December 14, 2023

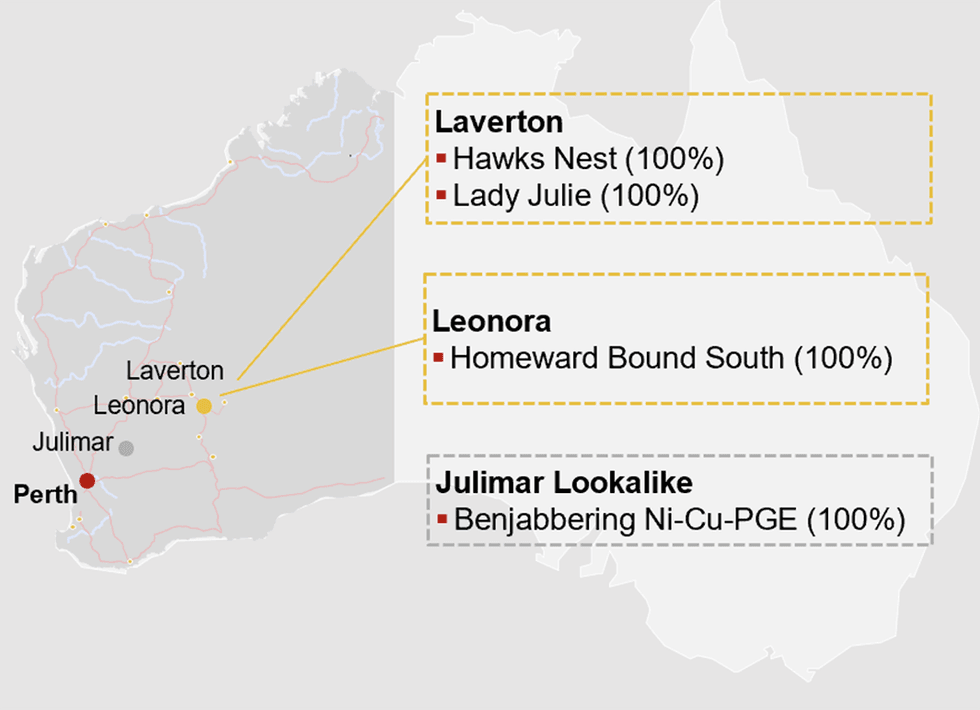

Magnetic Resources (ASX:MAU) develops a portfolio of significant gold projects in the established mining province, Laverton region, in Western Australia. The company owns the Hawks Nest and Lady Julie projects in Laverton, the Homeward Bound South project in Leonora, and the Benjabbering project in Julimar. The main deposits include Hawks Nest 9 (HN9), Lady Julie Central (LJC), Lady Julie North 4 (LJN4), Mount Jumbo and Homeward Bound South, all located in an area with well-endowed regional infrastructure, including three processing plants within 10 to 35 kilometres.

Magnetic Resources focuses on LJN4 of the Laverton project, which hosts thick breccia and silica pyrite zones up to 50 metres thick. Mau breccia zones often carry higher grades and are now being extended by new drilling at depth and further to the east and northeast, potentially growing the LJN4 resource.

The significance of LJN4’s gold resource has not gone unnoticed, as research firm Argonaut has called it a ‘sleeping giant,’ noting recent drilling at LJN4 “indicates a significant discovery unfolding in the Laverton region.” If MAU can replicate the recent drilling intercepts, the next resource update at LNJ4 could easily make it a 1-Moz deposit. This will position LJN4 as one of the best undeveloped gold assets in the Laverton region.

Company Highlights

- Magnetic Resources (MAU) is an Australian company focused on gold development projects in Western Australia.

- The company owns a 100-percent-interest in the Hawks Nest and Lady Julie projects in Laverton, the Homeward Bound South project in Leonora, and the Benjabbering project in Julimar.

- MAU’s large tenement positions in the Leonora and Laverton districts of Western Australia, are near numerous large deposits with existing mining operations and good infrastructure.

- The presence of three processing plants close to MAU’s Laverton deposits provides scope for toll processing.

- In November 2023, the company announced a 107-percent increase in the resource estimate for Laverton and Homeward Bound South deposits. The revised resource stands at 22.7 Mt @ 1.69 g/t gold totaling 1.24 Moz of gold at 0.5 g/t cutoff.

- For the Laverton project deposits - Lady Julie North 4, Lady Julie Central and Hawks Nest 9 - early work programs, including project environmental, heritage and technical background studies, are close to completion. The aim is to submit a mining proposal in January 2024.

- In October 2023, the company announced the completion of a AU$4.8-million private placement. The company is now fully funded with AU$7 million cash to aggressively advance to the next stage of development.

- The company’s highly experienced senior leadership team has a proven track record to capitalize on the high resource potential of its projects.

This Magnetic Resources NL profile is part of a paid investor education campaign.*

Click here to connect with Magnetic Resources (ASX:MAU) to receive an Investor Presentation

MAU:AU

The Conversation (0)

13 December 2023

Magnetic Resources NL

An Exciting Gold Development Play in Western Australia

An Exciting Gold Development Play in Western Australia Keep Reading...

8h

Mining’s New Reality: Strategic Nationalism, Gold Records and a Fractured Cost Curve

The era of “smooth globalization” is over, and mining is entering a more fragmented, politically charged phase defined by strategic nationalism, according to speakers at S&P Global’s latest webinar.Jason Holden, who opened the “State of the Market: Mining Q4 2025” session with a macro overview,... Keep Reading...

14h

Brazilian State Firm Seeks Injunction to Block Equinox Gold-CMOC Asset Sale

A Brazilian state-run mining company is seeking an emergency court injunction to block the sale of one of Equinox Gold's (TSX:EQX,NYSEAMERICAN:EQX) Brazilian assets. Bloomberg reported that Companhia Baiana de Produção Mineral (CBPM) has asked the Bahia State Court of Justice to immediately... Keep Reading...

15h

Silver Hammer Closes CDN$3,913,617 Non-Brokered Private Placement Pursuant to Listed Issuer Exemption

Silver Hammer Mining Corp. (CSE: HAMR,OTC:HAMRF) (the "Company" or "Silver Hammer") is pleased to announce that further to its news release dated February 2, 2026, it has closed its previously announced non-brokered private placement pursuant to the Listed Issuer Exemption ("LIFE") (the... Keep Reading...

22 February

High-Grade Near-Surface Graphite Intersected at Millennium

Metal Bank (MBK:AU) has announced High-Grade Near-Surface Graphite Intersected at MillenniumDownload the PDF here. Keep Reading...

22 February

Boundiali Resource Grows to 3Moz - Indicated Up 49%

Aurum Resources (AUE:AU) has announced Boundiali Resource Grows to 3Moz - Indicated Up 49%Download the PDF here. Keep Reading...

22 February

High-grade Assays incl 4m @ 26.7g/t Au in Sandstone Drilling

Brightstar Resources (BTR:AU) has announced High-grade assays incl 4m @ 26.7g/t Au in Sandstone drillingDownload the PDF here. Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00