- WORLD EDITIONAustraliaNorth AmericaWorld

May 07, 2024

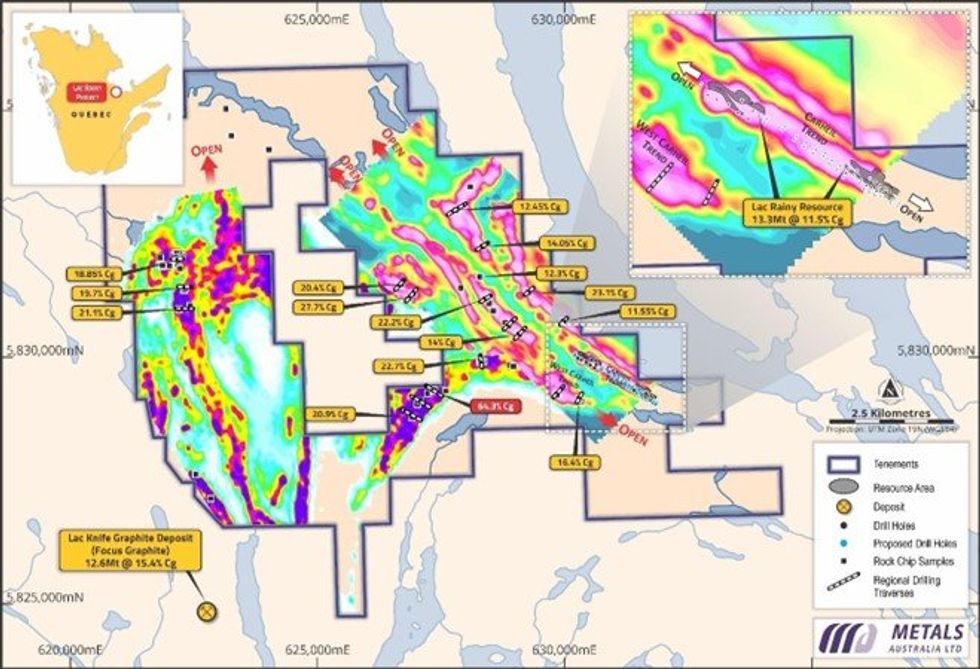

Metals Australia Ltd (ASX: MLS) is pleased to announce a series of major project study agreements have been awarded to advance development of the Company’s flagship Lac Rainy high-grade flake- graphite project in the Tier 1 mining jurisdiction of Quebec, Canada (see Figure 1). The various study agreements approved and initiated include:

- A Metallurgical & Laboratory Services Agreement with SGS Laboratories in Lakefield, Ontario and the appointment of specialist client advisor Metpro Management to oversee metallurgical test-work programs for the design of a flake-graphite concentrate plant.

- A Pre-Feasibility Study (PFS) for the design of a 100,000 tonnes per annum flake-graphite concentrate plant awarded to integrated engineering, design, and construction group Lycopodium. The PFS includes the flake-graphite concentrate plant and associated site infrastructure. It builds on the 2021 Scoping Study results1 that demonstrated Lac Rainy’s potential to generate high operating margins over a 14-year mine life - based on the current resource alone.

- A downstream battery-grade spherical graphite (SpG) concentrate purification options assessment, plant location and Scoping Study awarded to world-leading, German based, metallurgical test-work and process engineering design group ANZAPLAN. These programs will substantially build on the outstanding results of previous downstream product test-work that produced battery grade (99.96% Cg) spherical graphite (SpG) with excellent battery charging and discharge performance2.

- A drilling and full-service support contract signed with Magnor Exploration to complete the drilling and other exploration programs for Mineral Resource expansion and to test new regional targets at Lac Rainy, where the current resource is contained within only 1km of a demonstrated 36km strike-length of high-grade graphitic trends3 which have been tested to date.

Metals Australia CEO Paul Ferguson commented:

“We are delighted to have locked in a series of critical project development and test-work contracts with leading global service providers as we continue our efforts to grow the Lac Rainy resource and accelerate the development of what we believe is a world-class flake-graphite project, located in one of the world’s best mining jurisdictions.

Significantly, Metals Australia’s strong cash balance, which stood at $17.8 million at the end of the March quarter4, gives us the financial strength to rapidly advance our pipeline of development studies at Lac Rainy, while also continuing exploration programs across our suite of other highly prospective projects in Canada and Australia.

We believe these studies will help unlock the significant value of the Lac Rainy project, which is not reflected in the current share price. This is despite the fact Lac Rainy has already demonstrated compelling and robust economics, as outlined in the 2021 Scoping Study1.

The work we are now advancing will significantly de-risk the project and bring it closer to development - at an ideal time when North America is seeking reliable supplies of critical minerals to establish or reorient its manufacturing base and supply logistics.”

Metallurgical & Laboratory Services Agreement for metallurgical test-work with SGS Laboratories

Metals Australia has awarded the metallurgical test-work and laboratory services requirements for its PFS level flake-graphite metallurgical test-work program5 to SGS Laboratories in Lakefield, Ontario, Canada.

Two approximately 200kg bulk-samples have been prepared from existing drill-core and despatched to SGS for comminution and flotation test-work and characterisation to provide key inputs to the flake-graphite concentrate production PFS. The program is estimated to take approximately four months and will include all sample preparation, chemical characterisation, mineralogy testing, comminution and flotation testing and reporting.

Click here for the full ASX Release

This article includes content from Metals Australia Ltd, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

MLS:AU

Sign up to get your FREE

Metals Australia Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

02 July 2025

Metals Australia

High-quality graphite development project with an accelerated pathway to production, complemented by a diversified portfolio of critical, precious and base metals assets in tier-1 jurisdictions across Canada and Australia.

High-quality graphite development project with an accelerated pathway to production, complemented by a diversified portfolio of critical, precious and base metals assets in tier-1 jurisdictions across Canada and Australia. Keep Reading...

29 January

Quarterly Activities/Appendix 5B Cash Flow Report

Metals Australia (MLS:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

27 January

Graphite Project Links to Quebec's Critical Minerals Plan

Metals Australia (MLS:AU) has announced Graphite Project Links to Quebec's Critical Minerals PlanDownload the PDF here. Keep Reading...

18 December 2025

High Copper Anomalies Show Deeper Potential at Warrego East

Metals Australia (MLS:AU) has announced High Copper Anomalies Show Deeper Potential at Warrego EastDownload the PDF here. Keep Reading...

16 December 2025

Titanium-Vanadium-Magnetite Discovery Extended over 1km

Metals Australia (MLS:AU) has announced Titanium-Vanadium-Magnetite Discovery Extended over 1kmDownload the PDF here. Keep Reading...

05 November 2025

Drilling the Manindi Vanadium-Titanium-Magnetite Discovery

Metals Australia (MLS:AU) has announced Drilling the Manindi Vanadium-Titanium-Magnetite DiscoveryDownload the PDF here. Keep Reading...

21 January

Official signing of the Portuguese State Grant

Savannah joins other grant recipient companies at official signing ceremony

Savannah Resources Plc, the developer of the Barroso Lithium Project in Portugal, a 'Strategic Project' under the European Critical Raw Materials Act and Europe's largest spodumene lithium deposit (the 'Project'), was delighted to join with other recipients of State grants yesterday at the... Keep Reading...

21 January

Excellent Results from 2025 Core Drilling Program at McDermitt

Jindalee Lithium Limited (Jindalee, or the Company; ASX: JLL, OTCQX: JNDAF) is pleased to report assay results from the drilling program at the McDermitt Lithium Project completed late 2025. All holes returned strong lithium and magnesium intercepts from shallow depths, including:R92: 36.5m @... Keep Reading...

08 January

Top 5 US Lithium Stocks (Updated January 2026)

The global lithium market enters 2026 after a punishing 2025 marked by oversupply, weaker-than-expected EV demand and sustained price pressure, although things began turning around for lithium stocks in Q4. Lithium carbonate prices in North Asia fell to four-year lows early in the year,... Keep Reading...

07 January

5 Best-performing ASX Lithium Stocks (Updated January 2026)

Global demand for lithium presents a significant opportunity for Australia and Australian lithium companies.Australia remains the world’s largest lithium miner, supplying nearly 30 percent of global output in 2024, though its dominance is easing as other lithium-producing countries such as... Keep Reading...

05 January

CEOL Application for Laguna Verde Submitted

CleanTech Lithium PLC ("CleanTech Lithium" or "CleanTech" or the "Company") (AIM: CTL, Frankfurt:T2N), an exploration and development company advancing sustainable lithium projects in Chile, is pleased to announce it has submitted its application (the "Application") for a Special Lithium... Keep Reading...

29 December 2025

SQM, Codelco Seal Landmark Lithium Joint Venture in Salar de Atacama

Sociedad Quimica y Minera (SQM) (NYSE:SQM) and Codelco have finalized their long-awaited partnership, forming a new joint venture that will oversee lithium production in Chile’s Salar de Atacama through 2060.SQM announced on Saturday (December 27) that it has completed its strategic partnership... Keep Reading...

Latest News

Sign up to get your FREE

Metals Australia Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Trading Halt

9h

Equity Metals Exhibiting at the 2026 PDAC

06 February

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00