April 15, 2024

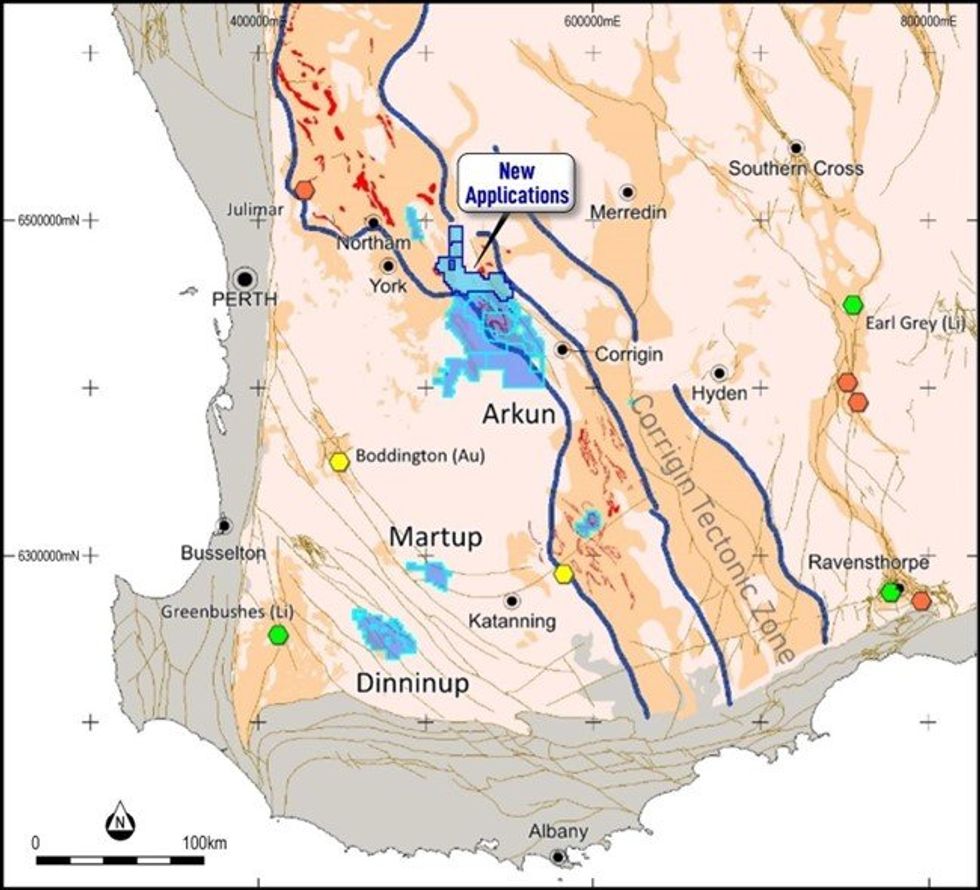

An aircore drill programme will commence this week at Impact Minerals Limited's (ASX:IPT) Hyperion REE prospect, which is part of the 100% owned Arkun Project, located 150km east of Perth in the emerging mineral province of southwest Western Australia ( Figure 1).

- Drilling to commence this week at the Hyperion Rare Earth Element (REE) Prospect to test a large Rare Earth Element soil geochemistry anomaly.

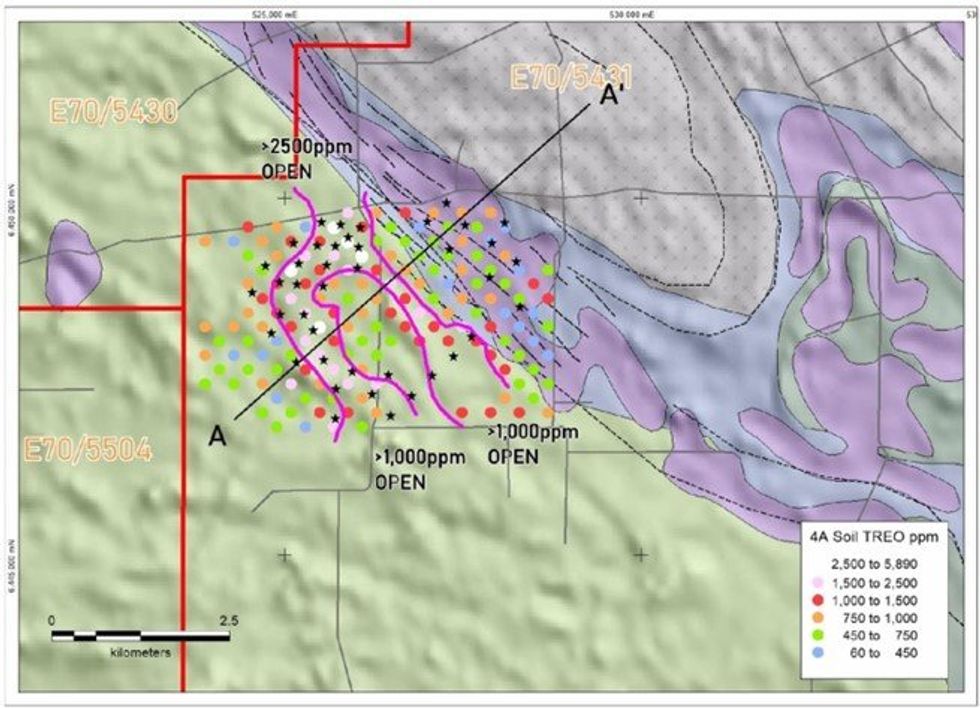

- The soil anomaly covers at least a 3 km2 area at greater than 1,000 ppm Total Rare Earth Oxide (TREO + Y) with peak values up to 5,880 ppm (0.59%) TREO+Y and Nd+Pr of up to 21%.

- The soil anomaly is hosted in weathered granite and is prospective for a large clay-hosted REE deposit.

- All necessary statutory approvals, Program of Works (POW) and land access permissions received.

- Aircore/ slimline RC rig has been secured and is currently mobilising to site

The drill programme, comprising approximately 40 holes for 2000 metres will test the significant REE soil geochemistry anomaly identified at Hyperion, where results of up to 5,880 parts per million (ppm) Total Rare Earth Element Oxides and Yttrium (TREO +Y) were reported previously (ASX Release 4th January 2024). These are some of the highest TREO-in-soil results reported recently in Western Australia. Other REE soil geochemistry anomalies have been identified at Swordfish and Horseshoe (Figure 2 and ASX Releases January 4th 2024 and June 1st 2023).

Impact Minerals’ Managing Director, Dr Mike Jones, said, “The discovery of the Hyperion REE Prospect was a significant breakthrough in exploring the Arkun Project, and we are eager to drill test the anomaly to assess the depth extent of the weathered clay that may host the REE mineralisation. The key to an economic discovery is to evaluate how easily the REEs can be extracted through simple acid leaching of clays and, so we will be sending samples for preliminary test work as quickly as possible. Given this is the first-ever drill programme at Arkun, and that several other significant REE anomalies remain to be tested at Arkun, for example Swordfish and Horseshoe, the extraction characteristics will have an important bearing on any future resource definition drilling”.

Hyperion Prospect

The soil geochemistry results have defined an area of more than 3 km2 at greater than 1,000 ppm TREO+Y at Hyperion (Figure 2). Five samples returned greater than 2,500 ppm TREO+Y with a peak value of 5,880 ppm (0.58%) TREO+Y, amongst some of the highest tenor REE soil values reported in Western Australia ASX Release January 4th 2024).

Within the anomaly, two broad northwest-southeast trending zones of more than 1,500 ppm TREO+Y-in- soils extend for 2.5 km along-trend and are open in both directions (Figure 2).

The anomaly has an average neodymium plus praseodymium percentage of about 20%, typical of most regolith-hosted mineralisation in the region with Heavy REE contents of between 54 ppm and 200 ppm within the >1,000 ppm parts of the anomaly (ASX Release January 4th 2024). This is encouraging for discovering the more economically compelling Heavy Rare Earths close to the surface.

The Hyperion anomaly is underlain by a well-preserved laterite (weathering) profile developed on very weathered granite bedrock, the likely source of the REE.

By coincidence, Impact's previous airborne electromagnetic (EM) survey covers part of the Hyperion anomaly (Section Line A-A’, Figure 3. ASX Release 18th September 2023). Geophysical modelling of this data shows a possible vertical thickness of up to 60 metres of conductive clays across much of the Hyperion anomaly, suggesting a significant volume of clay that may host REE mineralisation is present close to the surface (Figure 3). In addition, the regional magnetic data indicates the underlying granite may cover an area of about 170 km2, suggesting there is significant scope to increase the size of Hyperion with further soil surveys.

Click here for the full ASX Release

This article includes content from Impact Minerals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

IPT:AU

The Conversation (0)

22 October 2024

Impact Minerals Limited

Developing the lowest-cost HPA project in Australia

Developing the lowest-cost HPA project in Australia Keep Reading...

27 March 2025

Successful Completion of the Renounceable Rights Issue

Impact Minerals Limited (IPT:AU) has announced Successful Completion of the Renounceable Rights IssueDownload the PDF here. Keep Reading...

19 March 2025

Renounceable Rights Issue Closing Date

Impact Minerals Limited (IPT:AU) has announced Renounceable Rights Issue Closing DateDownload the PDF here. Keep Reading...

13 March 2025

Major drill targets identified at the Caligula Prospect

Impact Minerals Limited (IPT:AU) has announced Major drill targets identified at the Caligula ProspectDownload the PDF here. Keep Reading...

09 March 2025

NFM: Sale of Broken Hill East Project to Impact Minerals

Impact Minerals Limited (IPT:AU) has announced NFM: Sale of Broken Hill East Project to Impact MineralsDownload the PDF here. Keep Reading...

04 March 2025

Update on the Renounceable Rights Issue to raise $5.2M

Impact Minerals Limited (IPT:AU) has announced Update on the Renounceable Rights Issue to raise $5.2MDownload the PDF here. Keep Reading...

06 February

Editor's Picks: Is Gold and Silver's Price Correction Over?

It's been a wild couple of weeks for gold and silver. After surging to record highs at the end of January, prices for both precious metals saw significant corrections, creating turmoil for market participants.This week brought some relief, with gold bouncing back from its low point and even... Keep Reading...

06 February

Blackrock Silver to Present at the Precious Metals and Critical Minerals Virtual Investor Conference on February 10th 2026

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") is pleased to announce that Andrew Pollard, President & Chief Executive Officer of the Company, will present live at the Precious Metals & Critical Minerals Virtual Investor Conference hosted... Keep Reading...

05 February

Experts: Gold's Fundamentals Intact, Price Could Hit US$7,000 in 2026

Gold took center stage at this year's Vancouver Resource Investment Conference (VRIC), coming to the fore in a slew of discussions as the price surged past US$5,000 per ounce. Held from January 25 to 26, the conference brought together diverse experts, with a focus point being the "Gold... Keep Reading...

05 February

Barrick Advances North American Gold Spinoff After Record 2025 Results

Barrick Mining (TSX:ABX,NYSE:B) said it will move ahead with plans to spin off its North American gold assets after a strong finish to 2025.The Toronto-based miner said its board has authorized preparations for an IPO of a new entity that would house its premier North American gold operations,... Keep Reading...

05 February

Peruvian Metals Secures 6 Year Agreement with Community at Mercedes Project

Peruvian Metals Corp. (TSXV: PER,OTC:DUVNF) (OTC Pink: DUVNF) ("Peruvian Metals or the "Company") is pleased to announce that the agreement between San Maurizo Mines Ltd. ("San Maurizo"), a private Manitoba company which holds a 100% direct interest in the Mercedes Property, and Comunidades... Keep Reading...

05 February

TomaGold Borehole EM Survey Confirms Berrigan Deep Zone

Survey also validates significant mineralization and unlocks new targets Highlights Direct correlation with mineralization : The modeled geophysical plates explain the presence of semi-massive to massive sulfides intersected in holes TOM-25-009 to TOM-25-015. Priority target BER-14C :... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Equity Metals Exhibiting at the 2026 PDAC

06 February

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00