February 20, 2024

Lithium Universe Limited (referred to as "Lithium Universe" or the "Company," ASX: "LU7") is pleased to announce that as part of its strategy to address the Lithium conversion capacity gap in the North American market, the company has successfully executed an option agreement (Option Agreement) to acquire a commercial property strategically located within the Bécancour Waterfront Industrial Park (BWIP). The site is Lot 22 of the Parc industriel et portuaire de Bécancour, Bécancour, Québec, Canada, with an area estimated to be 276,423 square metres (the Site).

Highlights

- Strategy for closing the North American lithium processing gap

- Secured prime industrial property in the Bécancour Waterfront Industrial Park (BWIP)

- Strategic location, hydroelectricity, gas, road, rail, and spodumene import facilities

- The site has the capability for three 16,000 tpa Lithium Carbonate refineries

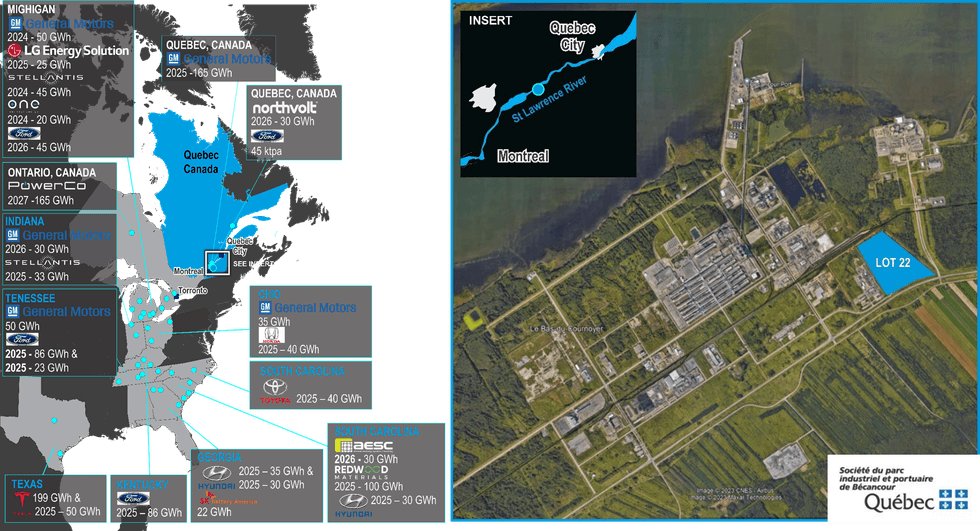

- Located within 1km of General Motors/POSCO Cathode factory and Ford/EcoPro BM Cathode factory and 140km from Northvolt’s EV battery facility at Saint-Basile-le-Grand

- Integral component of the Québec Lithium Processing Hub (QLPH) Strategy

- Favourable terms including no option fee until July 2024 and option term of 3 years

- Acquisition is subject to regulatory and shareholder approvals

- Land acquisition depends on Li Refinery project finance

- No funds are required to be raised for land acquisition

Video summary of the Company’s proposed Bécancour Lithium Refinery location: https://investorhub.lithiumuniverse.com/link/XyMO4r

Closing the Lithium Conversion Gap

The East Coast of North America is set to witness a substantial surge in battery manufacturing, with over 20 major battery manufacturers planning to deploy an estimated 900GW of battery capacity by 2028. By 2030, Georgia, Kentucky, and Michigan are poised to dominate electric vehicle (EV) battery production in the United States, joined by key players such as Kansas, North Carolina, Ohio, and Tennessee. These states aim to collectively manufacture between 97 and 136 gigawatt hours of EV batteries annually. To meet the escalating demand for EVs, North America's EV battery manufacturing capacity will skyrocket from 55 gigawatt-hours in 2021 to nearly 1,000 gigawatt-hours by 2030, requiring an investment exceeding $40 billion. This strategic expansion is expected to support the production of 10 to 13 million all-electric vehicles annually by 2030, positioning the U.S. as a formidable global EV competitor. Additionally, Canada's recent focus on investing in battery plants, backed by collaborations with Volkswagen, Stellantis, LG Energy Solution, and Northvolt, aims to safeguard its auto sector, potentially creating 250,000 jobs and contributing $48 billion annually to the economy by 2030.

The industry encounters a significant challenge in establishing a reliable supply chain, especially due to limited access to lithium converters in North America. The region seeks to decrease dependence on China and Chinese companies, aligning with both commercial and national security goals. Presently, Chinese companies dominate the global market for lithium converters and refining capacity. Similarly, Canada, acknowledging the significance of energy security, has intensified efforts to reduce Chinese involvement in the sector as part of a "decoupling" or "de-risking" strategy, mirroring the actions taken by the United States. The issue lies in the scarcity of independent lithium converters planned for construction in North America, potentially stemming from a lack of expertise or a series of recent failures and delayed startups in the sector. A significant gap in lithium conversion and processing looms in North America. Assuming the planned battery manufacturing capacity of 900 GW by 2028, using a ratio of 850g lithium carbonate equivalent (LCE) per KWh, the Company estimates that 800,000t of LCE per annum will be required to satisfy demand in North America. The Lithium Universe strategy is to bridge this gap by leveraging a proven track record in constructing such converters, with the Lithium Dream team being crucial to the success of this strategy.

Option Agreement

The execution of the Option Agreement follows from the Company’s announcement that Hatch Ltd (Hatch) has been appointed to undertake an engineering study for the design of a multi-purpose battery-grade lithium carbonate refinery, which will form part of the Company Québec Lithium Processing Hub (QLPH) strategy. The BWIP is the preferred site for the Company's 16,000 tpa Lithium Carbonate Refinery, validated through a comprehensive location option study conducted by Hatch. Investissement Québec has played an integral role in supporting the Company in its objective to secure this strategic location for the Company’s QLPH strategy.

The execution of the Option Agreement for the Site is another important step in the Company’s fast-tracking strategy to become a producer of lithium in Quebec, Canada. The land acquisition hinges on securing project finance for the Lithium Refinery Project. The Company isn't required to raise funds specifically for buying the land. If the project finance for the Lithium Refinery Project falls through, the Company retains the option to withdraw from the agreement.

About the Site

The Company's Site is strategically situated in Bécancour, just south of Trois-Rivières, and is optimally positioned between Montreal and Québec City. Positioned near a major highway, the site seamlessly connects to the extensive North American highway network. Additionally, the facility benefits from daily service by the Canadian National Railway (CN), enabling cross-continental transportation from east to west and north to south, linking key ports on the Atlantic and Pacific coasts. The Port of Bécancour, operational all year-round, boasts a water depth of 10.67 meters, accommodating vessels of varying sizes. It features a pier extending 1,130 meters into the St. Lawrence River, equipped with 5 berths and a roll-on/roll-off ramp, further solidifying its strategic fit as the location for the Company’s proposed Lithium Carbonate Refinery due to its ability to easily access international spodumene supply whilst the Canadian internal spodumene supply develops.

The Site stands at the intersection of hydro-electrical distribution networks, making the BWIP a highly reliable centre for low-cost hydroelectric power in Québec. In addition, the park features a co-generation plant generating 550 MW, reinforcing its appeal to the Company. Additionally, the BWIP benefits from a robust infrastructure, including a 2400 kPa high-pressure line and an underground distribution network, ensuring a seamless supply to user companies. Moreover, the park offers access to both potable and industrial water, as well as advanced industrial waste facilities.

Furthermore, the Bécancour Facility hosts the General Motors (GM) and Korea-based POSCO Chemicals’ new CAD$500 million cathode active material (CAM) factory forecasted for first production in 2025. In addition, the CAD$1.2 billion Ford/EcoPro BM Cathode factory with a proposed production of 45,000 tonnes of CAM per year and slated to start production in 2026 also is located within the BWIP. Both CAM factories have commenced construction mid-2023 are within 1km of the Company’s proposed Lithium Refinery location. Only 140km south- west of Bécancour and more recently, Swedish battery developer and manufacturer Northvolt is set to build a wholly integrated lithium-ion (Li-ion) battery gigafactory in Québec, Canada. This facility will have an annual cell manufacturing capacity of 60 gigawatt hours (GWh).

This article includes content from Lithium Universe Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

LU7:AU

The Conversation (0)

03 September 2025

Macquarie Electro Jet Silver Extraction Recovery

Lithium Universe (LU7:AU) has announced Macquarie Electro Jet Silver Extraction RecoveryDownload the PDF here. Keep Reading...

12 August 2025

Acquisition of Silver Extraction Technology

Lithium Universe (LU7:AU) has announced Acquisition of Silver Extraction TechnologyDownload the PDF here. Keep Reading...

30 July 2025

Quarterly Activities/Appendix 5B Cash Flow Report

Lithium Universe (LU7:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

30 July 2025

Lithium Universe Ltd Quarterly Activities Report

Melbourne, Australia (ABN Newswire) - During the June quarter, Lithium Universe Ltd (ASX:LU7,OTC:LUVSF) (FRA:KU00) (OTCMKTS:LUVSF) announced the acquisition of the global rights to commercially exploit a patented photovoltaic solar panel recycling technology known as "Microwave Joule Heating... Keep Reading...

17 July 2025

Completion of PV Solar Cell Recycling Acquisition

Lithium Universe (LU7:AU) has announced Completion of PV Solar Cell Recycling AcquisitionDownload the PDF here. Keep Reading...

21 January

Official signing of the Portuguese State Grant

Savannah joins other grant recipient companies at official signing ceremony

Savannah Resources Plc, the developer of the Barroso Lithium Project in Portugal, a 'Strategic Project' under the European Critical Raw Materials Act and Europe's largest spodumene lithium deposit (the 'Project'), was delighted to join with other recipients of State grants yesterday at the... Keep Reading...

21 January

Excellent Results from 2025 Core Drilling Program at McDermitt

Jindalee Lithium Limited (Jindalee, or the Company; ASX: JLL, OTCQX: JNDAF) is pleased to report assay results from the drilling program at the McDermitt Lithium Project completed late 2025. All holes returned strong lithium and magnesium intercepts from shallow depths, including:R92: 36.5m @... Keep Reading...

08 January

Top 5 US Lithium Stocks (Updated January 2026)

The global lithium market enters 2026 after a punishing 2025 marked by oversupply, weaker-than-expected EV demand and sustained price pressure, although things began turning around for lithium stocks in Q4. Lithium carbonate prices in North Asia fell to four-year lows early in the year,... Keep Reading...

07 January

5 Best-performing ASX Lithium Stocks (Updated January 2026)

Global demand for lithium presents a significant opportunity for Australia and Australian lithium companies.Australia remains the world’s largest lithium miner, supplying nearly 30 percent of global output in 2024, though its dominance is easing as other lithium-producing countries such as... Keep Reading...

05 January

CEOL Application for Laguna Verde Submitted

CleanTech Lithium PLC ("CleanTech Lithium" or "CleanTech" or the "Company") (AIM: CTL, Frankfurt:T2N), an exploration and development company advancing sustainable lithium projects in Chile, is pleased to announce it has submitted its application (the "Application") for a Special Lithium... Keep Reading...

29 December 2025

SQM, Codelco Seal Landmark Lithium Joint Venture in Salar de Atacama

Sociedad Quimica y Minera (SQM) (NYSE:SQM) and Codelco have finalized their long-awaited partnership, forming a new joint venture that will oversee lithium production in Chile’s Salar de Atacama through 2060.SQM announced on Saturday (December 27) that it has completed its strategic partnership... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00