without the application of cut-off grades, loss factors, or beneficiation yields.

- GC - Graphitic carbon, TC - Total carbon.

- Mining dilution of 5% applied.

- Mineralised tonnes have been rounded off and contained graphite metal tonnages have been rounded off to the nearest 1000 (Kt).

- Contained graphite has been reported without the application of cut-off grades, loss factors, or beneficiation yields.

Competent Person's Statement

The information in this release, which is related to Mineral Resource estimation, was compiled under the supervision of Mr Sean Nieman who is an employee of Minrom Consulting (Pty) Ltd; he is Member of the Geological Society of South Africa (GSSA) and a Certified Professional Natural Scientist (Pr.Sci.Nat) with the South African Council for Natural Scientific Professions (SACNASP).

Mr Sean Nieman has sufficient experience relevant to the style of mineralisation and type of deposit under consideration and to the activity that he has undertaken to qualify as a Competent Person as defined by the JORC (2012) Code. Mr Sean Nieman consents to the inclusion in this report of the matters based on his information in the form and context in which it appears.

The information in this release, which is related to Mineral Reserves estimation, was compiled under the supervision of Mr Iain Wearing who is an employee of Blencowe Resources Plc; he is Member of the Australian instate of Mining and Metallurgy (AusIMM) and a Certified Professional Engineer.

Mr Iain Wearing has sufficient experience relevant to the style of mineralisation and type of deposit under consideration and to the activity that he has undertaken to qualify as a Competent Person as defined by the JORC (2012) Code. Mr Iain Wearing consents to the inclusion in this report of the matters based on his information in the form and context in which it appears

For further information please contact:

Blencowe Resources Plc Sam Quinn | Tel: +44 (0)1624 681 250 |

Investor Relations Sasha Sethi | Tel: +44 (0) 7891 677 441 |

Tavira Financial Jonathan Evans | Tel: +44 (0)20 3192 1733 |

Twitter https://twitter.com/BlencoweRes

LinkedIn https://www.linkedin.com/company/72382491/admin/

Background

Orom-Cross Graphite Project

Orom-Cross is a potential world class graphite project both by size and end-product quality, with a high component of more valuable larger coarse flakes within the deposit.

A 21-year Mining Licence for the project was issued by the Ugandan Government in 2019 following extensive historical work on the deposit. Blencowe has now completed a successful Definitive Feasibility Study phase as the first major step towards initial production.

Orom-Cross presents as a large, shallow open-pitable deposit, with an initial JORC Indicated & Inferred Mineral Resource of 26.11Mt @ 5.58% TGC (Total Graphite Content). This Resource has been defined from only ~2% of the total tenement area which presents considerable upside potential ahead. Development of the resource is expected to benefit from a low strip ratio and free dig operations together with abundant inexpensive hydro-electric power off the national grid, thereby ensuring low operating costs. With all major infrastructure available at or near to site the capital costs will also be relatively low in comparison to most graphite peers.

The Conversation (0)

24 February

Iyan Deposit Delivers Further Significant Graphite Intercepts from Surface in the Final Release of Assays

Final Assay Batch Again Reinforces Bulk Blending Strategy, Resource Growth and Imminent JORC

Blencowe Resources Plc (LSE: BRES) is pleased to report the final set of assay results completed from the 87 shallow holes drilled at the Iyan deposit, part of the Company's Orom-Cross Graphite Project in Uganda. These results represent the third batch from the Stage 7 drilling programme, with... Keep Reading...

18 February

US Slaps Higher Tariffs on Chinese Graphite Imports After Final Commerce Determination

The US Department of Commerce has sharply increased trade penalties on Chinese graphite anode materials, concluding that producers in China engaged in unfair pricing and subsidy practices that harmed the US market.In a final determination issued February 11, 2026, Commerce raised countervailing... Keep Reading...

27 January

Top 5 Canadian Graphite Stocks (Updated January 2026)

Graphite stocks and prices have experienced volatility in recent years recently due to bottlenecks in demand for electric vehicles, as graphite is used to create lithium-ion battery anode materials. One major factor experts are watching is the trade war between China and the US.China introduced... Keep Reading...

09 December 2025

Greenland Government Grants Exploitation Licence for Amitsoq

GreenRoc Strategic Materials Plc (AIM: GROC), a company focused on the development of critical mineral projects in Greenland, is delighted to announce that the Government of Greenland has granted an Exploitation Licence for the Amitsoq Graphite Project to Greenland Graphite a/s ("Greenland... Keep Reading...

30 November 2025

Altech - Board Renewal and Strategic Focus

Altech Batteries (ATC:AU) has announced Altech - Board Renewal and Strategic FocusDownload the PDF here. Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00